Types of Fees for Using PayPal Invoice

When deciding to use PayPal Invoice to manage your billing, it’s important to understand the types of fees associated with this service. This will allow you to make an informed decision about whether PayPal Invoice is suitable for your business needs.

The first is standard transaction fees. This fee is charged every time you create an invoice and receive payment. The percentage you pay will vary depending on the country you are in and the type of transaction made. However, as a general guide, you can expect to pay around 2.9% + 0.30 USD for domestic transactions and 4.4% + 0.30 USD for international transactions.

Next, there are withdrawal fees. If you want to withdraw funds from your PayPal account to a bank account, you will be charged certain fees. These fees also vary depending on your location and withdrawal method. For example, domestic ACH withdrawals cost 0.50 USD per withdrawal, while international wire transfers can cost up to 40 USD.

In addition to standard transaction and withdrawal fees, there may also be additional fees. This may include charges for additional services such as currency conversion or recurring billing. It is important to check PayPal Invoice terms and conditions carefully to understand all fees that may apply.

To minimize costs, you may consider using PayPal pricing plans. PayPal offers various plans that include a certain number of free transactions per month. This can be a cost-effective option if you issue a lot of invoices.

Additionally, negotiating a deal with PayPal can also help reduce your costs. If you have a high transaction volume, you may qualify for a discount.

Finally, comparing PayPal Invoice with other invoicing service providers can help you find the most affordable option for your needs. There are many providers offering similar services, so take the time to research and compare their costs and features before making a decision.

By understanding the different types of fees associated with using PayPal Invoice, you can make an informed decision about whether this service is right for your business. Taking steps to minimize costs will help maximize your profits and keep your operating costs low.

How to Avoid Invoicing Fees on PayPal

When you send invoices via PayPal, you may be charged a number of fees that can reduce your profits. Below are details of these fees and how to avoid them:

Transaction Fees:

Every time you receive a payment via PayPal, you will be charged a transaction fee equal to a percentage of the payment amount plus a flat fee. These fees vary depending on the currency and payment method used.

How to Avoid It:

Manually exchange currencies before sending an invoice to get a better exchange rate and reduce transaction costs related to currency conversion.

Encourage customers to pay with methods that incur lower fees, such as bank transfer.

Credit Card Processing Fees:

If your customers pay via credit or debit card, PayPal will charge an additional credit card processing fee. These fees are usually higher than regular transaction fees.

How to Avoid It:

Offer discounts or incentives to customers who pay with non-credit card methods, such as PayPal Balance or bank transfer.

Set PayPal as the payment gateway on your website and avoid using PayPal Invoice for payments originating from your own domain.

Money Transfer Fees:

If you use PayPal Invoice to send money to another country, you will be charged a remittance fee. These fees vary depending on the destination country and the amount of money sent.

How to Avoid It:

Ask clients to pay you in their local currency to avoid currency conversion fees.

Return Fee:

If you need to return funds to a client, you will be charged a return fee. This fee is the same as the original transaction fee.

How to Avoid It:

Research your clients carefully before sending invoices to reduce the risk of refunds.

Make sure your product or service meets client expectations to minimize the chance of disputes.

In addition to the steps above, you can also consider using a PayPal Business account to get lower rates. This account offers a variety of additional features and benefits, including lower transaction fees and access to automation tools.

Invoicing Fees at PayPal: What You Need to Know

PayPal is one of the most popular online payment alternatives in the world. With more than 300 million active users, PayPal has become the top choice for many people and businesses for conducting online transactions. One of the most useful features in PayPal is the ability to send invoices to customers. Invoicing allows you to send electronic invoices to your customers and get paid easily. However, as with other services, invoicing on PayPal also has certain fees that you need to be aware of.

