How to use PayPal Credit for ATM withdrawals

Have you ever been in a situation where you need cash but don’t have access to your bank account? PayPal Credit is here to save you! This convenient feature allows you to withdraw cash from ATMs using your PayPal Credit debit card. This is a quick and easy solution when you need cash directly.

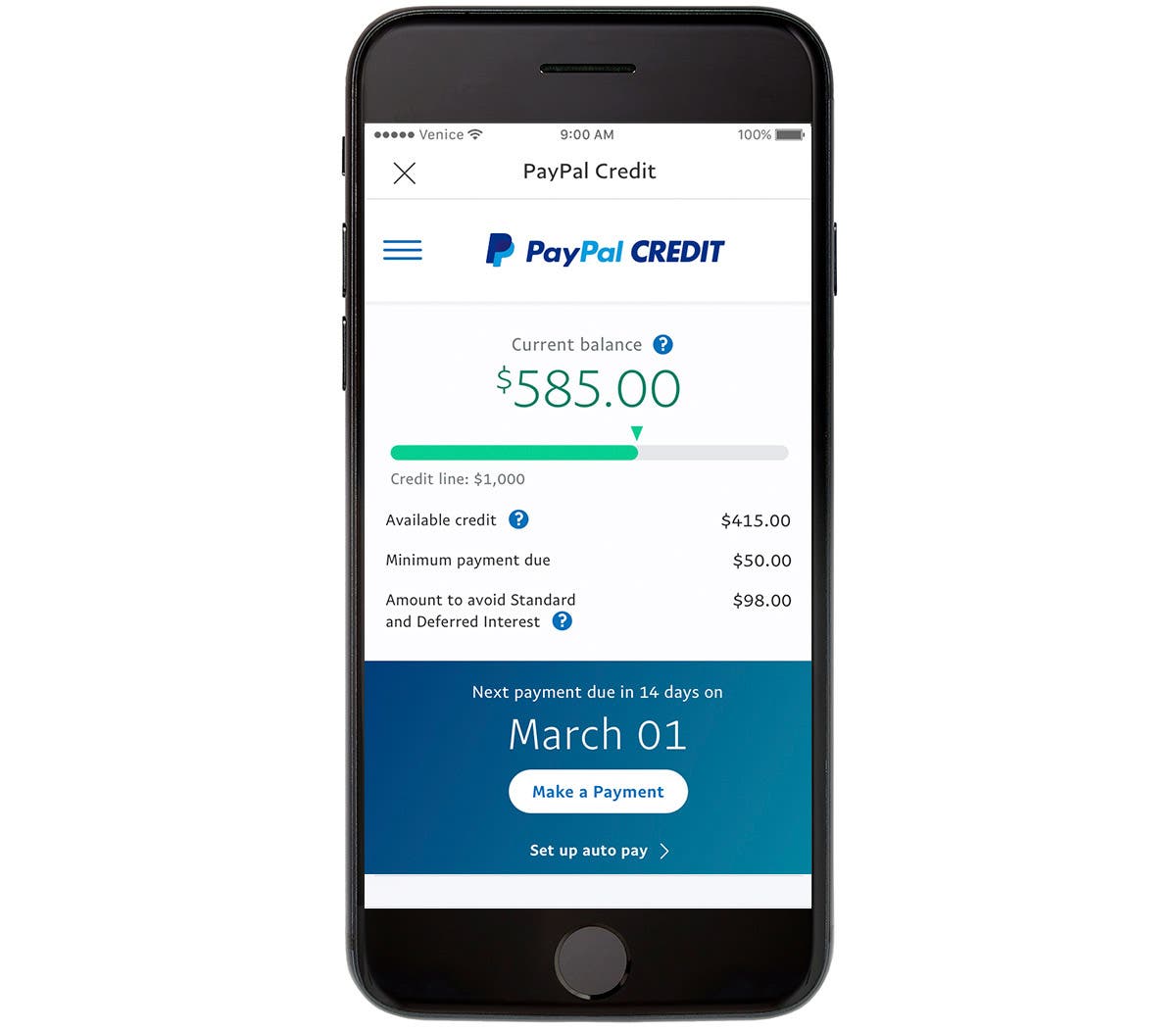

The way it works is very simple. First, you need to make sure you have an available balance in your PayPal Credit account. You can check your balance by logging into your PayPal account online. If you have enough balance, you can head to any ATM that accepts Visa debit cards.

