Comparison of PayPal and Klarna

In today’s world of digital payments, PayPal and Klarna have become two very familiar names. Both platforms offer a variety of services that simplify and secure online transactions, but each has unique features and advantages. Let’s compare PayPal and Klarna more closely to help you decide which best suits your needs.

PayPal, a leading player in the online payments industry, is known for its reliability and ease of use. This platform allows you to send and receive money, pay bills, and shop online quickly and securely. PayPal integrates with a large number of merchants, making it easy to make purchases from a variety of stores.

On the other hand, Klarna specializes in “buy now, pay later” services. With Klarna, you can make purchases and pay for them over a longer period of time, usually over several weeks or months. This can be a convenient option for those who want to manage their expenses or who do not have sufficient funds to make a full purchase up front.

In terms of fees, PayPal and Klarna have slightly different structures. PayPal charges fees for certain transactions, such as international transfers or withdrawing money to your bank account. On the other hand, Klarna does not charge interest or fees for its services if you make your payments on time. However, if you pay late, Klarna may charge a late fee.

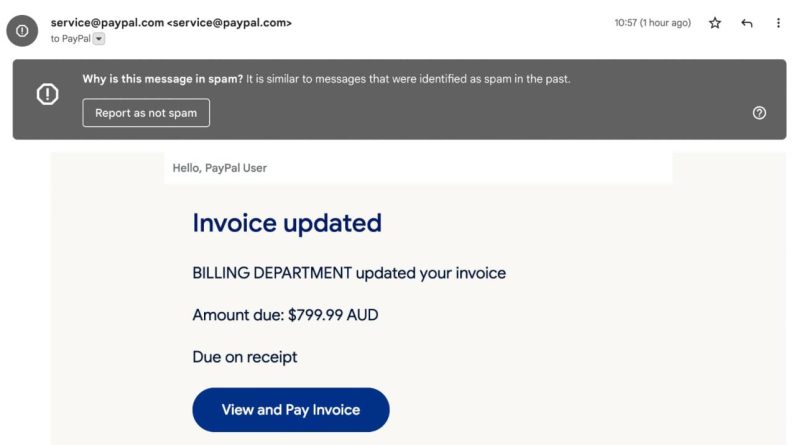

Security features are also an important consideration. PayPal and Klarna both use encryption technology and advanced security measures to protect your financial information. PayPal has a buyer protection system that also protects you in the event of an unauthorized transaction or dispute.

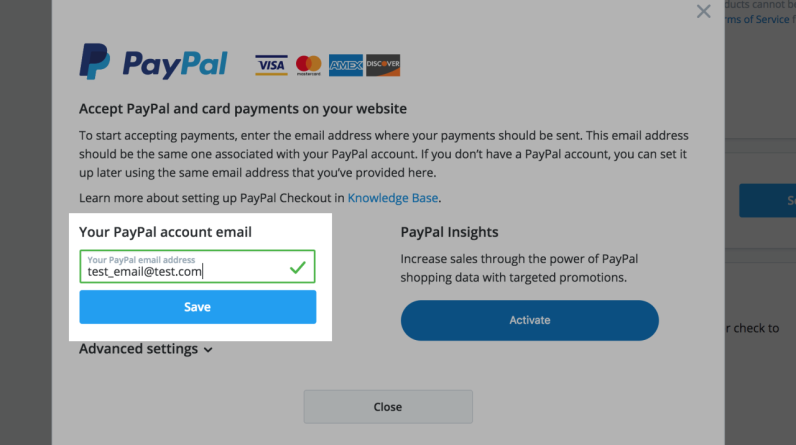

In addition to their core services, PayPal and Klarna also offer additional features. PayPal has a digital wallet service that lets you store your credit cards, debit cards, and loyalty cards in one place. Klarna, on the other hand, offers a price search service that helps you find the best deals on your purchases.

In conclusion, PayPal and Klarna are reliable digital payment options with their own strengths and weaknesses. PayPal is great for direct transactions and ease of use, while Klarna is better suited for “buy now, pay later” shopping. By considering your specific needs and preferences, you can choose the platform that best suits you.

Benefits of Using Klarna and PayPal for Payments

Let’s do a comparison between two payment giants, PayPal and Klarna. Both services offer convenience and security in online transactions, but there are some key differences to consider.

One of the main advantages of Klarna is its “pay later” option. This feature allows customers to make purchases without paying up front. Instead, they can pay in installments over a certain period of time, usually around 30 to 90 days. This can be especially beneficial for those on a limited budget or looking to avoid credit card debt. PayPal, on the other hand, does not offer this payment option.

However, PayPal has a wider reach than Klarna. PayPal is accepted by more online merchants than Klarna, making it easier to use for a variety of purchases. PayPal also has a PayPal Credit feature that allows customers to make purchases and pay for them over time, similar to Klarna. However, PayPal Credit has a higher interest rate than Klarna and can have a negative impact on credit scores.

In terms of fees, PayPal and Klarna have different structures. PayPal typically charges sellers a fee to process payments, while Klarna charges customers a fee to use its “pay later” service. The amount of the fee varies depending on the type of transaction and the country where you are located.

