PayPal and Other Alternatives: Understanding Online Payment Options

In the last few decades, online payment technology has developed rapidly, allowing us to make transactions more easily and quickly. One of the most recognized names in the online payments industry is PayPal. However, with the increasing number of options available, you may be wondering about other alternatives. In this article, we’ll talk about PayPal and some other alternatives, so you can make a better decision about which online payment option is right for you.

What is PayPal?

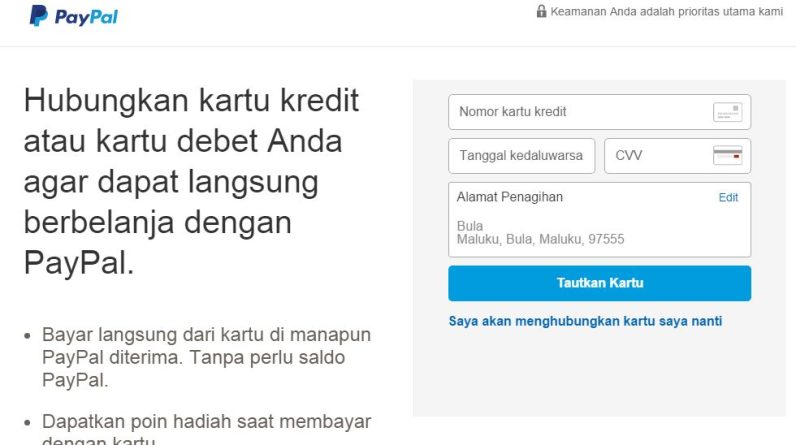

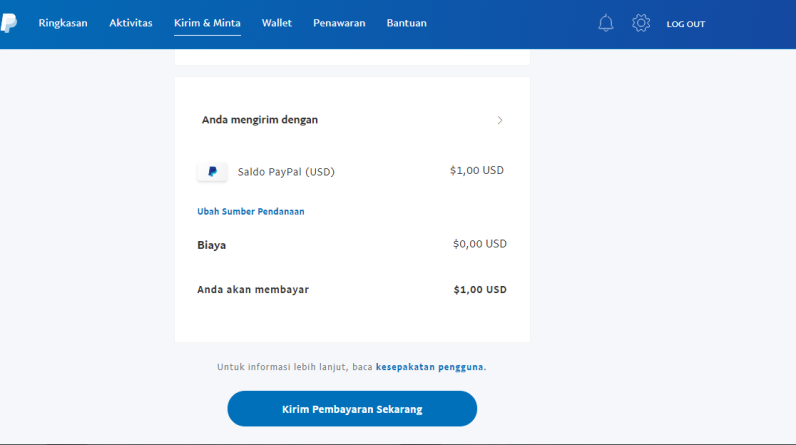

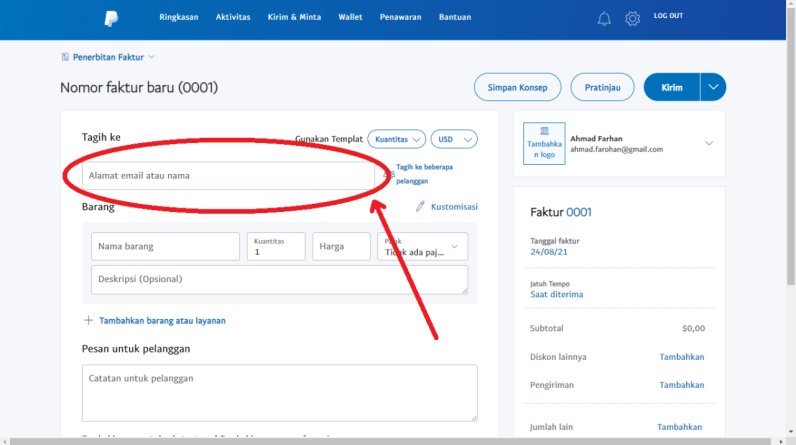

PayPal is an online payment service that allows users to make online transactions safely and easily. With PayPal, you can make payments to sellers, send money to friends or family, and receive payments from customers. PayPal was founded in 1998 and has since become one of the largest online payment services in the world.

