What is PayPal Kids?

PayPal Kids is a service designed to help parents teach their children about handling money, saving and spending responsibly. By linking a PayPal debit card to a child’s PayPal account, parents can monitor their transactions, set spending limits, and transfer money at any time.

The main benefit of PayPal Kids is that it allows children to learn how to manage money in a safe and controlled environment. Parents can assign certain tasks to their children, such as completing assignments or getting good grades, and then give them monetary rewards through their PayPal account. Kids can also make purchases of goods and services through their accounts, which helps them develop financial decision-making skills.

Additionally, PayPal Kids provides peace of mind for parents as they can easily monitor their child’s financial activities. They can receive real-time transaction notifications, block debit cards if they are lost or stolen, and monitor account balances. This gives parents complete control over their child’s finances, while allowing them to experience financial freedom.

To sign up for PayPal Kids, parents must have an active PayPal account. They can then create a child account through the PayPal app or website, and link it to their debit card. Parents can adjust their child’s account settings, such as setting spending limits and creating tasks.

PayPal Kids is a valuable tool for parents who want to teach their children about financial responsibility. It provides a safe environment for children to learn how to manage money, while also giving parents peace of mind and control over their children’s financial activities. With PayPal Kids, kids can develop important financial skills while preparing for the future.

How to Manage a PayPal Account for Kids

PayPal Kids, powered by PayPal, is a practical solution for parents who want to give their children financial freedom while maintaining control. This account gives kids the tools they need to learn about money management and financial responsibility from an early age.

For parents, PayPal Kids offers peace of mind. They can monitor their children’s spending, set spending limits, and block unwanted transactions. Additionally, kids can request money from their parents through the app, thereby avoiding the hassle of carrying cash or credit cards.

One of the main benefits of PayPal Kids is the “pocket money” feature. Parents can set monthly or weekly allowances for their children directly into their account. This gives children a sense of ownership and helps them understand the concept of money and budgeting. They can save, spend, or even donate their money, developing healthy financial habits.

PayPal Kids also encourages responsibility. Kids can track their own spending and set savings goals. Parents may assign certain tasks or responsibilities to their children, which may be associated with additional bonuses or allowances. This creates a natural incentive for positive behavior and helps children develop a strong work ethic.

Furthermore, PayPal Kids is integrated with the financial education platform Junior Money Coaches. It gives kids access to interactive games, quizzes, and fun educational content that teaches financial basics in an easy-to-understand way.

To sign up for PayPal Kids, parents must have an existing PayPal account and provide some basic information about their child. Children will need their own email address and phone number to create their account.

In conclusion, PayPal Kids is an innovative service that empowers children with early money management skills while providing peace of mind for parents. With its comprehensive features, parental controls, and educational tools, PayPal Kids is the ideal solution for helping children develop into financially responsible individuals.

PayPal Kids: A Financial Tool for Kids in the Digital Age

In this modern digital era, children are increasingly interacting with technology and carrying out online financial transactions. However, many parents are concerned about the safety and privacy of their children when making online transactions. Therefore, PayPal launched the PayPal Kids service, a financial tool designed specifically for children.

What is PayPal Kids?

PayPal Kids is an online financial service designed specifically for children under 18 years of age. This service allows children to conduct online financial transactions safely and reliably, and gives parents full control over the use of their children’s funds.

Key Features of PayPal Kids

Here are some of the main features of PayPal Kids:

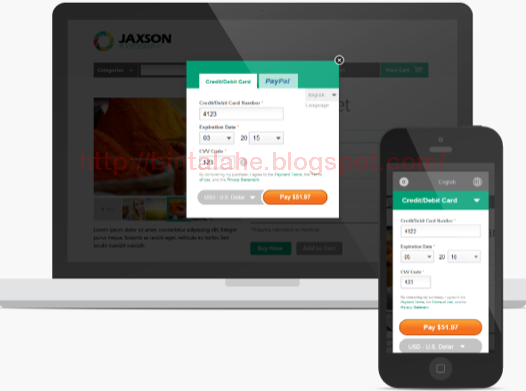

- Virtual Debit Card : Kids can have a virtual debit card to make online and offline transactions using the available balance in their PayPal Kids account.

- Transaction Limit Settings : Parents can set daily and weekly transaction limits for their children, so that they cannot make transactions that are too large.

- Transaction History : Parents can view their children’s transaction history in real-time, so they can monitor their children’s use of funds.

- Transaction Notification : Parents can receive notifications of their children’s transactions via email or notifications in the PayPal app.

- Transaction Category Settings : Parents can set the transaction categories allowed for their children, such as food, entertainment, or education.

- Full Control over Accounts : Parents have full control over their children’s PayPal Kids accounts, so they can monitor and manage their children’s use of funds.

Benefits of Using PayPal Kids

Here are some of the benefits of using PayPal Kids:

- Teaching Kids about Finance : PayPal Kids can be a good tool for teaching children about finances and fund management.

- Improve Security : PayPal Kids has advanced security features to protect children’s funds from fraud and loss.

- Saving time : Parents can save time by no longer having to give cash to their children to make transactions.

- Reducing Dependence on Cash : PayPal Kids can help reduce children’s dependence on cash and increase their use of digital financial technology.

- Increase Flexibility : PayPal Kids allows kids to make online and offline transactions using their virtual debit card.

How to Use PayPal Kids

Here’s how to use PayPal Kids:

- Open a PayPal Account : Parents must have a PayPal account to create a PayPal Kids account for their children.

- Create a PayPal Kids Account : Parents can create a PayPal Kids account for their children by filling out the form available on the PayPal website.

- Set Transaction Limits : Parents can set daily and weekly transaction limits for their children.

- Fill in Balance : Parents can top up their child’s PayPal Kids account.

- Set Up a Virtual Debit Card : Kids can have a virtual debit card to make online and offline transactions.

Conclusion

PayPal Kids is a financial tool designed specifically for children under 18 years of age. This service allows children to conduct online financial transactions safely and reliably, and gives parents full control over the use of their children’s funds. By using PayPal Kids, children can learn about finances and fund management, as well as increase security and flexibility in making online and offline transactions.

Benefits of Using PayPal for Children’s Finances

PayPal Kids is a financial solution designed specifically for children and teens. Launched as a joint service between PayPal and Greenlight, PayPal Kids empowers young people to manage their own money, while giving parents peace of mind.

One of the main benefits of using PayPal Kids is its convenience. Kids can create their own accounts and have them linked to their parents’ accounts. It allows parents to transfer money, track their children’s spending, and set spending limits.

Apart from that, PayPal Kids also teaches children about responsible money management. Kids can set savings goals, receive incentives for positive behavior, and learn about budgets and spending. The app provides an easy-to-use expense tracker feature, helping kids understand where their money goes.

Another advantage of PayPal Kids is security. The platform is safe and secure, protecting children’s financial information. Parents can also activate alerts for suspicious or unusual transactions.

Furthermore, PayPal Kids supports financial literacy for children. Teaching children about money at a young age is crucial to fostering healthy financial habits in the future. With PayPal Kids, kids can learn basic financial concepts through fun games and activities.

In conclusion, PayPal Kids is an excellent tool for parents to help their children learn about finances and manage their money responsibly. With its easy-to-use features, education focus, and robust security, PayPal Kids provides comprehensive financial solutions that support children’s growth and financial independence.