Steps for international money transfer via PayPal

If you need to transfer money internationally, PayPal offers an easy and secure way to do so. Here are the steps to follow so that your international money transfer via PayPal runs smoothly:

First, make sure you have a PayPal account. If you don’t have one, you can easily create one for free on the PayPal website. Once you have an account, verify it by adding your personal information, such as address and phone number.

Next, add a payment method to your PayPal account. You can use a debit or credit card, or link your bank account. Make sure to choose the payment method that is most convenient and suits your needs.

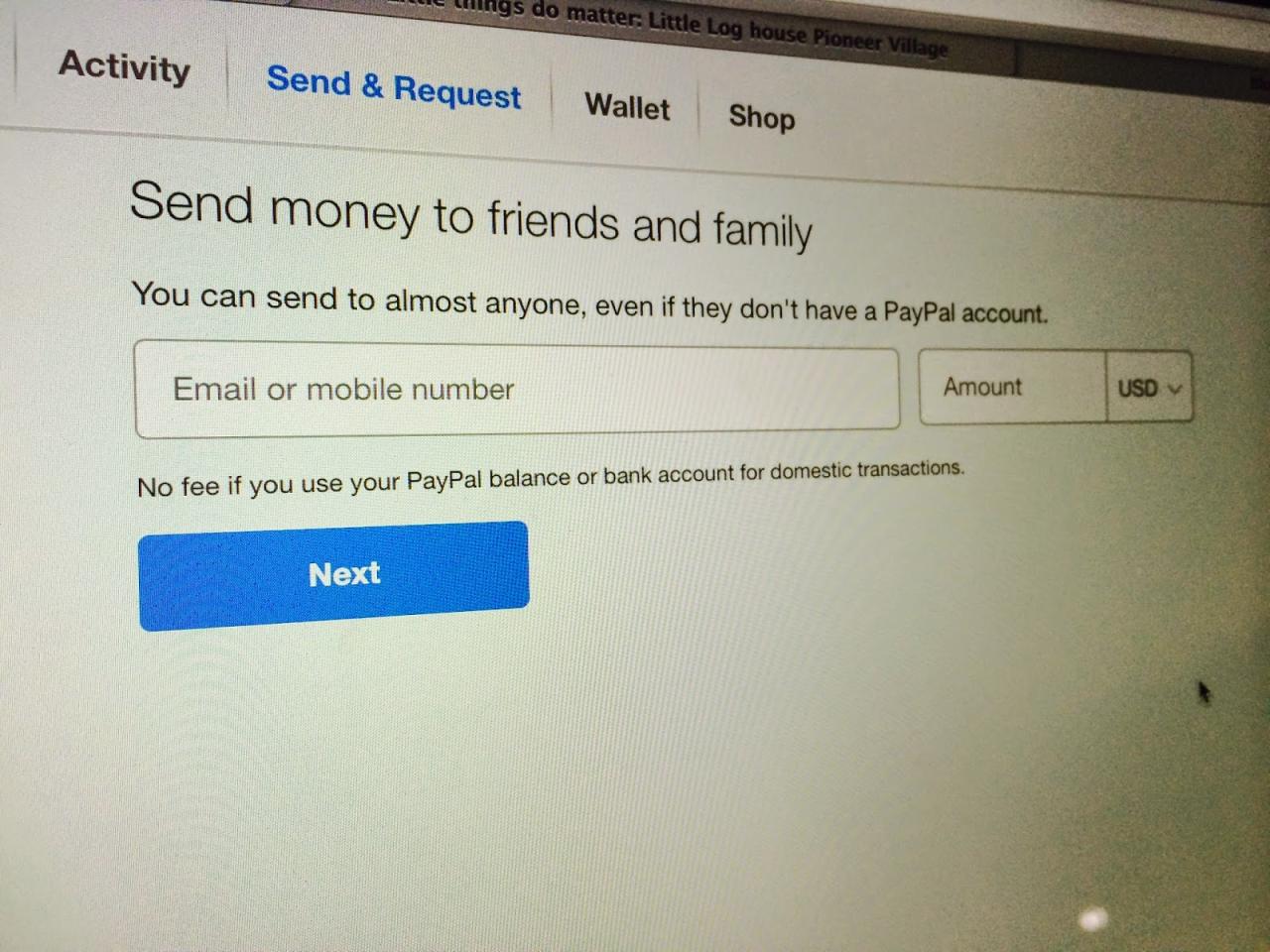

It’s time to start the money transfer. On the PayPal home page, click “Send & Request.” Select “Send Abroad” and enter the recipient’s email address or cell phone number. If the recipient does not have a PayPal account, they will be sent an email with instructions on how to create one.

