PayPal’s policy on linking a joint bank account

Have you ever felt a little awkward when trying to link a joint bank account to your PayPal account? You are not alone. PayPal has a unique policy regarding joint bank accounts, and understanding this policy can save you a lot of hassle.

The general rule is that PayPal only allows one person to link a joint bank account. The reason is related to security. If both account holders can access your PayPal account, this increases the risk of fraud or abuse.

However, there are some exceptions. If a joint bank account is opened in the business’ name, both business owners can link the account to the business’ PayPal account. Additionally, if a legal couple has a joint bank account, one partner can link that account to his or her PayPal account, even if the other partner has not been verified.

If a joint bank account doesn’t meet one of these exceptions, the primary account holder must link the account to his or her PayPal account. The main account holder is the person whose name is listed first on the bank account. If the primary account holder is not the PayPal account holder, you will need to create a new account and link it to a joint bank account.

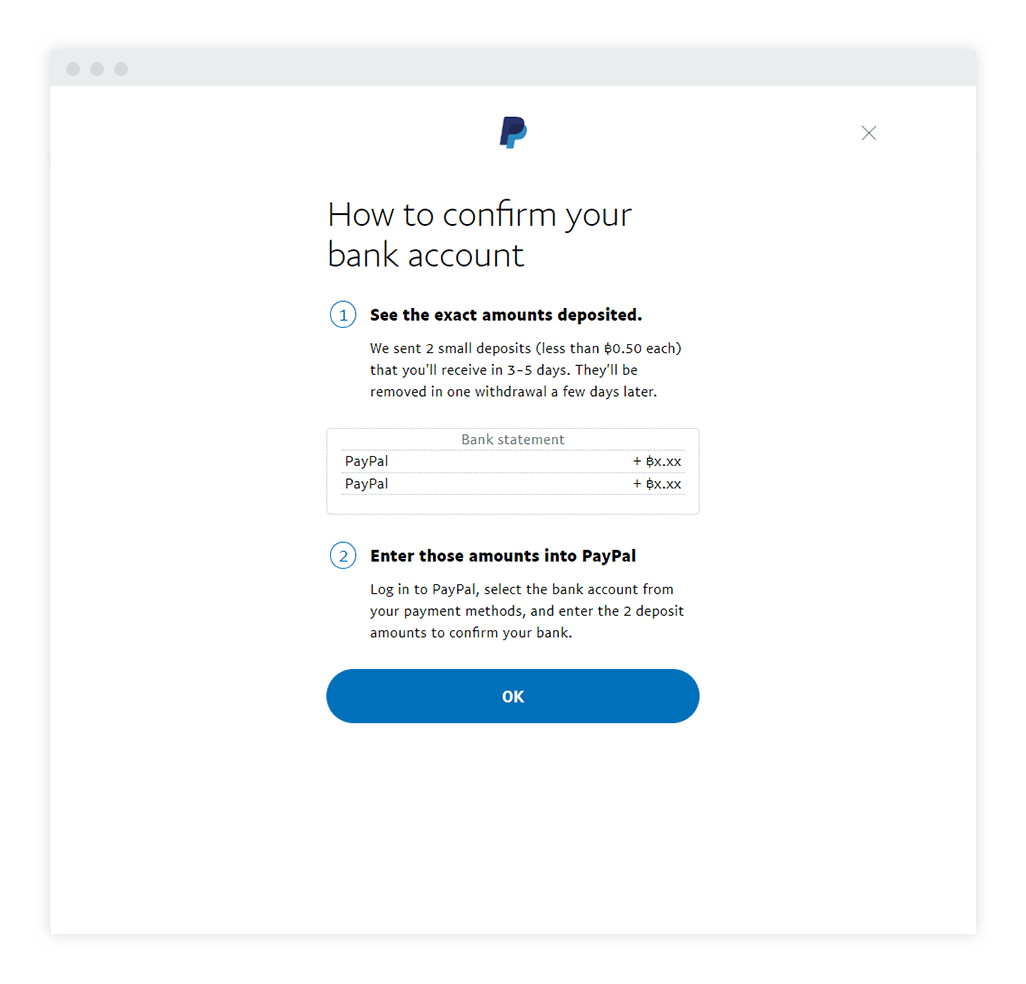

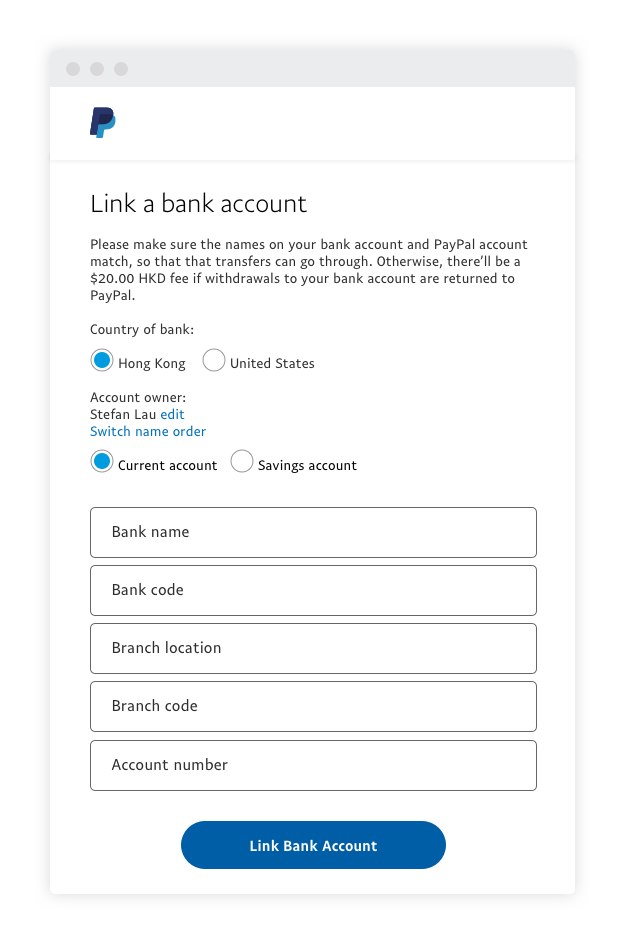

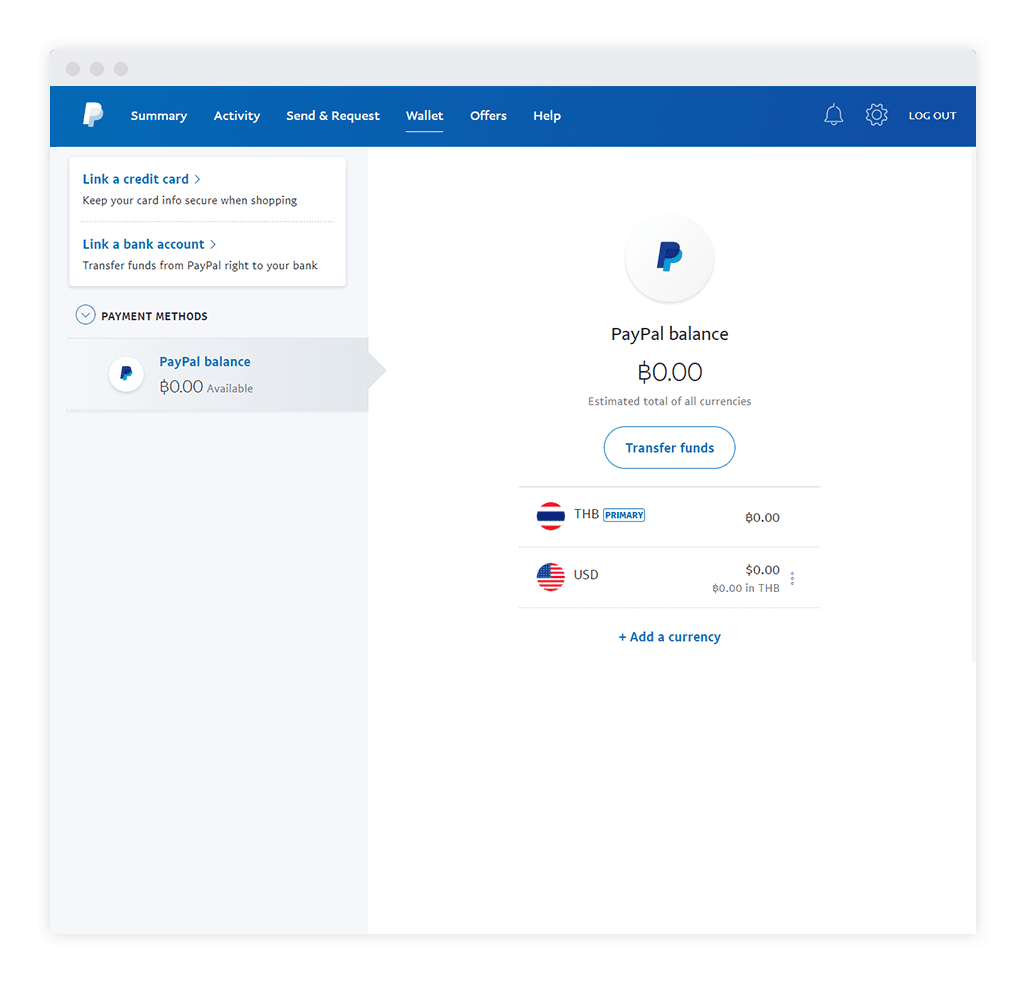

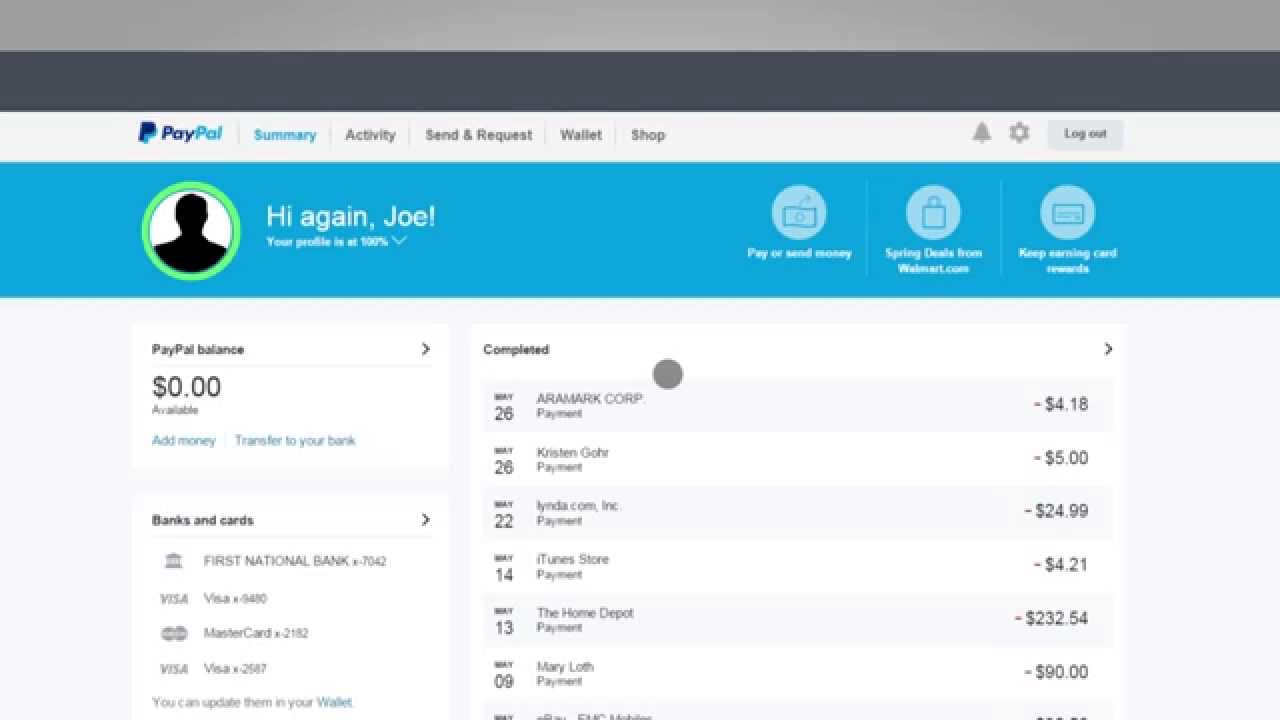

