What is PayPal Overdraft?

You’ve probably heard of overdrafts, but what is a PayPal overdraft? Similar to bank overdrafts, PayPal overdrafts allow you to make transactions that exceed the existing balance in your PayPal account. However, there are some key differences to keep in mind.

First of all, PayPal overdraft is only available to approved users. To qualify, you must have a good history of using PayPal and meet certain credit requirements. Once approved, you can apply for an overdraft of $50 to $1,500.

The main advantage of PayPal overdraft is its convenience and flexibility. If you run out of money in your PayPal account, you can still make transactions using overdraft funds. This can be very useful in emergency situations or when you cannot immediately transfer funds to your PayPal account.

However, it is important to remember that PayPal overdrafts are not free. You will be charged $10 for each overdraft transaction you make, and this fee is non-refundable. Additionally, you will be charged interest of 29.99% per year on your overdraft balance.

If you are considering using PayPal overdraft, it is important to understand the fees and terms. You should also make sure that you only use overdraft in emergencies or when you really need it. Using an overdraft too often can result in high fees and negatively impact your credit history.

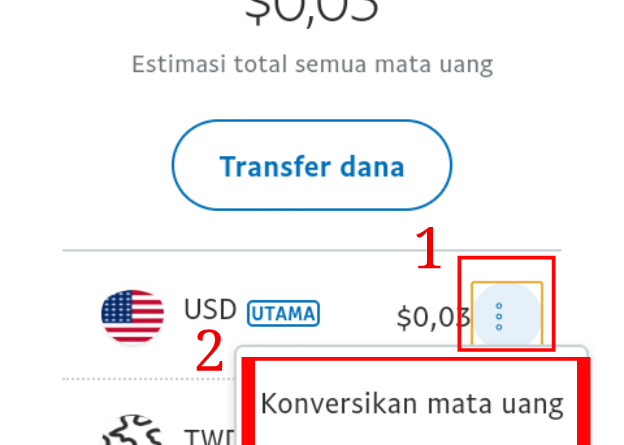

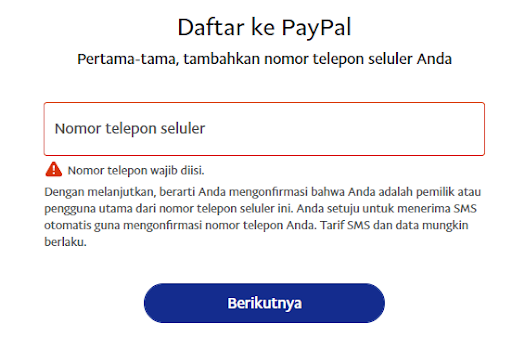

To set up a PayPal overdraft, you must log in to your PayPal account and navigate to the “Wallet” page. On this page, you will see the option to “Enable Overdraft”. Click this option and follow the on-screen instructions.

If you have overdraft enabled and want to disable it, you can follow the same steps. Simply log in to your PayPal account, navigate to the “Wallets” page, and click the “Disable Overdraft” option.

Overall, PayPal overdraft is a useful tool that can give you financial flexibility when you need it. However, it is important to use them wisely and understand the costs and terms associated with them.

How to Manage a PayPal Account to Avoid Overdrafts

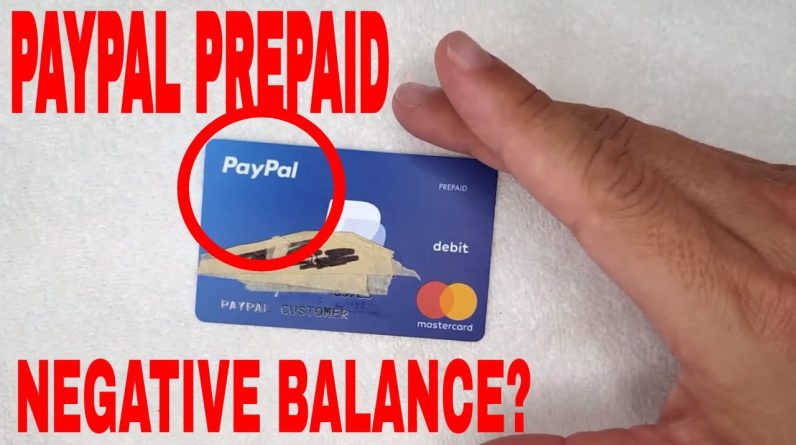

So, what exactly is a PayPal overdraft? Similar to an overdraft on a bank account, a PayPal overdraft occurs when you spend more money through PayPal than is available in your balance. In other words, you borrow funds from PayPal.

This may sound convenient, but PayPal overdrafts can incur high fees. PayPal charges $30 per overdraft transaction, up to $100 per day. So, if you forget to top up your balance or make a mistake, you could incur hefty fees.

Fortunately, there are several things you can do to avoid PayPal overdrafts:

Monitor your balance: Check your PayPal balance regularly to ensure you have enough funds to cover transactions.

Enable notifications: Set email or SMS notifications to notify you when your balance is low.

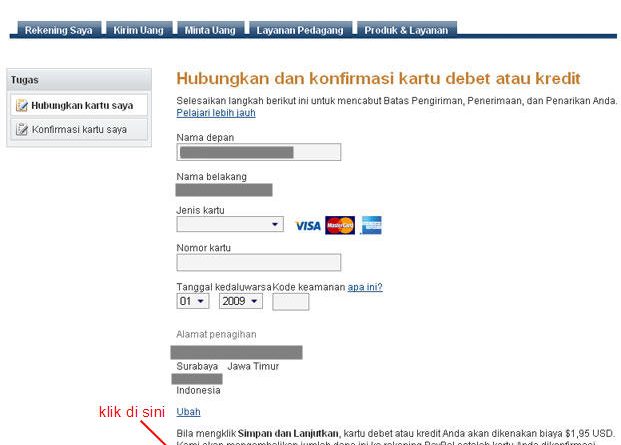

Use a backup funding source: Link a bank account or credit card to your PayPal account as a backup funding source.

