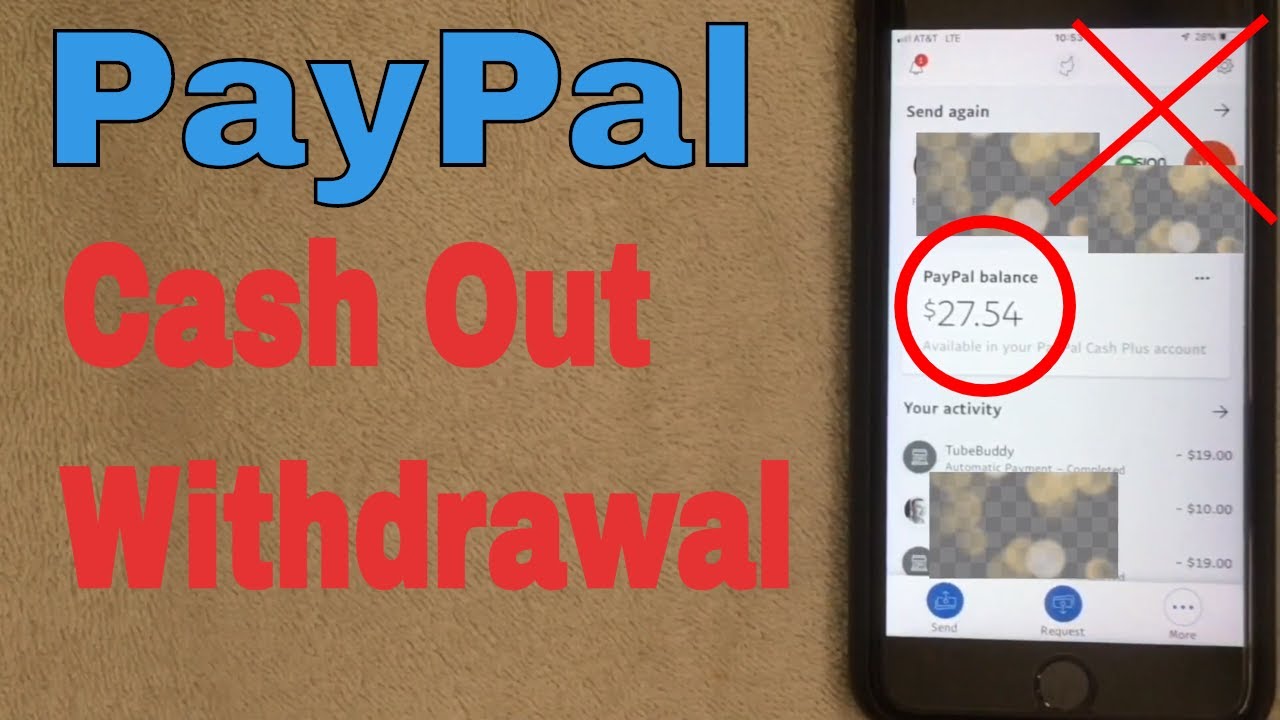

Steps to withdraw PayPal funds to your bank account

OK, friends! Let’s discuss an easy way to withdraw PayPal funds to your bank account. Follow these simple steps and your money will be coming in in no time.

Step 1: Log in to your PayPal Account

First of all, log in to your PayPal account with the registered email address and password. Make sure your internet connection is stable to prevent interruptions during the process.

Step 2: Select the “Withdraw Funds” Option

Once logged in, find and click the “Withdraw Funds” option in the main menu. This will bring up a new page showing your PayPal balance and withdrawal options.

