What Are Nonprofit Fees at PayPal?

What Are Nonprofit Fees at PayPal?

PayPal, a well-known online payment service, offers special rates for non-profit organizations. Compared to regular rates, nonprofit fees on PayPal are typically lower, providing significant savings for eligible organizations.

To qualify for nonprofit fees on PayPal, your organization must be registered as a 501(c)(3) nonprofit organization recognized by the Internal Revenue Service (IRS). Proof of nonprofit status, such as an IRS Letter of Determination, is required to verify your eligibility.

PayPal’s non-profit fees cover a wide range of transactions, including:

Credit Card Processing Fee: Fee charged when a donor makes a payment using a credit or debit card. These fees are usually lower than PayPal’s standard fees.

Transfer Fees: Fees charged when moving funds from your PayPal account to a bank account. These costs can also be lower for non-profit organizations.

Instant Withdrawal Fees: Fees charged when withdrawing funds from your PayPal account instantly. This fee may be waived for non-profit organizations.

International Transaction Fees: Fees charged when receiving payments from other countries. These fees may vary depending on the country.

In addition to these standard fees, PayPal also offers several additional features to nonprofit organizations, such as:

Recurring Donation Processing: A PayPal option that allows donors to set up recurring monthly or annual donations.

Customizable Donation Buttons: A feature that allows nonprofits to create and customize embeddable donation buttons on their websites or social media platforms.

Dedicated Customer Support: Nonprofit organizations can access a dedicated customer support team designed to help them with their PayPal needs.

By signing up for nonprofit fees on PayPal, your organization can save on payment processing fees and access additional features designed specifically for nonprofits. This can help you reduce expenses and maximize the impact of your donations.

If your organization qualifies for nonprofit status, we encourage you to sign up for PayPal nonprofit fees to save money and take advantage of the valuable features available.

How to Reduce Transaction Costs for Nonprofit Organizations

So, you’re a nonprofit organization looking to utilize PayPal to collect donations. Great! But before you start, it’s important to know about Nonprofit Fees at PayPal.

Nonprofit Fees, also known as rebate rates, are fees that PayPal charges non-profit organizations for processing credit and debit card transactions. These fees vary depending on the type of transaction and amount processed, but are generally lower than fees charged to businesses.

Why does PayPal charge fees to non-profit organizations? Well, they have to cover the costs of processing transactions, such as credit card processing fees and security fees. In addition, PayPal also has to make a profit.

Now that you know the basics of Nonprofit Costs, let’s discuss how to reduce them.

First, make sure you qualify for the discounted rate. To do this, you must be a registered non-profit organization in the US and have a PayPal Business account. You should also verify your non-profit status with PayPal.

Once you qualify for a reduced rate, there are several things you can do to reduce costs:

Use the Standard Payment option: PayPal’s Standard Payment option is usually the cheapest option for processing transactions.

Accept debit cards: Debit card transactions incur lower fees than credit card transactions.

Limit the number of transactions: The more transactions you process, the more fees you will pay. Try to limit the number of transactions by collecting several donations at once.

Use Free features for Nonprofits: PayPal offers a variety of free features for nonprofits, such as Donation Forms and Recurring Payment Processing. These features can help you reduce transaction costs.

Reducing your transaction costs can make a big difference to your bottom line. By following these tips, you can save money and allocate more funds to your mission.

As a reminder, Nonprofit Fees are subject to change, so be sure to check the PayPal website for the latest rates.

PayPal Nonprofit Fees: How to Save on Transaction Fees

PayPal has become one of the world’s most popular online payment methods, used by millions of people and organizations worldwide. However, for for-profit organizations, PayPal transaction fees can be a significant burden. In this article, we’ll discuss PayPal’s nonprofit fees, how to save on transaction fees, and some alternatives that may be better for nonprofits.

PayPal Nonprofit Fees

PayPal offers several types of fees for transactions, namely standard transaction fees and transaction fees with additional features. PayPal’s standard transaction fees are 2.9% + 0.30 USD per transaction. However, for non-profit organizations, PayPal offers lower transaction fees, namely 1.8% + 0.30 USD per transaction.

PayPal’s non-profit transaction fees can also vary depending on the type of transaction. Here are some examples of PayPal non-profit transaction fees:

- In-country transaction fees: 1.8% + 0.30 USD per transaction

- International transaction fees: 2.0% + 0.30 USD per transaction

- Credit card transaction fees: 2.9% + 0.30 USD per transaction

How to Save on PayPal Nonprofit Transaction Fees

Although PayPal’s nonprofit transaction fees are lower than standard transaction fees, nonprofit organizations can still save on transaction fees in the following ways:

- Use a PayPal Business account : PayPal Business accounts provide several benefits, including lower transaction fees.

