Understand PayPal International Fees: Complete Guide

PayPal is one of the most popular online payment services in the world. By using PayPal, you can make online transactions easily and quickly, whether it’s to buy goods online or make money transfers between countries. However, like other online payment services, PayPal also has international transaction fees that you need to understand before making a transaction.

In this article, we will discuss PayPal’s international fees in full, including the types of fees charged, how to calculate fees, and tips for saving on international transaction fees with PayPal.

PayPal International Fee Types

PayPal has several types of international fees that are charged to users, namely:

- International Transaction Fees : This fee is charged to users when making transactions with merchants from other countries. PayPal international transaction fees can range between 0.5% to 2% of the total transaction value, depending on the country of origin and destination of the transaction.

- Currency Conversion Fees : When making international transactions, PayPal will convert the currency used into the currency accepted by the merchant. Currency conversion fees can range between 2.5% to 4.5% of the total transaction value.

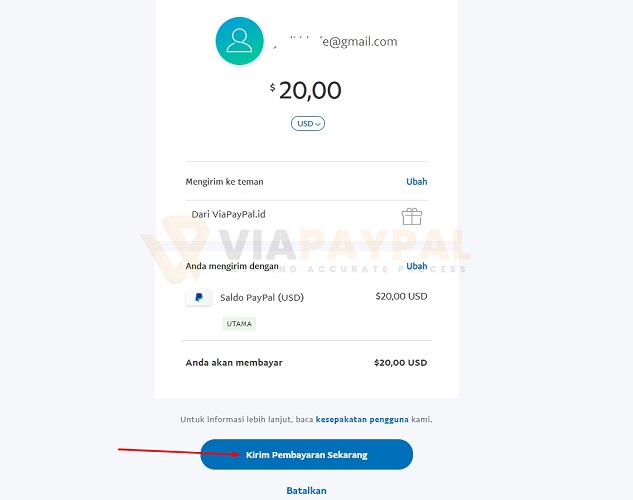

- Money Transfer Fees : If you want to send money to someone’s bank account in another country, PayPal will charge a money transfer fee that can range from $0.30 USD to $4.99 USD, depending on the destination country.

- Withdrawal Fees : If you want to withdraw funds from your PayPal balance to a bank account, PayPal will charge a withdrawal fee which can range from $0.25 USD to $1.50 USD, depending on the country and banking institution.

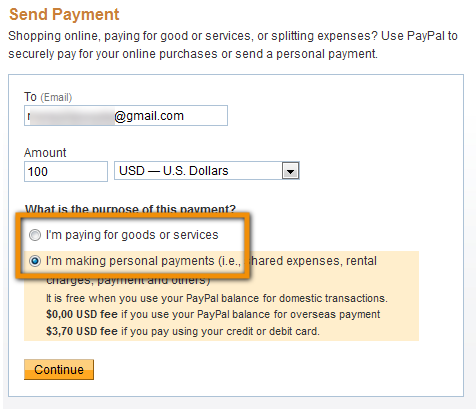

How to Calculate PayPal International Fees

To calculate PayPal international fees, you can use the following formula:

International Transaction Fees = (Transaction Value x International Transaction Fees) + Currency Conversion Fees

Currency Conversion Fee = Transaction Value x (Conversion Rate x Conversion Fee)

Example:

- You want to make a transaction of $100 USD to a merchant in the UK.

- PayPal’s international transaction fee is 1.5%.

- The currency conversion rate from USD to GBP is 0.76.

International Transaction Fee = ($100 x 1.5%) + ($100 x (0.76 x 3.5%))

International Transaction Fee = $1.50 + $2.66

International Transaction Fee = $4.16

Tips for Saving on International Transaction Fees with PayPal

Here are some tips for saving on international transaction fees with PayPal:

- Use a Business PayPal Account : Business PayPal accounts have lower international transaction fees than personal PayPal accounts.

- Use the Right Money Mattis : If you make transactions with merchants who accept the same currency as you, then you do not have to pay currency conversion fees.

- Select a Merchant that Accepts PayPal : If the merchant accepts PayPal, then you don’t have to pay international transaction fees.

- Use Promos and Discounts : PayPal often offers promos and discounts for international transactions. Make sure you check out the promotions available.

- Make Bigger Transactions : If you need to make a large transaction, then you should make a larger transaction to save on international transaction fees.

Conclusion

PayPal international fees can be a large additional expense if you don’t understand the types of fees charged and how they are calculated. However, by using the tips mentioned above, you can save on international transaction fees with PayPal. Make sure you understand international transaction fees before making a transaction to avoid unexpected additional fees.