What is a Shared PayPal Account?

Have you ever had difficulty managing finances with your partner or roommate? A Joint PayPal Account could be the solution you are looking for. Imagine having a virtual “bank account” where you and others can share funds, track expenses, and split bills easily.

With a Shared PayPal Account, you can add other members as account owners. Everyone can deposit money, withdraw funds, or make payments from the same account. This is especially convenient for couples splitting household expenses or friends planning a trip together.

Once the account is created, you can send an invitation link to other members. They need to accept the invitation and create their own PayPal account to join. After all members join, you can start managing finances together.

One of the best features of a Shared PayPal Account is the ability to track expenses. Every transaction will be recorded in the account history, so all members can see where the money goes. This helps avoid misunderstandings and ensures financial transparency.

In addition, a Joint PayPal Account also makes it easier to pay joint bills. You can set up recurring payments for utilities, rent, or any subscriptions directly from your shared account. This eliminates the need to remember payment due dates and ensures that all bills are paid on time.

Creating a Shared PayPal Account is free and easy. All you need is an email address and password for each member. Once the account is created, you can start taking advantage of the convenience of managing finances together.

If at any time one of the members wishes to leave the account, they can easily remove themselves from the account. All remaining funds in the account will be distributed proportionally to the remaining members.

So, if you’re looking for a way to simplify joint financial management, a Joint PayPal Account is an excellent choice. With expense tracking capabilities, easy bill payments, and financial transparency, you and the people you share accounts with can manage your finances more efficiently and smoothly.

How to Open and Manage a PayPal Joint Account

About Shared PayPal Accounts

In this digital era, managing joint finances has become easier with a PayPal Bersama account. This innovative feature is designed to help couples, family members, or friends who want to share expenses and funds.

With a Shared PayPal account, you can open an account shared by two or more people. All added members have full and equal access to account funds, meaning they can send, receive, and withdraw money without requiring additional approval.

