PayPal International Transfers: Complete Guide and Fees

In today’s digital era, making international money transfers has become easier and faster thanks to PayPal. PayPal is an online payment service that allows you to send and receive money internationally. In this article, we’ll talk about PayPal international transfers, including how they work, fees, and tips for minimizing fees.

What is PayPal International Transfer?

PayPal international transfer is a feature that allows you to send money to someone else’s PayPal account who is abroad. Using PayPal, you can send money to more than 200 countries and territories around the world. The money transfer process with PayPal is relatively fast and safe, because PayPal uses the latest security technology to protect your transactions.

How PayPal International Transfers Work

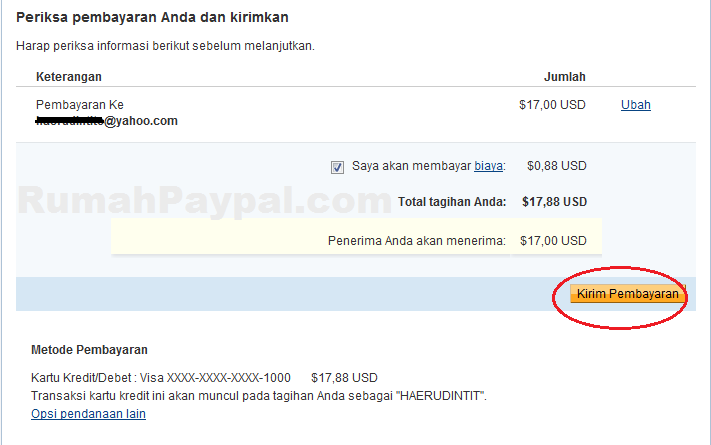

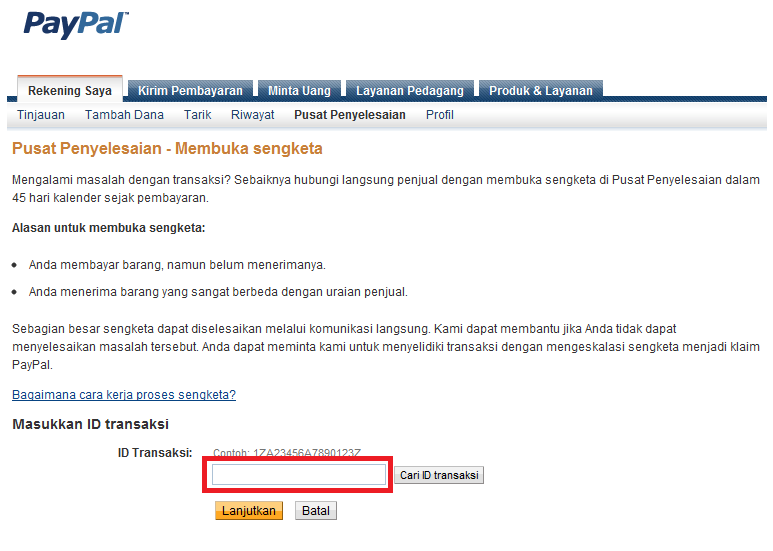

Here are the steps for how PayPal international transfers work:

- Create a PayPal Account : First of all, you need to create a PayPal account. You can register for free on the PayPal website.

- Account Verification : After creating an account, you need to verify your account by adding personal information and a valid email address.

- Add a Credit or Debit Card : To send money, you need to add a credit or debit card to your PayPal account.

- Select Recipient : To send money, you need to select the recipient you want to send money to. You can select from your contact list or enter the recipient’s email address manually.

- Enter the Amount of Money : Then, you need to enter the amount of money you want to send.

- Select Payment Method : You can choose the payment method, namely credit or debit card.

- Transaction Confirmation : Once you have entered the required information, you need to confirm the transaction.

PayPal International Transfer Fees

PayPal international transfer fees vary depending on several factors, such as the amount of money sent, payment method, and recipient country. Here are some costs you can find out about:

- Transfer fees : PayPal international transfer fees range from 0.5% to 2% of the amount of money sent, depending on the recipient’s country.

- Currency conversion fees : If you send money to a country that has a different currency, PayPal will charge a currency conversion fee of 2.5% to 4.5% of the amount sent.

- Administrative costs : Some countries have administration fees charged by banks or other financial institutions.

Tips for Minimizing Costs

Here are some tips for minimizing PayPal international transfer fees:

- Use the correct payment method : Choose a payment method that has low fees, such as a debit card.

- Send large amounts of money : Sending large amounts of money can minimize transfer fees.

- Use the same currency : If you send money to a country that has the same currency, you can save on currency conversion fees.

- Check fees before making a transaction : Make sure you check the fees before making a transaction to ensure that you will not be hit by any unexpected fees.

PayPal International Transfer Security

PayPal international transfers have several security features to protect your transactions, such as:

- Data encryption : PayPal uses data encryption to protect your personal and transaction information.

- Two-factor authentication : PayPal has a two-factor authentication feature that allows you to verify your identity using an OTP code or authentication app.

- Transaction monitoring : PayPal has a transaction monitoring system that allows you to monitor your transactions in real-time.

Conclusion

PayPal international transfer is an easy and fast way to send money internationally. Using PayPal, you can send money to more than 200 countries and territories around the world. However, keep in mind that PayPal international transfers have fees that vary depending on several factors. By using the tips we have provided, you can minimize costs and make safe and comfortable transactions.