History and Development of PayPal

PayPal, the leading digital payments platform, has had a long and innovative journey since its founding in 1998. Originally known as Confinity, the company introduced an online payment service that allowed individuals and small businesses to send and receive money via email.

In 2000, Confinity merged with X.com, and two years later, the company changed its name to PayPal. Through a series of acquisitions, including Braintree and Venmo, PayPal expanded its reach and offered a variety of services, from payment processing to financial services.

The next big break for PayPal came in 2015 when it was acquired by eBay. This gave PayPal access to eBay’s huge user base and allowed the company to expand its service offerings. In 2021, PayPal split from eBay, becoming an independent company once again.

Throughout its journey, PayPal has faced competition from new fintech companies and tech giants like Apple and Google. However, PayPal continues to innovate, introduce new features and expand its partnerships to maintain its leading position in the digital payments market.

One of the key factors to PayPal’s success is its extensive ecosystem. The company partners with banks, financial institutions, and other service providers to provide comprehensive payment solutions to users. PayPal also invests in cutting-edge security technology to protect customer transactions from fraud and theft.

Today, PayPal is a global leader in online and digital payments. It serves more than 400 million active users in more than 200 countries and regions. The company continues to innovate, explore new payment technologies and expand its service offerings to meet changing customer needs.

PayPal’s history and development is a story of innovation, growth, and adaptation. The company has grown from a simple email payment service to an all-in-one fintech platform used by millions of people around the world. With its commitment to innovation and customer focus, PayPal is expected to continue to play an important role in the evolution of digital payments and finance.

PayPal’s Impact on the Payments Industry

When it comes to the digital payments revolution, PayPal stands as the undisputed pioneer. PayPal’s journey has shaped the payments industry, ushering in a new era of convenience and security for consumers and businesses around the world.

In the early 2000s, the emergence of e-commerce sparked the need for safe and efficient online payment methods. PayPal fills this void by providing a platform that allows users to send and receive money virtually. Through a PayPal account, customers can easily link their financial information and make transactions without having to reveal sensitive details to sellers.

PayPal’s reliability and ease of use is quickly gaining popularity. Users appreciate the ability to make payments to friends, family and businesses securely from the comfort of their home. Companies are also adopting PayPal as an e-commerce payment solution, realizing that this can increase customer trust and speed up conversions.

As PayPal grows, it faces challenges from new competitors that emerge. However, the company continues to innovate and adapt to maintain its leading position. In 2002, PayPal acquired Braintree, a payment processing service focused on mobile devices. The acquisition strengthens PayPal’s mobile offerings and allows the company to reach a broader customer base.

PayPal also expanded its reach geographically, expanding its services to more than 200 countries. By providing support for multiple currencies and languages, PayPal facilitates international trade and drives global business growth. Additionally, the company introduced new services such as PayPal Credit and PayPal Checkout, which offer further flexibility in payments.

Today, PayPal has become a dominant player in the payments industry. The platform processes billions of transactions every year and has become a trusted choice for individuals and businesses around the world. PayPal’s impact is far-reaching:

Changing the way people pay: PayPal has made online payments easier and more secure, eliminating the need to share sensitive financial information.

Facilitates e-commerce growth: PayPal’s platform has enabled businesses to reach a global audience and streamline the checkout process, resulting in increased online sales.

Driving financial inclusion: PayPal provides access to financial services for individuals who do not have traditional bank accounts, promoting financial inclusion globally.

PayPal continues to evolve and adapt to the ever-changing payments landscape. With its innovative technology and focus on user experience, PayPal will likely remain a major force in the payments industry for years to come.

PayPal: The Online Payment Revolution

In the last few decades, technology has advanced rapidly and has had a significant impact on the way we conduct financial transactions. One of the clearest examples is the emergence of PayPal, an online payment platform that has changed the way we carry out online transactions. In this article, we will discuss PayPal, its history, features, advantages and disadvantages, and future prospects.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, this company was called Confinity, an online payment platform that allowed users to carry out financial transactions via PalmPilot devices. However, in 2000, Confinity merged with X.com, another online payments company founded by Elon Musk. After the merger, the company changed its name to PayPal and began to focus on developing an online payment platform.

In 2002, PayPal was acquired by eBay, a large e-commerce company, for 1.5 billion US dollars. This acquisition allows PayPal to expand its network and improve its payment capabilities. In 2015, PayPal was separated from eBay and became an independent company again.

