PayPal ATM Withdrawal: Quick and Easy Solution to Withdraw Money

PayPal is one of the largest online payment services in the world. With more than 400 million active users, PayPal has become the first choice for many people to make online transactions. However, sometimes we need cash and don’t want to wait days to get it. This is the time when PayPal ATM Withdrawal comes as a solution.

In this article, we’ll talk about PayPal ATM Withdrawal, including how it works, fees, and tips for using this service effectively.

What is PayPal ATM Withdrawal?

PayPal ATM Withdrawal is a service that allows you to withdraw cash from your PayPal account via an ATM machine. This service allows you to access your funds instantly, without having to wait days or make a trip to the bank.

How PayPal ATM Withdrawal Works

The way PayPal ATM Withdrawal works is quite simple. Here are the steps:

- Make sure you have an active and verified PayPal account.

- Make sure you have sufficient balance in your PayPal account.

- Look for an ATM machine that supports PayPal ATM Withdrawal.

- Insert your ATM card and select the “PayPal” option on the screen.

- Enter your PayPal PIN and select the amount of money you want to withdraw.

- Wait until the transaction is complete and your money comes out of the ATM machine.

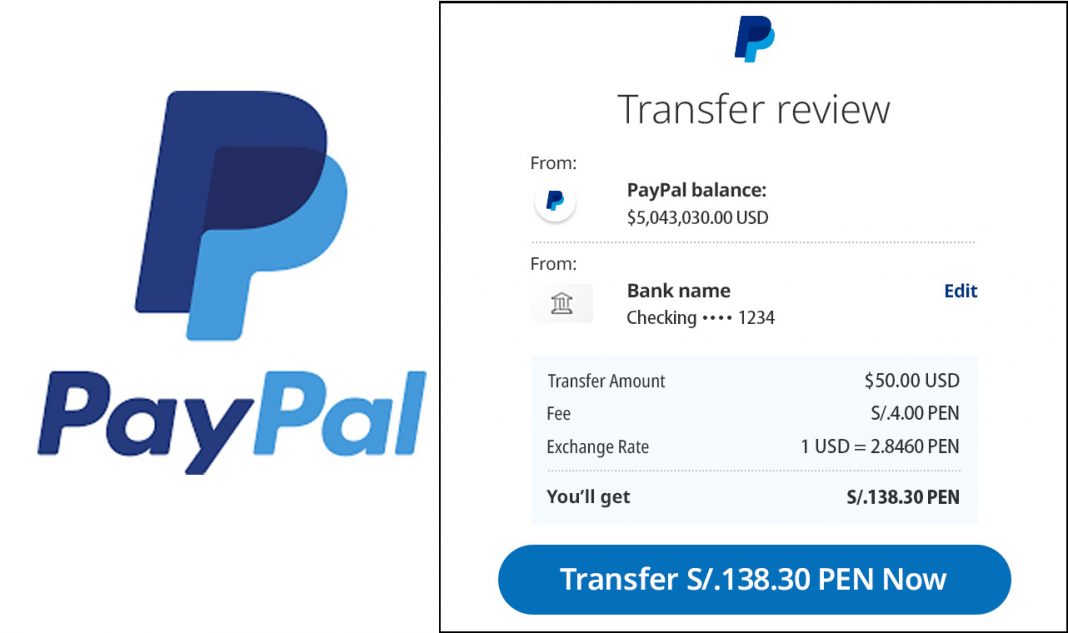

PayPal ATM Withdrawal Fees

PayPal ATM Withdrawal fees may vary depending on your location and the type of ATM card you use. However, in general, PayPal ATM Withdrawal fees are as follows:

- Transaction fee: 0.5% of the transaction amount (maximum IDR 10,000)

- ATM Fee: IDR 2,500 – IDR 5,000 (depending on the bank)

Tips for Using PayPal ATM Withdrawal

Here are some tips for using PayPal ATM Withdrawal effectively:

- Make sure your balance is sufficient : Before making a transaction, make sure your balance is sufficient to cover the transaction fees and the amount of money you withdraw.

- Choose the right ATM machine : Choose an ATM machine that supports PayPal ATM Withdrawal and has low fees.

- Use the right ATM card : Use an ATM card that supports PayPal ATM Withdrawal and has low fees.

- Don’t forget your PayPal PIN : Don’t forget your PayPal PIN to avoid difficulties when making transactions.

- Check your balance regularly : Check your balance regularly to ensure that it has enough to cover transaction fees.

Advantages and Disadvantages of PayPal ATM Withdrawal

Here are some of the advantages and disadvantages of PayPal ATM Withdrawal:

Excess :

- Fast and easy : PayPal ATM Withdrawal allows you to withdraw cash instantly and easily.

- Flexible : You can make transactions anywhere and anytime that has an ATM machine.

- Safe : PayPal ATM Withdrawal transactions are done online and are easy to track.

Lack :

- Cost : PayPal ATM Withdrawal fees may vary depending on your location and the type of ATM card you use.

- Balance limitations : You can only withdraw cash up to the existing balance in your PayPal account.

- Location limitations : PayPal ATM Withdrawal is only available at ATM machines that support this service.

Conclusion

PayPal ATM Withdrawal is a service that allows you to withdraw cash from your PayPal account via an ATM machine. This service allows you to access your funds instantly, without having to wait days or make a trip to the bank. Despite some fees and limitations, PayPal ATM Withdrawal remains a fast and easy solution for withdrawing cash.

FAQs

Q: What is PayPal ATM Withdrawal?

A: PayPal ATM Withdrawal is a service that allows you to withdraw cash from your PayPal account via an ATM machine.

Q: How do I use PayPal ATM Withdrawal?

A: You can use PayPal ATM Withdrawal by finding an ATM machine that supports this service, entering your ATM card and PayPal PIN, and selecting the amount of money you want to withdraw.

Q: What are the PayPal ATM Withdrawal fees?

A: PayPal ATM Withdrawal fees may vary depending on your location and the type of ATM card you use. However, in general, the PayPal ATM Withdrawal fee is 0.5% of the transaction amount (maximum IDR 10,000) and the ATM fee is IDR 2,500 – IDR 5,000.

Q: What are the advantages of PayPal ATM Withdrawal?

A: The advantages of PayPal ATM Withdrawal are that it is fast and easy, flexible and safe.

Q: What are the disadvantages of PayPal ATM Withdrawal?

A: The disadvantages of PayPal ATM Withdrawal are fees, balance limitations, and location limitations.