What is PayPal eCheck?

PayPal eCheck, a convenient feature offered by PayPal, allows you to pay for online shopping with unmatched convenience and security. Unlike traditional credit or debit card transactions, eCheck withdraws funds directly from your bank account, eliminating the potential for fraud or identity theft associated with other online payment methods.

To use PayPal eCheck, you just need to link your bank account to your PayPal account. This process is quick and easy, requiring just a few simple steps. Once your bank account is connected, you can start making payments using eCheck by selecting it as your preferred payment method when checking out.

The main advantage of using PayPal eCheck is its enhanced security. Unlike credit or debit cards, which require you to provide your card number and other personal information, eCheck only requires you to link your bank account. This greatly reduces the risk of identity theft or financial fraud.

Additionally, PayPal eCheck also offers unmatched ease of use. Once your bank account is connected, you don’t need to enter payment details every time you make a purchase. You simply select eCheck as your payment method, and PayPal will automatically complete the transaction from your bank account.

However, it should be noted that eCheck transactions typically take longer to process compared to credit or debit cards. This is because eCheck transactions must be verified by your bank, which can take several business days. Therefore, if you need payments made immediately, using a credit or debit card may be a better choice.

Despite processing time delays, PayPal eCheck remains a safe and convenient option for online payments. With enhanced security and unmatched ease of use, eCheck is the ideal choice for anyone looking for an alternative to credit or debit card payments.

Payment Process with PayPal eCheck

Payment Process with PayPal eCheck

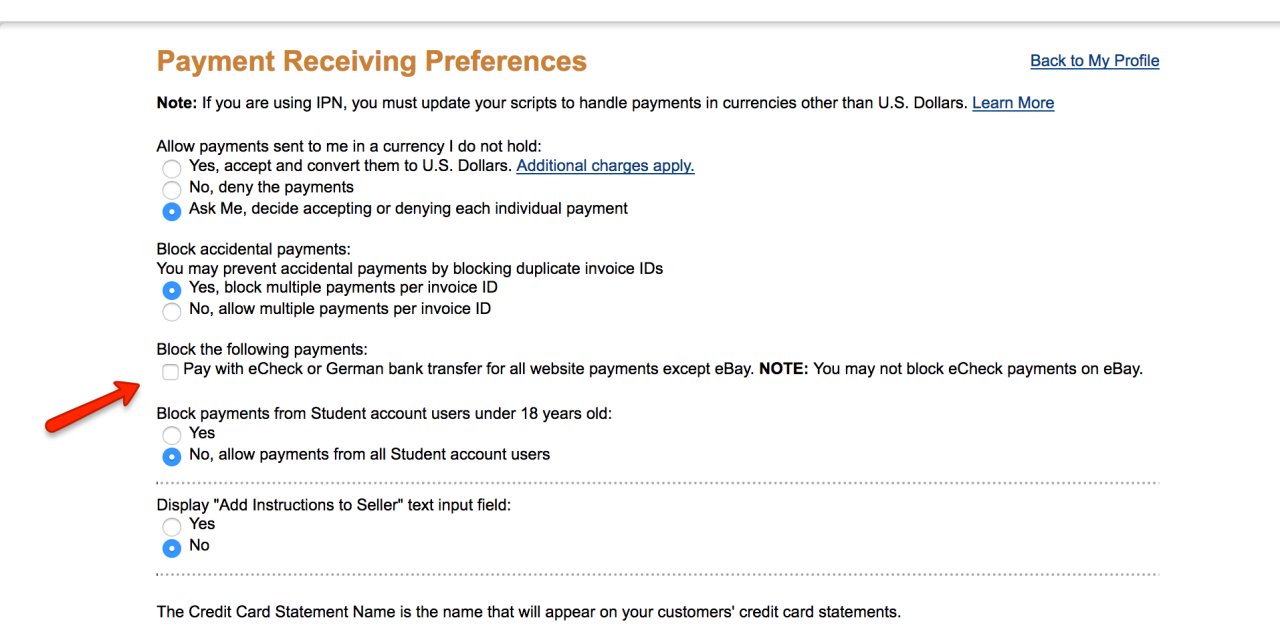

PayPal eCheck is a digital payment option that allows you to make transactions using your checking or savings account. In contrast to direct transfers, eChecks take 3-5 business days to process, but offer a higher level of security because the seller does not have access to your bank account information.

