PayPal Credit: Flexible Financial Solutions for E-commerce

In recent years, e-commerce has become one of the fastest growing industries in the world. Many consumers are turning to online shopping because of its ease and convenience. However, for some consumers, lack of funds or limited payment methods can be an obstacle to carrying out online transactions. Therefore, PayPal Credit is here as a flexible financial solution for e-commerce.

What is PayPal Credit?

PayPal Credit is a financial service offered by PayPal, a leading online payments company. This service allows consumers to make payments on credit, meaning they can pay their bills in installments. PayPal Credit can be used to make payments to various merchants who have collaborated with PayPal.

Advantages of PayPal Credit

Here are some of the advantages of PayPal Credit that make it a popular choice among consumers:

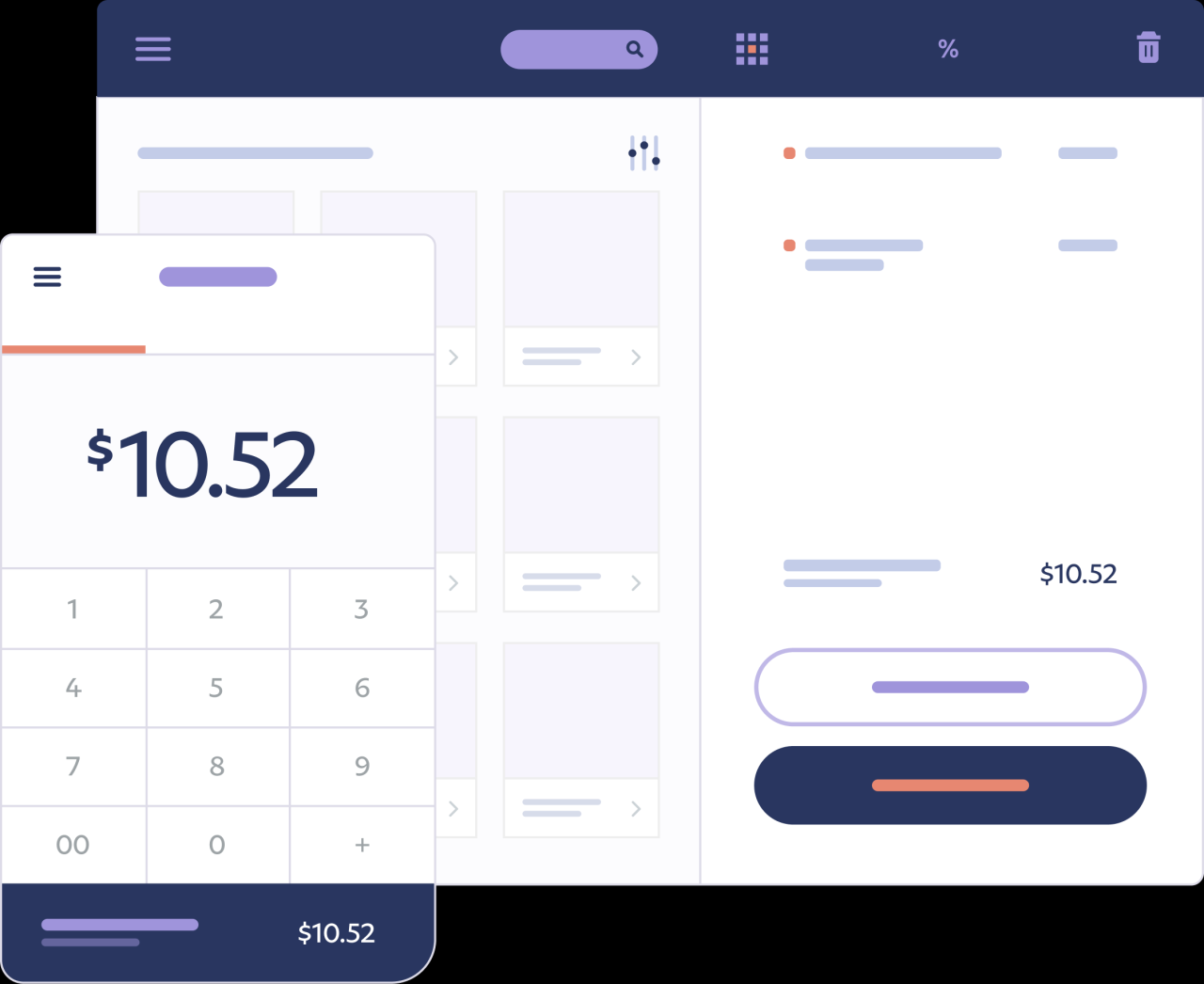

- Ease of Payment : With PayPal Credit, consumers can make payments on credit, meaning they can pay their bills in installments.