Avoid risky transactions: If you are worried about overdrafts, avoid making large transactions or repeat purchases.

If you have already overdrafted, top up your balance immediately to avoid further fees. You can top up your balance via bank transfer, credit card or PayPal Cash balance.

In addition to the steps above, it is also important to familiarize yourself with PayPal’s terms and conditions regarding overdrafts. PayPal may suspend or limit your account if you overdraft excessively.

Lastly, if you have any further questions or concerns, please do not hesitate to contact PayPal customer service. They will be happy to help you understand how PayPal overdraft works and avoid unnecessary fees.

PayPal Overdraft: What You Need to Know

PayPal has become one of the most popular online payment methods in the world. With more than 400 million active users, PayPal offers convenience and security in conducting online transactions. However, as with all financial services, PayPal also has several disadvantages, one of which is overdraft. In this article, we’ll discuss what a PayPal overdraft is, how to avoid it, and what you need to do if you experience an overdraft.

What is PayPal Overdraft?

PayPal overdraft is a situation where your PayPal balance goes below zero. This can occur when you make a transaction that exceeds the available balance in your PayPal account. For example, if you have a PayPal balance of $100 and make a purchase worth $150, your PayPal balance would be -$50. This means you have overdrafted $50.

Causes of PayPal Overdraft

There are several causes that can cause PayPal to overdraft, including:

- Purchases that exceed the balance : If you make a purchase that exceeds the available balance in your PayPal account, you will experience an overdraft.

- Transaction fees : PayPal transaction fees can cause your balance to decrease, especially if you make frequent transactions.

- Refund : If you make a refund for a transaction, your balance may decrease, especially if the transaction has already been processed.

- Subscription fees : Subscription fees, such as streaming service subscription fees, can cause your balance to decrease if you don’t monitor your balance.

How to Avoid PayPal Overdraft?

To avoid PayPal overdraft, you can take the following steps:

- Check balance : Make sure you check your PayPal balance regularly to ensure that you have enough balance to make transactions.

- Set notifications : Enable PayPal notifications to monitor your balance and receive alerts if your balance goes below zero.

- Use another payment method : If you don’t have enough balance, use another payment method, such as a credit or debit card.

- Update payment information : Make sure your payment information is up to date to ensure that your balance doesn’t decrease unexpectedly.

What Do You Need to Do if You Experience a PayPal Overdraft?

If you experience a PayPal overdraft, here are some steps you need to take:

- Check balance : Check your PayPal balance to ensure you understand the amount of the overdraft that occurred.

- Handle overdrafts : If you have sufficient balance in your bank account, you can transfer funds to your PayPal account to handle overdrafts.

- Contact PayPal : If you don’t have enough balance, you can contact PayPal for help.

- Update payment information : Make sure your payment information is up to date to ensure that your balance doesn’t decrease unexpectedly.

PayPal Overdraft Fees

PayPal overdraft fees may vary depending on your country and PayPal account type. Here are some examples of PayPal overdraft fees:

- PayPal overdraft fees in the United States: $25-$35

- PayPal overdraft fees in the UK: £10-£20

- PayPal overdraft fees in Australia: AU$20-AU$30

Conclusion

PayPal overdrafts can occur if you make transactions that exceed the available balance in your PayPal account. To avoid overdrafts, make sure you check your balance regularly, set notifications, and use other payment methods if necessary. If you experience an overdraft, check your balance, handle the overdraft, and contact PayPal if necessary. Make sure you understand PayPal overdraft fees and update your payment information to ensure that your balance does not decrease unexpectedly. By understanding PayPal overdrafts and how to avoid them, you can use PayPal safely and comfortably.

Tips to Avoid Overdraft Fees on PayPal

What is PayPal Overdraft?

PayPal Overdraft is a feature that allows you to pay for transactions using the negative balance in your PayPal account. In other words, you can make purchases even if you don’t have enough funds in your account. However, keep in mind that this is a fee-based feature, and it’s important to understand how it works to avoid unwanted overdraft fees.

When you make a transaction with PayPal Overdraft, you will be charged a $10 overdraft fee. This fee is added to your balance and must be paid in full before you can make further transactions. You will also be charged interest on your negative balance, which will continue to increase every day until the balance is paid in full.

How to Avoid Overdraft Fees on PayPal

There are several ways to avoid overdraft fees on PayPal:

Check your balance regularly: Before making a transaction, make sure you have enough funds in your PayPal account. You can check your balance online or through the PayPal mobile app.

Enable low balance notifications: PayPal offers a low balance notification feature that will send you an email or text message when your balance is low. This can help you track your expenses and avoid overdrafts.

Set a backup payment method: PayPal allows you to set a backup payment method, such as a debit card or bank account, that will be used automatically if your balance is insufficient. This can help you avoid overdraft fees in case of an emergency.

Disable PayPal Overdraft: If you don’t want to use the PayPal Overdraft feature, you can disable it in your account settings. This will prevent you from making transactions with a negative balance.

Overdraft fees on PayPal can be expensive, so it’s important to avoid them whenever possible. By following these tips, you can manage your PayPal balance effectively and avoid unnecessary overdraft fees.