What is PayPal Fee Calculator?

PayPal Fee Calculator, a very useful tool, allows you to calculate PayPal transaction fees before sending or receiving money. With this calculator, you can easily estimate how much you will pay or receive, ensuring transparency and helping you make informed decisions.

This calculator is easy to use. Simply enter the transaction amount, transaction type (such as goods and services or donations), and the country or region the transaction takes place. The calculator will automatically display a breakdown of fees, including fixed fees and transaction fee percentages.

This is especially beneficial for businesses that make frequent PayPal transactions. By estimating costs in advance, businesses can budget their expenses more accurately and price their products or services accordingly. This helps maintain profitability and avoid unexpected cost surprises.

Additionally, PayPal Fee Calculator is also a valuable tool for individuals who use PayPal for personal transactions. This allows them to compare the costs of different payment methods, such as credit cards or bank transfers, and choose the most cost-effective option.

This calculator is not only easy to use and useful, but it is also free and can be accessed online at any time. This makes it a reliable and accessible tool that can be used by anyone who wants to calculate their PayPal transaction fees.

So, if you make frequent PayPal transactions, whether for business or personal, PayPal Fee Calculator is a must-have tool. This tool provides clear cost information, helps you plan your expenses, compare payment options, and make better financial decisions. Take advantage of this calculator today and take advantage of its benefits.

How to Calculate Transfer Fees on PayPal

Understanding the PayPal Fee Calculator

PayPal, as a widely used payment platform, offers a useful fee calculator to help merchants estimate their transaction costs. This calculator is essential for understanding how much to pay for each transaction, ensuring transparency and accurate financial planning.

To access the PayPal fees calculator, users can log in to their account and navigate to the “Fees” section. The calculator will ask for some information, including:

Transaction type: Whether it is payment for goods or services, personal funds, or other transactions.

Currency: The currency used in the transaction.

Amount: The amount transferred.

Sending and receiving country: This affects the applicable fees.

After filling in the required information, click “Calculate” to see the estimated transaction fees. The calculator will display a breakdown of costs, including:

Base fee: A fixed fee charged for each transaction.

Percentage fee: A percentage of the transaction amount charged as a fee.

Fixed fees: Additional fees that may apply, such as currency conversion fees or international transaction fees.

PayPal’s fee calculator is an excellent tool for planning expenses and ensuring that merchants understand the costs associated with their transactions. By understanding these fees, merchants can make informed decisions about which payment methods work best for their business.

In addition to the fee calculator, PayPal also offers a variety of resources that can help merchants manage their transaction costs. These sources include:

PayPal fees guide: Includes a detailed explanation of PayPal’s fee structure.

PayPal fees FAQ: Answers frequently asked questions about PayPal fees.

PayPal customer support: Provides specialized help and guidance if needed.

By leveraging these resources, merchants can minimize their transaction costs and optimize the profitability of their business.

PayPal Fee Calculator: Calculating the Right Transfer Fee

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal has become one of the easiest and most secure ways to conduct online transactions. However, like any other service, PayPal also has fees that users must pay.

Fees charged by PayPal may vary depending on the type of transaction, country and currency used. Therefore, it is important for users to have accurate information about the fees that PayPal will charge. One way to do this is to use the PayPal Fee Calculator.

In this article, we will discuss the PayPal Fee Calculator, how to use it, and how to calculate the correct transfer fees using this tool.

What is PayPal Fee Calculator?

PayPal Fee Calculator is an online tool used to calculate the transfer fees that will be charged by PayPal. This tool allows users to enter the transaction amount, currency, and country of origin of the sender and recipient, thereby calculating accurate transfer fees.

PayPal Fee Calculator can be used by all PayPal users, both individuals and businesses. This tool is especially useful for people making international transactions, as transfer fees can vary depending on the country and currency used.

How to Use PayPal Fee Calculator

Using the PayPal Fee Calculator is very easy. Following are the steps that must be taken:

- Go to the PayPal website and log in to your account.

- Click on the “Tools” menu and select “PayPal Fee Calculator”.

