What is Fintech and the Role of PayPal?

Fintech, or financial technology, is a rapidly growing field that brings together the worlds of finance and technology to offer innovative and convenient financial services. From mobile payments to data-driven loans, fintech has revolutionized the way we manage money.

Among the leading fintech players is PayPal, a payments technology giant that has changed the way financial transactions are carried out. PayPal allows individuals and businesses to send, receive and store money online easily and securely. With a user base of more than 400 million, PayPal has become a major player in the fintech ecosystem.

PayPal plays an important role in facilitating online payments. Users can link their bank accounts or credit cards to PayPal, allowing them to make payments without having to enter their financial information each time. The platform also offers advanced security features to protect users from fraud and identity theft.

Apart from payments, PayPal also provides various other financial services, such as loans, budget management and investments. The service is designed to empower individuals and small businesses by providing access to financial tools that may not have previously been available to them.

Fintech and PayPal have had a significant impact on the financial industry. They have made financial services more accessible, convenient and affordable. Therefore, the fintech ecosystem is expected to continue to expand in the coming years, with PayPal as a key driver in driving innovation and growth.

By combining the power of technology with a deep understanding of the financial industry, fintech has revolutionized the way we interact with money. And with PayPal as a leader in the fintech space, we can expect more advancements and innovations that will reshape the financial landscape in the years to come.

PayPal’s Impact on the Digital Payments Industry

In this fast-paced digital era, we have become highly dependent on technology to facilitate various aspects of our lives, including the way we manage our finances. One of the main players in this financial revolution is PayPal, a leading financial technology (fintech) platform that has revolutionized the digital payments industry.

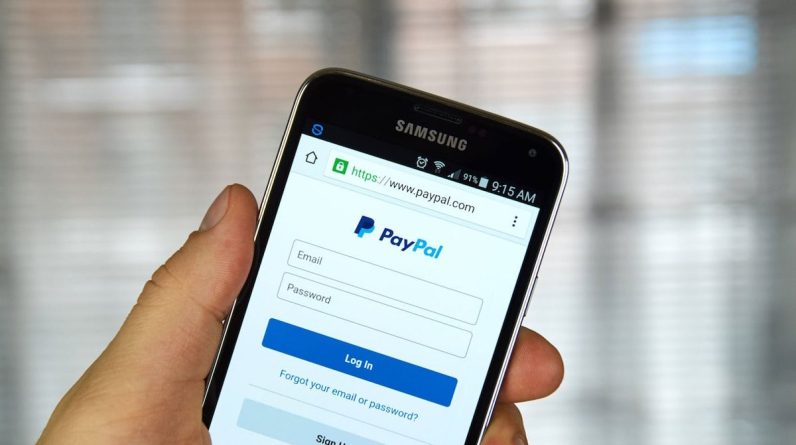

Fintech, a portmanteau of the words “finance” and “technology,” refers to companies that leverage technology to provide innovative financial services. PayPal fits this definition because it provides safe, convenient, and efficient digital payment solutions. Customers can send and receive money online, shop on websites and app stores, and manage their finances through an easy-to-use interface.

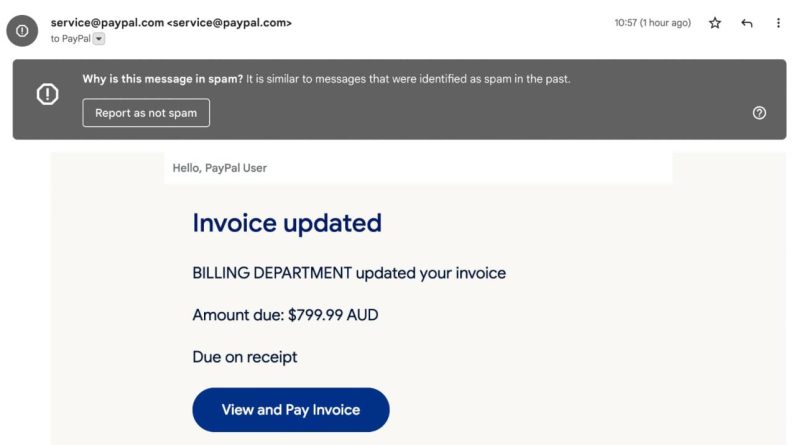

PayPal’s role in the digital payments industry cannot be underestimated. Before their emergence, online payment processes were complex and often involved sharing sensitive financial information. PayPal provides a safe and reliable solution by encrypting users’ financial information and acting as an intermediary between buyers and sellers. This has greatly increased trust in online transactions, paving the way for the growth of e-commerce.

