How PayPal transfers funds to your linked bank

The process of transferring funds from PayPal to a linked bank account is very easy and fast. Let’s discuss it step by step:

First, visit the PayPal website or app and log in to your account. After that, click on the “Balance & Activity” tab, located on the homepage.

Next, find the “Transfer” or “Withdraw Money” button and click on it. You will be asked to select the bank account you want to transfer funds to. If you haven’t linked a bank account, you can do so from here by following the instructions provided.

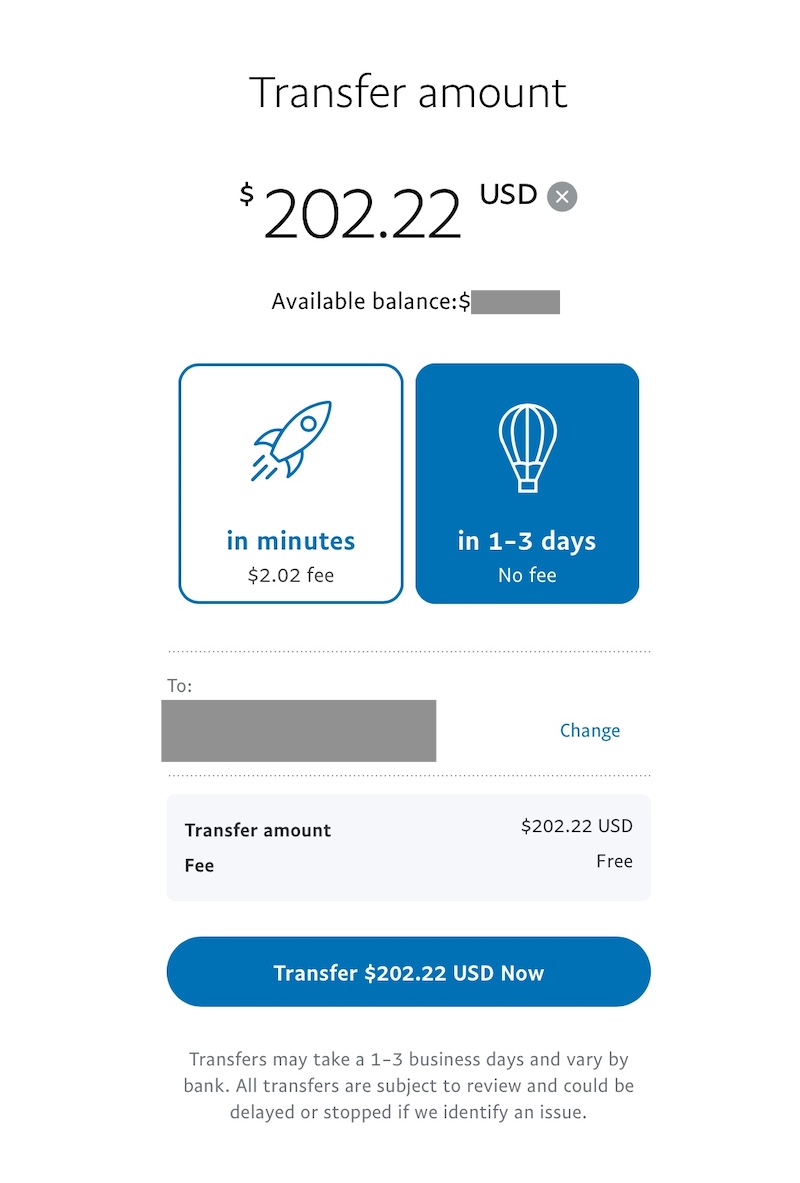

Once you have selected a bank account, enter the amount you want to transfer and click “Next”. PayPal will display a summary of the transaction, including any fees that may be charged. Confirm the details and click “Transfer”.

PayPal will process your transfer instantly. However, keep in mind that your bank may take a few business days to credit the funds to your account. You can check the status of your transfer in the “Activity” tab of your PayPal account.

PayPal uses various methods to transfer funds, depending on your bank and availability. Common methods include:

Account Transfer: Funds are withdrawn directly from your PayPal balance to your bank account.

ACH Transfers: Funds are transferred via the Automated Home Clearing Network (ACH) and may take several business days to process.

Debit Card Transfer: With this method, funds are transferred from your PayPal balance to the linked debit card.

Transfer fees vary depending on the method you use. Instant transfers usually incur higher fees than standard transfers. You can view the fees before confirming the transfer.

