What is PayPal and How Does It Work?

PayPal is one of the most popular online payment services in the world. This service allows users to carry out financial transactions online, such as payments, money transfers and other transaction activities. In this article, we’ll talk about what PayPal is, how it works, and some of its benefits.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, PayPal was called Confinity, which was a financial technology company that focused on online payments. In 2000, Confinity merged with X.com, another company also focused on online payments. In 2001, the company changed its name to PayPal and began offering online payment services to users.

How PayPal Works

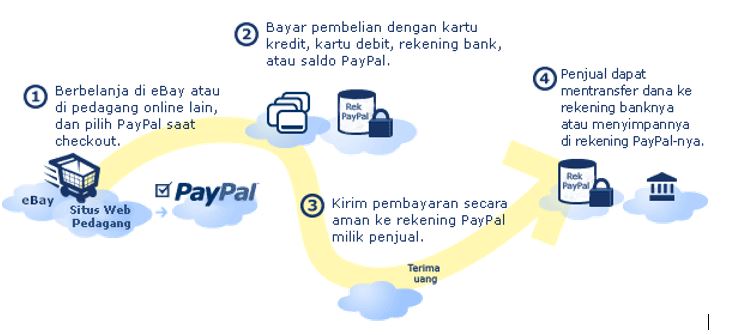

PayPal allows users to make transactions online easily and safely. Here’s how PayPal basically works:

- Create an Account : Users must create a PayPal account by adding personal information, such as name, address, and credit card number.

- Linking a Bank Account : Users can connect a bank account with PayPal to add funds to a PayPal account.

- Making Payments : Users can make payments to sellers or other merchants using a PayPal account.

- Receive Payment : Sellers or merchants can receive payments from users using a PayPal account.

PayPal Benefits

PayPal has several benefits, including:

- Comfort : PayPal allows users to make transactions online easily and quickly.

- Security : PayPal has a strict security system to protect users’ personal and transaction information.

- Flexibility : PayPal can be used to make transactions in various countries and currencies.

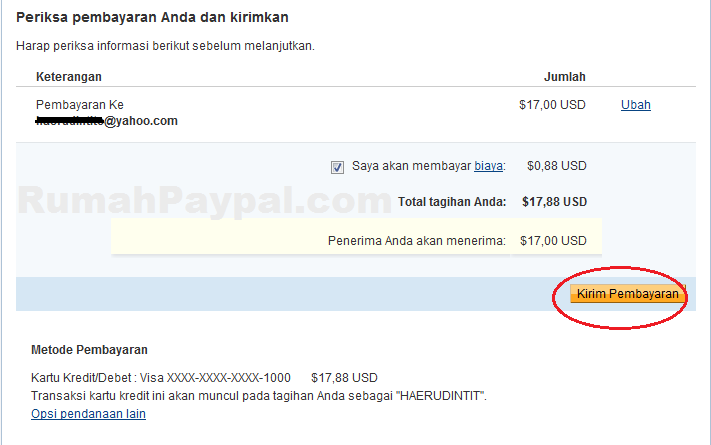

- Low Cost : PayPal has low fees for making transactions, unlike some other payment services.

PayPal Features

PayPal has several features that make it one of the best online payment services, including:

- PayPal Wallet : This feature allows users to deposit money in their PayPal account and carry out transactions easily.

- PayPal Credit : This feature allows users to make credit payments and pay bills periodically.

- PayPal Transfer : This feature allows users to send money to other users using PayPal.

- PayPal Secure : This feature allows users to carry out transactions safely using sophisticated encryption technology.

Advantages and Disadvantages of PayPal

PayPal has several advantages and disadvantages, including:

Excess:

- It’s easy to use and has a simple interface

- Has strict security to protect user transactions

- Can be used to carry out transactions in various countries and currencies

Lack:

- Has higher fees than some other payment services

- There are several restrictions for making transactions, such as additional limits and account usage limits

- Some users experience difficulties when trying to connect a bank account with PayPal

Conclusion

PayPal is one of the best online payment services that has tight security, high flexibility, and low fees. By using PayPal, users can make online transactions easily and safely. However, PayPal also has some drawbacks, such as higher fees than some other payment services and some limitations for making transactions. Therefore, users should consider the advantages and disadvantages of PayPal before deciding to use this service.