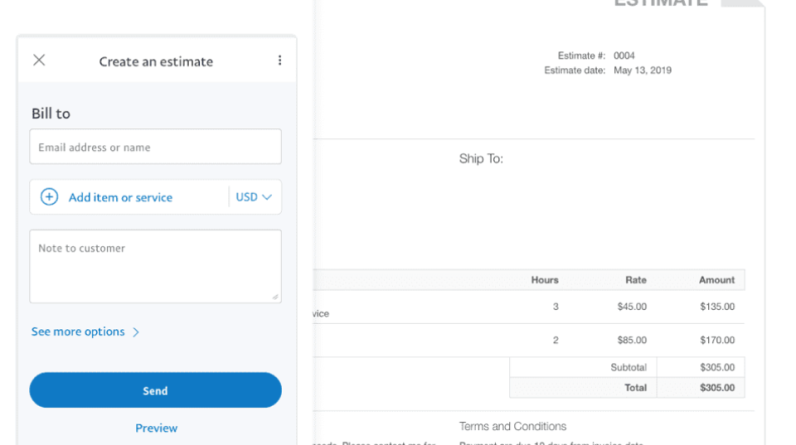

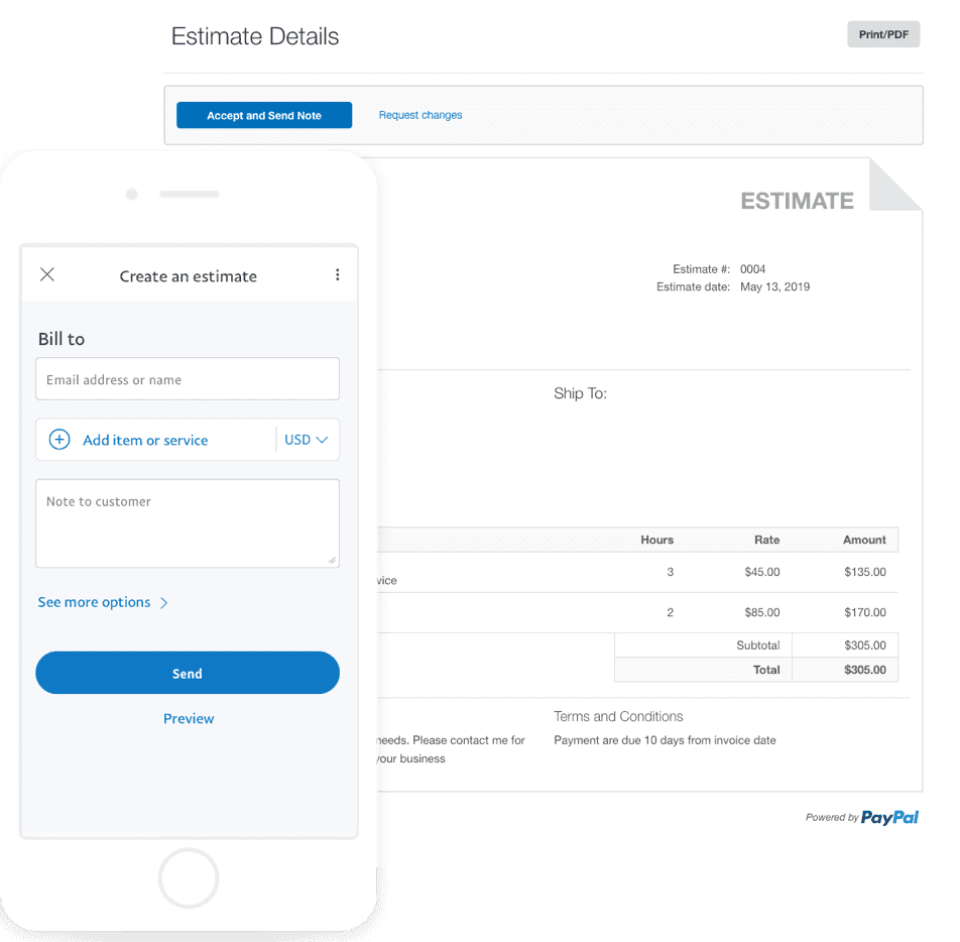

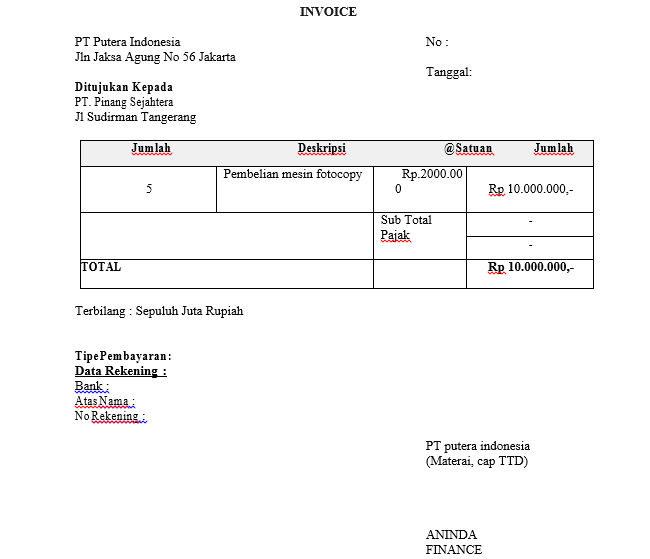

What is Invoicing on PayPal?