In terms of security, both PayPal and Klarna use industry-leading encryption technology to protect customers’ financial information. Both services also offer buyer protection in cases of fraud or disputes. PayPal has a more comprehensive buyer protection system, which may be an important consideration for some customers.

Overall, both PayPal and Klarna are reliable and secure payment options. The right choice for you will depend on your specific needs and preferences. If you’re looking for a “pay later” option and don’t mind extra fees, then Klarna is a great choice. However, if you want broader reach and more comprehensive buyer protection, then PayPal is a more appropriate solution.

PayPal and Klarna: Two Online Payment Giants

In recent years, the online payment industry has experienced very rapid development. With more and more people shopping online, the need for secure, easy and flexible payment systems has increased. In this article, we will discuss two of the most well-known online payment giants, namely PayPal and Klarna.

What is PayPal?

PayPal is an online payment company founded in 1998 by Peter Thiel and Max Levchin. Initially, this company was called Confinity, but then changed its name to PayPal in 2001. PayPal began expanding its network in 2002 by buying another online payment company, namely X.com.

PayPal is one of the world’s largest online payments companies, with more than 340 million active users worldwide. This company allows users to send and receive money online, either via credit card, debit or bank account.

What is Klarna?

Klarna is an online payments company founded in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson. Initially, this company was called Klarna AB, but then changed its name to Klarna Bank AB in 2017.

Klarna is one of Europe’s largest online payments companies, with more than 85 million active users worldwide. This company allows users to send and receive money online, either via credit card, debit or bank account.

Comparison of PayPal and Klarna

Here are some comparisons between PayPal and Klarna:

- Cost : PayPal has higher fees than Klarna, especially for international transactions. Klarna has lower fees, but with some limitations.

- Security : Both companies have excellent security systems, but PayPal has some additional security features, such as two-factor authentication.

- Flexibility : Klarna has some better flexibility features than PayPal, such as the ability to make payments in multiple stages.

- Network : PayPal has a wider network than Klarna, especially in the United States and Asia.

Advantages and Disadvantages of PayPal

Here are some of the advantages and disadvantages of PayPal:

- Excess :

- Excellent security system

- Very wide network

- Flexibility in making payments

- Lack :

- Higher costs

- Long verification process

- Some restrictions on making payments

Advantages and Disadvantages of Klarna

Here are some of the advantages and disadvantages of Klarna:

- Excess :

- Lower costs

- Good security system

- Flexibility in making payments

- Lack :

- More limited network

- Long verification process

- Some restrictions on making payments

Conclusion

PayPal and Klarna are two online payment giants that have several differences and similarities. PayPal has a wider network and excellent security system, but with higher fees. Klarna has lower fees and flexibility in making payments, but with a more limited network.

The choice between PayPal and Klarna depends on your needs and preferences. If you need excellent security and flexibility in making payments, then PayPal may be a better choice. If you need lower fees and flexibility in making payments, then Klarna may be a better choice.

Tips for Making the Right Choice

Here are some tips for making the right choice between PayPal and Klarna:

- Check costs : Make sure you understand the fees charged by both companies before making a decision.

- Check network : Make sure you understand the networks that both companies have before making a decision.

- Check the security system : Make sure you understand the security systems that both companies have before making a decision.

- Check flexibility : Make sure you understand the flexibility in making payments that both companies have before making a decision.

By paying attention to the tips above, you can make the right choice between PayPal and Klarna based on your needs and preferences.

PayPal and Klarna Synergy in Digital Payments

PayPal and Klarna: The Dynamic Duo in Digital Payments

PayPal and Klarna, two digital payment giants, have partnered to offer a more seamless and convenient shopping experience for customers. PayPal, with its large user base and global network, synergizes with Klarna, known for its flexible payment options and revamped shopping experience, to create a comprehensive payments solution.

One of the main advantages of this partnership is ease of use. Customers can now use their PayPal account to make payments through Klarna, providing a seamless and fast payment process. This seamless transition eliminates the need to re-enter payment details or create a new account, improving the overall customer experience.

Additionally, PayPal and Klarna’s synergy brings customers a variety of payment options. PayPal offers a variety of payment methods, including credit, debit and bank transfer cards, while Klarna specializes in “buy now, pay later” options that give customers flexibility in managing their spending. This combination gives customers more control over their finances and allows them to choose the option that best suits their needs.

This partnership also expands the global reach of both companies. PayPal has a strong presence in more than 200 countries and territories, while Klarna operates primarily in Europe and North America. By working together, PayPal and Klarna can offer their payment services to a larger customer base, expanding their reach in the global market.

In addition to providing convenience and flexibility for customers, the PayPal and Klarna partnership is also beneficial for merchants. With PayPal and Klarna integration, merchants can access a larger customer base and offer a variety of payment options. This can help increase conversions and increase average order value, as customers are more likely to make a purchase when they have a payment option they prefer.

Going forward, PayPal and Klarna’s synergies will continue to grow, opening up more opportunities for customers and merchants. Both companies are committed to innovation and finding new ways to improve the digital payments experience. By combining their strengths, PayPal and Klarna will undoubtedly continue to play a significant role in shaping the digital payments landscape in the years to come.