PayPal Debit Card is a debit card that allows you to access the money in your PayPal account. This card is accepted wherever Visa debit cards are accepted, both online and in brick-and-mortar stores.

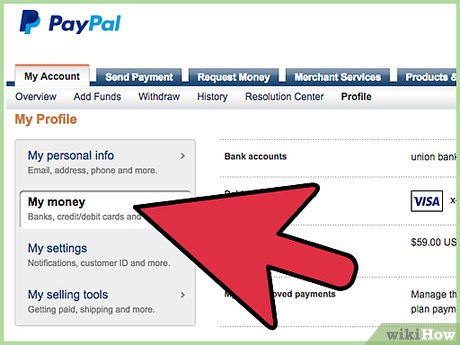

To use a PayPal Debit Card, you must first associate it with your PayPal account. You can do this by logging into your PayPal account and clicking on the “Wallet” tab. Then, click “Add Card” and follow the instructions to associate your debit card.

Once your debit card is associated, you can use it to shop in stores, withdraw cash from ATMs, and make online purchases. When you use a debit card, the money will be debited from your PayPal account.

Apart from making transactions directly, you can also use PayPal Debit Card with PayPal Key. PayPal Key is a technology that allows you to make purchases in physical stores without having to enter a PIN or sign a receipt. To use PayPal Key, you must activate it in the PayPal app and then add your debit card.

When you use PayPal Key to shop, you simply hold your debit card close to the payment terminal. The purchase amount will then be debited from your PayPal account. PayPal Key is a fast, easy and secure way to make payments in stores.

PayPal Debit Card is a convenient way to access the money in your PayPal account. This card can be used for shopping, withdrawing cash and making online purchases. You can also use a PayPal Debit Card with a PayPal Key to make payments in physical stores without having to enter a PIN or sign a receipt.

What is a PayPal Debit Card?

So, what is a PayPal Debit Card? In short, it’s a debit card linked to your PayPal account. This allows you to make purchases from any store that accepts Visa or Mastercard cards, even if you don’t have a balance in your connected bank account.

Now that we know the basics, let’s dig deeper into how these cards work. When you use a PayPal Debit Card, funds for your purchases will be immediately withdrawn from your PayPal balance. However, if your PayPal balance is insufficient, the card will automatically withdraw funds from the bank account linked to your PayPal account.

It’s quite easy to get this card. All you need to do is have a PayPal account with verified status. You must also live in a country where PayPal Debit Card is available. The card application process is usually quick and easy, and you can track the status online.

Fees for using a PayPal Debit Card vary depending on the type of transaction. For example, there are no fees for using the card to make purchases online or in stores. However, there are fees for making cash withdrawals at ATMs, and there are also fees for reloading cards from bank accounts that are not linked to your PayPal account.

Now, let’s talk about the benefits of using PayPal Debit Card. One of the main benefits is convenience and comfort. You can use this card anywhere Visa or Mastercard cards are accepted, meaning you don’t need to carry cash or a traditional credit card. Apart from that, this card is also safe because it is protected by advanced encryption technology.

Another benefit is the ability to track your expenses easily. Every time you use your PayPal Debit Card, you will receive an email notification to notify you of the transaction. You can also access your transaction history online or through the PayPal mobile app.

Although there are many benefits to using a PayPal Debit Card, there are a few things you need to pay attention to. For example, this card cannot be used to make cash withdrawals from your connected bank account. Additionally, you should make sure to have sufficient funds in your PayPal account to cover the purchase before using the card.

Overall, PayPal Debit Card is a convenient and safe financial tool that can make your life easier. If you frequently shop online or in stores, you may want to consider getting this card. However, it’s important to know the fees and limitations associated with the card before you sign up.

PayPal Debit Card: Advanced Digital Financial Integration

In recent years, digital financial technology has developed rapidly, allowing users to make transactions more easily and safely. One example of this innovation is the PayPal Debit Card, which is a digital debit card issued by the world’s largest online payment company, PayPal. In this article, we will discuss more about the PayPal Debit Card, the features it offers, and how it can help users manage their finances.

What is a PayPal Debit Card?

PayPal Debit Card is a digital debit card that allows users to make online and offline transactions using their PayPal balance. This card can be activated and used via the PayPal app, which is available for mobile and desktop devices. With PayPal Debit Card, users can make digital payments, both for online and offline transactions, without the need to use a traditional credit or debit card.

PayPal Debit Card Features

PayPal Debit Card offers several sophisticated features and makes it easier for users to carry out transactions. Here are some of the key features offered by this card:

- Online and Offline Payments : With PayPal Debit Card, users can make payments online and offline, without the need to use a traditional credit or debit card.

- Access PayPal Balance : This card allows users to access their PayPal balance directly, so they can make transactions more quickly and easily.