If you experience problems transferring funds from PayPal to your bank account, please do not hesitate to contact PayPal customer service. They can help resolve any issues and ensure that your funds are transferred safely and on time.

Steps for withdrawing money from PayPal to your bank

Withdrawing funds from PayPal to your bank account is easy and convenient. Here are the steps:

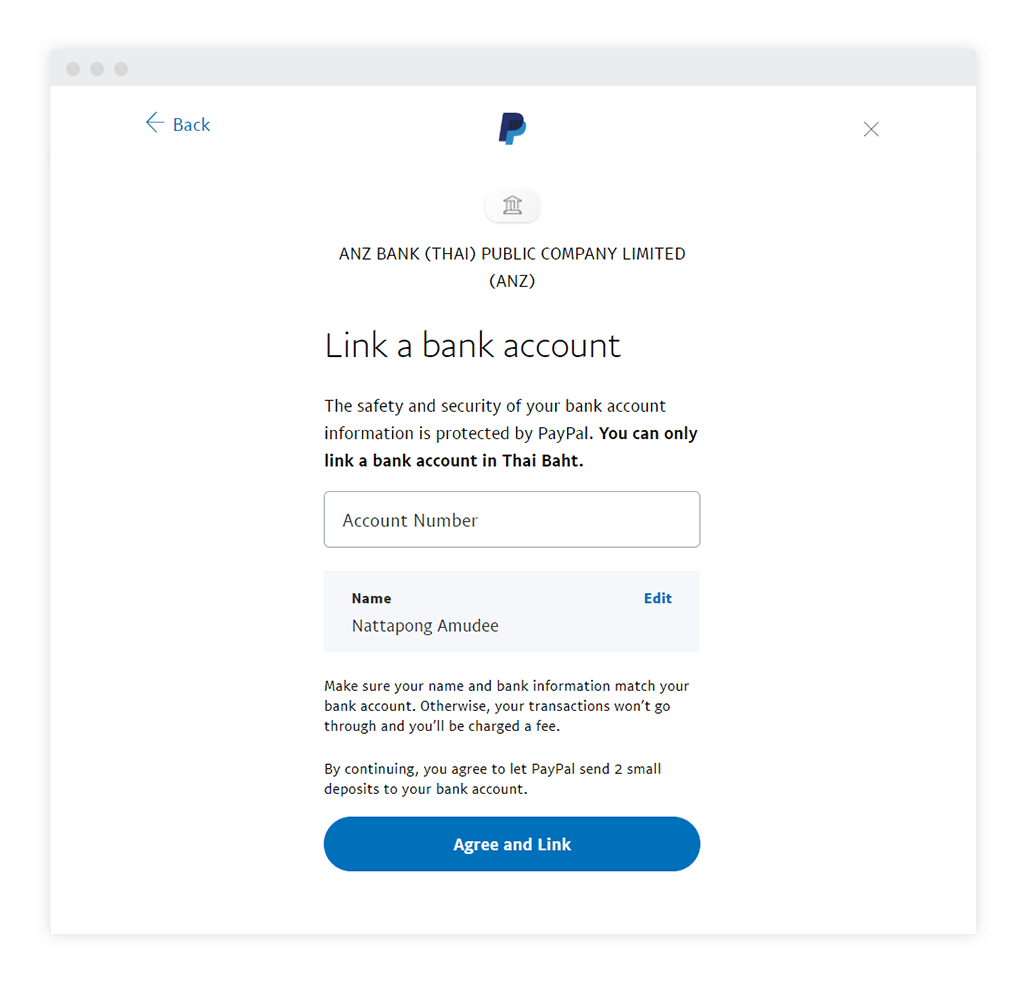

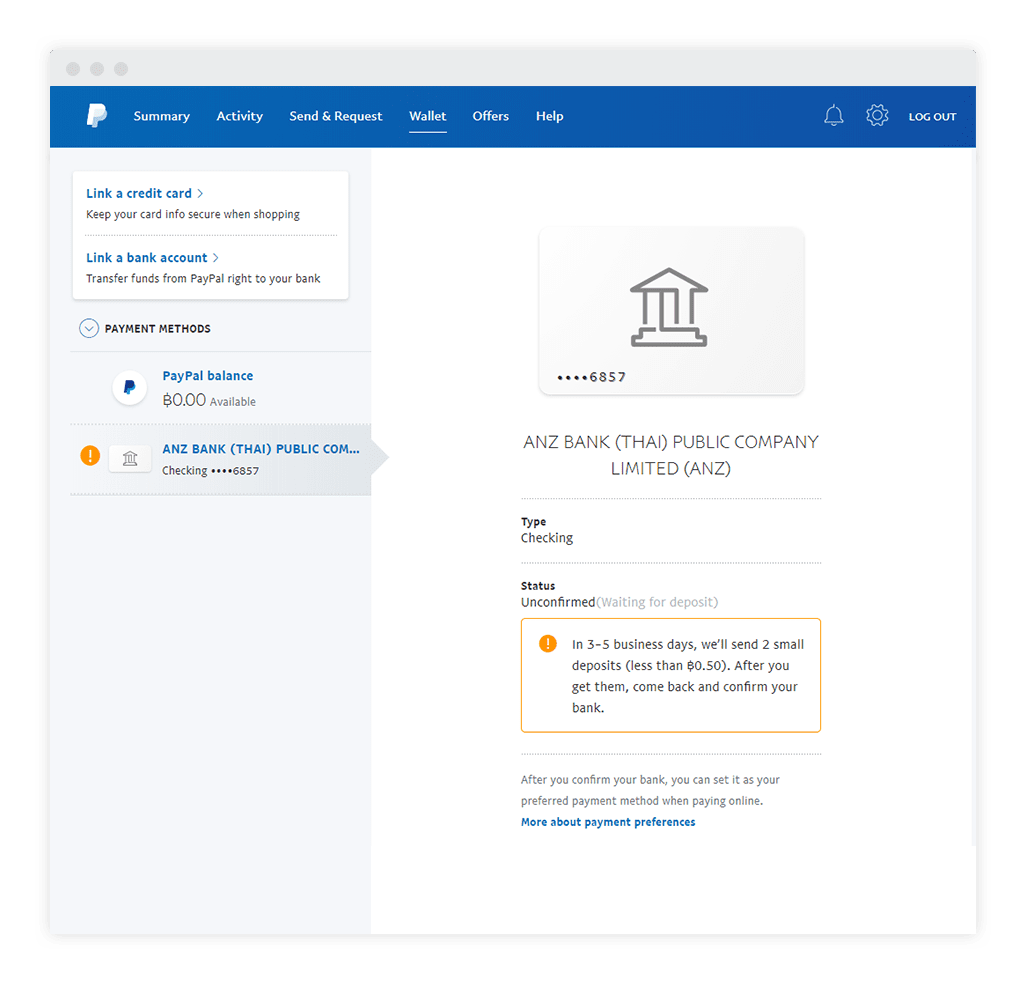

First of all, make sure you have connected your bank account to your PayPal account. If not, simply click “Wallet” and then “Link bank account” to add your banking details.

Once your bank account is connected, click “Withdraw” on your PayPal account homepage. Enter the amount you want to withdraw and select the bank account you want to use.

PayPal will then ask if you want to transfer funds “Instantly” or “Standard”. Instant transfers will complete the transaction immediately, but will incur a small fee. Standard transfers usually take 1-3 business days, but are free. Choose the option that best suits your needs.

Once you click “Continue,” PayPal will send a verification code to the phone number or email associated with your account. Enter this code to confirm the transaction.

PayPal will now process your withdrawal request. You can monitor the status of your transactions in the “Activity” section of your PayPal account.

If you choose standard transfer, funds will be credited to your bank account within 1-3 business days. If you choose instant transfer, the funds will be available in your bank account immediately.

Keep in mind that PayPal may charge a small fee for withdrawal transactions. These fees vary depending on the amount withdrawn and the transfer method chosen.

These are the simple steps to withdraw funds from PayPal to your bank account. The process is fast, secure and easy to follow, so you can access your money with ease.

Withdrawal limits and fees for bank-linked PayPal accounts

When it comes to transferring funds from PayPal to your linked bank account, the steps involved may vary depending on your specific bank and settings. However, in general, the process is quite easy and only requires a few simple steps.

First, log in to your PayPal account and go to the “Balance” section. There, you will see the option to “Withdraw Funds”. Click on it and select the bank account you want to transfer funds to. If you haven’t already linked your bank account to PayPal, you should do so at this point.

Once you have selected a bank account, enter the amount you want to transfer and click “Continue”. PayPal will then process your request and the funds will be transferred to your bank account within 1 to 3 business days.