How PayPal eCheck Works

When you choose to pay with PayPal eCheck, you will be redirected to the PayPal login page where you can enter your credentials. Once logged in, you will be asked to select the bank account you want to use to fund your eCheck.

Once you select a bank account and enter the amount you want to pay, PayPal will authorize the payment. The seller will receive an authorization notification, stating that you have authorized PayPal to withdraw funds from your bank account.

Funds paid will then be held for 3-5 business days while the bank processes the transaction. Once the transaction is processed, funds will be transferred from your bank account to the seller’s account.

Benefits of Using PayPal eCheck

High level of security: Because the seller does not have access to your bank account information, PayPal eCheck offers a higher level of security compared to direct transfers.

Convenient: You can pay with PayPal eCheck from anywhere with an internet connection. You don’t have to leave your home or office to go to the bank or write a physical check.

Flexible payment options: PayPal eChecks can be used to carry out various types of transactions, both for online purchases and personal payments.

Important Considerations

Longer processing time: It takes 3-5 business days to process a PayPal eCheck, which is longer compared to other direct payment methods.

Potential fees: Some banks may charge a fee for processing eChecks.

Availability: PayPal eCheck may not be available in all countries or regions.

Conclusion

PayPal eCheck is a safe and convenient digital payment option that offers a higher level of security than direct transfers. However, longer processing times and potential fees should be considered before using this payment method. Whether you choose to use PayPal eCheck or another payment method, it is always important to research all the options and choose the one that best suits your needs.

An introduction to PayPal eCheck

PayPal eCheck is an electronic payment method used by PayPal, a leading online payments company in the world. eCheck is an abbreviation of “electronic check” which means electronic check. This payment method allows PayPal users to make payments electronically using their bank account.

History of PayPal eCheck

PayPal eCheck was first introduced in 2000, several years after PayPal’s founding in 1998. At first, eCheck was only available to PayPal users in the United States, but is now available in many other countries around the world.

How PayPal eCheck Works

PayPal eCheck works the same way as a regular check, but with some differences. Here are the steps that occur when you use PayPal eCheck:

- User makes payment : You make a payment using PayPal eCheck by selecting the eCheck option as the payment method.

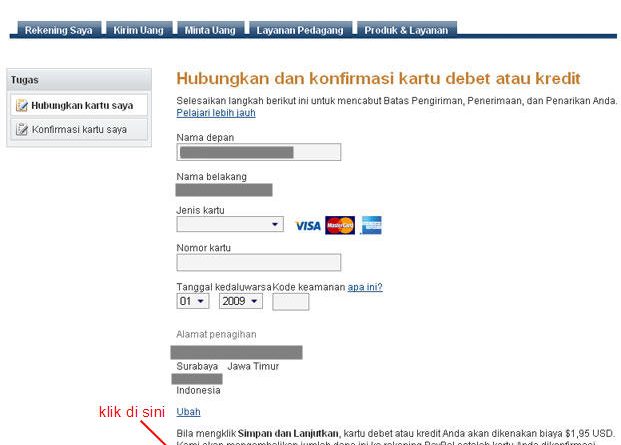

- PayPal asks for bank account information : PayPal asks for your bank account information, including account number, bank code, and account holder name.

- PayPal sends electronic checks : PayPal sends an electronic check to your bank, which then processes the payment.

- The bank processes the payment : Your bank processes the payment and moves the funds to your PayPal account.

- PayPal confirms payment : PayPal confirms payment and updates your account balance.

Advantages of PayPal eCheck

PayPal eCheck has several advantages, including:

- Low cost : Fees charged by PayPal eCheck are lower compared to other payment methods, such as credit cards.

- Convenience : PayPal eCheck is very easy to use, as you only need to enter your bank account information.

- Security : PayPal eCheck is very secure, because payments are made electronically and do not require a credit card or cash.

- Flexibility : PayPal eCheck can be used to make payments to merchants that accept PayPal, both online and offline.

