Feasibility of building PayPal-like systems in Python

Building a system like PayPal can be a daunting task, but is it possible using Python? The answer is yes, but it is not without its challenges.

Python is an excellent language for building complex web applications due to its simple syntax and wide range of libraries. However, building a payment system like PayPal requires secure financial handling and reliable transaction processing.

To overcome this challenge, we can use third-party libraries such as Django Payments or Stripe. This library provides integrated support for processing payments, managing subscriptions, and handling refunds. By using this library, we can focus on building the main features of our application rather than implementing complex financial infrastructure.

In addition to processing payments, systems like PayPal often require additional features such as user account management, identity verification, and fraud prevention. We can use libraries like Django User Management or Flask-Security to implement this feature securely.

However, it is important to remember that building a system like PayPal is a complex and time-consuming task. We must have a strong understanding of security, transaction processing, and regulatory compliance. Additionally, we need to test our applications thoroughly to ensure that they are secure and reliable.

Despite the challenges, building a system like PayPal using Python is well worth it. By using the right libraries and tools, we can create a secure, efficient, and user-friendly payment system.

So, if we want to build a flexible and scalable payment system, using Python and leveraging third-party libraries can be a great option. However, we must always put security and compliance first in our design and implementation.

Key technologies used to develop PayPal

Building a PayPal-like system in Python is possible thanks to a combination of core technologies that help it operate its powerful financial platform. Behind the scenes, Python plays a critical role in managing transactions, processing payments, and maintaining security.

One of the important components is the Django framework, which provides a powerful platform for web development. With Python, Django facilitates the creation of agile and trustworthy web applications, ideal for handling the complexity of financial transactions.

Additionally, Python seamlessly integrates with third-party payment-focused libraries. For example, Stripe’s library provides comprehensive APIs for processing payments, including credit cards, debit cards, and e-wallets. This integration allows developers to quickly add payment processing functionality into their systems.

Security is a major consideration in any payment system. Python supports a variety of cryptographic libraries that provide powerful tools for encrypting sensitive data, such as credit card numbers and account information. This library helps secure data as it is stored and transmitted, giving users peace of mind.

Additionally, Python offers a variety of options for monitoring and logging. By leveraging frameworks like Sentry or Loguru, developers can track and debug errors effectively, ensuring the system runs smoothly and responsively.

In addition to these core technologies, Python also benefits from an active developer community and extensive ecosystem of third-party packages. This allows developers to build on a solid foundation, saving time and minimizing potential problems.

By leveraging these core technologies, Python provides a strong foundation for building reliable, secure, and scalable PayPal-like systems. From web development to payment processing and security, Python offers all the tools needed to create payment solutions that meet the needs of modern users.

Python’s role in payment processing systems like PayPal

Is it possible to build a system like PayPal using Python? The answer is a resounding yes!

Python has comprehensive libraries and frameworks for web development, payment processing, and data encryption. Flask or Django, for example, are great for building user interfaces and backend APIs, while Stripe or Braintree provide easy integration for payment processing.

Additionally, Python is known for its strong security. Libraries such as Cryptography and PyOpenSSL enable data encryption and digital signature generation, ensuring the protection of sensitive user data, such as credit card information.

Although Python is an interpreted language, which can be considered slower than compiled languages, this problem can be overcome by using Cython or Numba to compile Python code into faster machine code.

Let’s look at the main components of a system like PayPal that can be built with Python:

User interface: Flask or Django can be used to create an easy to use and responsive user interface.

Payment processing: Stripe or Braintree handles payment processing, enabling integration with payment gateways and transaction management.

Encryption and security: Libraries like Cryptography and PyOpenSSL ensure data encryption and transaction security.

User management: Frameworks such as Flask-Login or Django-Allauth can manage users, including registration, authentication, and account management.

Building a system like PayPal using Python requires expertise in web development, payment processing, and security. However, with available libraries and frameworks, the process can be significantly simplified.

By leveraging Python, businesses and developers can build secure, reliable, and cost-effective payment processing systems, similar to PayPal.

Could something like PayPal be coded in Python?

Can a System like PayPal be Built in Python?

Python is one of the most popular programming languages and is widely used in the development of web applications and digital financial systems. A frequently asked question is: can a system like PayPal be built in Python?

In this article, we will explore the capabilities of Python and related technologies for building online payment systems like PayPal. We will discuss the advantages and disadvantages of using Python in developing digital financial systems, as well as examples of projects that have been successfully created with Python.

What is PayPal?

PayPal is an online payment system that allows users to carry out financial transactions online. Using PayPal, users can make payments, receive payments, and manage their balance easily. PayPal uses advanced technology to ensure the security and integrity of transactions.

