Types of Withdrawal Fees on PayPal

PayPal, a popular online payment platform, charges different fees when users withdraw funds from their accounts. Understanding these types of withdrawal fees is critical to managing your finances effectively when using PayPal.

The most common type of withdrawal fee is the standard withdrawal fee. This fee is charged when you withdraw funds to your bank account or linked debit card. The amount of the fee varies depending on the type of currency you withdraw and the country where your account is located.

If you make frequent withdrawals, you may want to consider using Instant Withdrawal. This service allows you to immediately withdraw funds to a linked debit card, but incurs higher fees compared to standard withdrawals. Instant Withdrawal fees vary depending on the currency and amount withdrawn.

In addition to standard withdrawal and Instant Withdraw fees, PayPal also charges foreign currency withdrawal fees. This fee applies if you withdraw funds in a currency different from your PayPal account currency. These fees vary depending on the currency involved.

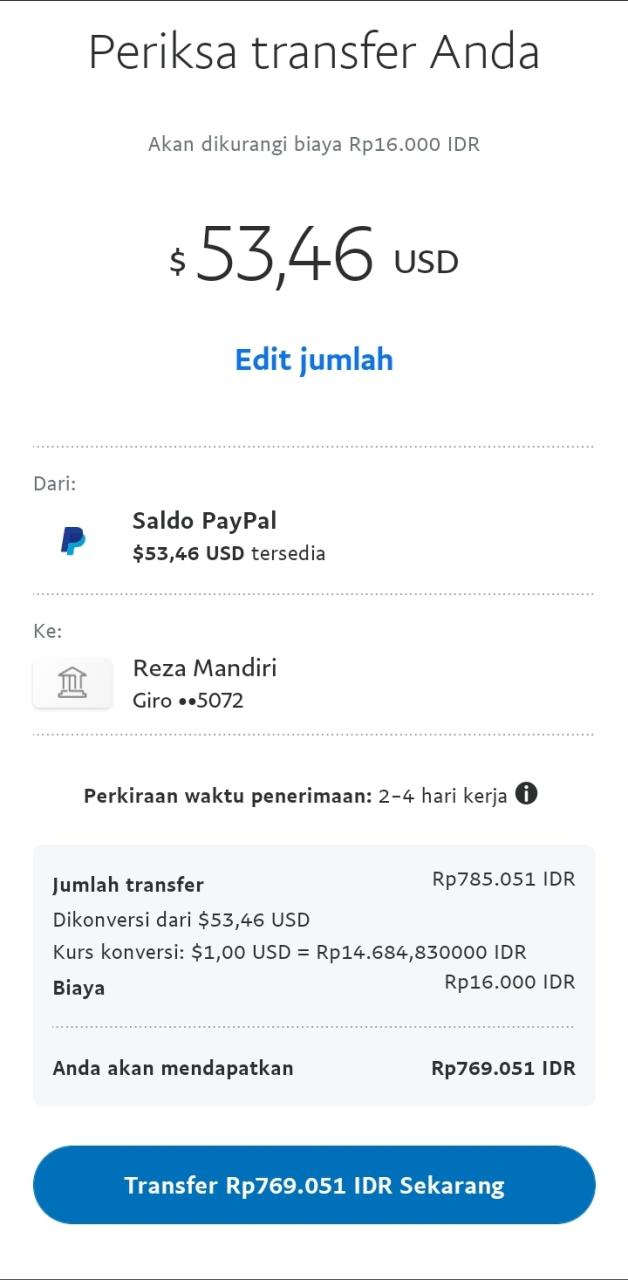

In the case of withdrawals involving currency conversion, users need to be aware of the conversion margin. This margin represents the difference between the PayPal conversion rate and the market rate. Users are charged a fee for this difference when withdrawing funds in different currencies.

Additionally, PayPal may charge third party withdrawal fees. This fee is charged if you withdraw funds through a third-party service, such as Xoom or Venmo. These fees vary depending on the services used.

It is important to note that withdrawal fees may change at any time. PayPal reserves the right to adjust these fees at its discretion. Therefore, it is recommended to always check the latest withdrawal fees before making any transaction.

Understanding the different types of withdrawal fees on PayPal will help you make informed financial decisions when using the platform. By planning ahead and choosing the most cost-effective withdrawal method, you can maximize your funds and minimize the fees associated with your PayPal transactions.

How to Avoid High Withdrawal Fees

PayPal, a popular online payment platform, offers a variety of withdrawal options. However, it is important to know the types of withdrawal fees charged in order to minimize costs and maximize profits.

One of the most common types of withdrawal fees is a percentage fee. This fee is applied as a percentage of the amount you withdraw. The percentage varies depending on the withdrawal method and your country of origin. For example, the fee for withdrawing via bank transfer to an account in the United States is 1.5%.

Another type of withdrawal fee is a fixed fee. This fee is charged as a fixed amount, regardless of the amount you withdraw. Flat fees usually apply to withdrawals to international bank accounts or to withdrawals made using a debit or credit card. For example, the fee for withdrawing to an international bank account is $5.00.

