What is PayPal Exchange Rate?

PayPal Exchange Rate: A Simple Guide

When you use PayPal to send or receive money internationally, you may wonder about the exchange rate used. So, what exactly is the PayPal Exchange Rate?

PayPal Exchange Rate is the rate PayPal uses to convert one currency to another. These values are updated regularly based on the foreign exchange market. When you make a transaction on PayPal, the exchange rate used is the rate in effect at the time the transaction is processed.

It’s important to note that the PayPal Exchange Rate may differ from the exchange rates you find elsewhere, such as banks or currency exchange services. This is because PayPal charges a small fee on each transaction, which is reflected in the exchange rate. This fee is usually between 2.5% to 4.5%, depending on the currency involved.

If you want to know the exchange rate to use for a particular transaction, you can use the PayPal Currency Conversion Calculator. This tool will give you the exact exchange rate to use for your transaction.

Here are some things to consider when using PayPal Exchange Rate:

Exchange rates can change quickly, so it’s best to check the latest rates before making a transaction.

PayPal charges a small fee for each transaction, so keep this in mind when calculating the overall cost.

You can use the PayPal Currency Conversion Calculator to find out the exchange rate to use for a particular transaction.

By understanding PayPal Exchange Rate, you can ensure that you get the best value when sending or receiving money internationally.

How to Calculate and Understand PayPal Exchange Rate

PayPal Exchange Rate: Understanding How It Works

When making international transactions using PayPal, it is very important to understand the applicable exchange rates. PayPal exchange rate is the exchange rate used to convert your currency to the recipient’s currency or vice versa.

Knowing PayPal’s exchange rate is very important because it can affect the amount of money you pay or receive. Let’s explore how to calculate and understand PayPal’s exchange rate.

How to Calculate PayPal Exchange Rate

PayPal uses a mid-market exchange rate, which is the average exchange rate between banks. However, PayPal adds its own profit margin to this exchange rate, which is usually around 2-5%.

To calculate the PayPal exchange rate, follow these steps:

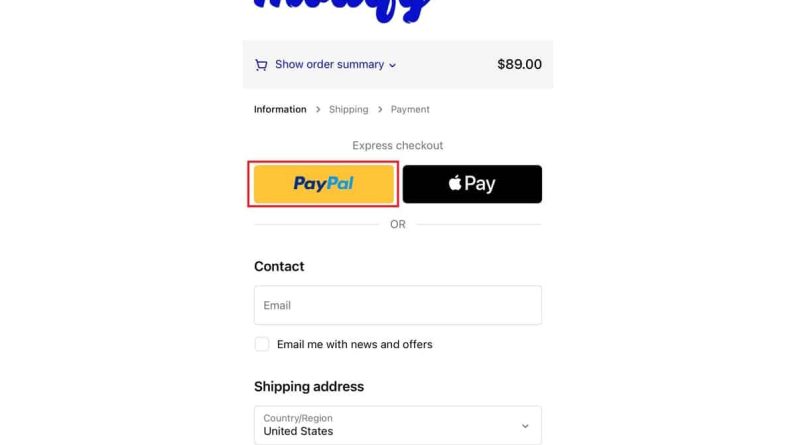

1. Visit the PayPal website and log in to your account.

2. Click the “Send & Request” tab.

3. Enter the amount of money you want to send and select your currency.

4. Select the recipient currency.

5. PayPal will display the exchange rate used to convert your money.

Understanding PayPal’s Exchange Rate

There are a few important things to remember about PayPal exchange rates:

Fluctuating: Exchange rates are constantly changing based on market conditions, so it is important to check the latest exchange rates before making a transaction.

Varies: PayPal exchange rates may differ from exchange rates offered by banks or other currency exchange companies.

Fees: In addition to the exchange rate, PayPal charges a flat fee for international transactions. These fees typically range from $0.30 to $4.99 per transaction.

How to Save Money on PayPal Exchange Rate

There are several ways to save money on the PayPal exchange rate:

Compare with other providers: Check exchange rates from banks or other currency exchange companies before using PayPal.

Wait for a favorable exchange rate: If possible, wait until the exchange rate is favorable before making a transaction.

Use a local PayPal account: If you make a transaction to a country where you have a local PayPal account, PayPal will not charge you a currency conversion fee.

Understanding PayPal exchange rates is critical to making the right financial decisions when making international transactions. By following the tips mentioned above, you can save money and ensure that you get the best value for your money.

Getting to Know PayPal Exchange Rate: How to Prevent Losses

PayPal is one of the most popular online payment services in the world. By using PayPal, we can carry out financial transactions online easily and quickly. However, PayPal’s performance depends not only on its technical capabilities, but also on the currency exchange rate applied. In this article, we will discuss more about the PayPal exchange rate, how it works, and tips to prevent losses.

What is PayPal Exchange Rate?

PayPal exchange rate is the currency exchange rate applied by PayPal to carry out financial transactions between two different currencies. For example, if you want to make a transaction from USD (United States Dollars) to IDR (Indonesian Rupiah), then PayPal will use the applicable exchange rate to convert the amount to be paid.

How Does PayPal Exchange Rate Work?

PayPal uses a combination of several methods to determine exchange rates, including:

- Market Exchange Rate : PayPal monitors market exchange rates to determine the applicable exchange rate.

- Transaction Fees : PayPal also charges a transaction fee for each transaction made.

- Margins : PayPal also has a margin that is applied to determine the exchange rate.

