What is KYC in PayPal?

Hello, do you know what is KYC in PayPal? Well, let’s discuss it in more detail.

KYC (Know Your Customer) is a customer identity verification process carried out by financial institutions, including PayPal. This is an important step to prevent fraud, money laundering and other illegal activities.

When you create a PayPal account, you may be asked to provide personal information such as your name, address, and date of birth. PayPal may also ask you to provide additional documents, such as government-issued identification or proof of address.

The KYC process can take a few days or weeks, depending on the type of documents you provide. Once the process is complete, your account will be verified and you can use PayPal services to the fullest.

However, keep in mind that PayPal may request additional information to verify your identity at any time. This is important to ensure that your account remains safe and avoids fraud.

If you do not complete the KYC process, PayPal may limit your account or even close it. So, make sure to provide the requested information accurately and in a timely manner.

Apart from complying with regulations, KYC also provides other benefits. One of them is increasing trust between you and PayPal. This can speed up the transaction approval process and reduce the risk of fraud.

Lastly, KYC helps PayPal identify and address high-risk customers. This protects other users and businesses from illegal activity.

So, although the KYC process may be a bit of a hassle, it is an important step to ensure the security and reliability of the financial system. By providing the necessary information, you not only protect yourself but also contribute to a safer and more reliable financial ecosystem.

Steps to Verify Identity on PayPal

PayPal is an online payment platform that is widely used to send and receive money. To ensure security, PayPal implements identity verification measures called Know Your Customer (KYC). KYC is the process of verifying customer identity to prevent money laundering and other illegal activities.

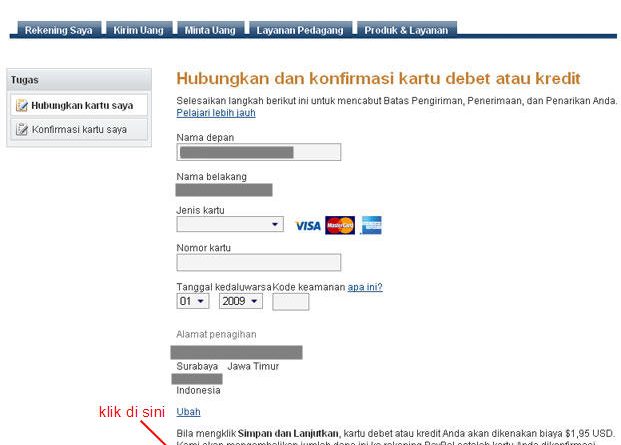

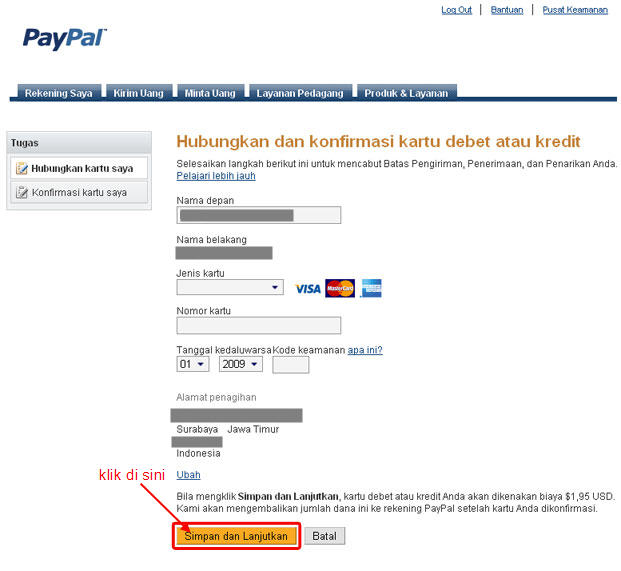

The KYC process at PayPal is usually easy and only takes a few steps. First, you must provide basic personal information, such as name, address, and telephone number. PayPal will also ask you to provide a copy of an identity document, such as a passport, driver’s license or national identity card. In some cases, you may also be asked to provide proof of residency, such as a utility bill or bank statement.

