Save Fees with PayPal: How to Calculate Transaction Fees

PayPal is one of the most popular online payment methods in the world. With more than 400 million active users, PayPal is the first choice for many people who want to make online transactions. However, like other payment services, PayPal also has fees associated with its use. These fees may vary depending on the type of transaction, the amount of money sent, and the user’s location.

In this article, we’ll talk about how to lower PayPal fees and make transactions more economical. We’ll talk about ways to save money, including reducing shipping costs, using your existing PayPal balance, and choosing the right transaction type.

PayPal Fees: What to Know

Before we talk about how to save on fees, we need to understand what PayPal fees are. Here are some of the most common types of PayPal fees:

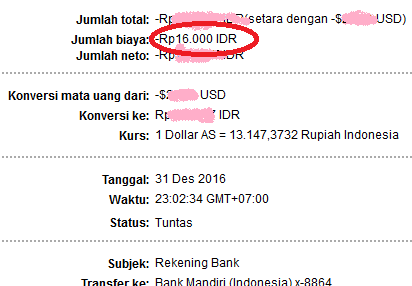

- Shipping costs : This fee is charged when you send money to another PayPal user. Sending costs may vary depending on the amount of money sent and the user’s location.

- Transfer fees : This fee is charged when you transfer money from PayPal to a bank account or credit card.

- Currency conversion fees : This fee is charged when you make transactions in different currencies.

How to Lower PayPal Fees

Here are some ways to save on PayPal fees:

- Reduce shipping costs : One way to save costs is to reduce shipping costs. You can do this by sending larger amounts of money at once, so sending costs can be lower.

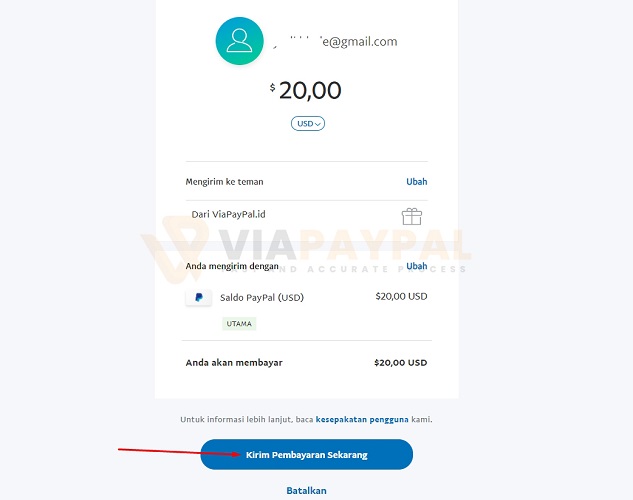

- Using your existing PayPal balance : If you have an existing PayPal balance, you can use that balance to make transactions. This way, you don’t need to send money from a bank account or credit card, so transfer fees can be avoided.

- Choose the right type of transaction : PayPal offers several different transaction types, such as “Purchase” transactions and “Remittance” transactions. “Purchase” transactions typically have lower fees than “Remittance” transactions.

- Using a bank account : If you have a bank account, you can use that account to make transactions with PayPal. Thus, transfer fees can be avoided.

- Using a credit card : If you have a credit card, you can use it to make transactions with PayPal. However, keep in mind that credit card fees can be higher than bank account transfer fees.

Choosing the Right Transaction Type

PayPal offers several different transaction types, such as “Purchase” transactions and “Remittance” transactions. Here are some differences between these two types of transactions:

- Transaction “Purchase” : This transaction is used to purchase goods or services online. These transaction fees are usually lower than “Remittance” transactions.

- Transaction “Remittance” : This transaction is used to send money to another PayPal user. These transaction fees are usually higher than “Purchase” transactions.

Lowering Costs by Using a Bank Account

If you have a bank account, you can use that account to make transactions with PayPal. Thus, transfer fees can be avoided. Here are some ways to lower costs by using a bank account:

- Using a bank account as a source of funds : You can use a bank account as a source of funds to make transactions with PayPal. Thus, transfer fees can be avoided.

- Use a bank account to send money : You can use your bank account to send money to other PayPal users. Thus, shipping costs can be avoided.

Using a Credit Card to Lower Costs

If you have a credit card, you can use it to make transactions with PayPal. However, keep in mind that credit card fees can be higher than bank account transfer fees. Here are some ways to lower costs by using a credit card:

- Using a credit card as a source of funds : You can use a credit card as a source of funds to make transactions with PayPal. Thus, transfer fees can be avoided.

- Using a credit card to send money : You can use a credit card to send money to other PayPal users. Thus, shipping costs can be avoided.

Conclusion

PayPal is one of the most popular online payment methods in the world. However, like other payment services, PayPal also has fees associated with its use. In this article, we’ve discussed how to lower PayPal fees and make transactions more economical. We’ve talked about several ways to save money, including reducing shipping costs, using your existing PayPal balance, and choosing the right transaction type. By using bank accounts and credit cards, we can also reduce transaction costs. In this way, we can carry out transactions more economically and efficiently.