In addition to the withdrawal fees charged by PayPal, you may also be charged fees by your bank. These fees vary depending on your bank and account type. Check with your bank to see if they charge withdrawal fees for transfers made from PayPal.

To avoid high withdrawal fees, consider the following:

Choose the withdrawal method with the lowest fees. Withdrawal fees vary depending on the method you use. Compare fees for bank transfers, debit cards, and credit cards before making a withdrawal.

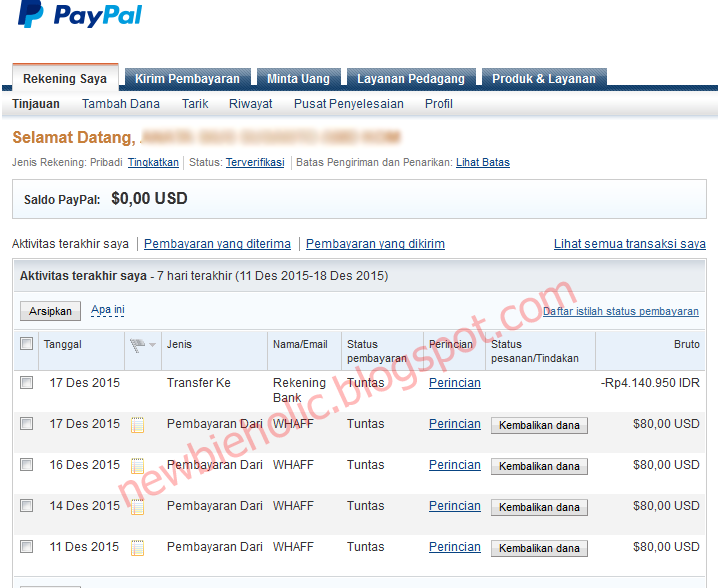

Withdraw larger amounts at once. The percentage fees can be greater if you withdraw smaller amounts multiple times rather than withdrawing larger amounts all at once.

Avoid international withdrawals. Withdrawal fees for international withdrawals are higher than domestic withdrawal fees. If possible, withdraw funds to a bank account in your home country.

Check your bank fees. Be sure to check with your bank to see if they charge withdrawal fees for transfers made from PayPal. If this happens, it may be cheaper to withdraw funds via another method.

By understanding the types of withdrawal fees charged by PayPal and your bank, you can take steps to minimize fees and save money when withdrawing funds.

PayPal Withdrawal Fees: Everything You Need to Know

PayPal is one of the most popular and widely used online payment methods worldwide. With PayPal, you can make payments and receive payments easily and safely. However, as is the case with other services, PayPal also has fees associated with using their services. In this article, we’ll talk about PayPal withdrawal fees, also known as withdrawal fees, and everything you need to know about them.

What are PayPal Withdrawal Fees?

