PayPal to PayPal Transfer Fees: Are There Any Fees Charged?

PayPal is one of the most popular online payment platforms in the world. With more than 400 million active users, PayPal allows you to make financial transactions easily and safely. However, like other payment platforms, PayPal also charges certain fees for some types of transactions. In this article, we will discuss PayPal to PayPal transfer fees and whether there are any fees charged.

Why is a Transfer Fee Necessary?

PayPal to PayPal transfer fees are required for several reasons. First, transfer fees help PayPal to cover their operational costs, such as server fees, security fees, and other costs. Secondly, transfer fees also help PayPal to generate revenue and increase their profits.

PayPal to PayPal Transfer Fees

PayPal to PayPal transfer fees vary depending on several factors, such as the country of origin and destination of the transfer, type of transaction, and payment method used. Here are some common PayPal to PayPal transfer fees:

- Domestic Transfer Fee : PayPal to PayPal domestic transfer fees are usually around 1-2% of the transfer amount, with a minimum fee of around IDR 1,500.

- International Transfer Fees : PayPal to PayPal international transfer fees are usually around 2-4% of the transfer amount, with a minimum fee of around IDR 3,000.

- Transfer Fees by Credit Card : Transfer fees using a PayPal credit card to PayPal are usually around 2.9% + IDR 3,000 of the transfer amount.

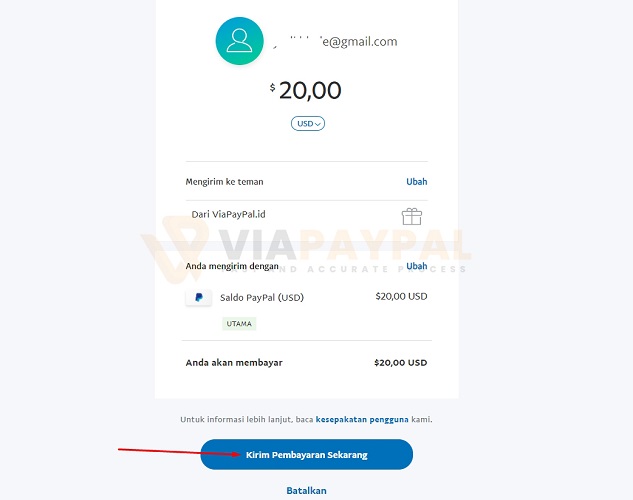

- Transfer Fees with PayPal Balance : Transfer fees with PayPal Balance PayPal to PayPal are usually free, but there are currency conversion fees if you make a transfer between countries.

How to Avoid Transfer Fees

While PayPal to PayPal transfer fees cannot be completely avoided, there are several ways to reduce transfer fees. Here are some tips to avoid transfer fees:

- Use PayPal Balance : If you have sufficient PayPal balance, you can use PayPal Balance to make transfers without fees.

- Choose the Right Payment Method : Choose the right payment method to make the transfer. For example, if you are making a domestic transfer, you can use a bank transfer to save on fees.

- Check Transfer Fees Beforehand : Check transfer fees before making a transfer to ensure that you are not hit with unwanted fees.

- Use Another Money Transfer Service : If you are making an international transfer, you can use other money transfer services such as TransferWise or Revolut to save costs.

Conclusion

PayPal to PayPal transfer fees are fees charged by PayPal for carrying out financial transactions. Transfer fees vary depending on several factors, such as the country of origin and destination of the transfer, type of transaction, and payment method used. However, there are ways to reduce transfer fees, such as using PayPal Balance, choosing the right payment method, and checking transfer fees beforehand.

FAQs

- Q: How much does a PayPal to PayPal transfer cost?

A: PayPal to PayPal transfer fees vary depending on several factors, such as the country of origin and transfer destination, transaction type, and payment method used. - Q: Is there a domestic transfer fee?

A: Yes, PayPal to PayPal domestic transfer fees are usually around 1-2% of the transfer amount. - Q: How can I avoid transfer fees?

A: You can use PayPal Balance, choose the right payment method, check transfer fees beforehand, and use other money transfer services to save costs. - Q: Are international transfer fees more expensive?

A: Yes, PayPal to PayPal international transfer fees are usually more expensive than domestic transfer fees.

Reference

- PayPal. (2023). Transfer Fees. Accessed from https://www.paypal.com/id/webapps/mpp/paypal-fees

- PayPal. (2023). How to Save on Transfer Fees. Accessed from https://www.paypal.com/id/webapps/mpp/save-money-on-transfers

- The Balance. (2023). PayPal Transfer Fees. Accessed from https://www.thebalance.com/paypal-transaction-fees-315453