PayPal Pay in 3: Easy Payment in 3 Installments

In recent years, online payment methods have grown rapidly, giving consumers more options for making online transactions. One payment method that is becoming increasingly popular is PayPal Pay in 3, which allows consumers to make payments in 3 installments. In this article, we’ll discuss more about PayPal Pay in 3, including how it works, its advantages and disadvantages, and how to use this payment method.

What is PayPal Pay in 3?

PayPal Pay in 3 is a payment method offered by PayPal, one of the largest online payment companies in the world. This payment method allows consumers to make payments in 3 installments, without interest or additional fees. With PayPal Pay in 3, consumers can make purchases more conveniently and flexibly, because they don’t have to pay the entire amount at once.

How PayPal Pay in 3 Works

The way PayPal Pay in 3 works is very simple. Following are the steps that need to be followed:

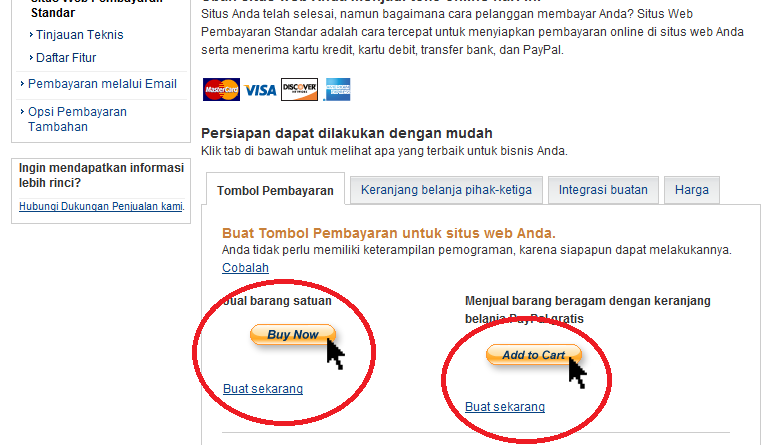

- Select Goods or Services: Consumers choose the goods or services they want to purchase from online sellers who accept PayPal Pay in 3.

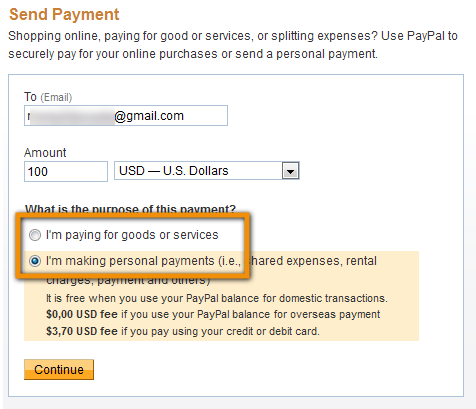

- Select Payment Method: Consumers select PayPal Pay in 3 as their payment method.

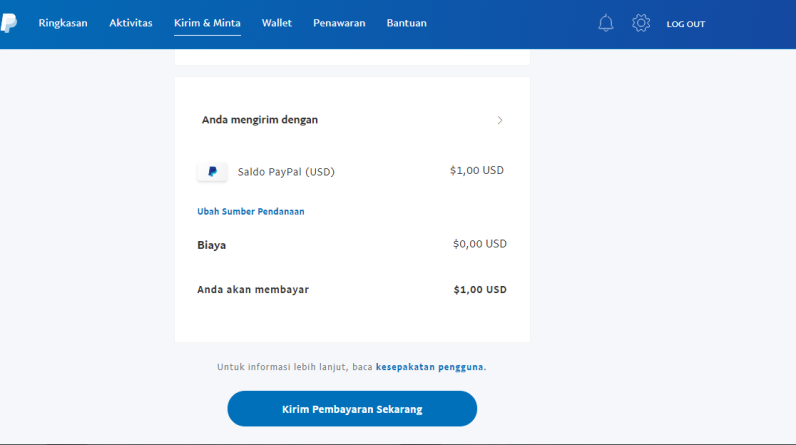

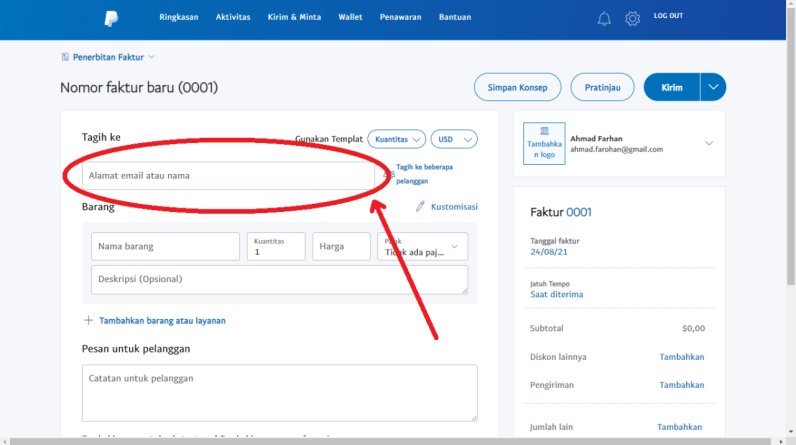

- Enter Payment Information: Consumers enter payment information, including email address and PayPal password.

- Payment Confirmation: Consumers confirm payment and receive information about the number of installments to be paid.

- Pay Installments: Consumers pay the first installment immediately after payment confirmation, and the next two installments will be paid automatically every month.

Advantages of PayPal Pay in 3

PayPal Pay in 3 has several advantages that make it a popular payment method. Here are some of these advantages:

- Ease of Payment : PayPal Pay in 3 allows consumers to make payments more conveniently and flexibly.

- No Interest or Additional Fees : PayPal Pay in 3 has no interest or additional fees, so consumers don’t have to worry about additional fees.

- Security : PayPal Pay in 3 uses advanced security technology to protect consumer payment information.

- Flexibility : PayPal Pay in 3 allows consumers to make payments in 3 installments, so they can better manage their budget.

Disadvantages of PayPal Pay in 3

Although PayPal Pay in 3 has several advantages, it also has several disadvantages. Here are some of these shortcomings:

- Availability : PayPal Pay in 3 is only available in some countries, so not all consumers can use this payment method.

- Transaction Limitations : PayPal Pay in 3 has transaction limitations, so consumers cannot make transactions that are too large.

- Payment Time : PayPal Pay in 3 has a fixed payment time, so consumers must pay installments at the specified time.

How to Use PayPal Pay in 3

To use PayPal Pay in 3, consumers need to take the following steps:

- Create a PayPal Account : Consumers need to create a PayPal account to use PayPal Pay in 3.

- Select a Seller that Accepts PayPal Pay in 3 : Consumers need to choose an online seller that accepts PayPal Pay in 3.

- Select Payment Method : Consumers need to select PayPal Pay in 3 as the payment method.

- Follow the Payment Steps : Consumers need to follow the payment steps described above.

Conclusion

PayPal Pay in 3 is a payment method that allows consumers to make payments in 3 installments. This payment method has several advantages, such as ease of payment, no interest or additional fees, and security. However, it also has several disadvantages, such as limited availability and transaction limitations. By understanding how it works and the advantages and disadvantages of PayPal Pay in 3, consumers can use this payment method more effectively and efficiently.