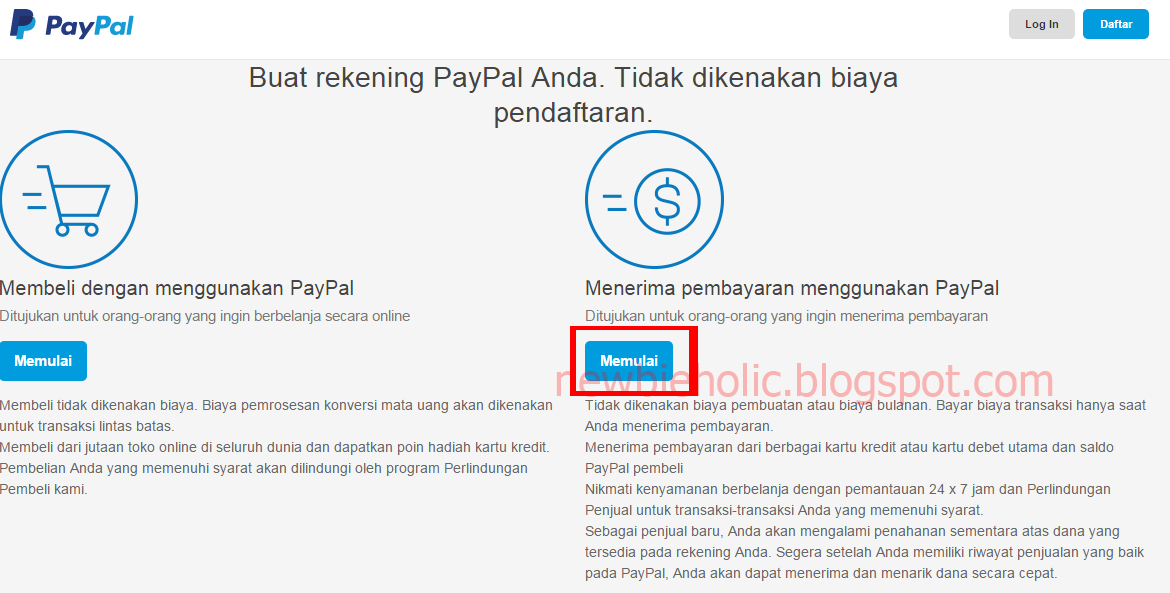

How to Open a Joint PayPal Account

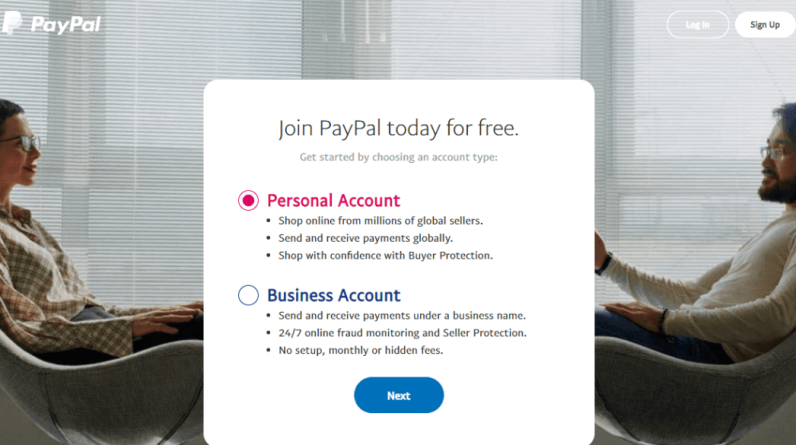

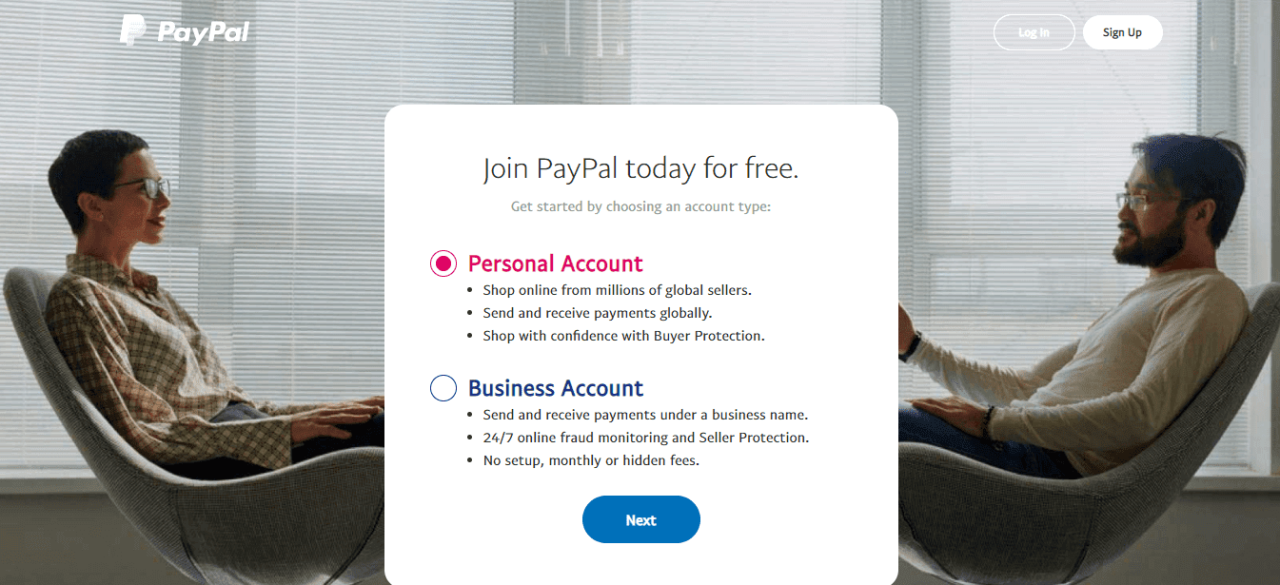

Opening a PayPal Together account is very easy. First, one of the members must create a new personal PayPal account. Once the account is created, follow these steps:

1. Click “Account Settings”.

2. Select “Create Joint Account”.

3. Enter the second member’s email address or cell phone number.

4. The second member will receive an email or SMS asking them to join the account.

5. The second member must click the link and create his own password.

Once the second member signs up, a Shared PayPal account will be created.

