What Are PayPal Instant Transfer Fees?

What Are PayPal Instant Transfer Fees?

PayPal, one of the world’s leading online payment platforms, offers a variety of services, including instant transactions. However, this convenience does not come without additional costs.

Instant Transfer Fee Type

If you want to transfer funds from your PayPal balance to your bank account instantly, you will be charged an instant transfer fee. These costs vary depending on several factors:

Currency: Fees vary depending on the currency you transfer.

Amount transferred: Fees are generally higher for larger transfer amounts.

Country: Fees may vary based on the country you transfer funds to.

How to Avoid Instant Transfer Fees

If you want to avoid these additional fees, PayPal offers a slower but free alternative:

Standard Transfer: Funds will arrive in your bank account within 3-5 business days, depending on your country.

Scheduled Transfers: You can schedule transfers for future dates, which is also free.

When to Use Instant Transfer?

Although instant transfers incur a fee, they are a good option in certain situations:

Emergency: If you need funds immediately, instant transfer is the fastest way to get them.

Urgent payments: If you need to make an urgent payment, such as a bill or rent, an instant transfer can prevent fines or other consequences.

Trust: If you are transferring funds to someone you know and trust, instant transfers can be quicker and easier than other options.

Conclusion

PayPal instant transfer fees are additional fees for the convenience of quickly transferring funds from your PayPal balance to your bank account. While these fees can vary, you can avoid these fees by using slower standard or scheduled transfer options. Ultimately, the best choice for you will depend on your needs and tolerance for additional costs.

Instant Fund Sending and Receiving Process

PayPal Instant Transfer Fees: A Quick Guide

PayPal offers an instant transfer feature, allowing you to send and receive money quickly. However, this service comes at a cost. Here’s an overview of the costs you may face:

Instant Transfer Fees

When sending money instantly, PayPal charges a flat fee plus a percentage of the amount transferred. These fees vary depending on your country and the payment method used.

For example, in the United States, the instant transfer fee is $0.25 plus 1.5% of the amount transferred. So, if you transfer $100, the total fee is $1.75.

Instant Acceptance Fee

On the other hand, receiving money instantly is usually free for business account holders. However, if you receive money from certain platforms, such as e-commerce sites or marketplaces, those platforms may charge additional fees for processing instant transfers.

How to Save on Instant Transfer Fees

To save on instant transfer fees, consider the following options:

Use a different payment method: Instant transfers from a debit or credit card incur higher fees than from your PayPal balance or bank account.

Send large amounts of money: Fixed fees are a smaller percentage of larger amounts, so combining multiple transactions into one transfer can save money.

Avoid receiving money instantly: If you don’t need to receive money immediately, let the transfer process the standard way, which is usually free.

Vital Records

Instant transfer fees may change over time, so always check with PayPal for the most up-to-date information.

Some countries have special regulations regarding instant transfer fees.

If you have questions or concerns regarding instant transfer fees, contact PayPal customer service for assistance.

By understanding PayPal instant transfer fees, you can plan your transactions wisely and save money when sending and receiving funds.

PayPal Instant Transfer Fees: What You Need to Know

PayPal is one of the world’s most popular online payment services, with more than 400 million active users. One of the features that makes PayPal so popular is instant transfer, which allows users to transfer funds from their PayPal account directly to their bank account. However, like all other services, PayPal instant transfers also have fees associated with them. In this article, we’ll discuss PayPal instant transfer fees and what you should know before using this feature.

What is PayPal Instant Transfer?

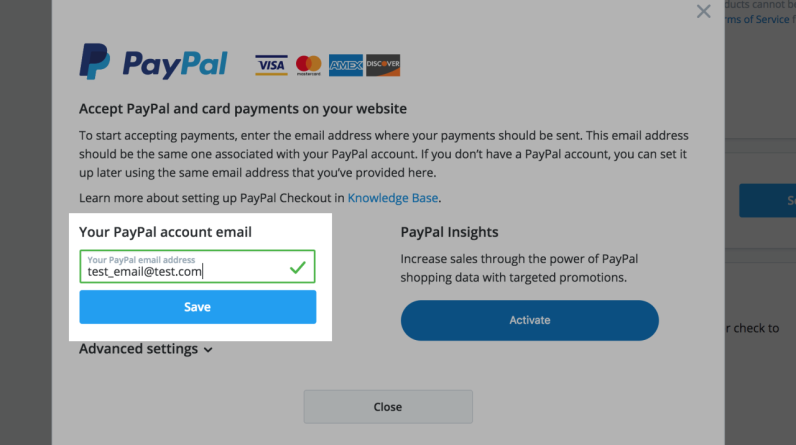

PayPal instant transfer is a feature that allows users to transfer funds from their PayPal account directly to their bank account. This transfer process usually takes a few minutes, depending on the network speed and banking system used. With PayPal instant transfer, you can withdraw funds from your PayPal account and use the funds for various purposes, such as paying bills, buying goods, or sending money to other people.