Disadvantages of PayPal eCheck

PayPal eCheck also has several disadvantages, including:

- Long processing time : Payment processing time using PayPal eCheck can take several days, as your bank must process the payment.

- Withdrawal fees : Fees for withdrawing funds from your PayPal account to your bank account may apply, depending on your country and bank.

- Payment limitations : Payment limits using PayPal eCheck may vary depending on your country and bank.

How to Use PayPal eCheck

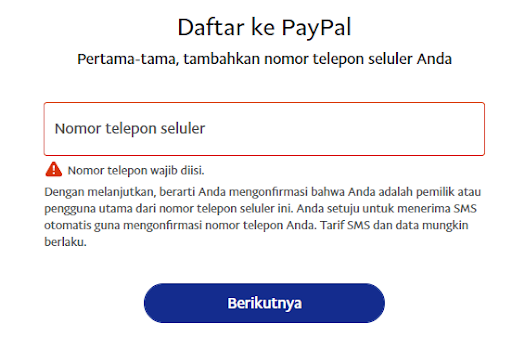

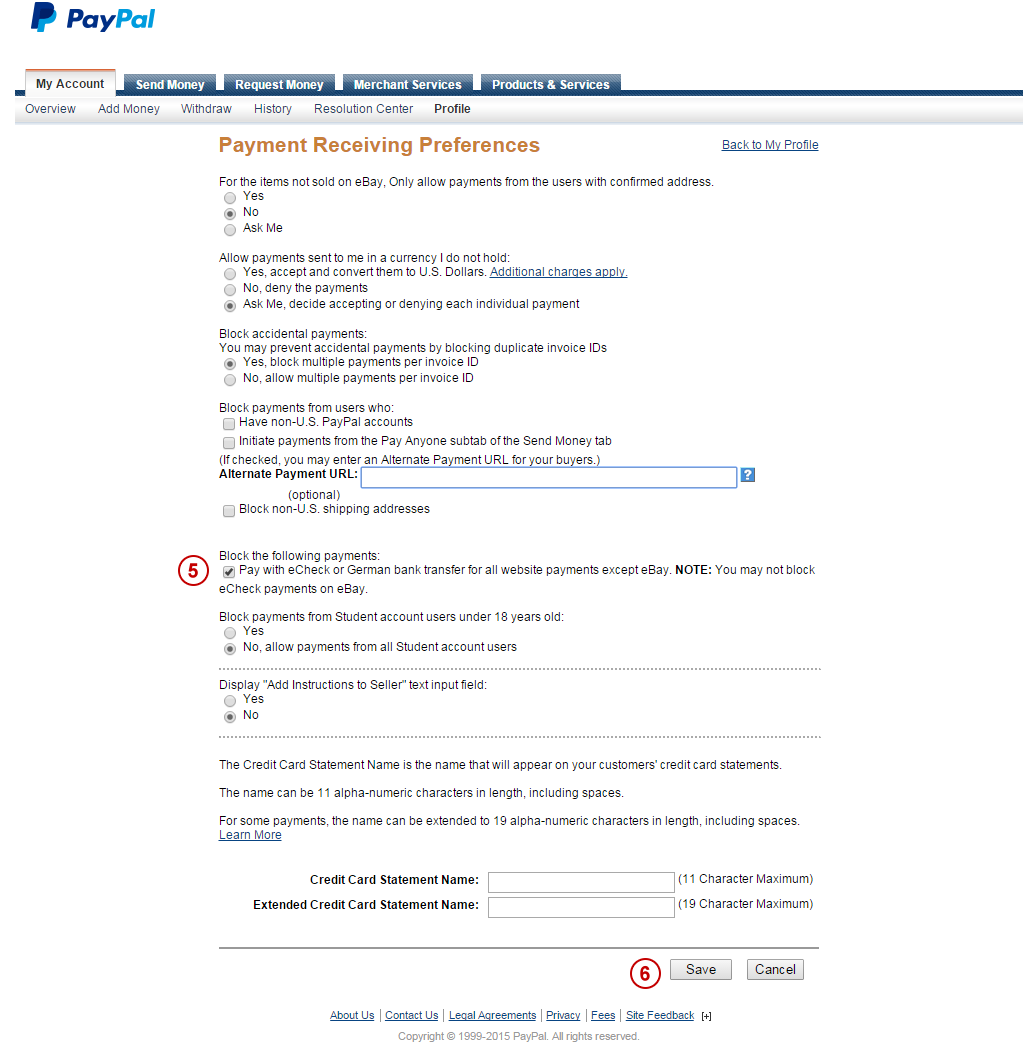

To use PayPal eCheck, you must have an active PayPal account and a bank account connected to your PayPal account. Here are the steps you need to do:

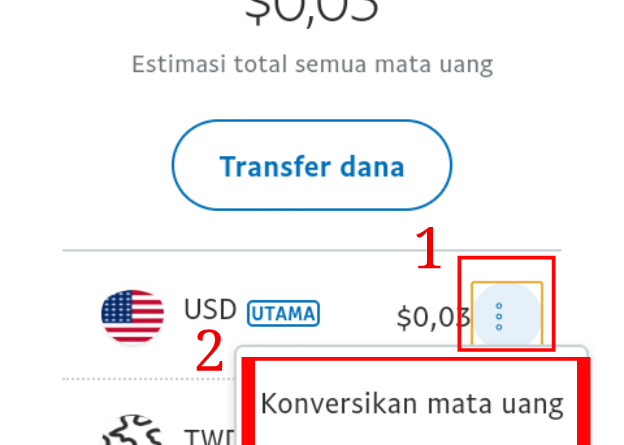

- Log in to your PayPal account : Log in to your PayPal account and select the “Payment” option.

- Select a payment method : Select the “eCheck” option as the payment method.

- Enter bank account information : Enter your bank account information, including account number, bank code, and account holder name.

- Confirm payment : Confirm payment and wait until the payment process is complete.

Tips and Tricks for Using PayPal eCheck

Here are some tips and tricks you can use to use PayPal eCheck more effectively:

- Make sure your bank account is connected to your PayPal account : Make sure your bank account is connected to your PayPal account before making a payment.

- Check payment limits : Check payment limits using PayPal eCheck before making a payment.

- Wait until the payment process is complete : Wait until the payment process is complete before taking other actions.

- Check your account balance : Check your account balance after making a payment to ensure that funds have been transferred.

Conclusion

PayPal eCheck is an easy, secure and flexible electronic payment method. By using PayPal eCheck, you can make payments electronically using your bank account. However, please note that payment processing time using PayPal eCheck may take several days and withdrawal fees may apply. By understanding how PayPal eCheck works and following the tips and tricks mentioned above, you can use PayPal eCheck more effectively and efficiently.

