How to Send Money Internationally with PayPal

Send money abroad quickly and easily using PayPal. Here’s a step-by-step guide to sending money internationally via this popular platform:

First of all, make sure you have a PayPal account. If you don’t have one, go to the PayPal website and sign up. You must provide basic personal information, email address, and telephone number.

Once your account is ready, log in and click “Send Money” on your dashboard. Then, enter the recipient’s email address or phone number. You can also choose to send money to the recipient’s PayPal account if they have one.

Next, select the destination country. PayPal supports sending money to over 200 countries and regions. Once you select a country, enter the amount of money you want to send.

The next step is to select the currency you want to send. PayPal automatically converts your currency to the destination country’s currency at the current exchange rate. You can check the exchange rate before proceeding.

Now, it’s time to fund your transfer. PayPal offers several funding options, including a bank account, debit or credit card, and your PayPal balance. Choose the option that is most convenient for you.

Once you’ve funded the transfer, review the details carefully before confirming. This includes the amount sent, transaction fees, and estimated arrival date.

Once you confirm the transfer, PayPal will process it. Transfers usually arrive in the recipient’s account within a few minutes to a few days, depending on the destination country and the funding method chosen.

When sending money internationally, there are some fees to be aware of. PayPal charges a transaction fee for each transfer. These fees vary according to the amount sent, destination country, and funding method. You can view the transaction fees before completing the transfer.

PayPal also offers an “Instant Send Funds” service, which allows money to arrive in the recipient’s account instantly. However, this option usually costs extra.

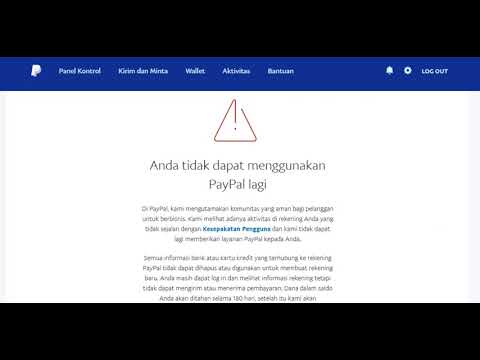

To avoid fraud, PayPal has a number of security measures. They verify user identity and monitor activity to detect and prevent suspicious transactions. You should also always be vigilant and only send money to people or businesses you trust.

By following these steps, you can easily send money internationally using PayPal. The platform offers a fast, safe and convenient way to transfer funds abroad, helping you connect with your loved ones and conduct business around the world.

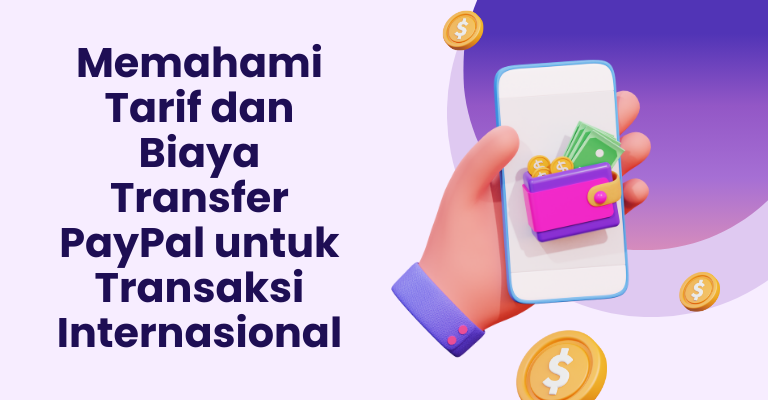

PayPal International Transfer Fees and Benefits

Once you understand how to send money internationally using PayPal, it’s time to examine the costs and benefits. Know up front what to expect to avoid unwanted surprises.

International Transfer Fees

PayPal charges a flat fee and a small percentage fee for international transfers. These fees vary depending on the currency you send and the destination country. However, it is generally in the range of 1.5% to 4%. For example, if you send $100 to an account in Mexico, the transfer fee will be around $2.

Additionally, if you fund your transfer using a credit or debit card, there may be additional fees charged by your card provider. Always check PayPal terms and rates before initiating a transfer.

PayPal Transfer Benefits

Despite the fees associated, PayPal offers several significant advantages for international transfers:

Convenience: Sending money internationally with PayPal is easy and convenient. You simply log into your account, enter recipient information, and click send.

Speed: PayPal transfers are usually completed within 24 hours, so the money can reach the recipient quickly. This is much faster than traditional transfer methods, such as wire transfers.

Security: PayPal is a safe and reliable service. This company uses advanced encryption technology to protect your financial information and prevent fraud.

Global reach: PayPal is available in more than 200 countries and territories, so you can send money to almost anywhere in the world.

Additional features: PayPal also offers additional features that can make international transfers easier, such as automatic currency conversion and transfer tracking.

Minimizing Costs

If you plan to make regular international transfers, there are several ways to minimize costs:

Use your PayPal balance: Funding your transfer using your PayPal balance is the most cost-effective way. There are no transfer fees when you use your balance.