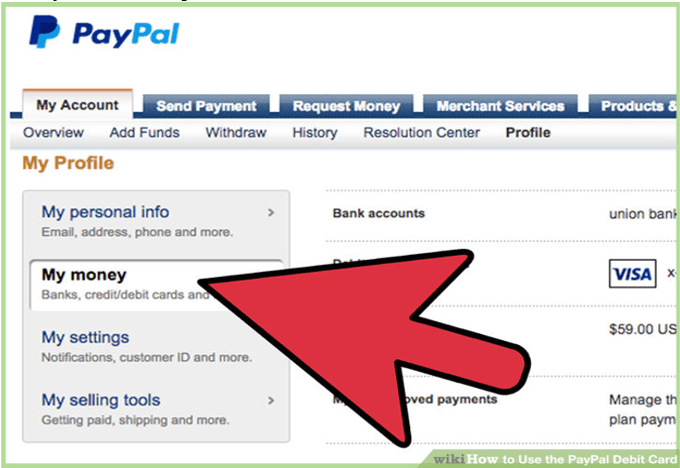

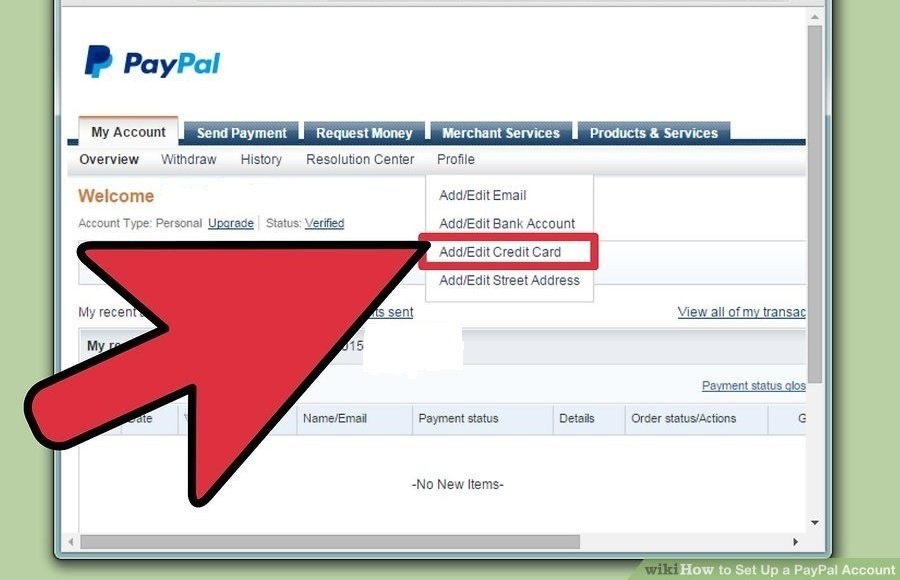

Step 3: Add Bank Account

If it isn’t already linked, you need to add a bank account to your PayPal account. Click “Add Bank Account” and follow the instructions. Make sure your bank account information is correct, because the funds will be transferred there.

Step 4: Enter the Amount You Want to Withdraw

After adding a bank account, enter the amount of funds you want to withdraw in the field provided. Make sure to check your balance and available for withdrawal.

Step 5: Review and Confirm

Double-check the withdrawal details, including the amount, destination bank account, and any fees that may apply. Once everything looks correct, click the “Withdraw Funds” button.

Step 6: Wait for Funds to Enter

The withdrawal process usually takes several working days, depending on your bank. You will receive an email notification when the funds have been credited to your bank account.

Additional Tips

Make sure your PayPal account is verified to avoid withdrawal delays.

Check the daily and weekly withdrawal limits for your PayPal account.

There are certain withdrawal fees that may apply, so check before proceeding with the process.

If you experience problems, contact PayPal customer service for assistance.

And that’s all, friends! By following these steps, you can easily withdraw PayPal funds to your bank account. Enjoy the ease and convenience of accessing your money anytime, anywhere.

Transfer limits and fees for cashing out to a bank account

Steps to Withdraw PayPal Funds to Your Bank Account

Do you want to convert your PayPal balance into spendable cash? The process of withdrawing funds to your bank account is easy and simple. Here are the steps:

Login to your PayPal Account

Start by visiting the PayPal website and logging into your account. Once inside, navigate to the “Wallet” section and click “Withdraw Funds”.

Select Destination Bank Account

If you’ve connected a bank account to your PayPal account, you’ll see it listed here. Select the account you want to use for withdrawals. If you haven’t connected any accounts, follow the instructions to add them.

Enter Amount and Confirm

Type the amount you want to withdraw to your bank account. Make sure to enter an accurate amount before continuing. After that, carefully review the transaction details and click “Withdraw”.

Withdrawal Limits and Fees

The maximum amount you can withdraw per transaction and per day will vary depending on your PayPal account level and location. You can check your limits by clicking “View Limits” in the “Wallet” section.

PayPal charges a fee for certain withdrawals. Fees vary depending on currency and withdrawal method. You can find detailed information about fees in the PayPal Help Center.

Processing Time

The time it takes for your funds to reach your bank account will vary. For standard withdrawals, funds will usually appear in your account within 3-5 business days. For instant withdrawals, funds will be available within minutes, but higher fees may apply.

Additional Tips

Verify your bank account to increase the withdrawal limit.

Consider using instant withdrawal if you need funds immediately.

Check limits and fees carefully before making a withdrawal.

If you experience any problems, don’t hesitate to contact PayPal customer support for help.

By following these steps, you can easily withdraw your PayPal funds to your bank account. This is a convenient way to convert your digital balance into cash that can be spent and used for your needs.

Troubleshooting issues when withdrawing PayPal funds

Find yourself in a tricky situation when withdrawing PayPal funds to your bank account? Don’t worry, you are not alone. Here’s a step-by-step guide to troubleshoot your PayPal withdrawals:

Before starting, make sure you have verified your bank account on PayPal. If not, follow the instructions on the PayPal website.