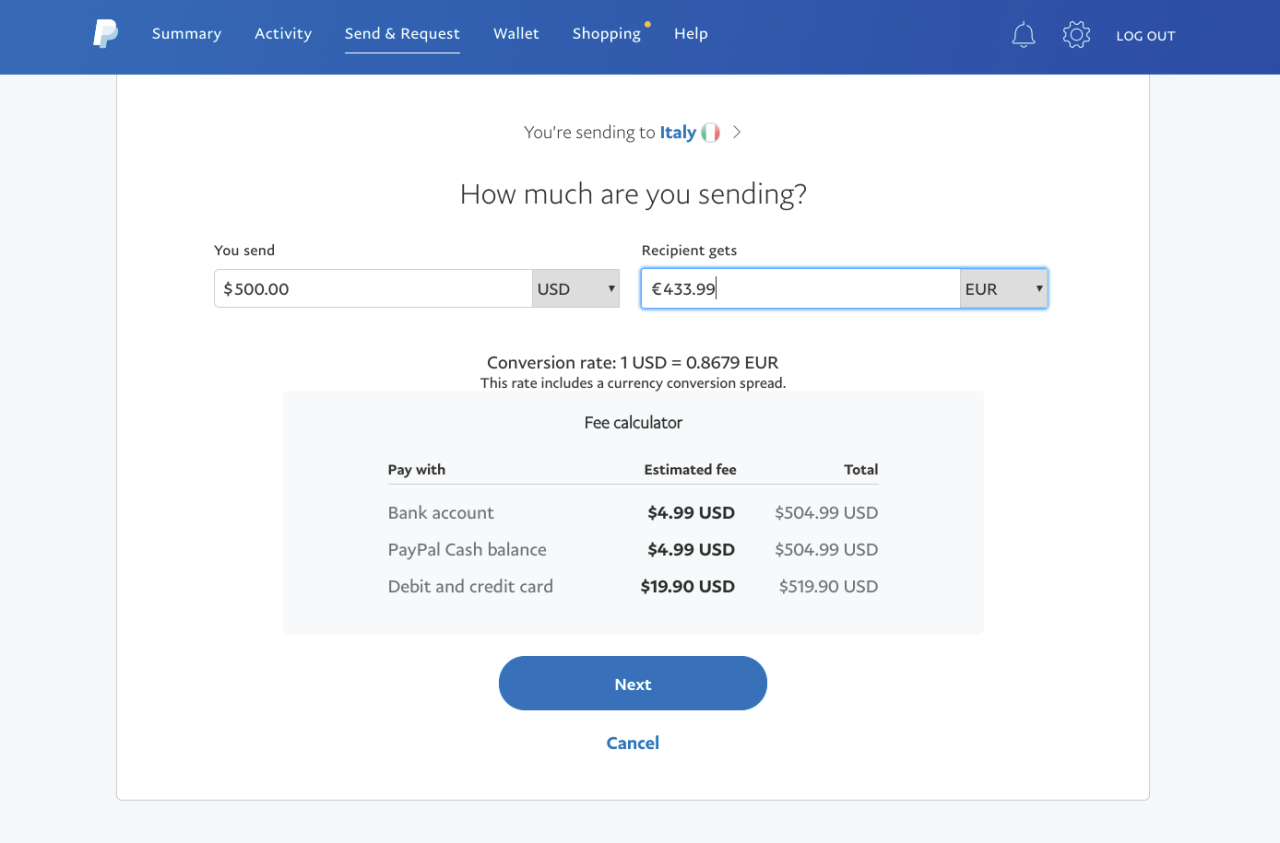

Specify the amount of money you want to transfer and the desired currency. PayPal will display the exchange rate in effect at that time. Double check the transaction details and make sure they are correct before confirming the transfer.

PayPal will process your transfer and send it to the recipient’s account within 2-3 business days. You can track the status of your transfer in the “Activity” section of your PayPal account.

To ensure the security of your international transfers, PayPal uses advanced encryption and fraud protection technology. However, for added security, it is always recommended to confirm the recipient’s identity before making a money transfer.

Additionally, make sure to factor in transfer fees when transferring money internationally. PayPal charges fees that vary depending on the amount of money transferred and the currency selected. You can view the fee details on the PayPal website before confirming your transfer.

