What is a PayPal Kids Account?

PayPal Kids is a special type of account that allows children to make online transactions safely and easily, while providing parental control through monitoring and financial management. Built on the renowned PayPal platform, this account is designed to give parents peace of mind knowing that their children can shop and manage their money responsibly.

One of the main benefits of PayPal Kids is its ease of use. Kids simply deposit money into their account via bank transfer or a parent’s credit card, and they can immediately use the funds to shop online, send money to friends, or make in-app purchases. Parents can set spending limits and control the types of transactions their children can make, giving them the flexibility to teach their children about financial management in a safe way.

In addition to parental controls, PayPal Kids also offers its own robust security features. The PayPal platform is known for its world-class fraud protection and security measures, which extends this protection to PayPal Kids accounts. Parents can rest assured that their children’s transactions will be conducted safely, and they can monitor their account activity in real-time.

Using PayPal Kids is a rewarding experience for both children and parents. Children can learn financial values, be responsible for their spending, and develop good spending habits. Parents can provide appropriate restrictions and supervision, helping their children develop responsible financial independence.

To open a PayPal Kids account, parents must first have a personal PayPal account. Then, they can create a PayPal Kids account through the PayPal app or website. Once a child’s account is created, parents can connect their bank account or credit card to it and set spending limits and transaction controls.

PayPal Kids is a valuable tool for parents who want to teach their children about financial management and give them the freedom to conduct online transactions safely. With comprehensive parental controls and PayPal security features, PayPal Kids provides the perfect solution for empowering kids and instilling responsible financial habits from an early age.

Safety and Benefits of PayPal Accounts for Children

You want your kids to learn to manage money, but you’re worried about giving them cash. Well, PayPal Kids could be the solution.

PayPal Kids is a PayPal account designed specifically for children aged 13 to 17 years. These accounts allow kids to receive and send money, shop online, and even save for the future. Best of all, this account is completely controlled by parents.

To sign up for PayPal Kids, you must have a personal PayPal account. Once you register, you can create accounts for each of your children. You can set spending limits, monitor their transactions, and freeze the account if necessary.

PayPal Kids comes with a number of benefits, including:

Financial education: Children can learn to manage money safely and responsibly.

Convenience: Kids can receive money from family and friends, shop online without a credit card, and even save for specific goals.

Security: You remain in full control of the account, so you can ensure that your child uses it properly.

Of course, it’s important to discuss financial responsibilities with your child before giving them access to PayPal Kids. Explain to them the importance of setting a budget, avoiding overspending, and protecting their financial information.

With proper supervision and guidance, PayPal Kids can be an effective tool for teaching children about wise money management. This is a great way to help them develop financial skills that will benefit them throughout their lives.

Get to know PayPal Kids Account: Digital Financial Solution for Children

In recent years, digital financial technology has developed rapidly, allowing people to carry out financial transactions more easily and quickly. One example of popular digital financial technology is PayPal, an online payment platform that allows users to carry out financial transactions safely and easily.

However, what if we want to provide digital financial access to our children? Actually, PayPal has a solution to this problem, namely PayPal Kids Account. In this article, we will discuss more about the PayPal Kids Account and how it works.

What is a PayPal Kids Account?

PayPal Kids Account is a PayPal account specifically designed for children under 18 years of age. These accounts allow parents or guardians to manage and monitor their children’s financial transactions. PayPal Kids Account is designed to help children understand digital financial concepts and develop good financial management skills.

PayPal Kids Account Features

PayPal Kids Account has several features that make it a safe and easy-to-use digital financial solution for children. Here are some of the main features of this account:

- Parental supervision : Parents or guardians can manage and monitor their children’s financial transactions in real-time. They can view transaction history, approve or reject transactions, and set transaction limits.

- Transaction limitations : This account has transaction limitations that can be set by parents or guardians. This allows children to carry out financial transactions safely and in a controlled manner.

- Security system : PayPal Kids Account has a strict security system, including data encryption and two-factor authentication. This ensures that children’s financial transactions are safe and secure.

- Financial education : PayPal Kids Account also offers financial education features that help children understand digital financial concepts. These features include tutorials, games, and other educational resources.

How to Open a PayPal Kids Account?