PayPal Instant Transfer Fees

PayPal instant transfer fees vary depending on several factors, such as country of origin, currency type, and transfer amount. Here is a summary of PayPal instant transfer fees for several countries:

- United States of America : 1% of the transfer amount, with a minimum of $0.25 and a maximum of $10.

- Canada : 1% of the transfer amount, with a minimum of $0.25 and a maximum of $10.

- European Union : 0.5% of the transfer amount, with a minimum of €0.25 and a maximum of €15.

- Australasia : 1% of the transfer amount, with a minimum of $0.25 and a maximum of $10.

- Asia Pacific : 1% of the transfer amount, with a minimum of $0.25 and a maximum of $10.

Please note that PayPal instant transfer fees can vary depending on the country and type of currency used. Additionally, some banks may also charge additional fees for instant PayPal transfers.

How to Calculate PayPal Instant Transfer Fees

To calculate PayPal instant transfer fees, you can use the following formula:

Instant Transfer Fee = (Transfer Amount x Instant Transfer Fee) + Additional Fee

For example, if you want to transfer $100 from your PayPal account to your bank account in the United States, then PayPal’s instant transfer fees are:

Instant Transfer Fee = ($100 x 1%) + $0.25 = $1.25

So, the total PayPal instant transfer fee is $1.25.

Tips to Save on PayPal Instant Transfer Fees

Here are some tips for saving on PayPal instant transfer fees:

- Use the right type of currency : If you want to transfer funds to a bank account that uses another currency, then use the correct currency type to avoid conversion fees.

- Use bank transfer : If you want to transfer large amounts of funds, then use bank transfer which is cheaper than PayPal instant transfer.

- Use PayPal Credit : If you have PayPal Credit, then you can use your credit card to transfer funds without instant transfer fees.

- Use the right bank account : Some banks offer bank accounts that do not charge PayPal instant transfer fees.

Conclusion

PayPal instant transfer is a feature that allows users to transfer funds from their PayPal account directly to their bank account. However, PayPal instant transfer fees may vary depending on several factors, such as country of origin, currency type, and transfer amount. By understanding PayPal instant transfer fees and using tips to save on fees, you can make fund transfers more effective and efficient.

FAQs

Q: What is PayPal instant transfer?

A: PayPal instant transfer is a feature that allows users to transfer funds from their PayPal account directly to their bank account.

Q: How much does PayPal instant transfer cost?

A: PayPal instant transfer fees vary depending on several factors, such as country of origin, currency type, and transfer amount.

Q: How do I calculate PayPal instant transfer fees?

A: You can use the formula: Instant Transfer Fee = (Transfer Amount x Instant Transfer Fee) + Additional Fee.

Q: How to save on PayPal instant transfer fees?

A: You can use tips such as using the right type of currency, bank transfer, PayPal Credit, and the right bank account.

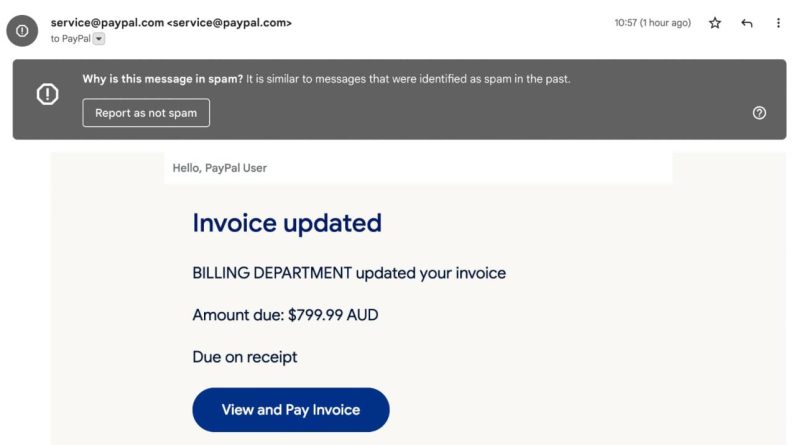

Tips to Avoid Unnecessary Instant Transfer Fees

When you need to transfer money instantly using PayPal, you may incur additional fees known as Instant Transfer Fees. These fees may vary depending on the amount you transfer and the country you send the money to.

However, there are several ways to avoid these unnecessary costs. First, check that you have enough PayPal balance to cover the transfer amount. If you have a balance, you can avoid instant transfer fees by using it to fund your transactions.

If you don’t have enough PayPal balance, you may consider using an alternative transfer method such as a bank transfer or debit card. This method usually has no instant transfer fees and may save you money in the long run.

If you must use instant transfers, try to reduce the transfer amount as much as possible. The more money you transfer, the higher the fees you will pay. By limiting the number of transfers, you can minimize the fees you incur.

You may also consider combining multiple transfers into one larger transaction. This way, you will only be charged one time, rather than a separate fee for each transfer.

Finally, check whether the recipient is willing to wait for the funds to be transferred via a slower method. This transfer method usually has no fees and can save you and the recipient money.

By following these tips, you can avoid unnecessary PayPal Instant Transfer Fees and save money when transferring money. Remember to always consider your transfer options and choose the most cost-effective method for your needs.