What is PayPal Loan?

What is PayPal Loan?

PayPal, a leading online payment platform, offers lending services that can help small businesses and individuals meet their financial needs. PayPal Loans are designed to provide fast access to capital, allowing you to finance a wide variety of business or personal expenses.

How PayPal Loans Work

Unlike traditional loans, PayPal Loan processing is fast and easy. You can apply and get approved in minutes, without requiring collateral or extensive credit checks. These loans are based on your PayPal transaction history, which gives PayPal a clear picture of your financial health.

Once approved, you will receive the loan funds directly to your PayPal account. You can use the funds for any purpose you wish, such as purchasing equipment, expanding business operations, or covering unexpected personal expenses.

Terms and Conditions

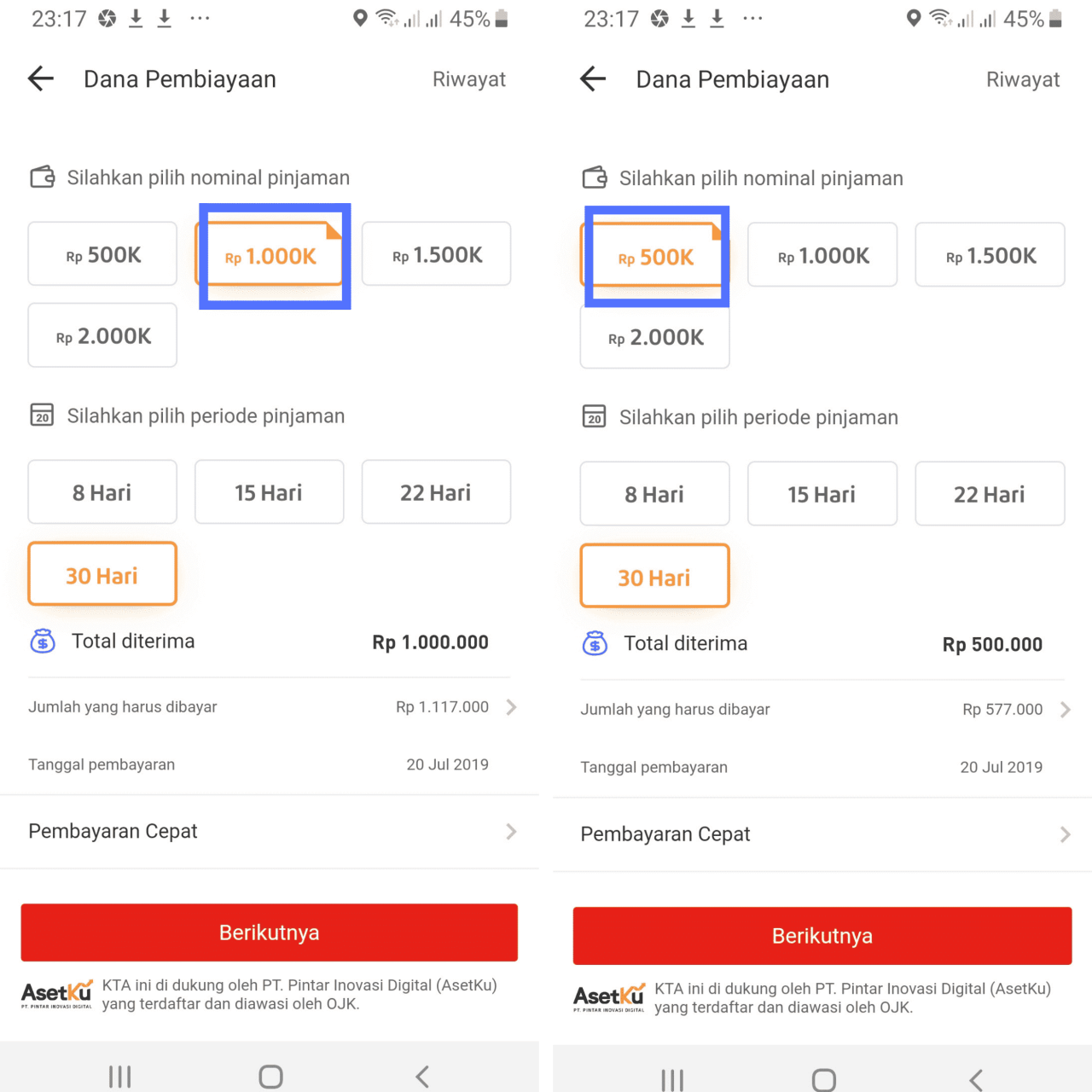

The loan amount you can apply for depends on your PayPal transaction history and other eligibility factors. Generally, small businesses can obtain loans of up to $250,000, while individuals can apply for loans of up to $50,000.

