Types of PayPal International Fees

Types of PayPal International Fees

When making international transactions through PayPal, it is important to understand the types of fees that may be charged. This can help you plan and minimize the costs associated with transferring money abroad.

Currency Conversion Fees

PayPal charges a currency conversion fee to exchange money from one currency to another. This fee is generally around 2.5% of the converted amount. For example, if you send $100 to a country whose currency is the euro, you will be charged a conversion fee of around $2.50.

Shipping costs

Sending fees are charged when you send money to a country that has a different currency than your own. These fees vary depending on the destination country and the amount sent. For example, delivery to the UK costs £0.99 for amounts under £300.

Payment Fees

PayPal also charges payment fees for accepting payments from abroad. This fee is generally around 1.5% of the amount received. For example, if you receive €200 from a client in the eurozone, you will be charged a payment fee of €3.

Withdrawal Fees

Withdrawal fees are charged when you withdraw money from your PayPal account to a bank account based in another country. These fees vary depending on the destination country and withdrawal method. For example, the fee for withdrawing to a bank account in the US is $5 per transaction.

Additional cost

In addition to the types of fees mentioned above, PayPal may also charge additional fees for certain transactions. These include:

Card transaction handling fees

Repurchase costs

Additional currency conversion fees

Account refill fees

How to Reduce Costs

There are several steps you can take to reduce PayPal’s international fees:

Use the same currency to send and receive money.

Send larger amounts at once to reduce the cost percentage.

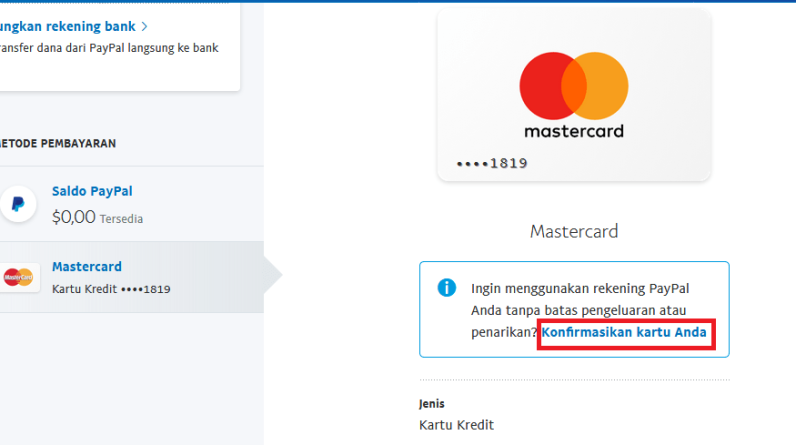

Verify your account to gain access to lower rates.

Look for alternative money transfer service providers that offer more competitive rates.

By understanding PayPal’s types of international fees and taking steps to reduce them, you can save money when making financial transactions across borders.

How to Avoid High Fees in International Transactions

When making international transactions using PayPal, it is important to understand the different types of fees that may arise. Knowing these fees can help you save money and plan your transactions more effectively.

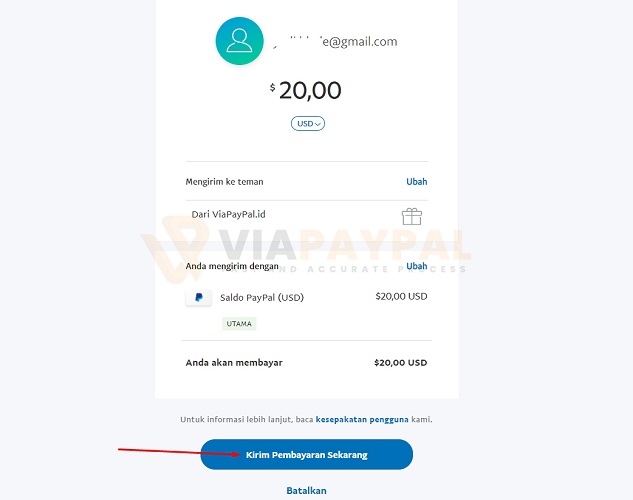

One of the most common types of fees is currency conversion fees. This fee is charged when you send or receive money in a currency different from your account. PayPal uses mid-market exchange rates plus a small margin to calculate these fees. For example, if you send $100 USD to a UK-based account, PayPal will convert the money to British Pounds (GBP) using the mid-market exchange rate plus a margin.

In addition to currency conversion fees, PayPal also charges a flat fee for international transactions. These fees vary depending on the country of origin and destination of the transaction. For example, the fee to send money to an account in the United States is $4.99 USD, while the fee to send money to an account in Canada is $5.99 CAD.

Additionally, recipients of international transactions may incur additional fees. Typically, these fees are charged by the recipient’s bank and are not related to PayPal. The amount of this fee may vary depending on the bank and recipient country.

To avoid high fees in international transactions, here are some tips:

Use the same currency: When possible, send and receive money in the same currency to avoid currency conversion fees.

Compare exchange rates: Before making a transaction, compare the exchange rate offered by PayPal with the exchange rate from your bank or other currency exchange service.

Avoid small transactions: Flat fees for international transactions can be a significant percentage of smaller amounts. If you need to send a small amount, consider using an alternative method such as a bank transfer or remittance.

Find out about recipient fees: Ask recipients if they will be charged additional fees by their bank before making a transaction.