Python Capabilities in Digital Financial System Development

Python has several capabilities that make it suitable for the development of digital financial systems, such as:

- Web Development : Python has popular web frameworks such as Django and Flask, which enable fast and effective web application development.

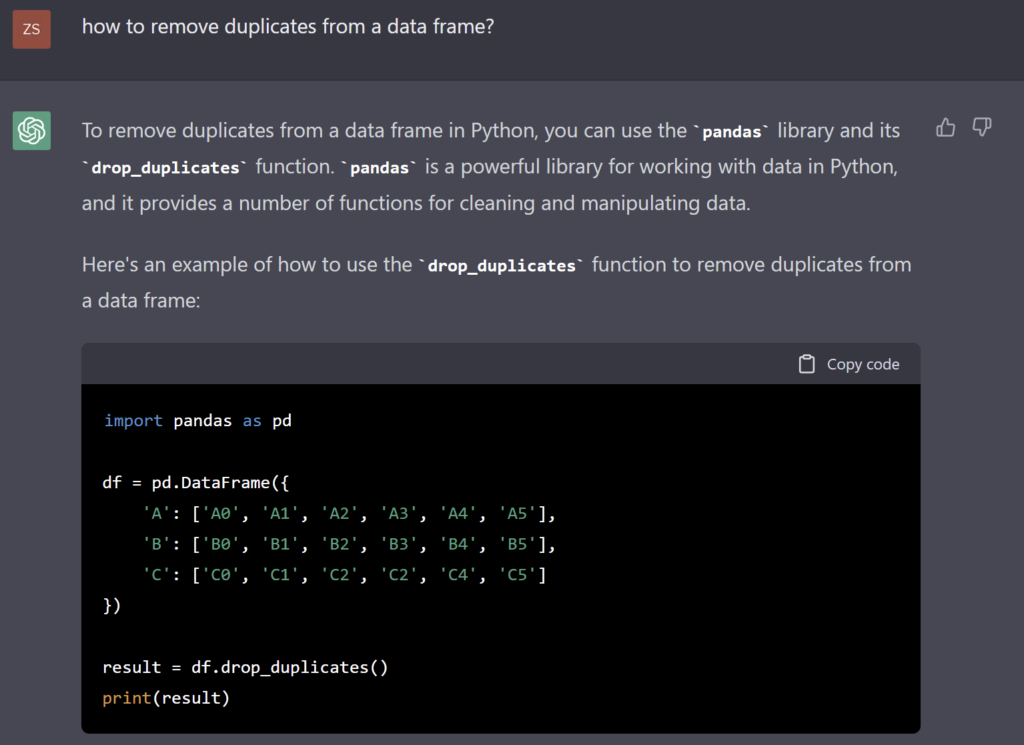

- Data processing : Python has powerful libraries for data processing, such as Pandas and NumPy, which enable the development of applications that can process financial data effectively.

- Integration with Financial Systems : Python can be integrated with existing financial systems, such as online payment systems and institutional financial systems.

- Security : Python has libraries and frameworks that can help improve the security of digital financial systems, such as Flask-Security and Django-Secure.

Advantages of Using Python in Digital Financial System Development

Here are some of the advantages of using Python in developing digital financial systems:

- Fast and Effective : Python enables fast and effective application development, so it can support dynamic business needs.

- Low Cost : Python is an open-source programming language, so it can help reduce the costs of developing digital financial systems.

- Active Community : Python has an active and large community, so it can help develop digital financial systems more easily.

- Support for Web Application Development : Python has a popular web framework, so it can help develop complex web applications.

Disadvantages of Using Python in Digital Financial System Development

Following are some of the disadvantages of using Python in developing digital financial systems:

- Security : Python has several shortcomings in terms of security, so it is necessary to increase security when developing digital financial systems.

- Data processing : Python has several shortcomings in processing big data, so it is necessary to improve data processing when developing digital financial systems.

- Support for Financial Systems : Python has some shortcomings in terms of support for existing financial systems, so it is necessary to improve support when developing digital financial systems.

Examples of Projects That Have Been Successfully Created with Python

Here are some examples of projects that have been successfully created with Python in developing digital financial systems:

- Stripe : Stripe is an online payment system built in Python. Stripe uses the Django web framework for web application development.

- Square : Square is an online payment system built in Python. Square uses the Flask web framework for web application development.

- PayPal : PayPal uses Python as a programming language in developing online payment systems.

Conclusion

In conclusion, Python can be used for the development of digital financial systems such as PayPal. Python has several capabilities that make it suitable for developing digital financial systems, such as web development, data processing, integration with financial systems, and security. However, it is necessary to improve security and data processing when developing digital financial systems with Python. Thus, Python can be one of the right programming language choices for developing digital financial systems.