Once you’re at the ATM, simply insert your PayPal Credit debit card and enter your PIN. You can then choose the amount of money you want to withdraw. Keep in mind that there will be cash withdrawal fees, so be sure to check them before completing the transaction.

Once you confirm the amount to withdraw, the ATM will dispense your cash. Most ATMs have daily withdrawal limits, so if you need to withdraw a large amount of cash, you may need to visit multiple ATMs.

One of the main benefits of using PayPal Credit for ATM withdrawals is that you can access your cash at any time. It doesn’t matter if your bank is closed or you don’t have internet access. As long as you have a PayPal Credit debit card, you can withdraw cash whenever you need it.

However, it’s important to remember that ATM withdrawals using PayPal Credit are considered a cash advance. This means interest charges and additional fees will be charged to your balance. Therefore, it is important to only use ATM withdrawals for emergencies or when you really need cash.

Additionally, you should be aware that not all ATMs accept PayPal Credit debit cards. It’s best to contact your bank or ATM operator before attempting to make a withdrawal to ensure that your card is accepted.

In conclusion, PayPal Credit is a fast and convenient way to access cash when you need it. However, it is important to use them wisely and understand the fees associated with ATM withdrawals. By following the steps outlined above, you can utilize PayPal Credit to meet your emergency cash needs.

Limitations and fees when using PayPal Credit at ATMs

Now that you understand how to use PayPal Credit to withdraw cash at an ATM, it’s time to discuss the limitations and fees you may encounter.

First and foremost, it’s important to know that you cannot withdraw any amount of money from an ATM using PayPal Credit. There are daily and monthly withdrawal limits to be aware of. Daily withdrawal limits vary depending on the country you live in and the level of your PayPal account. In general, you can withdraw up to $300 per day. As for the monthly withdrawal limit, it is usually set at $1,000.

In addition to withdrawal limits, there are also fees associated with using PayPal Credit to withdraw cash at an ATM. You will be charged a flat transaction fee of $2.50 per withdrawal. This fee will be charged to your PayPal account along with the amount withdrawn.

Please note that these transaction fees are not charged by PayPal. This fee is charged by the ATM network where you make the withdrawal. PayPal only facilitates transactions and does not profit from these fees.

If you’re considering using PayPal Credit to withdraw cash at an ATM, it’s important to consider the limitations and fees involved. Make sure you understand the withdrawal limits and are willing to pay transaction fees before making a withdrawal.

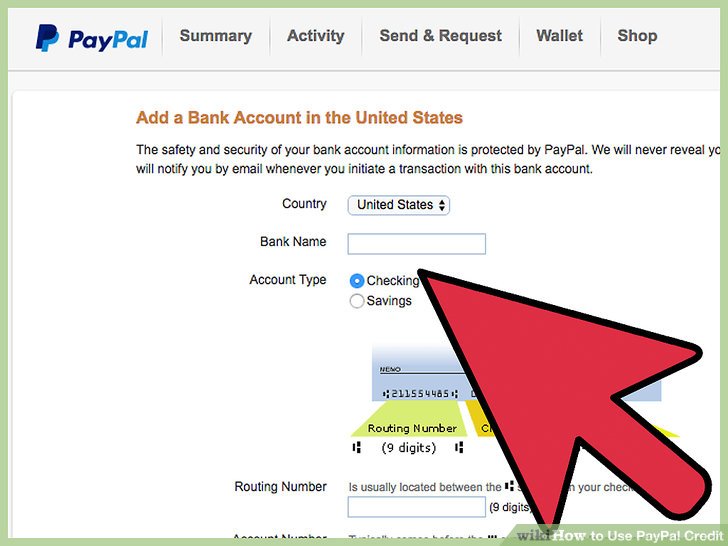

Additionally, you may want to consider using other options to withdraw cash if possible. For example, you can transfer funds from your PayPal account to your bank account and then withdraw cash from an ATM linked to that bank account. This may be cheaper and more convenient than using PayPal Credit for ATM withdrawals.