How to Manage a Joint PayPal Account

Setting up and using a PayPal Together account is very simple. Here are some tips:

Set account holder priorities: Determine who will be the primary account holder and who will be the secondary account holder. The primary account holder has more control over the account, such as changing settings and moving funds.

Set a shared budget: Discuss your monthly budget with other members and allocate funds as needed. This will help you manage your expenses and avoid overspending.

Monitor transactions: Review account activity regularly to track spending and ensure there are no unauthorized transactions.

Clear communication: Communicate openly with other members about spending and withdrawing cash. Avoid surprises or misunderstandings by being transparent.

Benefits of a Shared PayPal Account

Using a Shared PayPal account offers many benefits, including:

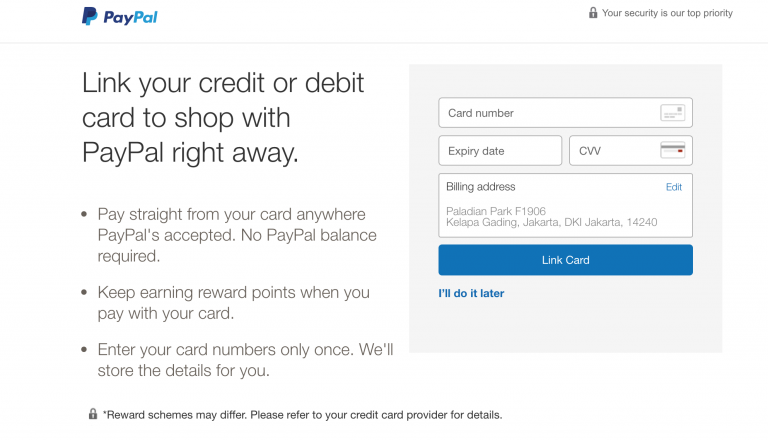

Easy financial collaboration: Share expenses, pay bills, and transfer funds easily between members.

Easy access to funds: All members have access to the entire account balance, eliminating the need for traditional joint accounts.

Buyer protection: Eligible transactions are protected by PayPal Buyer Protection, providing peace of mind when shopping online.

Convenience: Manage shared finances from anywhere, anytime via the PayPal mobile app or website.

With a Joint PayPal account, you can simplify your joint finances and create a more efficient and convenient money management experience.

PayPal Joint Account: A Complete Guide for Sharing Users

PayPal joint account is one of the features offered by PayPal to allow multiple users to share the same PayPal account. This way, multiple people can have control over one PayPal account and can make transactions, receive payments, and manage balances together. This feature is especially useful for those with joint ventures, couples, or family members who want to share a PayPal account.

What is a PayPal Joint Account?

PayPal joint account is a PayPal account that can be shared by several users. With this feature, multiple people can have control over one PayPal account and can make transactions, receive payments, and manage balances together. Any user who has access to a joint PayPal account can make transactions, receive payments, and manage balances, but each transaction must be approved by all users who have access to the account.

Benefits of PayPal Joint Account

Here are some of the benefits of using a PayPal joint account:

- Shared Control : With a PayPal joint account, multiple users can have control over one PayPal account and can make transactions, receive payments, and manage balances together.

- Ease of Sharing Costs : PayPal joint account is very useful for those who have a joint business or couples who want to share costs. With this feature, they can share costs and carry out transactions together.

- Security : PayPal joint account has high security because every transaction must be approved by all users who have access to the account.

- Flexibility : PayPal joint account can be used by several users who have different locations.

How to Create a PayPal Joint Account

Here’s how to create a PayPal joint account:

- Login to PayPal Account : First of all, log in to your PayPal account.

- Select “Manage Account” : Select “Manage Account” at the top of the PayPal page.

- Select “Account Settings” : Select “Account Settings” in the dropdown menu.