Step 1: Check Your Account Status

First, check that your PayPal account is in good condition. Restricted or suspended accounts cannot make withdrawals. If your account is restricted, contact PayPal customer support for more information.

Step 2: Review Your Payment Details

Make sure your payment details, such as bank account number and routing number, are correct. Any errors may result in funds not reaching the correct account. Double-check all information before continuing.

Step 3: Check Withdrawal Limits

PayPal has daily, weekly, and monthly withdrawal limits. If you try to withdraw an amount that exceeds this limit, your transaction will be rejected. Check your withdrawal limits on the PayPal website.

Step 4: Secure Your Account

Suspicious withdrawals may trigger PayPal’s security measures. If you try to withdraw an unusual amount or make frequent withdrawals, PayPal may ask you to verify your identity. Follow the instructions provided and complete the verification steps.

Step 5: Contact Customer Support

If you’ve followed these steps and are still experiencing problems, don’t hesitate to contact PayPal customer support. Describe your problem in detail and provide supporting evidence if necessary. The support team will guide you through the troubleshooting process and help you complete your withdrawal.

Remember, withdrawing funds from PayPal is usually an easy process. By following these steps, you can identify and resolve any issues you may encounter, ensuring your funds arrive safely in your bank account.

Can you cash out the money you have on PayPal to a bank account?

Taking Money Out of PayPal to a Bank Account: Complete Guide

PayPal is one of the most popular online payment services used by people around the world. With PayPal, you can make online transactions easily and securely, and receive and send money to and from anywhere in the world. However, did you know that you can withdraw the money in your PayPal account to your bank account? In this article, we will talk about how you can get money out of PayPal to your bank account.

What is PayPal?

PayPal is an online payment service that allows you to make online transactions easily and safely. With PayPal, you can make payments, receive payments, and send money anywhere in the world. PayPal was founded in 1998 and has become one of the most popular online payment services in the world.

How to Get Money Out of PayPal to a Bank Account?

Taking money out of PayPal to a bank account is very easy and fast. Here are the steps you can follow:

- Make sure you have an active PayPal account : Before you can take money out of PayPal, make sure you have an active PayPal account. If you don’t have a PayPal account, you can register on the official PayPal website.

- Make sure you have sufficient balance : Make sure you have sufficient balance in your PayPal account to make a withdrawal.

- Click on the “Withdraw” button : Log in to your PayPal account and click on the “Withdraw” button at the top of the page.

- Select a bank account : Select the bank account you want to use to receive money.

- Enter the withdrawal amount : Enter the amount of money you want to withdraw from your PayPal account.

- Click on the “Continue” button : Click on the “Continue” button to continue the withdrawal process.

- Make sure the information you enter is correct : Make sure the information you enter is correct, such as the withdrawal amount and the bank account you choose.

- Click on the “Confirm” button : Click on the “Confirm” button to confirm the withdrawal.

PayPal Withdrawal Fees

PayPal withdrawal fees may vary depending on your country and the type of PayPal account you have. Here are common PayPal withdrawal fees:

- The withdrawal fee is 1.5% of the withdrawal amount, with a minimum fee of IDR 10,000 and a maximum fee of IDR 200,000.

- The currency conversion fee is 2.5% of the withdrawal amount, if you make a withdrawal in a currency different from your PayPal account currency.

PayPal Withdrawal Times

PayPal withdrawal times may vary depending on the type of PayPal account you have and the country you are withdrawing from. Here are common PayPal withdrawal times:

- Withdrawals can be processed within 2-3 working days, if you make a withdrawal in the same currency as your PayPal account currency.

- Withdrawals can be processed within 4-5 working days, if you make a withdrawal in a currency different from your PayPal account currency.

Tips and Tricks for Withdrawing Money from PayPal to a Bank Account

Here are some tips and tricks you can use to get money from PayPal to your bank account:

- Make sure you have sufficient balance : Make sure you have sufficient balance in your PayPal account to make a withdrawal.

- Choose the right bank account : Choose the right bank account to receive money, so that you don’t receive the wrong money.

- Enter the correct information : Enter the correct information, such as the withdrawal amount and the bank account you selected, to avoid errors.

- Confirm withdrawal : Confirm your withdrawal to avoid errors.

Conclusion

Taking money out of PayPal to a bank account is very easy and fast. By following the steps we’ve outlined, you can get money out of PayPal to your bank account easily and safely. Make sure you have sufficient balance, choose the right bank account, and enter the correct information to avoid mistakes. With PayPal, you can make online transactions easily and safely, and easily withdraw money from PayPal to your bank account.