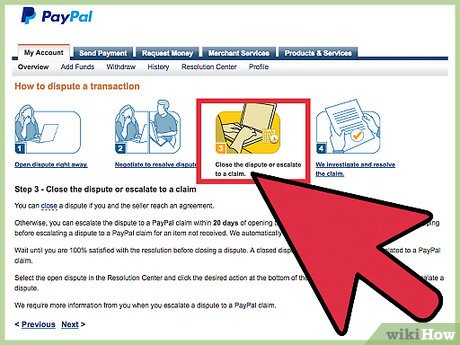

Opening a PayPal Kids Account is quite easy and can be done in a few steps. Here are the steps to open this account:

- Open a PayPal account : Parents or guardians must have an active PayPal account before they can open a PayPal Kids Account.

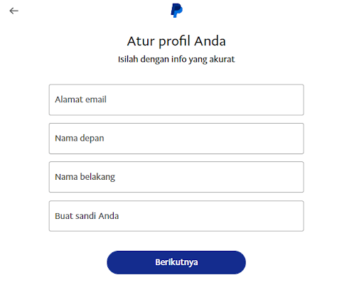

- Create a child profile : Parents or guardians must create a child profile in their PayPal account. This profile will be used to manage and monitor children’s financial transactions.

- Set transaction limits : Parents or guardians should set transaction limits for their children. This allows them to control the amount of money children can use to make financial transactions.

- Set payment method : Parents or guardians must set up a payment method for their children. This can be a credit card, debit card, or bank account.

- Identity verification : Parents or guardians must verify their children’s identity by providing the necessary information, such as date of birth and address.

Benefits of a PayPal Kids Account

PayPal Kids Account offers several benefits for children and their parents or guardians. Here are some of the main benefits of this account:

- Develop financial management skills : PayPal Kids Account helps children understand digital financial concepts and develop good financial management skills.

- Manage financial transactions safely : This account allows parents or guardians to manage and monitor their children’s financial transactions in real-time.

- Avoid fraud : PayPal Kids Account has a strict security system, which helps avoid fraud and other financial crimes.

- Develop independence : These accounts allow children to conduct financial transactions independently, which helps them develop independence and responsibility.

Conclusion

PayPal Kids Account is a safe and easy-to-use digital financial solution for children. These accounts allow parents or guardians to organize and monitor their children’s financial transactions in real-time, as well as help children understand digital financial concepts and develop good financial management skills. With advanced features and a tight security system, PayPal Kids Account is the right choice for parents or guardians who want to provide digital financial access to their children.

How to Manage PayPal Accounts for Kids

Did you know that PayPal has an option to create accounts for children? Called PayPal Kids Account, this feature allows parents to give their children controlled financial freedom. Let’s explore what a PayPal Kids Account is and how you can manage it for your children.

A PayPal Kids account is a sub-account linked to a parent account. They are designed to teach children about money management from an early age. Children can receive money from parents or others, deposit it in their accounts, and spend it online. However, parents have full control over the account and can monitor activity, set spending limits, and even determine where kids can spend their money.

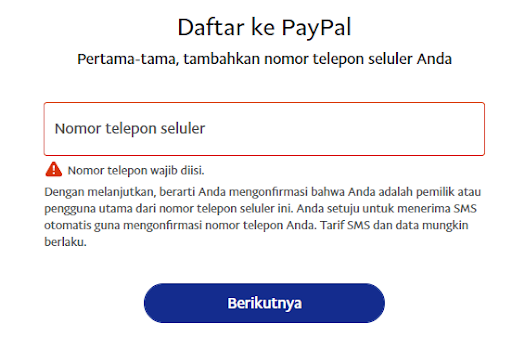

To create a PayPal Kids Account, you must be an existing PayPal user. Just log in to your account, click the “Family and Friends” tab, and then “Add Children.” You will be asked to provide your child’s information, such as name, email address, and date of birth. Once the account is created, you can connect it to your own account.

One of the main benefits of a PayPal Kids Account is that it allows parents to teach their children about financial responsibility. Kids can learn to manage their money, understand the value of money, and make responsible purchasing decisions. Parents can also use the account to provide allowances, gifts, or money in exchange for tasks completed.

Additionally, PayPal Kids Accounts offer additional security. Children do not have access to their parents’ financial information, and all transactions are protected by PayPal’s security system. This provides peace of mind for parents who want to give their children controlled financial freedom.

However, it’s important to note that PayPal Kids Accounts are only available to children in certain markets. If you’re not sure whether this feature is available in your area, you can check the PayPal website or contact customer service.

If you want to give your kids a valuable and controlled financial experience, a PayPal Kids Account is a great option. It’s a safe and effective way to teach kids about money management, while giving them the freedom to make their own purchasing decisions.