What is PayPal Mastercard?

So, you must have heard about PayPal, right? Well, now they have a cool debit card called PayPal Mastercard. Let’s discuss what it is and how it works.

PayPal Mastercard is a debit card that is connected directly to your PayPal balance. This means you can use it wherever Mastercard is accepted, both online and in physical stores. When you make a purchase, the money will be immediately taken from your PayPal balance.

One of the main advantages of PayPal Mastercard is its ease of use. You don’t need to bother bringing cash or credit cards. Just swipe your PayPal debit card and enter your PIN. Apart from that, you can also use this card to make cash withdrawals at ATMs.

Additionally, PayPal Mastercard comes with several advanced security features. This card is equipped with chip and PIN technology that helps prevent fraud. PayPal also offers zero liability protection, which means you will not be held responsible for unauthorized transactions.

However, there is one important thing to note. PayPal Mastercard can only be used if you have sufficient PayPal balance. So, make sure to top up your balance before making any purchases.

Now, let’s discuss some ways to use PayPal Mastercard effectively. Firstly, you can use it to save money by taking advantage of cashback offers and discounts offered by PayPal and Mastercard. Apart from that, you can also track your expenses easily by using the PayPal application. Lastly, PayPal Mastercard is a great option for security and convenience when shopping online or in stores.

So, that’s PayPal Mastercard. This is an easy, safe and useful way to manage your finances. If you are a PayPal user, then you will definitely want to consider getting this debit card.

How to Use PayPal Mastercard for Shopping

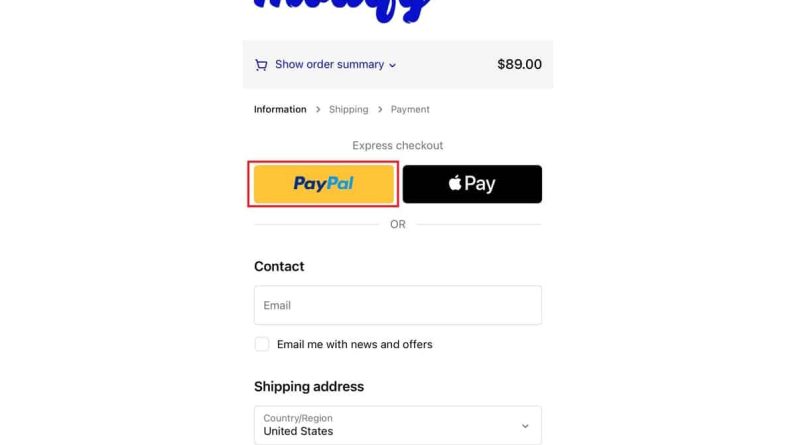

PayPal Mastercard is a credit card linked to your PayPal account. This allows you to use your PayPal balance or credit to make purchases anywhere that accepts Mastercard. So how do you use PayPal Mastercard to shop?

First, you have to register for a card. You can do this online on the PayPal website or via the mobile app. Once you are approved, you will receive a physical card in the mail. You can also add cards to your digital wallet for contactless payments.

To use PayPal Mastercard, simply swipe or insert the card like any other credit or debit card. You will be asked to enter your PIN or sign a receipt. If you use your PayPal balance, funds will be debited from your account. If you use credit, payment will be charged to your monthly bill.

One of the main advantages of using a PayPal Mastercard is that you can enjoy the same protection as when using a PayPal account. This includes Buyer Protection, which can help you get your money back if you’re not satisfied with your purchase. Additionally, you can earn cashback rewards or points for every purchase you make.

PayPal Mastercard is also convenient because you can use it anywhere that accepts Mastercard. You don’t need to bring cash or other credit cards. Plus, you can check your balance and transactions anytime in the PayPal app.

If you’re looking for a safe and convenient way to shop, PayPal Mastercard is a great choice. It connects to your PayPal account, gives you added protection and benefits, and can be used anywhere Mastercard is accepted.

PayPal Mastercard: Digital Credit Card that Makes Online Transactions Easy

In recent years, digital technology has developed rapidly and made it easier for us to carry out various activities, including financial transactions. One example of digital technology that makes financial transactions easier is PayPal Mastercard. In this article, we’ll talk about what PayPal Mastercard is, how it works, and its advantages and disadvantages.

What is PayPal Mastercard?

PayPal Mastercard is a digital credit card issued by PayPal, the world’s most popular online financial services company. This card allows users to make online transactions more easily and safely. PayPal Mastercard can be used to make payments on various websites, applications and online stores that accept Mastercard credit cards.

How PayPal Mastercard Works

PayPal Mastercard works the same way as a conventional credit card. When you make an online transaction, you can choose PayPal Mastercard as a payment method. The PayPal system will then send the card information to the seller, and you will be able to make payments more easily.

However, there are some differences between PayPal Mastercard and conventional credit cards. First, the PayPal Mastercard does not have a physical card number or expiration date. Second, this card can only be used for online transactions, not offline transactions. And third, PayPal Mastercard does not require identity verification or credit applications.