PayPal loans have flexible terms, ranging from 6 to 18 months. You can choose the term that best suits your needs and repayment capabilities. Interest rates and loan fees vary depending on your credit profile and loan terms.

PayPal Loan Benefits

Fast Approval Process: You can get approval in minutes, without having to wait long.

No Collateral Required: No need to provide any collateral to get PayPal Loan.

Flexible: You can use the loan funds for any purpose you want.

Automatic Payments: Loan payments will be debited automatically from your PayPal account, so you don’t have to worry about forgetting to pay.

Conclusion

PayPal Loan is a financing solution that can help small businesses and individuals meet their financial needs quickly and easily. Its simple approval process, flexible terms, and ease of use make it an attractive option for those looking for quick access to capital. If you’re considering getting a loan, PayPal Loan is worth considering.

Process for Applying for a PayPal Loan

Process for Applying for a PayPal Loan

If you are considering applying for a PayPal Loan, you should know the process. Here are the steps you need to take:

First of all, you have to make sure that you qualify for a loan. To qualify, you must have a PayPal account for at least 90 days and have a good payment history of PayPal transactions. You must also have sufficient income to repay the loan.

Once you are sure you qualify, you can apply online. You’ll need to provide basic information such as your name, address, and Social Security number. You must also provide financial information, such as your income and expenses.

PayPal will review your application and make a decision whether to approve the loan or not. The review process usually takes several days. If your loan is approved, the funds will be deposited into your PayPal account.

You can use the loan funds for any purpose you wish. However, it is important to remember that the loan must be repaid according to the repayment schedule. If you repay your loan on time, you will help build a good credit history.

If you pay off the loan, PayPal will automatically debit your PayPal account for the payment. You can set up automatic payments or make payments manually. If you don’t make payments, this can have a negative impact on your credit history.

Applying for a PayPal loan can be a great way to get the funds you need. However, it is important to understand the process and ensure that you qualify. By following the steps above, you can increase your chances of being approved for a loan and use the funds to achieve your financial goals.

PayPal Loan: Fast and Easy Online Loan Solution

In recent years, financial technology (fintech) has developed rapidly and provided many options for people to obtain loans online. One popular choice is PayPal Loan, launched by PayPal, the world’s leading online payments company. In this article, we will discuss PayPal Loan, its advantages and disadvantages, and how to use it.

What is PayPal Loan?

PayPal Loan is an online loan offered by PayPal, a company that is widely known as an online payment service provider. PayPal Loan is designed to help PayPal users who need additional funds for personal or business purposes. By using PayPal Loan, users can get loans quickly and easily, without having to wait for a long loan application process.

Advantages of PayPal Loans

Here are some of the advantages of PayPal Loan:

- Fast application process : The PayPal Loan application process is very fast and easy. Users only need to fill out an online form and wait a few minutes to get a decision.

- Funds that can be accessed quickly : Once approved, loan funds can be quickly accessed via the user’s PayPal account.

- No need for collateral : PayPal Loan does not require collateral or collateral, so users don’t need to worry about the risk of losing assets.

- Competitive interest : PayPal Loan interest is relatively low compared to other loans.

- Payment flexibility : Users can choose a payment term that suits their needs.

Disadvantages of PayPal Loans

Here are some of the disadvantages of PayPal Loan:

- High interest costs : Although PayPal Loan interest is relatively low, it is still higher than some other loans.

- Limited loan limit : The maximum loan amount that can be obtained through PayPal Loan is relatively limited.

- Strict application requirements : PayPal Loan has strict application requirements, so not all PayPal users can get a loan.

- Limited use of funds : Loan funds can only be used for personal or business purposes, and cannot be used for other purposes.

How to Use PayPal Loan

Here are some steps to use PayPal Loan:

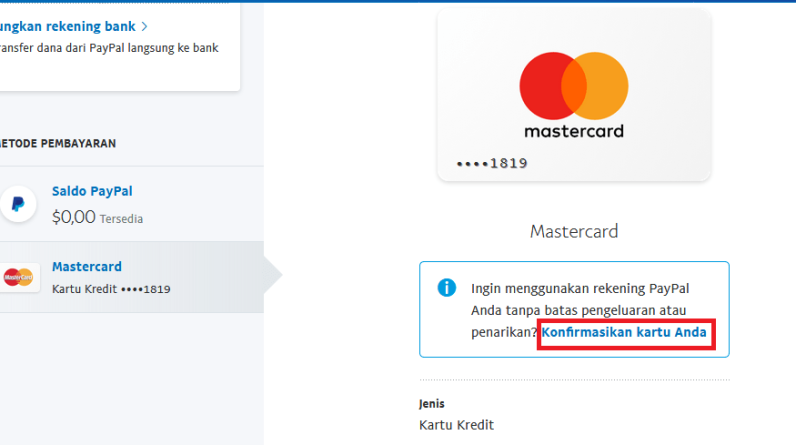

- Open a PayPal account : Users must have an active PayPal account to apply for a loan.