The amount of time it takes for funds to reach your bank account may vary depending on your bank. Some banks may process transfers faster than others. You can check with your bank for estimated processing times.

It is important to know that PayPal charges a fee for each withdrawal. These fees vary depending on the withdrawal method and the country you are in. You can find more information about withdrawal fees in the PayPal help center.

In addition to withdrawal fees, you may also be charged additional fees from your bank. These fees may vary depending on your bank’s policies. It’s best to check with your bank to see if there are any additional fees associated with PayPal transfers.

If you have problems transferring funds from PayPal to your bank account, you can contact PayPal customer service for assistance. They will be able to provide additional guidance and assistance to resolve your issue.

Can PayPal withdraw money from a linked Bank account?

Withdrawing Money from a Bank Account Linked to PayPal: How Does It Work?

PayPal is one of the most popular online payment platforms in the world. With PayPal, you can make online transactions easily and safely. One of the features that makes PayPal so popular is the ability to withdraw money from connected bank accounts. But how does it work? In this article, we’ll talk about how PayPal withdraws money from connected bank accounts and what you need to know before making a withdrawal.

What is PayPal?

Before we discuss withdrawing money from a connected bank account, let’s first discuss what PayPal is. PayPal is an online payment platform that allows you to make online transactions easily and safely. With PayPal, you can make online payments, send money to others, and even receive payments from others.

How Does PayPal Work?

PayPal works by connecting your bank account with your PayPal account. When you create a PayPal account, you will be asked to enter your bank account information, such as your account number and SWIFT code. Once your bank account is connected to your PayPal account, you can make online transactions using your PayPal balance.

Withdrawing Money from Linked Bank Accounts

Now, let’s talk about withdrawing money from a connected bank account. When you have a balance in your PayPal account, you can withdraw the money from the connected bank account. Here are the steps you need to take to withdraw money from a connected bank account:

- Make sure your bank account is connected to your PayPal account . Make sure you have entered your bank account information correctly and that your bank account is connected to your PayPal account.

- Check your PayPal account balance . Make sure you have sufficient balance in your PayPal account to make a withdrawal.

- Select the bank account you want to use . Select the bank account you want to use to withdraw money from your PayPal account.

- Enter the withdrawal amount . Enter the amount of money you want to withdraw from your PayPal account.

- Confirm withdrawal . Confirm your withdrawal by entering the confirmation code sent by PayPal to your email address.

How long does it take to withdraw money from a connected bank account?

Time to withdraw money from a connected bank account may vary depending on your location and type of bank account. Here is some information about when to withdraw money from connected bank accounts:

- Withdrawing money from a bank account in the United States : 1-3 working days

- Withdrawing money from a bank account in Europe : 2-5 working days

- Withdraw money from bank accounts in Asia : 3-7 working days

What Do You Need to Know Before Withdrawing Money from a Linked Bank Account?

Before withdrawing money from a connected bank account, there are a few things you need to know:

- Withdrawal fees : Make sure you understand the withdrawal fees you will pay. Withdrawal fees may vary depending on your location and bank account type.

- Withdrawal limits : Make sure you understand the applicable withdrawal limits. Withdrawal limits may vary depending on your location and bank account type.

- Security guarantee : Make sure you understand that withdrawing money from a connected bank account can be done safely and securely.

Conclusion

In conclusion, withdrawing money from a connected bank account on PayPal is an easy and safe process. By understanding how PayPal works and what you need to know before making a withdrawal, you can make online transactions more easily and safely. Make sure you read and understand the applicable terms and conditions before withdrawing money from the connected bank account.

FAQs

Q: What is PayPal?

A: PayPal is an online payment platform that allows you to make online transactions easily and safely.

Q: How does PayPal work?

A: PayPal works by linking your bank account to your PayPal account.

Q: What do I need to do to withdraw money from a linked bank account?

A: Make sure your bank account is connected to your PayPal account, check your PayPal account balance, select the bank account you want to use, enter the withdrawal amount, and confirm the withdrawal.

Q: How long does it take to withdraw money from a connected bank account?

A: Time to withdraw money from connected bank accounts may vary depending on your location and type of bank account.

Q: What do I need to know before withdrawing money from a linked bank account?

A: Make sure you understand the withdrawal fees, withdrawal limits, and security guarantees before withdrawing money from a connected bank account.