Once you submit the required information, PayPal will review it and verify your identity. This process usually only takes a few minutes, but may take longer in complicated cases. Once your identity is verified, you can use PayPal to make transactions without restrictions.

There are several reasons why PayPal implements a KYC process. Firstly, KYC helps prevent money laundering. Money launderers often use anonymous accounts to hide their identity and the source of their funds. By requiring customers to verify their identity, PayPal makes it harder for money launderers to use its platform.

Additionally, KYC helps PayPal comply with government regulations. In many countries, financial companies are required to verify the identity of their customers. By implementing a KYC process, PayPal meets these legal requirements and helps prevent illegal activity.

Lastly, KYC helps protect PayPal users from fraud. When fraudsters try to create a PayPal account using a fake identity, PayPal will detect this during the KYC process. This helps protect users from fraud attempts and identity theft.

The KYC process at PayPal is an important step to ensure the security of its platform and comply with government regulations. By verifying the identity of its users, PayPal helps prevent money laundering, fraud, and other illegal activities.

Identity Verification on PayPal: What is KYC and How to Do It?

PayPal is one of the most popular online payment platforms in the world. With more than 400 million active users, PayPal allows you to make online transactions easily and securely. However, to use PayPal effectively, you need to perform identity verification, known as Know Your Customer (KYC). In this article, we’ll discuss what KYC is on PayPal, why it’s important, and how to do it.

What is KYC on PayPal?

KYC is the identity verification process used by PayPal to ensure that you are the legitimate account holder. This process aims to prevent fraud, money laundering and other illegal activities. By carrying out KYC, PayPal can ensure that you are the person who has the right to use the account.

Why is KYC Important at PayPal?

KYC is important at PayPal for several reasons:

- Prevent Fraud : KYC helps PayPal to prevent fraud and identity theft. By ensuring that you are the legitimate account holder, PayPal can reduce the risk of fraud.

- Reducing the Risk of Money Laundering : KYC also helps PayPal to reduce the risk of money laundering. By ensuring that you are the person authorized to use the account, PayPal can reduce the risk of money laundering.

- Improve Security : KYC increases the security of your account. By ensuring that you are the authorized account owner, PayPal can reduce the risk of unauthorized access to your account.

- Reduce the Risk of Involvement in Illegal Activities : KYC also helps PayPal to reduce the risk of involvement in illegal activities. By ensuring that you are the person authorized to use the account, PayPal can reduce the risk of involvement in illegal activity.

How to Do KYC on PayPal

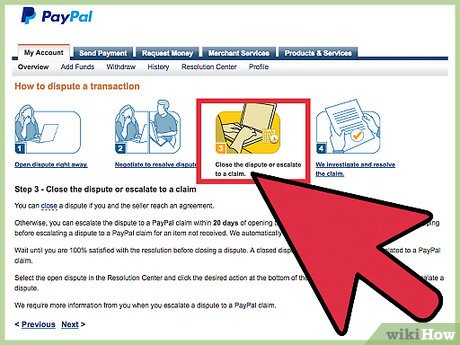

How to do KYC on PayPal is quite easy. Here are the steps you need to do:

- Log in to your PayPal Account : First of all, log in to your PayPal account using your email and password.

- Click on “About” : Click on “About” in the top right corner of the screen.

