History of PayPal: From the Beginning to Going Global

PayPal, the online payments giant, has had a remarkable journey since its humble beginnings. As it turns out, this success story started among a group of passionate encryption experts.

In 1998, Peter Thiel and Max Levchin created their first company, Confinity, which developed security software for mobile devices. However, they soon realized the potential of online payments. In 1999, Confinity launched PayPal as a money transfer service between Palm Pilot users.

Soon after, a small company called X.com, founded by Elon Musk, started taking part in the online payments market. Competition was fierce, but in 2000, PayPal acquired X.com. This event became a turning point for the company and paved the way for exponential growth.

By acquiring X.com, PayPal gained a powerful online banking platform and a large user base. In 2002, eBay, the largest online auction platform at the time, acquired PayPal for $1.5 billion. This partnership proved to be very successful, as PayPal became the preferred payment method on eBay.

This acquisition also gives PayPal access to the global market. In 2005, the company entered the Asian market by acquiring VeriSign Japan. Furthermore, PayPal expanded its reach into Europe with the acquisition of Bill Me Later in 2008.

As PayPal grows, the company also adapts to emerging technologies. In 2013, PayPal launched its mobile payments service, PayPal Here, which allows merchants to accept payments via their mobile devices.

In 2015, PayPal split from eBay and became an independent company once again. This move allows PayPal to focus on its own growth and innovation. Since then, the company has continued to develop new products and services, including Venmo, a popular social payments service.

Today, PayPal is one of the world’s leading financial technology companies. The company operates in more than 200 countries and has more than 400 million active users. PayPal’s journey from humble beginnings to becoming a global player is a testament to tenacity, innovation and vision.

PayPal’s Main Functions in Digital Payments

After exploring the beginnings of PayPal, it’s time to dive into the important role it plays in the digital payments landscape.

PayPal serves as a bridge connecting people and businesses around the world, facilitating safe and efficient online transactions. Packed with a host of features, PayPal has revolutionized the way we pay and receive payments.

Money Transfer: PayPal empowers users to send and receive money instantly, both domestically and internationally. This is very convenient for individuals who want to split bills, send money to friends or family, or conduct business transactions.

Online Payments: PayPal’s platform seamlessly integrates with e-commerce websites and apps, allowing customers to make purchases easily and securely. With just a few clicks, buyers can complete transactions without having to enter sensitive financial information each time.

Mobile Payments: In the era of smart devices, PayPal introduced various mobile applications that allow users to make transactions on the go. From in-store payments to online purchases, the PayPal app offers convenience and security.

Buyer Protection: PayPal not only acts as a payment processor but also acts as a buyer protector. With a Buyer Protection policy, users can rest assured that they will get a refund if they are not satisfied with their purchase or the item received does not match the description.

Seller Protection: On the other hand, PayPal also offers protection for sellers. An advanced Risk Management system helps identify and prevent fraudulent transactions, thereby reducing risks for businesses that accept payments through the platform.

Subscription Payments: PayPal automates subscription payments, allowing users to set up recurring payments for memberships, subscriptions, and other services. This provides convenience to customers and removes the hassle of manual payment management.

In addition to its main functions, PayPal has also expanded its offerings to include additional services such as:

Financing: The PayPal platform provides financing options for users and businesses, allowing them to make large purchases or cover expenses without paying in full up front.

Prepaid Cards: PayPal offers prepaid cards that can be reloaded and used to make purchases, withdraw cash, and transfer funds.

Business Solutions: PayPal provides a range of tailored solutions for businesses, including invoice management, credit card processing, and financial reporting services.

Through its comprehensive suite of services, PayPal has become a driving force in the digital payments revolution. From basic money transfers to sophisticated business solutions, PayPal has established itself as a major player in the industry, helping businesses grow and empowering individuals to manage their finances safely and efficiently.

PayPal: History, Functions and Benefits in the World of Digital Payments

In the last few decades, technology has developed rapidly and allows us to carry out financial transactions online more easily and quickly. One example of technology that has revolutionized the way we make payments is PayPal. In this article, we will discuss its history, functions and benefits in the world of digital payments.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin in Palo Alto, California, United States. Initially, PayPal was only used as a payment service for digital products, such as e-books and music. However, within a few years, PayPal developed into a broader online payment service and can be used for various types of transactions, including the purchase of physical products and services.

In 2002, PayPal was acquired by eBay, a leading e-commerce company at the time. With this acquisition, PayPal became the official payment service for eBay and grew in popularity among internet users. In 2015, eBay spun off PayPal into an independent company, allowing PayPal to grow further and offer a wider range of services.

PayPal Function

PayPal is a digital payment service that allows users to carry out financial transactions online. Here are some of PayPal’s main functions:

- Payment Services : PayPal allows users to make payments to sellers who have accepted PayPal as a payment method.