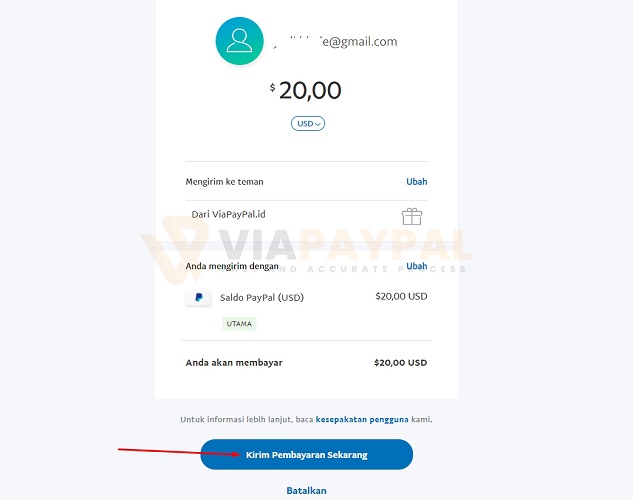

- Use a lower cost payment method : Payment methods such as PayPal Balance or bank transfer have lower transaction fees than credit cards.

- Collect donations regularly : Collecting donations regularly can help reduce transaction costs.

- Use the free donation feature : Some donation platforms, such as Network for Good or Qgiv, offer free donation features with no transaction fees.

- Consider PayPal alternatives : Some PayPal alternatives, such as Stripe or WePay, may have lower transaction fees.

PayPal Nonprofit Fee Alternative

If nonprofits want to save further on transaction fees, there are several PayPal nonprofit fee alternatives to consider:

- Stripe : Stripe offers lower transaction fees, namely 2.9% + 0.30 USD per transaction.

- WePay : WePay offers lower transaction fees, namely 2.9% + 0.30 USD per transaction.

- Network for Good : Network for Good offers lower transaction fees, namely 1.5% + 0.30 USD per transaction.

- Qgiv : Qgiv offers lower transaction fees, namely 1.5% + 0.30 USD per transaction.

Conclusion

PayPal’s nonprofit fees can be a significant burden for nonprofit organizations. However, with several ways to save on transaction fees and alternatives to PayPal’s nonprofit fees, nonprofits can save on transaction fees and increase fundraising. Be sure to consider several PayPal nonprofit fee alternatives and choose the one that best suits your organization’s needs.

Advice for Using PayPal Nonprofit Fees

Here are some suggestions for using PayPal nonprofit fees:

- Understand transaction costs : Make sure you understand the transaction fees required by PayPal.

- Choose the right payment method : Choose the payment method that best suits your organization’s needs.

- Use the free donation feature : Use the free donation feature to save on transaction costs.

- Consider PayPal alternatives : Consider PayPal alternatives if you want to save further on transaction fees.

- Monitoring transaction costs : Monitor transaction fees regularly to ensure that you do not exceed the specified transaction fee limits.

By understanding PayPal’s nonprofit fees and some ways to save on transaction fees, nonprofits can increase their fundraising and achieve their goals.

Benefits of Using PayPal for Non-Profit Organizations

When you run a nonprofit, every penny counts. PayPal is a payment platform that can help save money while making it easier to collect donations. Knowing what PayPal charges is important for planning your budget.

PayPal charges fees on transactions, both for selling items and collecting donations. These fees vary depending on how the donation is made and your organization’s country of origin.

For credit and debit card donations, PayPal charges a processing fee of 2.2% plus a flat fee of $0.30. For example, if someone donates $100 with a credit card, you will be charged $2.50.

However, fees are reduced if donors use their PayPal account. In this case, PayPal only charges 2.2% of the donation amount, with no fixed fees. So, for a $100 donation processed through your PayPal account, you will be charged $2.20.

PayPal also offers a Non-Profit Payment Processing feature that provides lower rates for qualifying nonprofit organizations. To qualify, your organization must have 501(c)(3) non-profit status and be registered with PayPal as a non-profit organization.

With Nonprofit Payment Processing, PayPal charges 2.2% of the donation amount, with no flat fees, regardless of how the donation is made. This can save you a lot of money compared to standard costs.

In addition to transaction fees, PayPal also charges fees for several other services, such as:

Converting foreign funds: 3.5% of the total amount

Withdrawing money to a bank account: $1.50 per withdrawal

Sending payments abroad: Fees vary depending on the country

It’s important to consider these costs when deciding whether to use PayPal for your nonprofit organization. However, its savings in donation processing costs and ease of use make PayPal an attractive option for many nonprofit organizations.