PayPal, the global payments giant, has entered the Kenyan market, offering various lucrative benefits to users in the country. Here, we’ll explore some of the key advantages of using PayPal in Kenya:

Easy Money Transfers: PayPal makes it easy to transfer money internationally, allowing users to send and receive funds instantly to and from other PayPal accounts. Additionally, PayPal supports multiple currencies, making cross-border transactions easier.

Security: PayPal is known for its stringent security measures, providing peace of mind for users. All transactions are encrypted and closely monitored, minimizing the risk of fraud and protecting users’ financial information.

Low Transaction Fees: Compared to traditional money transfer methods, PayPal offers competitive transaction fees. Fees vary depending on the type of transaction and currency involved, but are generally lower than bank fees or other money transfer services.

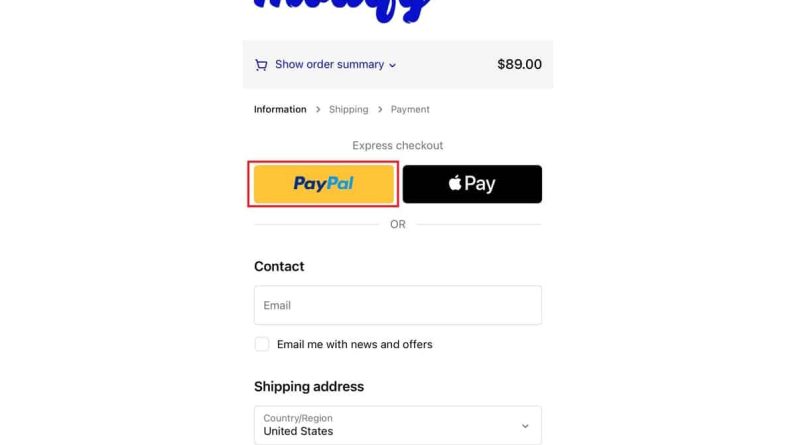

Convenient Online Shopping Payment: PayPal is a widely accepted payment method on websites and online stores worldwide. It provides a fast, easy and secure way to shop online, providing extra convenience for Kenyan shoppers.

Business Benefits: For Kenyan business owners, PayPal opens up new opportunities to reach international customers. By accepting PayPal payments, businesses can expand their market, take orders from customers all over the world, and increase revenue.

Reliable Customer Support: PayPal has a responsive and knowledgeable customer support team available 24/7 to help users with any issues or questions. Support is available via email, phone, or live chat, providing convenience and peace of mind.

With all these benefits, PayPal is poised to revolutionize the way Kenyan users transfer money, make online payments and grow their businesses. Users can leverage PayPal’s security, convenience and global reach to enhance their financial experience in the digital age.

Introduction of PayPal in Kenya

Kenya welcomes PayPal, the global payments giant, which is now coming to the country to shake up the financial industry. PayPal’s entry marks an important milestone for Kenyan consumers and businesses, paving the way for easier, faster and more secure transactions.

PayPal’s move into Kenya is a strategic move aimed at capitalizing on a fast-growing market. The country has experienced significant economic growth in recent years, and the number of internet users continues to increase. Additionally, the growing interest in digital payments provides a great opportunity for PayPal to expand its reach.

With PayPal, Kenyan consumers can now make online payments easily and securely. The platform provides various payment options, including credit cards, debit cards, and bank accounts. Simplified payment processes make it easier for consumers to purchase goods and services from merchants around the world.

In addition to convenience, PayPal also offers fraud protection and unmatched security. Its sophisticated system scans transactions in real-time to detect suspicious activity, providing peace of mind for users. Customer assistance available 24/7 also provides reliable support for any questions or problems.

For Kenyan businesses, PayPal presents new opportunities to connect with customers around the world. With easy payment platform integration, businesses can accept payments from international customers quickly and efficiently. This paves the way for growth and expansion, enabling Kenyan businesses to compete on the global stage.