- Select “Shared Account” : Select “Shared Account” at the bottom of the page.

- Add User : Add the users you want to add to your joint PayPal account.

- Confirm User Information : Confirm the user information you have added.

- Set Access Rights : Set access rights for each user you have added.

How to Manage PayPal Joint Account

Here’s how to manage a PayPal joint account:

- Select “Manage Account” : Select “Manage Account” at the top of the PayPal page.

- Select “Account Settings” : Select “Account Settings” in the dropdown menu.

- Select “Shared Account” : Select “Shared Account” at the bottom of the page.

- View Account Summary : View a summary of your joint PayPal account, including balance, transactions, and users who have access to the account.

- Set Access Rights : Set access rights for each user you have added.

- Transaction Confirmation : Confirm transactions made by other users who have access to the account.

PayPal Joint Account Security

PayPal joint accounts have high security because every transaction must be approved by all users who have access to the account. Apart from that, PayPal also has other security features, such as:

- Two Factor Authentication : Two-factor authentication allows you to have more control over access to your account.

- Data Encryption : Data encryption allows you to have more control over the data you send and receive.

- Transaction Supervision : Transaction monitoring allows you to have more control over transactions made by other users who have access to the account.

Conclusion

PayPal joint account is a very useful feature for those with joint ventures, couples, or family members who want to share a PayPal account. With this feature, multiple users can have control over one PayPal account and can make transactions, receive payments, and manage balances together. PayPal joint account has high security and can help you to have more control over access to your account.

FAQs

Here are some frequently asked questions about PayPal joint accounts:

- Q: What is a PayPal joint account?

A: A PayPal joint account is a PayPal account that can be shared by several users. - Q: How do I create a PayPal joint account?

A: The way to create a PayPal joint account is to log in to your PayPal account, select “Manage Account”, select “Account Settings”, select “Shared Account”, add users, confirm user information, and set access rights. - Q: How do I manage a PayPal joint account?

A: The way to manage a PayPal joint account is to select “Manage Account”, select “Account Settings”, select “Joint Account”, view the account summary, set access rights, and confirm transactions. - Q: Does PayPal joint account have high security?

A: Yes, PayPal joint accounts have high security because every transaction must be approved by all users who have access to the account. Apart from that, PayPal also has other security features, such as two-factor authentication, data encryption, and transaction monitoring.

Benefits and Benefits of Using a Shared PayPal Account

Having a joint PayPal account can be a practical solution for many people, especially those who need a convenient way to manage their finances together. A shared PayPal account allows two or more people to share one account, providing the following benefits and advantages:

Ease of Sharing Expenses

One of the main advantages of a shared PayPal account is that it makes it easier to share expenses. Instead of trying to keep track of who pays what, users can easily split bills, such as rent, utilities, or dinner, right from a shared account. This takes the hassle out of tracking expenses and reimbursements, saving time and effort.

Pooled Fund Management

With a joint PayPal account, users can manage their combined funds effectively. They can contribute money to the account, and the balance can be used to pay for purchases, bills, or transfers to other accounts. This is especially useful for couples, roommates, or family members who share expenses and want to keep an eye on their balance together.

Safe and Convenient Transactions

Just like a regular PayPal account, a shared PayPal account offers safe and convenient transactions. Users can make purchases, send and receive money, and withdraw funds easily. PayPal’s buyer protection system helps protect users from unauthorized transactions, providing peace of mind when transacting online.

Shared Account Activity Tracking

Shared PayPal accounts also provide transparency when it comes to tracking account activity. Users can easily view all transactions, including payments, receipts, and transfers, made from a shared account. This encourages accountability and ensures that all users know how funds are used.

Building Credit Together

While not directly linked to a joint PayPal account, using a credit card linked to a joint account can help users build joint credit. When they make purchases and pay bills on time, they contribute to a shared credit history, which can benefit both of them in the long run.

If you’re looking for an easy and convenient way to manage your finances with someone else, a joint PayPal account is an option worth considering. The benefits and advantages it offers can make sharing expenses, managing funds, and transactions easier and more efficient.