Additionally, PayPal introduced the concept of a digital wallet, which allows users to store funds online and make payments without having to enter their credit card details every time. It has revolutionized the way people pay online, making the process safer and more convenient. PayPal also allows users to make payments in physical stores, further increasing its reach and convenience.

PayPal’s impact on the digital payments industry has been enormous. These platforms have created new markets for consumers and businesses, enabling them to conduct transactions in new ways. This opens the door to cross-border transactions, removing geographical barriers and facilitating global trade. PayPal’s success has also inspired other players to enter the fintech market, sparking competition and innovation that leads to better service and lower costs for consumers.

In conclusion, PayPal has revolutionized the digital payments industry by providing a safe, convenient and efficient solution. The role of fintech in facilitating and simplifying financial transactions is critical, and PayPal remains a leader in this space. Its ongoing influence on the way we manage our finances cannot be underestimated, as it continues to shape the future of digital payments.

PayPal: A Fintech That Changes the Way of Transactions

PayPal is one of the world’s most prominent fintech companies, which has changed the way we carry out online transactions. In this article, we will discuss PayPal, how the company was founded, and how it has become one of the largest fintech companies in the world.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, the company was called Confinity, and focused on payments using mobile phones. However, after merging with another company called X.com, the concept of this company changed to a broader online payment platform.

In 2000, X.com changed its name to PayPal, and the company began to grow rapidly. In 2002, PayPal was acquired by eBay for $1.5 billion. This acquisition helped PayPal increase its popularity and usage, especially among online merchants.

How PayPal Works

PayPal is an online payment platform that allows users to make transactions safely and easily. Here’s how PayPal works:

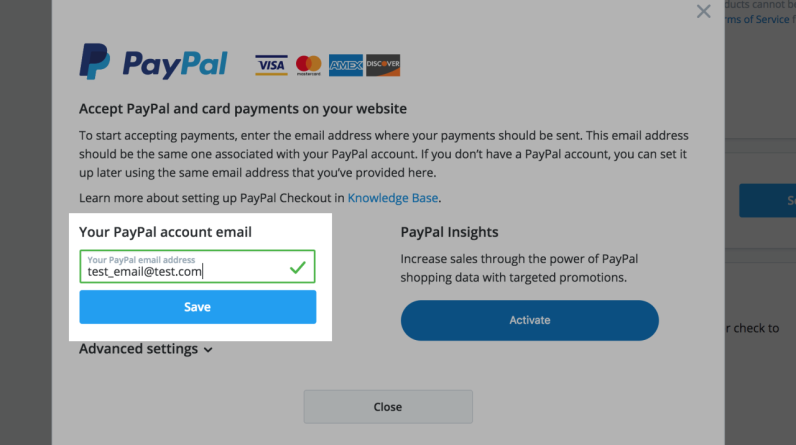

- Create an Account : Users create a PayPal account by entering personal and financial information, such as email addresses, phone numbers, and credit or debit card information.

- Connecting Cards : Users connect their credit or debit cards to their PayPal account.

- Sending Money : Users can send money to others using their PayPal account.

- Receiving Money : Users can receive money from others using their PayPal account.

PayPal also offers several security features, such as:

- Data Encryption : PayPal uses data encryption to protect user information.

- Identity Verification : PayPal verifies the user’s identity before making a transaction.

- Customer Service : PayPal has a customer service team that can help users if they have questions or problems.

PayPal Features

PayPal has several features that make it one of the best online payment platforms in the world. Here are some of PayPal’s features:

- Online Payment : PayPal allows users to make online payments easily and securely.

- Payment by Telephone : PayPal allows users to make payments via mobile phone.