Additionally, PayPal encourages financial inclusion by providing access to financial services for those who may not have access to traditional banking. By enabling digital transactions, PayPal expands the reach of the financial system, empowering underserved individuals and businesses.

PayPal’s entry into Kenya is an important development that will shape the future of the country’s financial industry. With its combination of convenience, security and opportunity, PayPal is poised to revolutionize the way consumers and businesses conduct transactions, driving economic growth and opening a new chapter in Kenya’s digital payments landscape.

PayPal Kenya: Safe and Easy Online Payment Solution

PayPal is one of the world’s largest online payment platforms, allowing users to make online transactions safely and easily. In Kenya, PayPal has become one of the top choices for people who want to make online transactions, be it to shop online, pay bills or send money to other people.

In this article, we’ll talk about PayPal Kenya, including the pros and cons of using PayPal, how to sign up for and use PayPal, as well as some tips and tricks for making the most of PayPal in Kenya.

Advantages of Using PayPal

PayPal has several advantages that make it one of the top choices for people in Kenya. Here are some of the advantages of using PayPal:

- Safe : PayPal uses advanced security technology to protect online transactions, so users can be confident that their transactions are safe and reliable.

- Easy : PayPal is very easy to use, both for making online transactions and managing accounts.

- Wide : PayPal can be used in various countries, including Kenya, so users can make online transactions easily.

- Lots of choices : PayPal offers several payment method options, including credit card, debit, and bank account.

Disadvantages of Using PayPal

While PayPal has several advantages, there are also some disadvantages to consider. Here are some disadvantages of using PayPal:

- Cost : PayPal charges relatively high transaction fees, especially if the transaction is made using a credit card.

- Limitation : PayPal has relatively low transaction limits, so users cannot make online transactions of large amounts.

- Verification : PayPal has a relatively long verification process, so users have to wait several days to be able to use their account.

How to Register for PayPal

Registering for PayPal is very easy and can be done in the following steps:

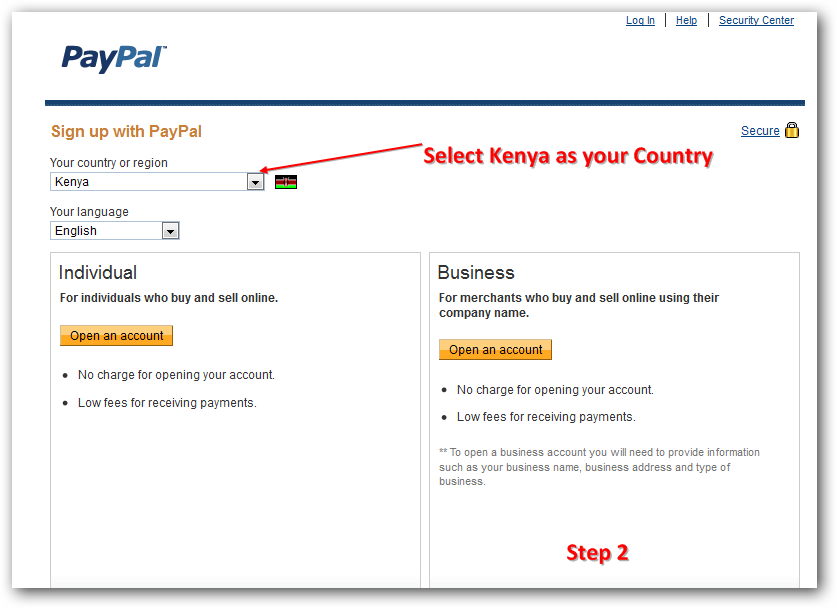

- Go to the PayPal Website : Go to the PayPal website at the address www.paypal.com .

- Select Country : Select the country where you live, namely Kenya.

- Enter Information : Enter your basic information, such as name, email address, and password.

- Verify Email Address : Verify your email address by clicking the verification link sent by PayPal to your email address.