Choose a slower delivery option: If you don’t need the money to reach the recipient immediately, you can choose a slower delivery option, which usually has lower fees.

Group your transfers: If you need to send small amounts of money to multiple recipients in the same country, you can group your transfers to reduce costs per transaction.

With these costs and benefits in mind, you can make an informed decision when sending money internationally using PayPal.

International Transfers with PayPal: The Easy and Safe Way

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal enables users to make online transactions easily and securely. One of PayPal’s most useful features is international transfers, which allow users to send and receive money from different countries. In this article, we’ll talk about how to use PayPal for international transfers, the fees involved, and some tips to ensure your transactions are secure.

How to Use PayPal for International Transfers

Using PayPal for international transfers is very easy. Here are the steps you need to do:

- Open a PayPal account : If you don’t have a PayPal account, open one first. You can do this by visiting the PayPal website and following the instructions provided.

- Account verification : Once you open an account, verify your account by entering personal information such as name, address, and phone number.

- Add a credit or debit card : Add your credit or debit card to your PayPal account. This will allow you to carry out online transactions.

- Select the destination country : Select the country you want to transfer to. PayPal supports more than 200 countries, so you can send money to almost any country in the world.

- Enter the transfer amount : Enter the transfer amount you want to make. Make sure you enter the correct amount, as you cannot change the transfer amount once the transfer process has started.

- Select a transfer method : Select the transfer method you want to use. PayPal offers several transfer methods, including fast transfers and standard transfers.

- Confirm transaction : Confirm your transaction by entering the security code sent to your phone.

International Transfer Fees with PayPal

International transfer fees with PayPal vary depending on several factors, including:

- Country of destination : International transfer fees with PayPal vary depending on the destination country. Some countries have lower costs than others.

- Transfer amount : International transfer fees with PayPal also vary depending on the transfer amount. Lower fees are usually charged for larger transfers.

- Transfer method : International transfer fees with PayPal also vary depending on the transfer method used. Fast transfers usually have lower fees than standard transfers.

Here are examples of international transfer fees with PayPal:

- Fast transfer : 2-4% of the transfer amount + IDR 10,000 (fixed fee)

- Standard transfer : 4-6% of the transfer amount + IDR 20,000 (fixed fee)

Tips to Ensure Safe Transactions

Here are some tips to ensure your transactions are safe:

- Use a verified PayPal account : Make sure you use a verified PayPal account to make online transactions.

- Don’t share personal information : Do not share personal information such as name, address and telephone number with others.

- Use a secure transfer method : Use a safe transfer method such as fast transfer or standard transfer.

- Check transaction details : Check your transaction details before making a transfer.

- Do not make transfers to unknown people : Do not make transfers to people you don’t know or don’t have a good reputation.

Advantages of International Transfers with PayPal

Here are some of the advantages of international transfers with PayPal:

- Easy and fast : International transfers with PayPal are very easy and fast.

- Safe : International transfers with PayPal are very safe.

- Can be accessed from anywhere : International transfers with PayPal can be accessed from anywhere, as long as there is internet.

- Supports many countries : PayPal supports more than 200 countries, so you can send money to almost any country in the world.

Disadvantages of International Transfers with PayPal

Here are some of the disadvantages of international transfers with PayPal:

- High costs : International transfer fees with PayPal can be higher than international transfer fees with other services.

- Limitations on transfer amount : PayPal has a limited transfer amount that can be done in a day.

- Transfer delays : International transfers with PayPal can take several days to a week to process.

Conclusion

International transfers with PayPal are an easy and safe way to send and receive money from different countries. With fees varying depending on several factors, international transfers with PayPal can be cheaper than other services. However, keep in mind that international transfers with PayPal have several drawbacks, such as high fees and limited transfer amounts. Therefore, it is necessary to consider carefully before making international transfers with PayPal.

Security in International Transfers Using PayPal

When making international money transfers using PayPal, security is of course a major concern. PayPal has implemented a number of security measures to ensure your transactions are protected.

First, PayPal uses high-level encryption technology to protect your information, including account numbers and other financial details. This means your data is encrypted as it is sent over the internet, so it is protected from thieves and hackers.

Additionally, PayPal has a two-step verification system for increased security. Once you enable this feature, you will be asked to enter a unique code that is sent to your phone every time you log in to your account or make a transaction. This helps prevent unauthorized access to your account.

PayPal also actively monitors transactions to detect suspicious activity. If the company detects anything unusual, they will contact you to confirm the transaction and can block it if necessary.

In addition to these measures, PayPal also complies with industry standards for data security, such as the Payment Card Industry Data Security Standard (PCI DSS). This ensures that your financial information is handled in accordance with security best practices.

If you’re still concerned about security when sending money internationally using PayPal, there are a few additional steps you can take:

Use strong passwords and never share them with others.

Enable email alerts to notify you of any account activity.

Review your transaction history regularly to detect any unusual activity.

Report suspicious transactions to PayPal as soon as possible.

By following these steps, you can be sure that your international money transfers using PayPal are safe and secure. PayPal continues to invest in security to provide peace of mind for its users.