- High Security : PayPal Debit Card is equipped with advanced security technology, such as data encryption and two-factor verification, to ensure that user transactions are safe and secure.

- Receiving Gifts : Users can receive rewards and promotions from PayPal, such as cashback and discounts, when they use this card to make transactions.

- Transaction Limit Settings : Users can set their daily or monthly transaction limits, so they can control their card usage.

- Transaction Notification : This card provides real-time transaction notifications, so users can monitor their transactions more easily.

How to Use PayPal Debit Card

Using a PayPal Debit Card is quite easy and simple. Here are some steps to follow:

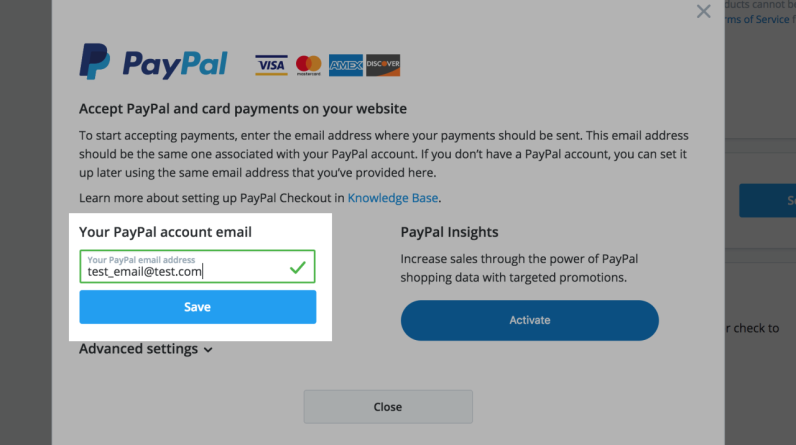

- Card Activation : First, users need to activate their card via the PayPal app.

- Information Verification : Users need to verify their information, such as email address and phone number, to ensure that their card is active.

- Set Transaction Limits : Users can set their daily or monthly transaction limits to control their card usage.

- Make Transactions : When users want to make transactions, they can use PayPal Debit Card to pay online or offline.

Advantages of PayPal Debit Card

PayPal Debit Card has several advantages that make it a popular choice among users. Here are some of the main advantages:

- Comfort : This card allows users to make transactions digitally, so they don’t need to carry a traditional credit or debit card.

- Security : This card is equipped with sophisticated security technology, so users can feel safe when making transactions.

- Flexibility : This card can be used online and offline, so users can make transactions more easily.

- Cost Savings : This card has no annual fees or high transaction fees, so users can save on fees.

Disadvantages of PayPal Debit Card

Although PayPal Debit Card has several advantages, it also has several disadvantages that need to be considered. Here are some of the main drawbacks:

- Limitations : This card can only be used with PayPal balance, so users need to have sufficient balance to make transactions.

- Cost : This card has fees for several types of transactions, such as international transactions or transactions that exceed the daily transaction limit.

- Application Dependencies : This card can only be activated and used through the PayPal app, so users who do not have a mobile or desktop device cannot use this card.

Conclusion

PayPal Debit Card is a sophisticated digital debit card that makes it easy for users to carry out online and offline transactions. With advanced features, such as PayPal balance access, high security, and gift acceptance, this card is a popular choice among users. Even though it has several drawbacks, this card is still a good choice for users who want to make digital transactions more easily and safely.

Benefits and Features of PayPal Debit Card

The PayPal Debit Card is a practical and versatile financial tool that allows you to access your PayPal balance in retail stores and online. With a variety of benefits and features on offer, this card is worth considering for anyone who wants to manage their finances better.

One of the main advantages of the PayPal Debit Card is its convenience. You don’t need to carry extra cash or credit cards, as this card can be used to make purchases anywhere that accepts MasterCard. Plus, you can easily manage your balance and transactions online or through the PayPal mobile app.

The PayPal Debit Card also offers a number of security features to protect your finances. This card is equipped with an EMV chip that uses encryption technology to prevent fraud. You can also set transaction notifications and freeze your card instantly in case of loss or theft.

Another advantage of the PayPal Debit Card is its ability to help you save. You can earn cash back on certain purchases, and you’re entitled to exclusive discounts from a number of merchant partners. Additionally, this card has no monthly fees or foreign transaction fees, saving you money in the long run.

The PayPal Debit Card also allows you to better control your spending. You can set daily or weekly transaction limits, and you will receive notifications whenever you approach those limits. This way, you can avoid overspending and stay within your budget.

Apart from the benefits mentioned above, PayPal Debit Card also has several other advantages. You can use it to withdraw cash at ATMs, make automatic recurring payments, and send money to friends and family. With its flexibility and ease of use, the PayPal Debit Card is the right choice for anyone who wants to manage their finances more effectively and comfortably.