Example of PayPal Exchange Rate Calculation

For example, if you want to make a transaction from USD to IDR with an amount of $100, PayPal will use the applicable exchange rate to convert the amount to be paid. The following is an example of calculation:

- Market Exchange Rate: 1 USD = 14,000 IDR

- Transaction Fee: 2.5% of the transaction amount

- Margin: 1.5% of the transaction amount

By using the exchange rate above, the calculation will be:

- Transaction amount: $100

- Transaction fee: $2.50 (2.5% of $100)

- Margin: $1.50 (1.5% of $100)

- Amount due: $104.00

- Exchange Rate: 1 USD = 14,000 IDR

- Amount to be paid in IDR: IDR 1,456,000 (14,000 x $104.00)

Tips to Prevent Losses

When using PayPal, there are several tips you can do to prevent losses due to exchange rates:

- Check the Exchange Rate Before Making a Transaction : Make sure you check the applicable exchange rate before making a transaction.

- Use Bank Transfer Services : If you want to make large transactions, then bank transfer services may be more effective and cheaper.

- Avoid Transactions on Holidays : Exchange rates can fluctuate on holidays, so you should avoid making transactions on these days.

- Use Special Applications : Apps like TransferWise and Revolut can help you make transactions with lower fees and better exchange rates.

Conclusion

PayPal exchange rate can have a big influence on the performance of your financial transactions. By understanding how exchange rates work and using the right tips, you can prevent losses and make more effective transactions. Make sure you check the exchange rate before making a transaction and use a bank transfer service if necessary. Thus, you can enjoy the benefits of using PayPal without worrying about exchange rate losses.

Tips to Avoid Losses in Currency Conversion

What is PayPal Exchange Rate?

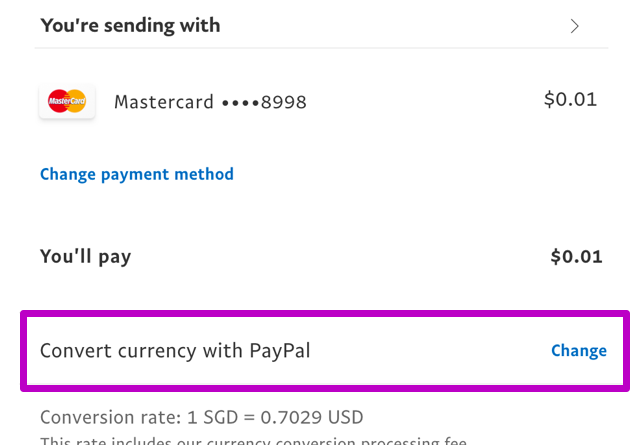

When you shop or receive payment in a different currency, PayPal will convert that currency to your account’s base currency. This is done using PayPal’s exchange rate, which is called the PayPal exchange rate.

This exchange rate is different from the mid-market exchange rate, which is the average of exchange rates published by central banks or other financial sources. PayPal adds margin to mid-market exchange rates to cover operating costs and make a profit.

This margin may vary depending on the currency converted, transaction amount, and your PayPal account type. In addition, PayPal exchange rates can fluctuate rapidly, influenced by market changes and other economic factors.

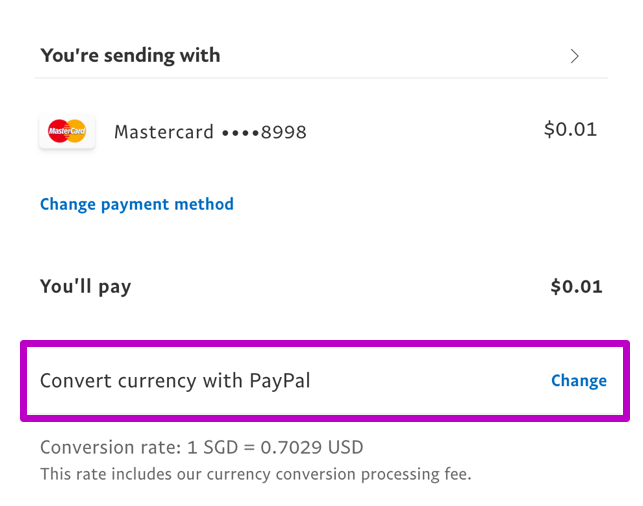

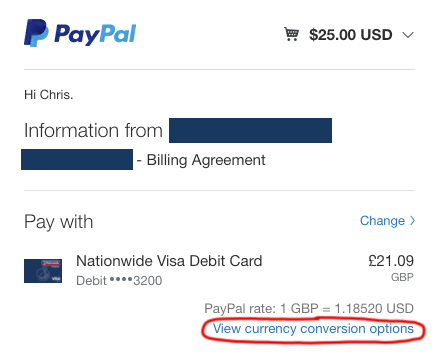

Identify the PayPal Exchange Rate

You can find the PayPal exchange rate on the transaction confirmation page or in the currency conversion fee calculator available on the PayPal website. It is important to review exchange rates carefully before completing a transaction, as high margins can have a significant impact on conversion costs.

How to Avoid Losses in Currency Conversion

Compare exchange rates: Before confirming a transaction, compare PayPal’s exchange rate to the mid-market exchange rate to ensure you’re getting the best rate. There are also online exchange rate comparison services that can help you do this.

Minimize the number of transactions: The more transactions you make, the more conversion fees you will incur. If possible, combine multiple transactions into one to reduce the number of currency conversions.

Use the right PayPal account: Businesses and private individuals have different types of PayPal accounts, with varying exchange rates. Make sure you use the right account type to get the best exchange rate.

Although PayPal exchange rate cannot be avoided, by following these tips, you can minimize losses and save money on currency conversions. Always review exchange rates carefully and do research before making a transaction to ensure you are getting fair value for your money.