The process of linking a joint bank account is quite easy. Just log in to your PayPal account, click the “Wallet” section, and select “Link a bank account.” Follow the on-screen instructions, which usually involve verifying account ownership by depositing a small amount of money.

Once a joint bank account is linked, you can use it to make deposits and withdrawals. However, keep in mind that PayPal may require additional verification if you use a joint bank account that is not registered in your name. As a security precaution, this helps ensure that you are actually allowed to access the account.

So, there you have it. PayPal’s policy regarding linking joint bank accounts can be a little confusing, but understanding the rules will help you avoid problems later. If you’ve tried linking joint bank accounts and encountered problems, now you know why. And remember, if you have any further questions, you can always contact the PayPal Help Center for help.

How to manage a shared bank account on PayPal

When it comes to managing a joint bank account at PayPal, understanding their policies is essential to maximize convenience and avoid potential problems. The following is a description of PayPal’s policy regarding linking joint bank accounts:

First and foremost, PayPal allows users to link shared bank accounts. It provides an easy and secure way to access account funds both individually and jointly. However, there are several requirements that must be met.

One of the requirements is that both account holders must have a verified PayPal account. This involves providing basic information, such as name, address, and banking information. The verification process helps PayPal ensure the identity of all users and prevent fraud.

Once both account holders have verified accounts, they can proceed to link their joint bank accounts. This process is relatively easy and can be done through the PayPal interface. Just go to the “Withdraw Funds” section, select the joint bank account, and enter the required information.

However, it is important to note that PayPal has certain rules regarding withdrawing funds from shared bank accounts. One of the rules is that funds can only be withdrawn to the PayPal account associated with the account holder making the withdrawal. This means that each account holder can only access his or her own funds, preventing the possibility of unauthorized withdrawals or misuse of funds.

To increase security, PayPal also recommends that both account holders establish clear roles and responsibilities. This may include assigning a primary account holder and a secondary account holder, with different permissions for withdrawals and account management. By setting these restrictions, account holders can reduce the risk of misuse or errors in managing shared accounts.

Overall, PayPal’s policy regarding linking joint bank accounts provides flexibility and security for joint account holders. By following their requirements and recommendations, account holders can maximize the benefits of a joint bank account while minimizing potential risks.

Risks and considerations when using joint accounts with PayPal

PayPal provides the option to link joint bank accounts, but there are some risks and considerations to be aware of before you do so.

One of the main risks of linking joint bank accounts is the possibility of disputes with other account holders. If both account holders disagree regarding the use of a PayPal account, this can cause problems, especially if one of them makes unauthorized or illegal transactions.

Additionally, linking joint bank accounts can make it difficult to track finances. If both account holders use a PayPal account at the same time, it can be difficult to know which transactions came from each party. This can cause budgeting and accounting problems.

Additionally, it is important to remember that joint bank accounts are subject to bankruptcy or foreclosure. If one of the account holders experiences financial problems, the joint account may be confiscated, including funds held in the PayPal account.

While there are some risks, connecting a joint bank account to PayPal can also provide some benefits. For example, this can simplify co-pays for bills or purchases. In addition, it can make it easier to manage shared expenses, such as household costs or grocery shopping.