Invoicing in PayPal is a feature that allows you to send electronic invoices to your customers. With invoicing, you can create professional, neat invoices that include all the necessary information, including the amount due, due date, and payment method. Your customers can pay the bill directly via the email they receive, or they can click a link to pay online.

Invoicing Fees on PayPal

Invoicing fees at PayPal vary depending on the country and type of transaction. Here are the invoicing fees at PayPal for several countries:

- Invoicing Fees in the United States : 2.9% + $0.30 per transaction

- Invoicing Fees in the UK : 2.9% + £0.20 per transaction

- Invoicing Fees in Australia : 2.9% + AUD $0.30 per transaction

- Invoicing Fees in Singapore : 2.9% + SGD $0.30 per transaction

The invoicing fees above are fees charged by PayPal for each transaction made via invoicing. This fee will be taken from the amount paid by your customers.

How to Calculate Invoicing Fees on PayPal

To calculate invoicing fees on PayPal, you can use the following formula:

Invoicing Fees = (Amount paid x Invoicing Fees%) + Fixed Fees

Example:

- If you send an invoice of $100 to your customer, and the invoicing fee in the United States is 2.9% + $0.30 per transaction, then the invoicing fee charged is:

Invoicing Fee = (100 x 2.9%) + $0.30 = $2.90 + $0.30 = $3.20

In the example above, the invoicing fee charged is $3.20. This amount will be taken from the $100 paid by your customer, leaving you with $96.80.

Tips for Saving on Invoicing Fees on PayPal

Here are some tips for saving on invoicing fees at PayPal:

- Use PayPal Business : If you have a business, then you can use PayPal Business to save on invoicing costs. PayPal Business allows you to send invoicing at a lower cost.

- Use the Correct Payment Method : Make sure you choose the correct payment method for your invoicing. For example, if you send an invoice for a large amount, then you can choose a payment method that allows you to save costs.

- Avoid Using Credit Cards : Credit cards have higher fees than other payment methods. If possible, then you can ask your customers to pay using another payment method.

- Lunar Devices : Make sure you update your software and applications regularly. Newer software and applications can help you save on invoicing costs.

Conclusion

Invoicing fees at PayPal may vary depending on the country and type of transaction. However, by understanding invoicing costs and using the right tips, you can save costs and increase your income. Make sure you choose the correct payment method, avoid using credit cards, and update your software and applications regularly. This way, you can use invoicing on PayPal more effectively and efficiently.

Benefits of Using PayPal Invoice for Business

When using PayPal Invoice for your business, there are several types of fees to consider. Understanding these costs will help you make the right decision when choosing a payment option.

The first fee to pay attention to is the processing fee. This is the fee PayPal charges for processing your transaction. Fees vary depending on the payment method you use and your region. Typically, processing fees range from 2.9% to 3.9% of the transaction amount, plus a fixed fee.

In addition to processing fees, you may also be charged currency exchange fees. This fee applies if you receive payment in a currency different from your PayPal account currency. PayPal will convert currency to your account currency using the applicable exchange rate, and charge additional fees for the conversion.

Another fee you may face is a cancellation fee. This applies if you cancel an invoice after the customer has paid it. The amount of the cancellation fee is usually the same as the processing fee.

For businesses with high transaction volumes, PayPal offers a PayPal Business account. These accounts offer lower processing fees compared to personal PayPal accounts, as well as additional features such as bulk invoicing and expense tracking.

Additionally, PayPal also offers the PayPal Checkout feature, which allows customers to pay via PayPal without having to leave your website. This feature has a processing fee that is the same as PayPal’s invoice processing fee.

Understanding the types of fees associated with PayPal Invoice is critical to managing cash flow and maximizing your profits. By considering these costs, you can choose the best payment option for your business and optimize your billing process.