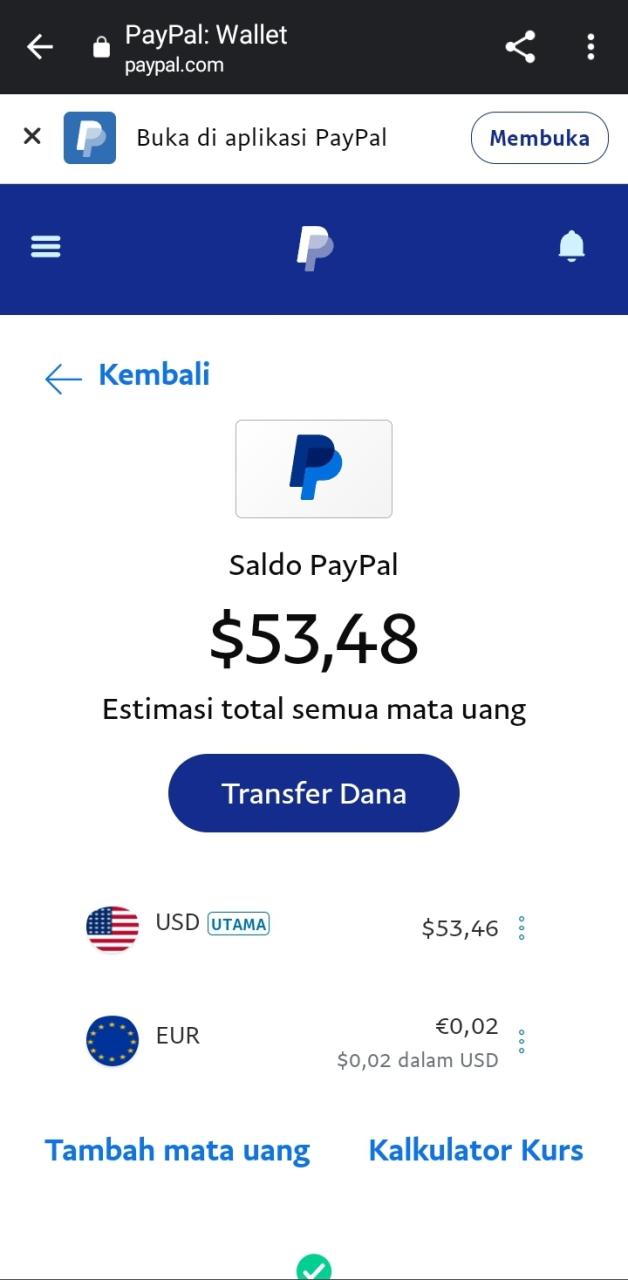

PayPal withdrawal fees are fees charged by PayPal to users when they want to withdraw funds from their PayPal account and transfer them to their bank account or credit card. These fees are usually charged as a percentage of the withdrawal amount and can vary depending on the country and type of account you use.

How Much Are PayPal Withdrawal Fees?

Withdrawal fees from PayPal may vary depending on the country and type of account you use. Here are some examples of withdrawal fees from PayPal for several countries:

- United States: 1% of the withdrawal amount, with a minimum of $0.30 and a maximum of $10.

- Canada: 1% of the withdrawal amount, with a minimum of $0.30 and a maximum of $10.

- UK: 1% of the withdrawal amount, with a minimum of £0.25 and a maximum of £10.

- Australia: 1% of the withdrawal amount, with a minimum of $0.30 and a maximum of $10.

Why Are PayPal Withdrawal Fees Charged?

Withdrawal fees from PayPal are charged for several reasons:

- Process Costs : PayPal must pay a processing fee to process withdrawals from a PayPal account to a bank account or credit card.

- Cost of Risk : PayPal must also pay a risk fee to cover the possible loss or theft of funds during the withdrawal process.

- Operating costs : PayPal also has operational costs that must be paid, such as infrastructure costs, human resource costs, and other costs.

How to Reduce Withdrawal Fees from PayPal?

Here are some ways you can reduce withdrawal fees from PayPal:

- Withdraw large amounts of funds : The larger the withdrawal amount, the smaller the withdrawal fee charged.

- Use a local bank account : If you have a local bank account, you can reduce withdrawal fees by moving funds directly to that bank account.

- Use a debit card : Debit cards have lower withdrawal fees compared to credit cards.

- Avoid small withdrawals : If you only want to withdraw small funds, you should wait until the withdrawal amount reaches the minimum fee limit.

Tips and Tricks to Save on Withdrawal Fees from PayPal

Here are some tips and tricks you can do to save on withdrawal fees from PayPal:

- Check withdrawal fees before making a withdrawal : Make sure you check withdrawal fees before making a withdrawal to avoid unwanted fees.

- Use the withdrawal fee calculator : PayPal provides a withdrawal fee calculator that can help you calculate withdrawal fees before making a withdrawal.

- Withdraw funds in local currency : If you have a local bank account, we recommend that you withdraw funds in local currency to avoid currency conversion.

- Avoid withdrawing funds on holidays : Withdrawing funds on holidays may increase withdrawal fees.

Conclusion

PayPal withdrawal fees are fees charged by PayPal to users when they want to withdraw funds from their PayPal account and transfer them to their bank account or credit card. These fees may vary depending on the country and type of account you use. By understanding withdrawal fees and using the right tips and tricks, you can save on PayPal withdrawal fees. Make sure you check withdrawal fees before making a withdrawal and use a local bank account to reduce withdrawal fees.

Tips for Managing PayPal Withdrawal Fees Effectively

When you are ready to withdraw funds from your PayPal account, it is important to be aware of the various withdrawal fees that may apply. By understanding these types of fees, you can take steps to minimize them, so you can maximize the amount of money you receive.

One of the most common types of withdrawal fees is a flat fee. This is a flat fee that PayPal charges for processing your withdrawal, regardless of the amount you withdraw. The amount of this fee varies depending on the currency you withdraw, but usually ranges from a few dollars to tens of dollars.

Another type of fee is a percentage fee. This fee is charged as a percentage of the amount you withdraw. The percentage varies depending on the withdrawal method you use and the currency you receive. For example, withdrawals to a local bank account usually have a lower percentage than withdrawals to a credit card.

In addition to fixed and percentage fees, PayPal may also charge a currency conversion fee if you withdraw funds in a currency different from your account currency. These fees may vary depending on current exchange rates and the currencies involved.

To avoid or minimize PayPal withdrawal fees, consider the following tips:

Withdraw your funds in large amounts at once, instead of withdrawing small amounts at regular intervals. This way, you are only charged a flat fee once.

Choose the withdrawal method with the lowest percentage fee. Withdrawing to a local bank account is usually the cheapest option.

If you withdraw funds in a currency different from your account currency, look for the best exchange rate before making a withdrawal. You can use online currency calculators to compare exchange rates from different banks and financial institutions.

By following these tips, you can manage your PayPal withdrawal fees effectively and maximize the amount of money you receive. Always check PayPal’s current fee schedule for the most accurate information on applicable fees.