PayPal is like Afterpay: A Flexible and Secure Payment Solution

In recent years, digital payment technology has developed rapidly, giving consumers a variety of options for making online transactions. One example of a popular digital payment technology is PayPal, which has become one of the most widely used online payment methods in the world. However, PayPal also offers other features that are similar to Afterpay, namely flexible and safe installment payments.

What is PayPal?

PayPal is a financial technology company founded in 1998 and headquartered in San Jose, California. The company offers a variety of digital payment services, including money transfers, online payments and financial management. PayPal allows users to make online transactions easily and safely, for both personal and business purposes.

What is Afterpay?

Afterpay is a financial technology company founded in 2014 and headquartered in Sydney, Australia. This company offers a flexible and secure installment payment service, which allows consumers to make online purchases by paying in installments. Afterpay has become one of the most popular installment payment companies in Australia and has expanded into several other countries.

PayPal is like Afterpay: Flexible and Secure Installment Payments

PayPal also offers an installment payment feature similar to Afterpay, which allows consumers to make online purchases by paying in installments. This feature is called “PayPal Credit” and allows consumers to make online purchases by paying in installments over several months.

PayPal Credit offers several benefits to consumers, including:

- Payment flexibility : Consumers can choose flexible payment terms, ranging from a few months to several years.

- Low cost : Low installment payment costs, so consumers don’t have to pay expensive fees.

- Comfort : Installment payments can be made online, so consumers don’t need to bother visiting a shop or bank.

How PayPal Works like Afterpay

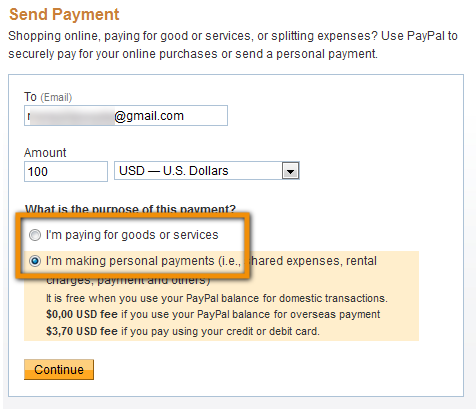

The way PayPal works like Afterpay is very simple. Following are the steps that need to be taken:

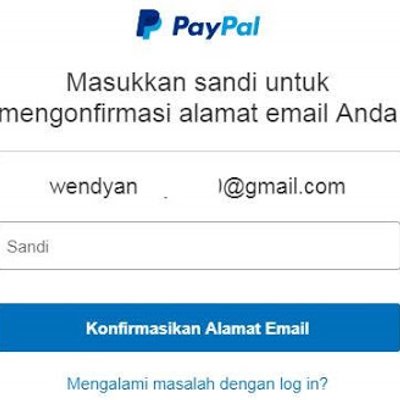

- Register for PayPal : Consumers need to register for a PayPal account first.

- Select PayPal Credit : Consumers need to select PayPal Credit as the payment method.

- Select payment term : Consumers need to choose flexible payment terms.

- Make a purchase : Consumers can make online purchases using PayPal Credit.

- Pay in installments : Consumers need to pay in installments according to the chosen time period.

PayPal benefits like Afterpay

PayPal like Afterpay offers several benefits to consumers, including:

- Payment flexibility : Consumers can choose flexible payment terms.

- Low cost : Low installment payment costs.

- Comfort : Installment payments can be made online.

- Security : PayPal offers high security for online transactions.

Disadvantages of PayPal like Afterpay

However, PayPal like Afterpay also has some disadvantages, including:

- Interest costs : Interest fees that can be charged if consumers do not pay on time.

- Payment limitations : Payment limits that PayPal may impose.

- Dependence : Consumers may become dependent on installment payments and be unable to pay in full.

Conclusion

PayPal like Afterpay offers flexible and secure payment solutions for consumers. With the flexible installment payment feature, consumers can make online purchases by paying in installments. However, consumers need to be careful and understand the costs and losses that can be incurred. Thus, consumers can use PayPal like Afterpay wisely and effectively.