- Flexibility : PayPal Credit offers flexibility in making payments, so consumers can choose a payment schedule that suits their finances.

- No Interest : PayPal Credit does not charge interest on transactions made within a certain period, so consumers can save money.

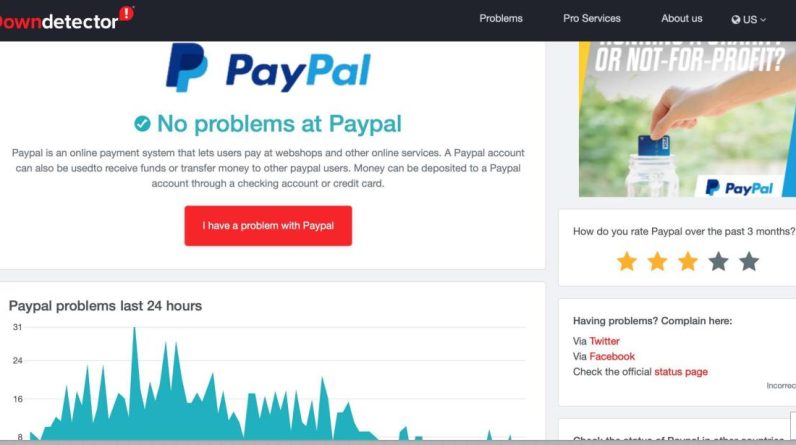

- Protection : PayPal Credit offers protection for transactions made, so consumers can feel safe and comfortable when making payments.

- Ease of Use : PayPal Credit is very easy to use, because consumers only need to activate this service on their PayPal account.

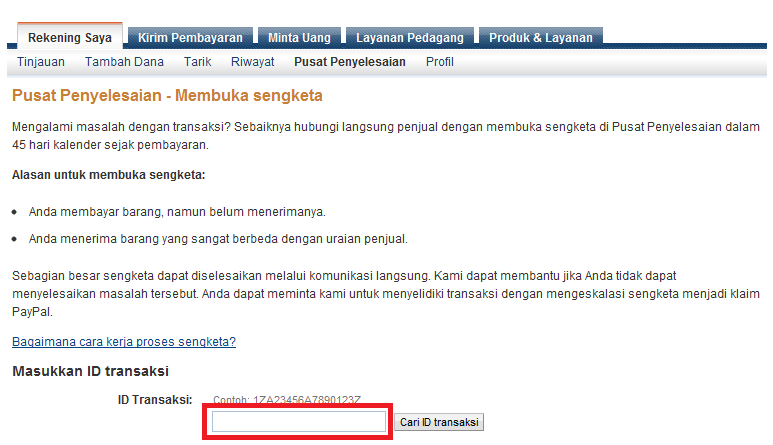

How to Use PayPal Credit

Here’s how to use PayPal Credit:

- Create a PayPal Account : If you don’t have a PayPal account, create one. If you already have a PayPal account, make sure you have enough balance to make transactions.

- Activate PayPal Credit : Activate PayPal Credit on your PayPal account. You can do this by following the steps on the PayPal page.

- Select Merchant : Choose a merchant that has collaborated with PayPal and offers PayPal Credit as a payment method.

- Make Payment : Make payment by selecting PayPal Credit as the payment method. You will be asked to choose a payment schedule that suits your finances.

- Pay Bills : Pay your bill in installments according to the payment schedule you have chosen.

Benefits of PayPal Credit for Merchants

PayPal Credit is not only beneficial for consumers, but also for merchants. Here are some of the benefits of PayPal Credit for merchants:

- Increase Sales : PayPal Credit can help increase merchant sales, because consumers can make payments on credit.

- Increase Trust : PayPal Credit can help increase consumer trust in merchants, because this service offers protection for transactions.

- Make Payments Easy : PayPal Credit can help merchants make payments easier, because consumers can make payments on credit.

Conclusion

PayPal Credit is a flexible financial solution for e-commerce. With PayPal Credit, consumers can make payments on credit, meaning they can pay their bills in installments. This service offers flexibility, no interest, protection and ease of use. PayPal Credit is also beneficial for merchants, because it can help increase sales, trust and make payments easier. Therefore, PayPal Credit is a popular choice among consumers and merchants.