PayPal: An Example of a Successful Electronic Transaction in the Digital Age

In the last few decades, the world of technology and finance has experienced significant changes. One example of these changes is the emergence of electronic payment systems, such as PayPal. PayPal is an example of a successful electronic transaction in the digital era. In this article, we will discuss what PayPal is, how it works, and why it is an example of successful electronic transactions.

What is PayPal?

PayPal is an electronic payments company founded in 1998 by Peter Thiel and Max Levchin. Initially, PayPal was called Confinity, but later changed to PayPal after merging with another company. PayPal allows users to carry out electronic transactions, such as sending and receiving money, as well as making online payments.

How PayPal Works

PayPal uses internet technology to enable users to conduct electronic transactions. Here’s how PayPal works:

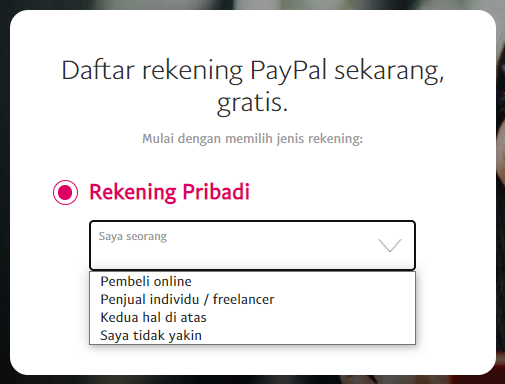

- Registration : Users must first register on the PayPal website to create an account.

- Verification : After registering, users must verify their account using email and telephone number.

- Addition of Payment Methods : Users can add payment methods, such as credit cards or bank accounts, to their PayPal account.

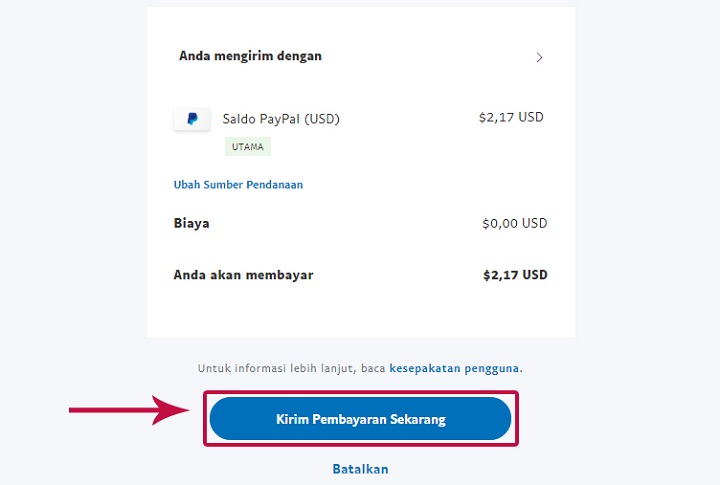

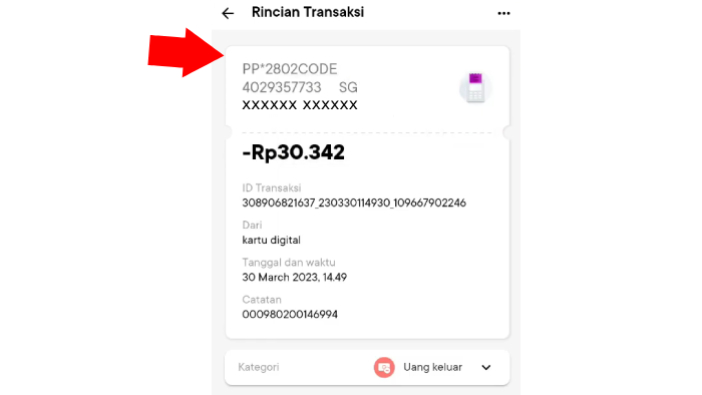

- Money Transfer : Users can send money to other users using a PayPal account.

- Payment : Users can make online payments using a PayPal account.

Why PayPal is an Example of a Successful Electronic Transaction

PayPal is an example of a successful electronic transaction for several reasons:

- Comfort : PayPal allows users to make electronic transactions easily and quickly.

- Security : PayPal has a strict security system to protect user transactions.

- Neutrality : PayPal has no additional fees for users who want to make transactions.

- Availability : PayPal is available in various countries and can be used by users from all over the world.

- Integration with Merchants : PayPal can be used by merchants to carry out electronic transactions.

PayPal Benefits

PayPal has several benefits, including:

- Saving time : PayPal allows users to make electronic transactions quickly and efficiently.

- Save Costs : PayPal has no additional fees for users who want to make transactions.

- Improve Security : PayPal has a strict security system to protect user transactions.

- Increases Comfort : PayPal allows users to make electronic transactions easily and quickly.

Disadvantages of PayPal

PayPal also has several disadvantages, including:

- Transfer Fees : PayPal has a transfer fee for users who want to make transactions between countries.

- Verification Requirements : PayPal has strict verification requirements for users wishing to make transactions.

- Payment Method Limitations : PayPal has limited payment methods that can be used by users.

Conclusion

PayPal is an example of a successful electronic transaction in the digital era. PayPal allows users to make electronic transactions easily and quickly, and has a strict security system to protect user transactions. Although PayPal has some drawbacks, its benefits are far greater. Therefore, PayPal is one of the best choices for carrying out electronic transactions.

Reference

- PayPal. (n.d.). About PayPal. Accessed from https://www.paypal.com/id/about

- Investopedia. (n.d.). What is PayPal?. Accessed from https://id.investopedia.com/apa-itu-paypal)

- Wikipedia. (n.d.). PayPal. Accessed from https://id.wikipedia.org/wiki/PayPal