Title: PayPal Integration with MPESA: Ease of Online Transactions in East Africa

Introduction

Currently, the use of online payment technology is increasing, especially in East Africa. One interesting example of integration is between PayPal and MPESA, two of the most popular payment systems in East Africa. In this article, we will discuss more about PayPal integration with MPESA, its benefits and how it works.

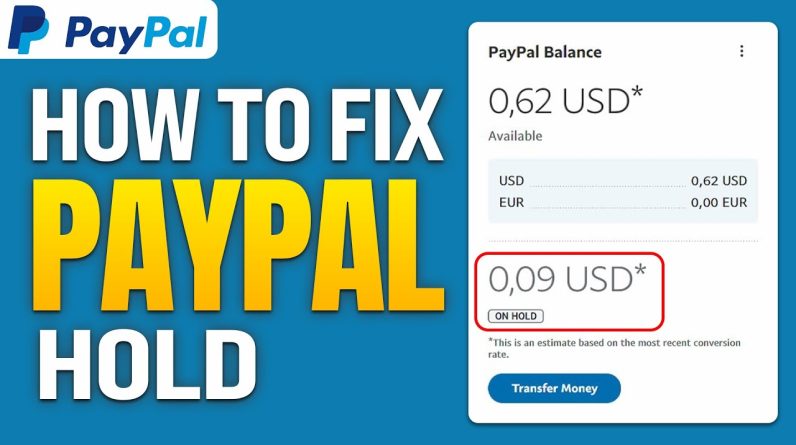

What is PayPal?

PayPal is an online payment system that allows users to make transactions safely and easily. Founded in 1998, PayPal has become one of the world’s largest online payment systems, with more than 300 million active users. PayPal allows users to make transactions using a credit, debit card, or bank account.

What is MPESA?

MPESA is a mobile payment system developed by Vodafone and Safaricom. Launched in 2007, MPESA allows users to carry out financial transactions using their mobile phones. MPESA has become very popular in East Africa, especially in Kenya, Tanzania and Uganda. MPESA allows users to carry out transactions such as sending money, paying bills, and purchasing goods.

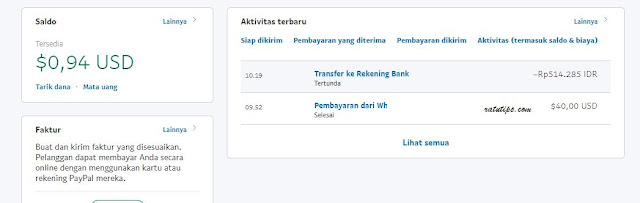

PayPal integration with MPESA

In 2018, PayPal and Safaricom announced an integration between PayPal and MPESA. This integration allows MPESA users to receive and send money to their PayPal accounts. This integration also allows PayPal users to send money to MPESA users.

Benefits of PayPal Integration with MPESA

Here are some of the benefits of PayPal integration with MPESA:

- Ease of transactions : Integration between PayPal and MPESA allows users to make transactions more easily and quickly.

- Economic development : This integration can help improve the economy in East Africa by allowing more people to access financial services.

- Comfort : This integration allows users to carry out transactions online, reducing the need to carry out transactions physically.

How PayPal Integration Works with MPESA

Here’s how the integration between PayPal and MPESA works:

- Register an MPESA account : First, users must register their MPESA account.

- Link your MPESA account with PayPal : Users must then link their MPESA account with their PayPal account.

- Account verification : Once the MPESA and PayPal accounts are connected, users must verify their accounts.

- Make a transaction : After verification, users can carry out transactions such as sending money and paying bills.

Challenges and Limitations

Although the integration between PayPal and MPESA brings many benefits, there are several challenges and limitations that need to be overcome:

- Transaction fees : Transaction fees between PayPal and MPESA can be higher than domestic transaction fees.

- Geographical limitations : Integration between PayPal and MPESA is only available in some countries in East Africa.

Conclusion

The integration between PayPal and MPESA is an example of the ease of online transactions in East Africa. With this integration, users can make transactions more easily and quickly. However, there are several challenges and limitations that need to be overcome. In the long term, this integration could help improve the economy in East Africa by enabling more people to access financial services.

Tips and Suggestions

Here are some tips and suggestions for users who want to use the integration between PayPal and MPESA:

- Make sure your MPESA and PayPal accounts are connected : Make sure your MPESA and PayPal accounts are connected before making a transaction.

- Check transaction fees : Check the transaction fees between PayPal and MPESA before making a transaction.

- Use safe financial services : Use safe and reliable financial services to carry out transactions.

In conclusion, the integration between PayPal and MPESA is an example of the ease of online transactions in East Africa. With this integration, users can make transactions more easily and quickly. However, there are several challenges and limitations that need to be overcome. In the long term, this integration could help improve the economy in East Africa by enabling more people to access financial services.