PayPal Credit’s availability for cash advances

When your wallet is empty and you need quick access to funds, PayPal Credit can be a convenient option. With ATM cash withdrawals available, you can withdraw funds from your PayPal line of credit and have cash in your hands when you need it.

However, it is important to note that cash withdrawals from PayPal Credit are different from cash withdrawals from traditional bank accounts. There are fees associated with withdrawing cash from PayPal Credit, usually a certain percentage of the amount you withdraw. Additionally, there are daily and monthly withdrawal limits to be aware of.

To make cash withdrawals at an ATM using PayPal Credit, you need a PayPal Cash Card. This card can be linked to your PayPal Credit account and allows you to access your funds at any ATM that accepts MasterCard.

The steps to make a cash withdrawal at an ATM using PayPal Credit are as follows:

1. Insert your PayPal Cash card into the ATM.

2. Select the “Cash Withdraw” option.

3. Enter the amount of money you want to withdraw.

4. Enter your PayPal Cash card PIN.

5. Take your cash and receipt.

While withdrawing cash at an ATM using PayPal Credit can be a convenient option, it’s important to use it wisely. The fees and associated limits can add up quickly, so it’s important to plan ahead and only withdraw the money you really need. Additionally, it is always recommended to check with your ATM before making a withdrawal to ensure that it accepts MasterCard and understand the fees associated with PayPal Credit withdrawals.

Can you use PayPal credit at an ATM?

Using PayPal Credit at an ATM: What You Need to Know

PayPal Credit is a feature that allows you to use credit to make payments online and offline. However, can you use PayPal Credit at an ATM? The answer is yes, but there are a few things you need to know before doing so.

What is PayPal Credit?

PayPal Credit is a credit service offered by PayPal, which allows you to make online and offline payments using credit. With PayPal Credit, you can make payments online on sites that support PayPal, as well as make payments offline at stores that accept PayPal.

How do I use PayPal Credit at an ATM?

To use PayPal Credit at an ATM, you must have a PayPal Debit card or PayPal Credit card issued by PayPal. These cards can be used at ATMs that accept PayPal cards.

Here are the steps to use PayPal Credit at an ATM:

- Make sure you have a PayPal Debit card or PayPal Credit card issued by PayPal.

- Look for an ATM that accepts PayPal cards.

- Insert your card into the ATM and select the “Cash Withdraw” or “Withdrawal” option.

- Enter your PIN and confirm the transaction.

- Wait for the transaction to be processed and your cash to come out.

Fees associated with using PayPal Credit at an ATM

There are several fees associated with using PayPal Credit at an ATM, including:

- Cash withdrawal fees: PayPal will charge a cash withdrawal fee of 2.5% of the transaction amount, with a minimum fee of $0.25.

- Credit fees: If you use PayPal Credit to make a payment, you will be charged a credit fee which depends on the type of card you use.

- Borrowing fees: If you use PayPal Credit to make a purchase, you will be charged a borrowing fee which depends on the type of card you use.

Things you need to know before using PayPal Credit at an ATM

Before you use PayPal Credit at an ATM, there are a few things you need to know:

- Make sure you have sufficient balance in your PayPal account to make the payment.

- Make sure you have a PayPal Debit card or PayPal Credit card issued by PayPal.

- Make sure the ATM you use accepts PayPal cards.

- Be aware of the fees associated with using PayPal Credit at an ATM.

Benefits of using PayPal Credit at ATMs

Using PayPal Credit at an ATM can have several benefits, including:

- Convenience: You can easily make payments online and offline using PayPal Credit.

- Flexibility: You can use PayPal Credit at ATMs that accept PayPal cards.

- Security: PayPal Credit has advanced security features to protect your transactions.

Conclusion

Using PayPal Credit at an ATM can be an easy and flexible way to make payments online and offline. However, you need to pay attention to the fees associated with using PayPal Credit at an ATM. Make sure you have sufficient balance in your PayPal account and a PayPal Debit card or PayPal Credit card issued by PayPal. Thus, you can use PayPal Credit at ATMs safely and comfortably.