If you’re considering connecting a joint bank account to PayPal, it’s important to weigh the risks and benefits carefully. Discuss with other account holders and make a decision that is appropriate for your specific financial situation.

In conclusion, connecting a joint bank account to PayPal can be a convenient solution for managing joint payments, but it is important to be aware of the risks and considerations involved. By considering these factors, you can make an informed decision about whether this option is right for you.

Can you use a joint bank account in PayPal that is already used by your partner for their PayPal account?

Using a Joint Bank Account on PayPal that Your Spouse Already Uses

Do you have questions about how to use a joint bank account on PayPal? In this article, we will discuss whether it is possible to use a joint bank account on PayPal that a couple already uses for their PayPal account.

Using a Joint Bank Account on PayPal

PayPal is one of the most popular online payment services used by the public. To use PayPal, you need a bank account registered as a payment method. However, what if you have a joint bank account with your partner? Can I use the joint bank account on PayPal?

Joint Bank Accounts and the Need for Confirmation

To use a joint bank account on PayPal, you need to ensure that the bank account is registered as a payment method on your PayPal account. If the joint bank account is already used by the couple as a payment method on their PayPal account, then you need to make sure that the bank account can be used as a payment method on your PayPal account as well.

Joint Bank Account Confirmation Process

To confirm a joint bank account as a payment method in your PayPal account, you need to take the following steps:

- Log in to your PayPal account : First, you need to log in to your PayPal account using the correct email address and password.

- Click on “Settings” : After logging in, click on the “Settings” option in the top left corner of the page.

- Select “Payment Method” : Select the “Payment Method” option from the drop-down menu.

- Click on “Add Payment Method” : Click on the “Add Payment Method” button in the top right corner of the page.

- Select “Bank Account” : Select the “Bank Account” option as the payment method.

- Enter bank account information : Enter the information of the joint bank account you want to add, including nominee, account number, and address.

- Click on “Save” : Click on the “Save” button to save the bank account information.

Confirm Joint Bank Account via PayPal

Once you add a joint bank account as a payment method, PayPal will send a confirmation to that bank account. You need to ensure that your partner has given consent to use the joint bank account as a payment method on your PayPal account.

Dangers of Using a Joint Bank Account on PayPal

Using a joint bank account on PayPal can have several dangers, such as:

- Fraud risk : If the joint bank account is used by irresponsible people, it can cause fraud and financial loss.

- Incorrect payment : If your partner makes incorrect payments, it can cause financial loss to you.

- Bank account dependency : If a joint bank account is used as a payment method on your PayPal account, it may cause dependency on that bank account.

Advice on Using a Joint Bank Account on PayPal

To avoid the dangers of using a joint bank account on PayPal, here are some suggestions you can take:

- Discuss with your partner : Before using a joint bank account on PayPal, discuss security and cooperation with your partner.

- Set boundaries : Set payment limits to prevent fraud and financial loss.

- Monitor activity : Monitor joint bank account activity regularly to ensure that there is no fraud or financial loss.

Conclusion

Using a joint bank account on PayPal can be done by ensuring that the bank account is registered as a payment method on your PayPal account. However, keep in mind that using a joint bank account can have several dangers, such as the risk of fraud and bank account dependency. Therefore, it is important to discuss it with your partner, set boundaries, and monitor joint bank account activity regularly.

FAQs

Q: Can I use a joint bank account with PayPal?

A: Yes, you can use a joint bank account on PayPal by ensuring that the bank account is registered as a payment method on your PayPal account.

Q: How can I confirm a joint bank account on PayPal?

A: You can confirm a joint bank account in PayPal by entering the bank account information, including nominee, account number, and address, and then clicking on the “Save” button.

Q: Does using a joint bank account on PayPal carry any risk of fraud?

A: Yes, using a joint bank account on PayPal can have a risk of fraud if an irresponsible person can access the bank account. Therefore, it is important to discuss it with your partner and set boundaries to prevent deception.