Linking Credit Card to PayPal

Linking a credit card to PayPal is an easy process that only takes a few steps. First of all, log in to your PayPal account. Once you’re logged in, click the “Wallet” tab and then “Connect card or bank.”

Next, enter your credit card information, including card number, expiration date, and security code. Once you have entered all the necessary information, click “Save.” Your credit card will now be linked to your PayPal account.

Once your card is connected, you can use it to make payments on any website and store that accepts PayPal. Just select PayPal as your payment method and enter your PayPal password. PayPal will then process your payment.

There are several benefits to connecting a credit card to PayPal. Firstly, it is a safe and convenient way to make online payments. PayPal uses encryption technology to protect your financial information, so you can be sure that your information is safe.

Second, connecting your credit card to PayPal can help you manage your finances. PayPal will track your transactions and provide you with monthly reports that you can use to see how you are spending your money.

Lastly, connecting your credit card to PayPal can help you earn rewards. PayPal offers a variety of rewards programs that allow you to earn points or cash back for purchases you make.

If you want to connect your credit card to PayPal, the process is easy and only takes a few steps. You can start enjoying the benefits of connecting your credit card to PayPal today.

How to Make Payments with Credit Cards on PayPal

Linking Credit Card to PayPal

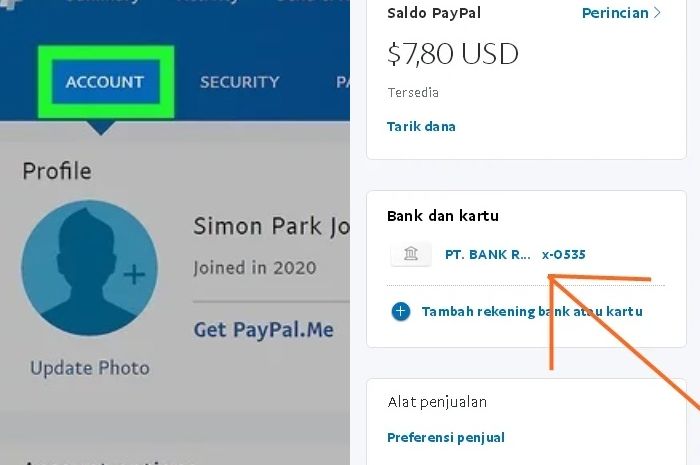

Once you’ve created a PayPal account, the next step is to connect a credit card so you can easily make online payments. This process is fast and convenient, and only requires a few simple steps.

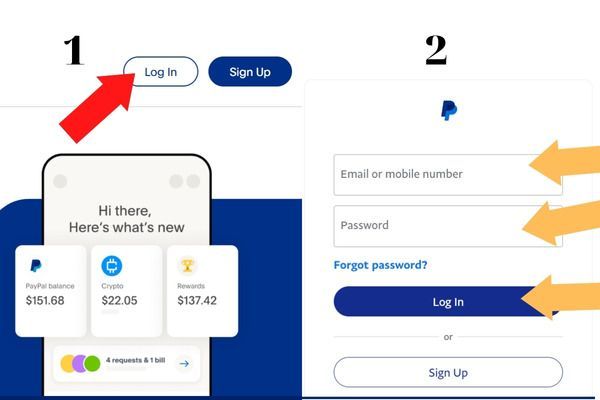

Step 1: Login to Your Account

Visit the PayPal website and log in to your account. Click the “Wallet” tab in the top menu.

Step 2: Add a New Payment Method

In the “Payment Methods” section, click the “Add Credit or Debit Card” button.

Step 3: Enter Card Information

Enter your credit card information, including card number, expiration date, and security code (CVV). Make sure all information is correct.

Step 4: Verify Your Card

PayPal will usually verify your card by charging a small amount to your account. This is to ensure that the card is valid. You must enter a verification code which will be sent to your mobile number or email.

Step 5: Finish

Once your card is verified, click the “Save” button to complete the process. Your credit card is now linked to your PayPal account.

Using Your Credit Card on PayPal

Once your credit card is connected, you can use it to make payments on PayPal by following these steps:

During checkout, select PayPal as your payment method.

Enter your PayPal email address and password.

Select the credit card you want to use from your list of payment methods.

Click the “Pay Now” button to complete the transaction.

Additional Tips

You can link multiple credit cards to your PayPal account.

You can set a default credit card that will be used automatically for payments.

PayPal offers buyer protection for purchases made using your linked credit card.

By connecting your credit card to PayPal, you can easily and safely make online payments. The process is quick and easy, and provides peace of mind knowing that your transactions are protected.

PayPal: Safe and Easy Payment Solution with Credit Cards

In this digital era, making online payment transactions has become easier and safer. One way to make online payments is through PayPal, an electronic payment service that is popular throughout the world. PayPal allows you to make payments ONLINE easily and securely, and gives you complete control over your transactions.