- Direct Payment : PayPal allows users to make payments directly to a bank account or credit card.

- Recurring Payments : PayPal allows users to make recurring payments automatically.

Advantages of PayPal

PayPal has several advantages that make it one of the best online payment platforms in the world. Here are some of the advantages of PayPal:

- Security : PayPal has advanced security features to protect user information.

- Convenience : PayPal allows users to make online payments easily and quickly.

- Flexibility : PayPal allows users to make payments via a variety of methods, such as credit, debit and mobile phone cards.

- Compatibility : PayPal can be used on a variety of platforms, including desktop, mobile, and tablet.

Disadvantages of PayPal

PayPal also has some drawbacks to consider. Here are some of the disadvantages of PayPal:

- Cost : PayPal has quite high fees for making transactions, especially if users make international payments.

- Limitations : PayPal has limitations in making payments, especially if users make payments to certain countries.

- Complexity : PayPal has complexities in making payments, especially if the user is not familiar with using this platform.

Conclusion

PayPal is one of the best online payment platforms in the world, which has changed the way we carry out online transactions. With advanced security features, ease of making payments, flexibility in making payments, and compatibility with various platforms, PayPal has become one of the largest fintech companies in the world. However, PayPal also has several disadvantages that need to be considered, such as high fees, limitations in making payments, and complexity in making payments. Thus, PayPal remains one of the best options for making online payments.

Questions and Answers

Here are some questions and answers about PayPal:

Q: What is PayPal?

A: PayPal is an online payment platform that allows users to make transactions safely and easily.

Q: How does PayPal work?

A: PayPal works by allowing users to create an account, link a card, and make transactions online.

Q: What are the advantages of PayPal?

A: PayPal has advantages in security, convenience, flexibility and compatibility.

Q: What are the disadvantages of PayPal?

A: PayPal has its drawbacks in fees, limitations, and complexity.

Reference

- ” PayPal: A History of the Online Payment Company ” by Investopedia

- ” How PayPal Works ” by NerdWallet

- ” PayPal’s History and Evolution ” by Forbes

- ” PayPal’s Features and Benefits ” by CNET

Benefits of Using PayPal as Fintech

What is Fintech and the Role of PayPal?

Benefits of Using PayPal as Fintech

Fintech (financial technology) is revolutionizing the way we manage our finances, and PayPal is at the forefront of this innovation. As a major player in the fintech industry, PayPal offers a variety of services that make financial transactions easier, safer and more convenient.

Receive Payments Easily

One of the main advantages of PayPal is that it allows businesses to accept online payments easily. Seamless integration with websites and e-commerce platforms allows customers to pay securely without having to leave the website. PayPal supports a variety of payment methods, such as credit cards, debit cards, and bank transfers, providing flexibility for customers.

Fast and Secure Fund Transfer

PayPal also makes sending and receiving funds easy. Users can transfer funds between PayPal accounts instantly and for free. Additionally, PayPal offers transfer services to bank accounts with fast turnaround times, providing a convenient and secure fund transfer solution.

Purchase Protection

PayPal offers purchase protection for customers who purchase goods or services online. If a purchased product never arrives or is different from what was advertised, PayPal can help customers obtain a refund or replacement. This protection provides customers with peace of mind when shopping online.

Shop Easily

Customers can also use PayPal to shop at millions of online merchants and in brick-and-mortar stores. Convenient one-click checkout allows customers to complete purchases quickly and securely, saving time and hassle. PayPal also has a digital wallet feature that stores payment and shipping information, making shopping easier.

Advanced Business Features

For businesses, PayPal offers advanced business features such as invoicing, financial reports, and payment gateways. These features help businesses manage finances more efficiently and improve customer experience. PayPal also provides 24/7 customer service to provide support to businesses and customers.

Conclusion

PayPal is a leading leader in the fintech industry, offering a wide range of services that make managing your finances easier, safer and more convenient. From accepting payments to transferring funds and shopping online, PayPal is transforming the way we interact with money. With advanced business features and purchase protection, PayPal is a comprehensive choice for individuals and businesses looking for a reliable fintech solution.