PayPal Features

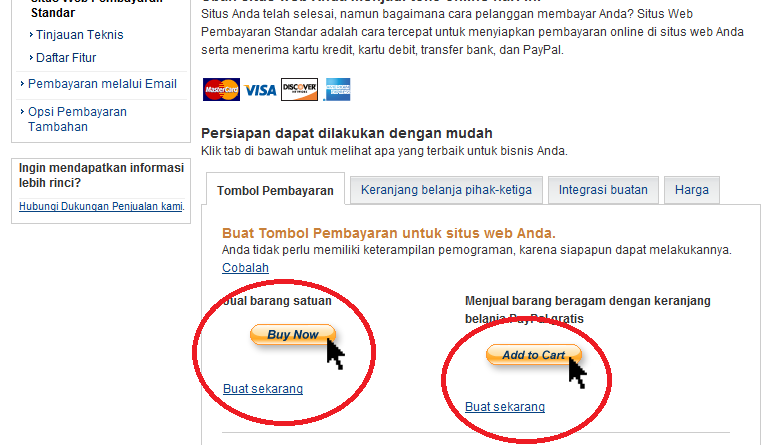

PayPal has several features that make it a popular choice among users. Some of these features include:

- Security : PayPal has a sophisticated security system to protect user data and transactions.

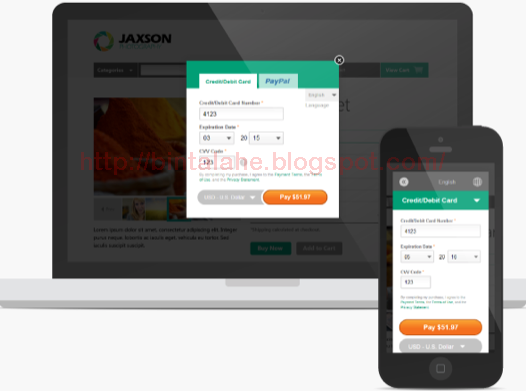

- Easy to use : PayPal has an easy-to-use interface, so you can make transactions quickly and easily.

- Can be used anywhere : PayPal can be used anywhere in the world, as long as you have an internet connection.

- Can be used with multiple currencies : PayPal can be used with multiple currencies, so you can make transactions with users from other countries.

PayPal Alternative

Although PayPal is one of the largest online payment services in the world, there are several other alternatives that you can consider. Some of these alternatives include:

1. Stripe

Stripe is an online payment service that allows users to make online transactions safely and easily. Stripe has similar features to PayPal, but with some differences. Some of Stripe’s advantages include:

- Lower transaction fees : Stripe has lower transaction fees compared to PayPal.

- Integration with e-commerce : Stripe can be integrated with popular e-commerce platforms such as Shopify and WooCommerce.

- Can be used with multiple currencies : Stripe can be used with multiple currencies, so you can make transactions with users from other countries.

2. Square

Square is an online payment service that allows users to make transactions online safely and easily. Square has similar features to PayPal, but with some differences. Some of Square’s advantages include:

- Lower transaction fees : Square has lower transaction fees compared to PayPal.

- Integration with e-commerce : Square can be integrated with popular e-commerce platforms such as Shopify and WooCommerce.

- Can be used with multiple currencies : Square can be used with multiple currencies, so you can make transactions with users from other countries.

3. Google Pay

Google Pay is an online payment service that allows users to make online transactions safely and easily. Google Pay has similar features to PayPal, but with some differences. Some of the advantages of Google Pay include:

- Lower transaction fees : Google Pay has lower transaction fees compared to PayPal.

- Integration with e-commerce : Google Pay can be integrated with popular e-commerce platforms such as Shopify and WooCommerce.

- Can be used with multiple currencies : Google Pay can be used with multiple currencies, so you can make transactions with users from other countries.

4. AmazonPay

Amazon Pay is an online payment service that allows users to make online transactions safely and easily. Amazon Pay has similar features to PayPal, but with some differences. Some of the advantages of Amazon Pay include:

- Lower transaction fees : Amazon Pay has lower transaction fees compared to PayPal.

- Integration with e-commerce : Amazon Pay can be integrated with popular e-commerce platforms such as Shopify and WooCommerce.

- Can be used with multiple currencies : Amazon Pay can be used with multiple currencies, so you can make transactions with users from other countries.

Conclusion

PayPal is one of the world’s largest online payment services, but there are several other alternatives you can consider. Stripe, Square, Google Pay, and Amazon Pay are some examples of alternatives you can consider. When choosing an online payment service, make sure you consider features such as transaction fees, integration with e-commerce, and security. This way, you can make a better decision about which online payment option is right for you.