In this article, we will discuss PayPal Credit Card, one of the features offered by PayPal to make it easier for you to make payments online. We will also discuss the advantages and disadvantages of PayPal Credit Card, as well as how to use this service.

What is PayPal Credit Card?

PayPal Credit Card is a credit card issued by PayPal, which allows you to make online payments more easily and safely. This credit card can be used to make payments at various online stores that accept PayPal, and can also be used to make payments directly at various merchants that accept credit cards.

Advantages of PayPal Credit Card

Here are some of the advantages of using a PayPal Credit Card:

- Easy to use : PayPal Credit Card is very easy to use, you only need to register and activate your credit card to be able to make payments online.

- Safe : PayPal Credit Card is equipped with advanced security technology, so you can make payments online safely.

- No need to have a bank account : You don’t need to have a bank account to use PayPal Credit Card, so you can make payments online without needing to have a bank account.

- No need to have a debit card : You don’t need to have a debit card to use PayPal Credit Card, so you can make payments online without needing to have a debit card.

- Can be used in various countries : PayPal Credit Card can be used in various countries, so you can make payments online in various countries.

- No annual fees : PayPal Credit Card has no annual fee, so you can use this credit card without worrying about annual fees.

Disadvantages of PayPal Credit Card

Here are some of the disadvantages of using a PayPal Credit Card:

- Transaction fees : PayPal Credit Card has transaction fees that can vary depending on the type of transaction and destination country.

- Transaction limits : PayPal Credit Card has a transaction limit that can change depending on the type of transaction and destination country.

- Flower : PayPal Credit Card has interest that can change depending on the type of transaction and destination country.

- Delivery time : PayPal Credit Card has delivery times that may vary depending on the type of transaction and destination country.

- Card restrictions : PayPal Credit Card may be blocked or canceled if you do not use this credit card regularly.

How to Register for PayPal Credit Card

Here’s how to register for a PayPal Credit Card:

- Go to the PayPal website : Go to the PayPal website and log in to your account.

- Select the “Credit Card” option : Select the “Credit Card” option in the PayPal main menu.

- Fill out the registration form : Fill out the registration form that will appear on your screen.

- Verify your identity : Verify your identity by uploading the required identification documents.

- Wait for approval : Wait until your account is approved and your credit card is issued.

How to Use PayPal Credit Card

Here’s how to use PayPal Credit Card:

- Log in to your PayPal account : Log in to your PayPal account.

- Select the “Credit Card” option : Select the “Credit Card” option in the PayPal main menu.

- Select a payment method : Select the payment method you want (for example: credit card).

- Enter the card number : Enter your credit card number.

- Confirm transaction : Confirm your transaction.

Tips for Using PayPal Credit Card

Here are some tips for using PayPal Credit Card:

- Do not share card information : Do not share your credit card information with others.

- Use the card regularly : Use your credit card regularly to avoid blocking.

- Check card balance : Check your credit card balance regularly to avoid running out of funds.

- Avoid fraudulent transactions : Avoid fraudulent transactions by checking the authenticity of the merchant before making a transaction.

By using PayPal Credit Card, you can make online payments more easily and safely. Make sure you understand the advantages and disadvantages of using this credit card, and follow the tips for using a credit card that we have provided.

Benefits and Security of Using a Credit Card on PayPal

Linking a credit card to PayPal offers a variety of benefits and an additional layer of security that cannot be ignored. Let’s dive into the key benefits and safety precautions you need to know.

Unmatched Comfort

One of the main advantages of connecting a credit card to PayPal is its ease and convenience. PayPal serves as a bridge between financial institutions, allowing you to make online transactions quickly and easily without having to enter your credit card details repeatedly. Transactions can be made with just a few clicks, saving time and hassle.

Enhanced Security

Paypal employs strict security measures to protect your financial information. When you connect a credit card, PayPal encrypts your data, reducing the risk of fraud and identity theft. Plus, you don’t have to share your sensitive credit card information with merchants, further minimizing the risk of data leaks.

Buyer Protection

PayPal offers comprehensive buyer protection, providing peace of mind when shopping online. If you don’t receive your purchased item or are dissatisfied with the product, PayPal provides an easy dispute resolution process. This can help protect your money and ensure a positive shopping experience.

Low Transaction Fees

PayPal transactions typically have low transaction fees, especially compared to other payment providers. This can save you money in the long run, especially if you make frequent online purchases.

Reserve Funds

If you run out of PayPal balance, PayPal will automatically charge your connected credit card to complete the transaction. This feature provides a reserve of funds, ensuring you can complete your purchase without interruption.

Safety Precautions

Although PayPal is safe, it is important to take the following security precautions:

Use strong passwords and two-factor authentication.

Check your PayPal activity report regularly.

Report suspicious transactions immediately.

Restrict access to your PayPal account to trusted people.

Don’t click on links or download attachments from unknown senders.

By following these security precautions, you can maximize security when connecting your credit card to PayPal.