By understanding the types of PayPal international fees and following these tips, you can minimize fees and save money on your international transactions.

PayPal International Fees: Complete Guide

PayPal is one of the most popular online financial services in the world, with more than 400 million active users in more than 200 countries. However, for users making international transactions, the fees charged by PayPal can be a significant additional cost. In this article, we’ll talk about PayPal’s international fees, how they work, and some tips for saving on fees.

What are PayPal International Fees?

PayPal international fees are fees charged by PayPal for carrying out international transactions, namely transactions involving senders and recipients from different countries. These fees are calculated based on several factors, including transaction type, transaction value, and the country of origin of the sender and recipient.

PayPal International Fee Types

PayPal has several types of international fees, including:

- Currency Conversion Fees : This fee is charged when PayPal converts currency from one country to another. Currency conversion fees are usually around 2.5% to 4.5% of the transaction value.

- International Transaction Fees : This fee is charged when carrying out international transactions, namely transactions involving senders and recipients from different countries. International transaction fees are usually around 0.5% to 2% of the transaction value.

- Shipping costs : This fee is charged when making international transactions and choosing a faster shipping option. Shipping fees are usually around 1% to 3% of the transaction value.

- Recipient Fees : This fee is charged when the recipient withdraws funds from a PayPal account to a bank account or credit card. Recipient fees are usually around 1% to 3% of the transaction value.

How to Calculate PayPal International Fees

How to calculate PayPal international fees can be done using the following formula:

International Fees = (Transaction Value x Currency Conversion Fee) + (Transaction Value x International Transaction Fee) + (Transaction Value x Shipping Fee) + (Transaction Value x Recipient Fee)

Example:

If you make an international transaction of IDR 1,000,000 from Indonesia to the United States, with a currency conversion fee of 3%, international transaction fee of 1%, shipping fee of 2%, and recipient fee of 1%, then the international fee will be charged is:

International Fee = (IDR 1,000,000 x 3%) + (IDR 1,000,000 x 1%) + (IDR 1,000,000 x 2%) + (IDR 1,000,000 x 1%) = IDR 30,000 + IDR 10,000 + IDR 20,000 + IDR 10,000 = IDR 70,000

Tips for Saving on PayPal International Fees

Here are some tips for saving on international PayPal fees:

- Choose a Cheaper Shipping Option : If you don’t need fast shipping, you can choose a cheaper shipping option to save costs.

- Use Local Currency : If you make international transactions, you can use local currency to avoid currency conversion fees.

- Choose the Right Bank Account : If you withdraw funds from your PayPal account to a bank account, you can choose a bank account that does not have international transaction fees.

- Use the Right Credit Card : If you make international transactions with a credit card, you can choose a credit card that does not have international transaction fees.

- Using Other Online Financial Services : If you make international transactions regularly, you may consider using other online financial services that have lower fees.

Conclusion

PayPal’s international fees can be a significant additional cost when making international transactions. However, by understanding how PayPal’s international fees work and using the right tips, you can save on fees and make international transactions more efficiently.

Tips for Managing International Fees on PayPal

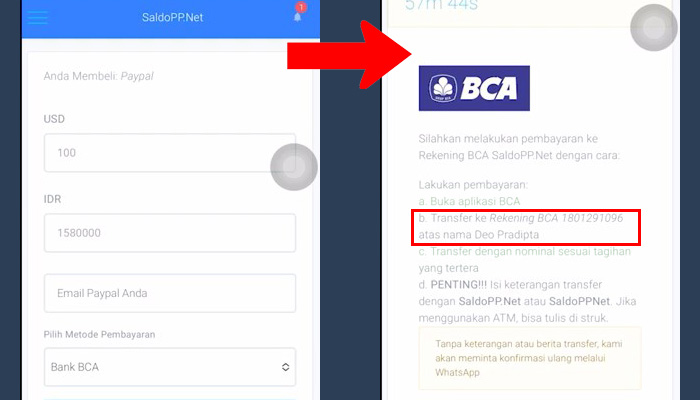

PayPal is an easy and convenient way to transfer money internationally. However, it’s important to know the costs associated with international transactions so you can budget your purchase and avoid surprises. There are several types of fees that may apply, depending on the country you send money to and the payment method you use.

Currency Conversion Fees

When you make transactions in a currency other than the base currency of your PayPal account, PayPal will charge a currency conversion fee. These fees vary depending on the current exchange rate and the currency pair involved. In general, less common currency pairs will incur higher conversion fees.

Transaction Fees

PayPal also charges transaction fees for all international transfers. These fees vary depending on the payment method you use. For example, transaction fees for bank transfers are usually lower than fees for credit or debit card transfers.

Acceptance Fee

In some cases, the recipient of your money may be charged a receiving fee. This usually happens if the recipient is in another country or if the payment is sent in another currency. This fee is charged by PayPal and is deducted from the amount received by the recipient.

Other Fees

In addition to the types of fees above, there are several other fees that may be charged for international transactions. For example, you may incur additional fees if you make large transactions or if you send money to countries considered to be at high risk of fraud.

Here are some tips for managing international fees on PayPal:

Choose the payment method with the lowest transaction fees.

Send large amounts of money at once to save on currency conversion fees.

Use a third-party currency exchange service to get better exchange rates.

Avoid sending money to countries considered to be at high risk of fraud.

By following these tips, you can manage international fees on PayPal and save money on your transfers.