PayPal Features

PayPal offers various features that allow users to carry out financial transactions easily and safely. Some of PayPal’s main features include:

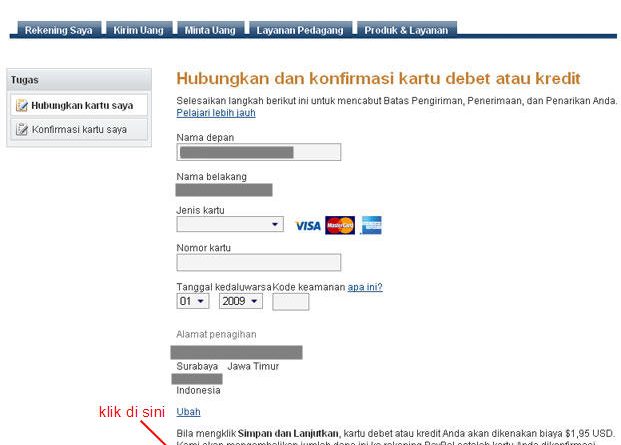

- Online Payment : PayPal allows users to make online payments easily and quickly. Users can make payments using credit cards, debit cards or bank accounts.

- Payment Acceptance : PayPal also allows users to accept payments from other people. Users can accept payments from customers, clients, or friends.

- Money Transfer : PayPal allows users to transfer money between other users. Users can transfer money to a bank account or credit card.

- Financial management : PayPal also offers financial management features that allow users to track financial transactions, pay bills, and perform financial analysis.

Advantages of PayPal

PayPal has several advantages that make it a popular choice among users. Some of the advantages of PayPal include:

- Convenience : PayPal is very easy to use, even for those who have no experience in making online transactions.

- Security : PayPal has a very strong security system, so users can make transactions safely.

- Flexibility : PayPal offers a variety of payment methods, so users can choose the method that best suits their needs.

- Scalability : PayPal can be used by large and small companies, so it is very flexible and can be adapted to the company’s needs.

Disadvantages of PayPal

Although PayPal has many advantages, it also has some disadvantages. Some of PayPal’s disadvantages include:

- Cost : PayPal charges quite large transaction fees, so it can be a burden for users.

- Limitations : PayPal has limitations in carrying out financial transactions, so users must ensure that they have sufficient balance before making a transaction.

- Dependence : PayPal is very dependent on the internet network, so users must have a stable internet connection to make transactions.

- Security Risks : Even though PayPal has a strong security system, there are still security risks that can occur, such as identity theft or fraud.

PayPal’s Future Prospects

PayPal has become one of the most popular online payment platforms in the world, and its future prospects look very bright. Some factors that could influence PayPal’s prospects include:

- Ecommerce Growth : The rapid growth of e-commerce can increase demand for online payments, so PayPal can take advantage of this opportunity to increase revenue.

- Technology Development : Rapid technological development can help PayPal to improve its payment capabilities and increase transaction security.

- Geographic Expansion : PayPal’s geographic expansion can help the company to improve its network and increase revenue.

In conclusion, PayPal has become one of the most popular online payment platforms in the world, and its future prospects look very bright. With features that allow users to carry out financial transactions easily and safely, PayPal can take advantage of this opportunity to increase revenue and expand its network. However, companies must also continue to monitor existing deficiencies and strive to improve their payment capabilities and increase transaction security.

PayPal Innovation in Changing the Way People Transact

The journey of PayPal, the online payments platform that has revolutionized the way we transact, is a story of constant innovation and adaptation. Originally founded as Confinity in 1998, PayPal began its journey as a money transfer service between handheld device users.

However, in 2000, PayPal was acquired by eBay and since then it has started to grow rapidly. Leveraging eBay’s large user base, PayPal quickly became the payment method of choice for e-commerce transactions. PayPal’s key innovation is the use of a “digital wallet” system, which allows users to store their personal financial information securely and make payments without sharing their details with merchants.

Over time, PayPal continues to innovate. The platform introduces new features, such as the ability to send and receive money instantly, make payments from mobile phones, and integrate with other businesses and platforms. This innovation expands PayPal’s reach and makes it a convenient and secure choice for a variety of transactions, from online purchases to bill payments.

In addition to its innovative features, PayPal also invests in strategic acquisitions. The company has acquired several startups, including Venmo and Braintree, which have expanded its offerings and given it access to new markets.

One of the most important aspects of PayPal’s success is its focus on security. The platform uses multiple layers of security measures, including data encryption, fraud detection, and continuous account monitoring, to protect user privacy and security.

As a payments platform, PayPal has played an important role in driving the growth of e-commerce and the digitalization of transactions. Continuous innovation and adaptation have been the driving forces behind its success. PayPal continues to invest in new technology and look for ways to improve the user experience, so it will likely continue to play an important role in shaping the payments landscape of the future.