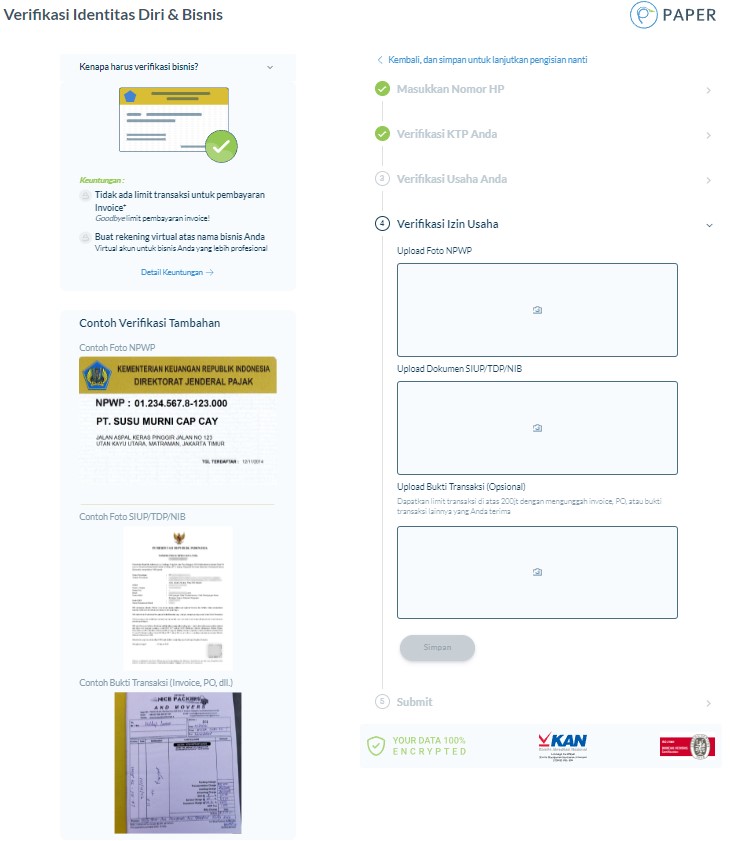

- Select “Identity Verification” : Select “Identity Verification” from the dropdown menu.

- Select Document Type : Select the type of document you want to use for identity verification, such as KTP, SIM, or Passport.

- Upload Document : Upload your selected documents to the PayPal site.

- Wait for Verification : Wait for verification from PayPal. The verification process usually takes several hours to several days.

Required Documents for KYC on PayPal

Documents required for KYC on PayPal are as follows:

- ID card : Resident Identity Card (KTP) is one of the most commonly used documents for identity verification.

- driver’s license : A driving license (SIM) can also be used to verify identity.

- Passport : Passport is the most commonly used document for international identity verification.

- NPWP : Taxpayer Identification Number (NPWP) is also required for identity verification.

Tips and Tricks for Performing KYC on PayPal

Here are some tips and tricks for doing KYC on PayPal:

- Make sure the documents you use are valid : Make sure the documents you use to verify identity are valid and not expired.

- Upload Clear Documents : Upload documents that are clear and not blurry.

- Wait Patiently for Verification : Wait patiently for verification from PayPal. The verification process usually takes several hours to several days.

- Don’t Forget to Check Your Email : Don’t forget to check your email for notifications from PayPal about your identity verification status.

Conclusion

Identity verification on PayPal is an important process to ensure that you are the legitimate account owner. By performing KYC, PayPal can prevent fraud, money laundering and other illegal activities. How to do KYC on PayPal is quite easy, and the documents required are KTP, SIM, Passport and NPWP. By following the tips and tricks above, you can perform KYC on PayPal easily and safely.

KYC Benefits for PayPal Users

Once you’ve created a PayPal account, you’ve probably heard the term “KYC.” KYC stands for “Know Your Customer”, and it is a very important identity verification process to ensure platform security for all users.

So, what does KYC benefit you as a PayPal user? First of all, KYC helps protect your account from fraud and identity theft. By verifying your identity, PayPal can help prevent criminals from using your account for malicious purposes.

Additionally, KYC allows you to access more PayPal features and services. For example, once you complete KYC, you will be able to increase your transaction limits, make larger transactions, and withdraw money faster. This is especially useful if you plan to use PayPal for business or for larger transactions.

KYC also helps PayPal comply with financial and legal regulations. Many jurisdictions have regulations that require businesses like PayPal to verify the identity of their users. By completing KYC, you help PayPal meet these regulations and ensure the platform remains safe and legal.

The KYC process usually involves submitting your identity documents, such as a driver’s license, passport, or state ID. PayPal may also ask you to provide additional information, such as proof of your residence or telephone number.

We understand that you may want to know the right way to stay safe when using PayPal. Here are some tips:

Use a strong and unique password.

Enable two-step verification.

Review your account activity regularly.

Report suspicious transactions immediately.

By following these steps, you can help ensure the security of your PayPal account and take advantage of all the benefits of KYC.