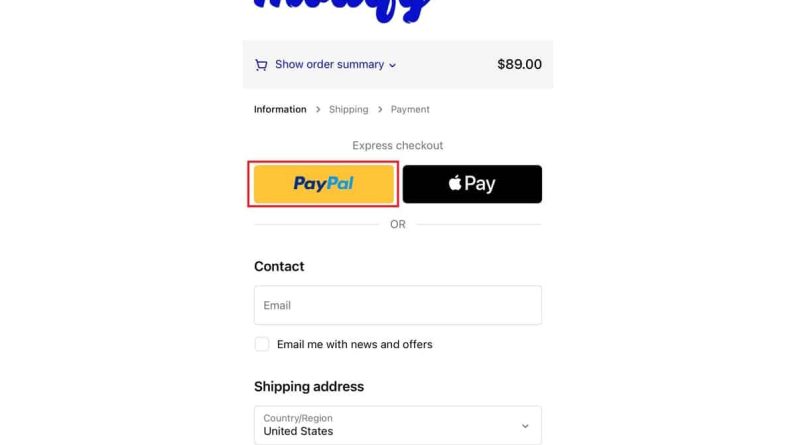

- Click the “Loan” button : On the main page of PayPal account, users can find the “Loan” button and click on it.

- Fill out the application form : Users must fill out an application form containing information about themselves and their loan needs.

- Wait for the decision : After submitting the application form, the user has to wait for a few minutes to get the decision.

- Receive loan funds : If the application is approved, the loan funds will be sent to the user’s PayPal account.

Terms and Conditions

Following are several terms and conditions that must be met by users to apply for a loan via PayPal Loan:

- Minimum age 18 years : Users must be at least 18 years old to apply for a loan.

- Have an active PayPal account : Users must have an active and verified PayPal account.

- Have a good payment record : Users must have a good payment record on PayPal to increase the chances of being approved.

- Have a stable income : Users must have a stable income to repay the loan.

Conclusion

PayPal Loan is a fast and easy online loan solution, which can help PayPal users who need additional funds. With a fast application process, funds that can be accessed quickly, and competitive interest, PayPal Loan can be a good choice for those who need a loan. However, keep in mind that PayPal Loan has several disadvantages, such as high interest fees and limited loan limits. Therefore, users should consider the advantages and disadvantages of PayPal Loan before applying for a loan.

Benefits and Limitations of Using PayPal Loan

Benefits and Limitations of Using PayPal Loans

PayPal Loans, a personal loan-like service offered by fintech company PayPal, provides a convenient alternative for individuals who need fast funds. However, just like other financial products, this loan has its own advantages and disadvantages.

Profit:

Easy Application Process: You can apply for a PayPal loan online in just a few minutes, without having to undergo a complicated credit check.

Fast Disbursement: Once approved, funds will be transferred to your PayPal account within a few business days.

Flexible: PayPal Loans offers a variety of loan options, from $100 to $20,000, with flexible repayment terms.

No Onboarding Fees: There are no closing fees or onboarding fees associated with PayPal loans, saving you money.

Building Credit: Making PayPal loan payments on time can help you build or improve your credit score.

Restrictions:

High Interest Rates: PayPal loans incur relatively high interest rates, which can weigh on the overall cost of your loan.

Short Repayment Terms: PayPal loan repayment terms are relatively short, typically ranging from six to twelve months, which may limit your ability to repay them.

Not Available to Everyone: PayPal Loans may not be available to everyone, as eligibility criteria may vary depending on factors such as your credit history and overall financial status.

Impact on Credit Score: If you fail to make your PayPal loan payments on time, it can have a negative impact on your credit score.

Late Fees: PayPal Loans charges high late fees if you miss a payment, which can further increase the cost of your loan.

Conclusion

PayPal loans offer an easy and convenient way to get fast funds, but it’s important to weigh the benefits and limitations carefully before applying for a loan. If you have a good credit score and need funds in the short term, a PayPal loan may be an option worth considering. However, if you have a low credit score or need a long-term loan, you should explore other options with lower interest rates and more flexible repayment terms.