Benefits and Limitations of Using PayPal eCheck

In today’s digital world, PayPal has become one of the most common online payment methods. One of the features offered by PayPal is PayPal eCheck. Let’s explore its advantages and limitations.

PayPal eCheck is an electronic payment method that allows you to transfer funds from your bank account to the recipient’s PayPal account. Unlike traditional bank transfers, which can take several days, PayPal eChecks are usually processed within 3-5 business days.

The main advantage of using PayPal eCheck is its convenience and convenience. You don’t need to enter your bank account information every time you make a payment, and you can make transactions anytime, anywhere with an internet connection. Additionally, PayPal eCheck is generally safer than traditional bank transfers, because PayPal uses encryption technology to protect your financial information.

However, there are several limitations to consider. First, PayPal eCheck requires a valid bank account and sufficient balance. Second, the process can be a bit slow compared to alternative payment methods such as credit cards or PayPal Balance. Additionally, PayPal eCheck may incur fees, which may vary depending on the transaction amount and currency.

Despite these limitations, PayPal eCheck remains a popular payment option for online transactions. It offers a balance between convenience, security, and cost. If you have a bank account and are willing to wait a few days for your funds to be processed, PayPal eCheck could be a great option.

However, if you are looking for a faster or more cost-effective payment option, you may want to consider alternatives such as credit cards, PayPal Balance, or other bank transfer methods. Ultimately, choosing the best payment method depends on your own needs and preferences.