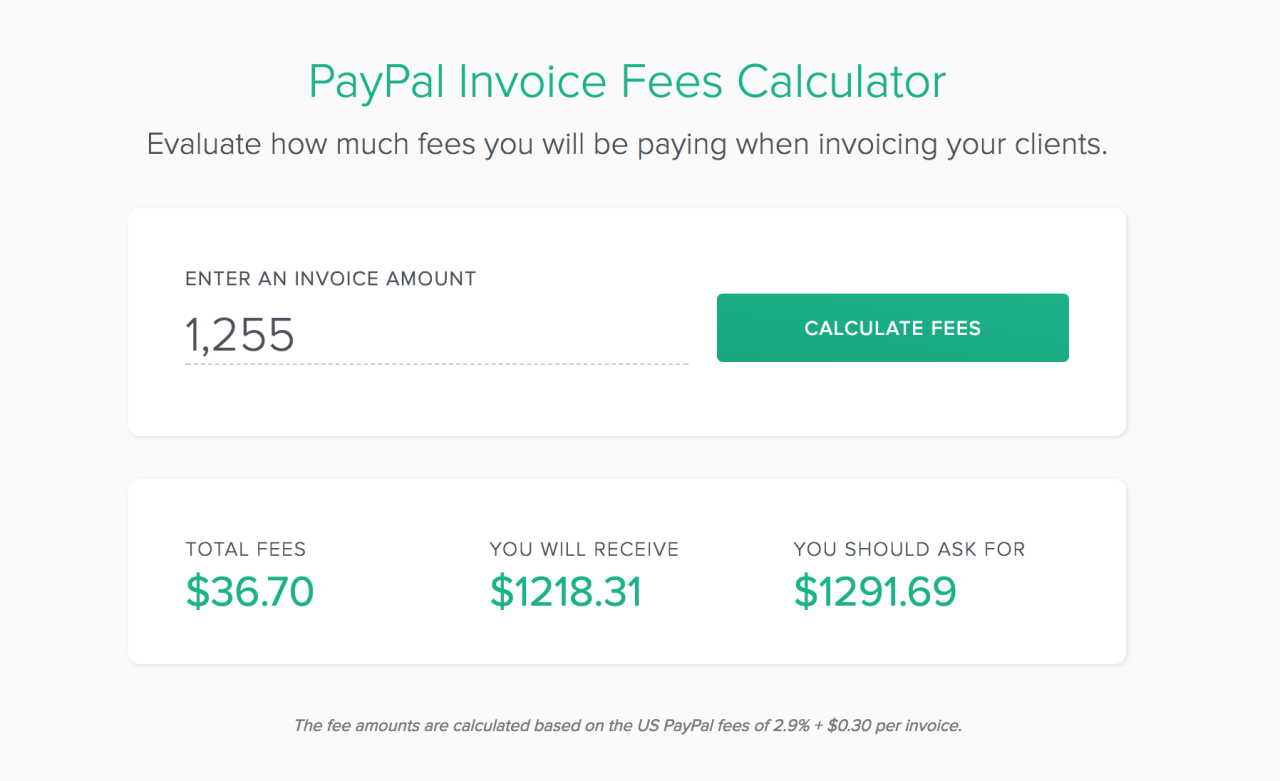

- Enter the transaction amount you want to make.

- Select the currency used for transactions.

- Select the country of origin of the sender and recipient.

- Click the “Calculate Fees” button to calculate the transfer fee.

After you click the “Calculate Fees” button, PayPal Fee Calculator will display the transfer fee calculation results. The calculation results will include transfer fees, currency conversion fees, and the total fees to be paid.

How to Calculate Transfer Fees with PayPal Fee Calculator?

Calculating transfer fees with PayPal Fee Calculator is very easy. The following is an example of how to calculate transfer fees:

Suppose you want to make a transaction of $100 from the United States to Indonesia. Following are the steps that must be taken:

- Enter a transaction amount of $100.

- Select USD (United States Dollar) as the transaction currency.

- Select the United States as the sender’s country of origin.

- Select Indonesia as the recipient country.

- Click the “Calculate Fees” button to calculate the transfer fee.

The transfer fee calculation results will show a transfer fee of $1.50 (1.5% of the transaction amount), a currency conversion fee of $0.30 (0.3% of the transaction amount), and a total fee payable of $1.80.

Advantages of Using PayPal Fee Calculator

Using the PayPal Fee Calculator has several advantages, including:

- Saving time : By using the PayPal Fee Calculator, you no longer need to calculate transfer fees manually.

- Avoid mistakes : Accurate transfer fee calculation results can help you avoid mistakes in calculating transfer fees.

- Make transactions easy : PayPal Fee Calculator can help you make international transactions easier by calculating accurate transfer fees.

Conclusion

PayPal Fee Calculator is a very useful tool for calculating the transfer fees that PayPal will charge. Using this tool, you can calculate accurate transfer fees and save time. Apart from that, PayPal Fee Calculator can also help you avoid mistakes in calculating transfer fees and make international transactions easier.

If you want to make international transactions with PayPal, make sure you use the PayPal Fee Calculator to calculate accurate transfer fees. This way, you can make transactions more easily and safely.

Tips for Avoiding Unnecessary Fees with Fee Calculator

You want to send money to your friends or family who are abroad, or maybe you are planning to buy something online from an international seller. Whatever the purpose, you will probably use PayPal, one of the leading online payment platforms today. However, before you hit the “Submit” button, it’s a good idea to know what fees you may incur.

This is where PayPal Fee Calculator comes into play. This handy tool is designed to help you calculate the approximate fees that PayPal will charge when you make a transaction. This way, you can avoid unwanted surprises and make informed financial decisions.

Fee Calculator is very easy to use. Just enter the amount of money, destination country or seller location, and transaction type (such as remittance or purchase). The calculator will then provide an estimate of costs, including fixed costs and percentages.

Knowing the fees before making a transaction is very important. This allows you to plan your expenses and ensure that you have sufficient funds to cover costs as they arise. Additionally, by comparing the costs of different calculators, you can choose the most cost-effective option.

Apart from avoiding unnecessary costs, Fee Calculator can also help you minimize them. The calculator will provide information about cheaper payment options, such as using a debit card or linked bank account. You may also consider sending money using the destination country’s local currency to avoid currency conversion fees.

However, it is important to note that the fees displayed by Fee Calculator are only estimates. Actual fees may vary slightly depending on factors such as exchange rate fluctuations or the payment method you use. Therefore, always double check the final fees before confirming your transaction.

Using the PayPal Fee Calculator is a simple yet effective step to managing your PayPal expenses. By knowing and minimizing fees, you can save money and ensure that your transactions are carried out efficiently and cost-effectively.