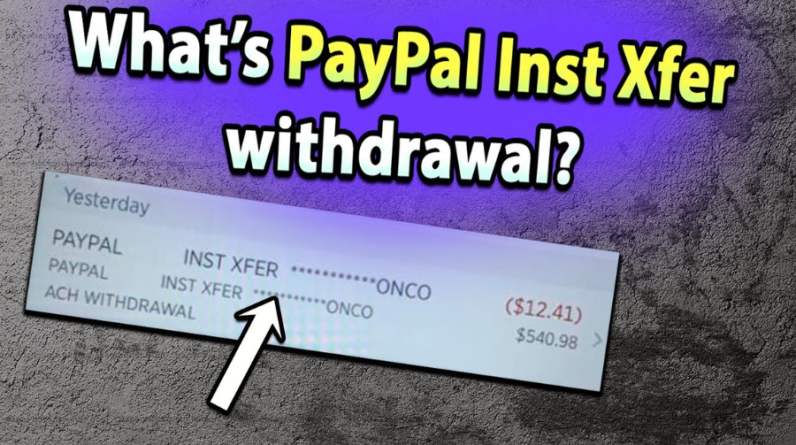

- Withdrawing Money : Users can withdraw money from their PayPal balance to their bank account.

- Money Transfer : Users can send money to others via PayPal.

- Card Storage : Users can store their credit or debit card information in PayPal, so they don’t have to enter their card information every time they make a transaction.

PayPal Benefits

PayPal offers many benefits to users, including:

- Comfort : PayPal allows users to make financial transactions online more easily and quickly.

- Security : PayPal uses advanced security technology to protect user information and their transactions.

- Flexibility : PayPal can be used for many types of transactions, including the purchase of physical products and services.

- Low Cost : PayPal transaction fees are relatively low compared to other payment methods.

- International : PayPal can be used to make international transactions more easily and quickly.

PayPal Security

PayPal places great importance on the security of its users and their transactions. Here are some of the security technologies used by PayPal:

- Encryption : PayPal uses strong encryption to protect user information and their transactions.

- Two Factor Verification : PayPal offers two-factor verification that allows users to make transactions more securely.

- Fraud Detection : PayPal has a sophisticated fraud detection system to prevent unauthorized transactions.

How to Use PayPal

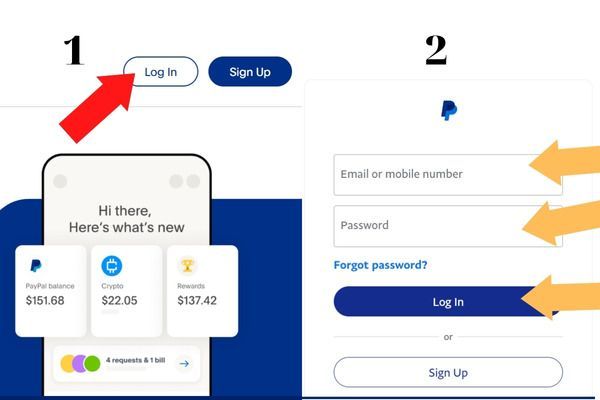

Using PayPal is relatively easy and simple. Here are the steps to use PayPal:

- Register : Users must register to create a PayPal account.

- Entering Card Information : Users must enter their credit or debit card information in PayPal.

- Carrying out Transactions : Users can make financial transactions online using PayPal.

- Monitoring Balance : Users can monitor their PayPal balance and make money withdrawals if necessary.

Conclusion

PayPal is a digital payment service that allows users to carry out financial transactions online more easily and quickly. By using PayPal, users can enjoy convenience, security, flexibility, low fees, and international capabilities. In this article, we have discussed its history, functions and benefits in the world of digital payments. Apart from that, we have also discussed PayPal security and how to use PayPal. Thus, we can understand better about PayPal and how we can utilize it in our daily life.

Benefits of Using PayPal for Businesses and Consumers

PayPal has revolutionized the way we conduct online transactions. Founded in 1998 as Confinity, the company initially focused on connecting handheld devices with desktop computers. However, fate had other plans.

In 2000, PayPal was acquired by online auction giant eBay, paving the way for a new era of payment services. This platform is quickly becoming a safe and convenient solution for sending and receiving money. Additionally, PayPal offers many benefits to businesses and consumers.

For businesses, PayPal simplifies the payment process. By allowing customers to pay using credit cards, debit cards, or PayPal balances, businesses can reach more buyers and speed up the checkout process. PayPal also provides additional security, as customers don’t have to share sensitive financial information with merchants.

Consumers also get a lot of benefits from PayPal. The platform is safe and secure, so you can transfer and receive money with peace of mind. Additionally, PayPal offers purchase protection, which gives you peace of mind when shopping online.

Plus, PayPal is very convenient. You can manage your account from anywhere with the PayPal app or website. This platform is also equipped with an autofill feature, which can save you time when shopping online.

PayPal’s success is not limited to the United States. The company has expanded to more than 200 countries and territories, supporting 25 currencies. PayPal has become a global player in the payments industry, thanks to its dedication to convenience, security and innovation.

It’s no surprise that PayPal has become a popular choice for businesses and consumers. With its global reach, wide range of features, and commitment to security, PayPal has set the standard for online transactions. So, please use PayPal the next time you make a payment or receive money, and experience its incredible benefits for yourself!