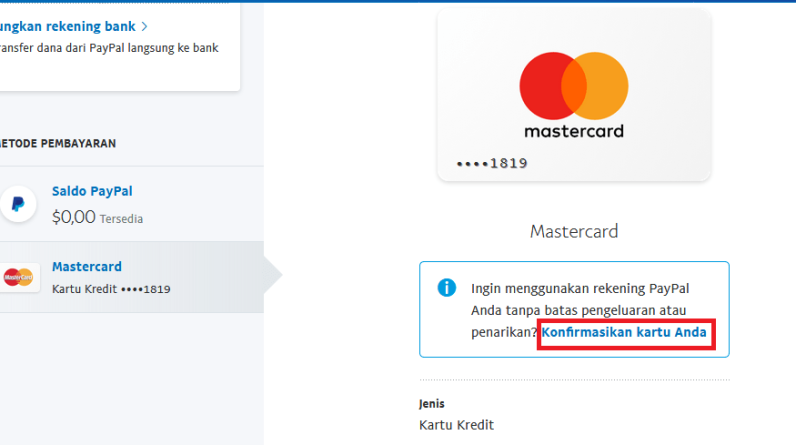

- Add a Credit or Debit Card : Add your credit or debit card to be able to make online transactions.

- Credit or Debit Card Verification : Verify your credit or debit card by clicking the verification link sent by PayPal to your email address.

How to Use PayPal

Using PayPal is very easy and can be done in the following steps:

- Login to PayPal Account : Log in to your PayPal account using your password and email address.

- Select Transaction : Select the transaction you want to make, such as making an online payment or sending money to someone else.

- Enter Information : Enter transaction information, such as transaction value and recipient email address.

- Transaction Confirmation : Confirm your transaction by clicking the “Pay” or “Send” button.

- Transaction Verification : Verify your transaction by clicking the verification link sent by PayPal to your email address.

Tips and Tricks for Using PayPal

Here are some tips and tricks for making the most of PayPal in Kenya:

- Use a Debit Card : Use a debit card to make online transactions, because transaction fees are lower than credit cards.

- Account Verification : Verify your PayPal account to be able to make online transactions with greater value.

- Use PayPal Mobile : Use PayPal Mobile to make online transactions more easily and quickly.

- Save Information : Save your transaction information to be able to make online transactions more quickly and easily.

- Check Fees : Check transaction fees before making online transactions to save costs.

Conclusion

PayPal is one of the world’s largest online payment platforms, allowing users to make online transactions safely and easily. In Kenya, PayPal has become one of the top choices for people who want to make online transactions. With several advantages and disadvantages, PayPal can be a safe and easy online payment solution for users in Kenya.

PayPal’s Impact on Kenya’s Digital Economy

The introduction of PayPal in Kenya has shaken the landscape of its digital economy, having a significant impact on its growth and development. As a leading online payments platform, PayPal has facilitated cross-border trade, opening up opportunities for Kenyan businesses to reach global markets.

PayPal’s secure and efficient payment system has increased consumer confidence in online transactions, creating a more conducive environment for shopping and investing. As a result, e-commerce is growing rapidly, opening new jobs and driving economic growth.

Additionally, PayPal’s integration with social media platforms and other e-commerce platforms has created a comprehensive digital payments ecosystem. Users can now make payments seamlessly from the comfort of their home or office, making the process of shopping and making payments more convenient and efficient.

PayPal’s impact on Kenya’s digital economy also extends beyond the e-commerce sector. The platform has empowered small businesses and entrepreneurs by providing access to overseas markets, growing export opportunities and increasing revenue. By removing geographic barriers, PayPal has enabled Kenyan entrepreneurs to compete globally.

Furthermore, the availability of PayPal as a payment method has increased international confidence in Kenyan businesses. Global shoppers can now conduct transactions with confidence, knowing that their payments are processed through a secure and trusted system. This has enhanced Kenya’s reputation as a business-friendly destination, attracting foreign investment and driving economic growth.

The introduction of PayPal in Kenya is a testament to the power of technology to change the economic landscape. Its impact on cross-border trade, e-commerce and consumer confidence has been a catalyst for growth and development, paving the way for a more digital and prosperous future for this East African country.