Advantages of PayPal Mastercard

Here are some of the advantages of PayPal Mastercard:

- Easy to use : PayPal Mastercard is very easy to use. You just need to log in to your PayPal account, choose a payment method, and enter your card information.

- Safe : PayPal Mastercard uses advanced security technology to protect your transactions. PayPal’s system can also detect and prevent suspicious transactions.

- No Physical Card Required : PayPal Mastercard doesn’t require a physical card, so you don’t have to worry about losing or damaging your card.

- No Identity Verification Required : PayPal Mastercard does not require identity verification or credit applications, so you can use this card quickly and easily.

- Can be Used on Various Websites : PayPal Mastercard can be used on various websites, apps and online stores that accept Mastercard credit cards.

Disadvantages of PayPal Mastercard

Here are some disadvantages of PayPal Mastercard:

- Transaction Fees : PayPal Mastercard requires a transaction fee of 3.4% + IDR 1,500 per transaction.

- Risk of Fraud : Like other credit cards, PayPal Mastercard also carries a risk of fraud. You should always be careful when making online transactions.

- Cannot be used for offline transactions : PayPal Mastercard can only be used for online transactions, not offline transactions.

- Has No Credit Limit : PayPal Mastercard does not have a credit limit, so you should always be careful when making online transactions.

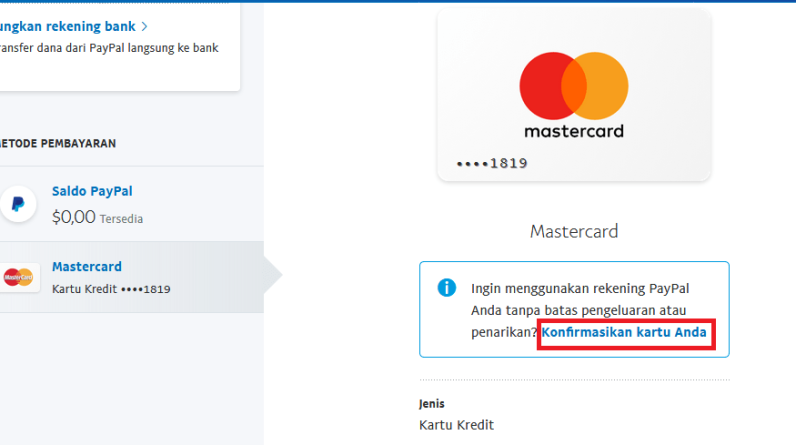

How to Register for PayPal Mastercard

How to register for a PayPal Mastercard is very easy. Here are the steps:

- Create a PayPal Account : First, you have to create a PayPal account. You can use your email address or phone number to register.

- Account Verification : After registering, you must verify your account. The PayPal system will send a verification code to your email address or phone number.

- Add Card Information : Once your account is verified, you can add card information. You must enter card information, such as name, date of birth, and address.

- Card Activation : Once your card information is registered, you can activate the card. The PayPal system will send an activation code to your email address or telephone number.

Conclusion

PayPal Mastercard is a digital credit card that makes online transactions easy. By using this card, you can make online payments more easily and safely. However, there are some drawbacks you need to consider, such as transaction fees and fraud risks. By being careful and using this card wisely, you can enjoy the advantages of PayPal Mastercard.

PayPal Mastercard Benefits and Features

Hello everyone, have you heard about PayPal Mastercard? This is a credit card offered by PayPal, a leading online payment company. This card comes with various benefits and features that can make managing your finances easier and more comfortable.

One of the main advantages of the PayPal Mastercard is that you can use it to withdraw money from your PayPal account at millions of ATMs worldwide. This can be very useful if you need to access funds quickly and easily. Plus, this card also offers fraud protection and zero liability, so you can feel confident that your transactions are safe.

PayPal Mastercard also connects to your PayPal account, allowing you to make online purchases, send money, and receive payments directly. This eliminates the need to enter your financial information into different websites, which can save time and increase security.

Another feature of PayPal Mastercard is flexible payment options. You can choose to pay off your balance in full each month or make minimum payments. This card also has a competitive interest rate, making it an affordable option for many people.

Additionally, PayPal Mastercard can help you build a credit history. By using your card responsibly and making payments on time, you can improve your credit score over time. This can open the door to loan and mortgage offers with better interest rates in the future.

While PayPal Mastercard has many advantages, it is important to note that there are some limitations as well. For example, this card may not be accepted in all stores, and you may incur fees if you make transactions abroad. Additionally, there is an annual fee associated with the card, although the fee may be negligible for those who use it frequently.

Overall, PayPal Mastercard is a powerful tool that can enhance your online banking experience. With its many benefits and features, this card can facilitate your financial management and make your life easier. If you’re looking for a credit card tied to a trusted payment platform, PayPal Mastercard is worth considering.