By following these steps, you can easily and safely transfer money internationally via PayPal. The process is fast, convenient, and ensures that your money reaches the recipient safely and on time.

Transfer fees and exchange rates for international transactions

When making international money transfers via PayPal, it is important to understand the transfer fees and applicable exchange rates. These fees and exchange rates may vary depending on several factors, including the country of origin and destination of the transfer, as well as the currency involved.

First of all, PayPal charges a flat fee for every international transaction. These fees typically range from 0.5% to 4.9% of the transfer amount, with certain minimums set. For example, if you transfer $100 to an overseas account, you may be charged a fee of around $5.

In addition to fixed fees, PayPal also applies exchange rates when converting currencies. These exchange rates are usually more unfavorable than mid-market rates, which are the rates used by banks and other financial institutions. Differences between PayPal exchange rates and market rates may result in hidden fees that can affect the final amount the recipient receives.

To get a clear idea of the fees and exchange rates you will face, it is recommended to use the PayPal transfer fee calculator before making a transaction. This calculator will provide estimated fees and exchange rates for your transfer.

If you find that PayPal’s fees and exchange rates are too high, you may want to consider using an alternative money transfer provider. These providers often offer lower fees and better exchange rates, which can save you money in the long run.

However, it is important to research these providers thoroughly before entrusting them with your money. Make sure the provider is reputable and regulated by a reputable financial authority.

By understanding the transfer fees and exchange rates involved in international money transfers via PayPal, you can make informed decisions about the best way to send funds overseas. By comparing fees and exchange rates from different providers, you can choose the option that best suits your needs and minimize overall costs.

Limitations and supported countries for PayPal transfers

As you venture into the world of international money transfers via PayPal, it’s important to know some of the restrictions and supported countries. Come on, let’s discuss it together!

First, PayPal limits the amount of money you can transfer in a day, week, and month. These limits vary depending on your account status and country. Be sure to check these restrictions before making any transfers.

Additionally, PayPal only supports transfers to certain countries. A complete list of supported countries can be found on the PayPal website. If the country you are transferring to is not on the list, you may need to look for another transfer method.

However, the good news is that PayPal supports transfers to most major countries, including the United States, United Kingdom, Canada, Australia, Germany, and France. So, there is a big chance that your transfer will be successful if it is sent to one of these countries.

Also keep in mind that international transfer fees via PayPal may vary depending on the amount transferred, currency used, and destination country. Make sure to check the fees involved before confirming the transfer.

By paying attention to these restrictions and supported countries, you can ensure that international money transfers through PayPal go smoothly and without a hitch. PayPal remains a popular choice for cross-border money transfers, offering security, convenience and wide reach.

Can PayPal be used to transfer money to another country?

Using PayPal to Transfer Money Abroad: Convenience and Costs

In the current era of digital technology, transferring money abroad has become easier and faster. One popular way to make international money transfers is using PayPal. PayPal is an online payment service that allows users to make transactions easily and quickly, both online and offline.

In this article, we will discuss PayPal’s ability to transfer money overseas, as well as the fees and processes involved. Let’s take a look!

What is PayPal?

PayPal is an online payment service that was launched in 1998. This service allows users to make transactions easily and quickly, both online and offline. PayPal allows users to send and receive money, make online payments, and even make money transfers overseas.

Can PayPal be Used to Transfer Money Abroad?

Yes, PayPal can be used to transfer money overseas. PayPal allows users to send money to more than 200 countries and territories worldwide. The process of transferring money abroad using PayPal is relatively easy and fast.

How to Use PayPal to Transfer Money Abroad?

Here are the steps to use PayPal for overseas money transfers:

- Create a PayPal Account : First of all, you need to create a PayPal account. You can create a PayPal account by visiting the official PayPal website and following the instructions.

- Information Verification : After you create a PayPal account, you need to verify your information, including email address and phone number.

- Adding Payment Method : You will need to add a payment method, such as a credit or debit card, to your PayPal account.

- Sending Money : Once you add a payment method, you can send money abroad using your PayPal account. You will need to enter the recipient’s email address or phone number, as well as the amount of money you want to send.

- Transaction Verification : After you send money, PayPal will verify your transaction and ensure that your money has been sent safely.

Fees for Transferring Money Abroad with PayPal

Fees for transferring money overseas with PayPal can vary depending on several factors, such as:

- Transfer Fees : PayPal will charge a transfer fee of 0.3% to 2% of the amount sent, depending on the destination country.

- Conversion Costs : If you send money to a country with a different currency, PayPal will charge a conversion fee of 2.5% to 4.5% of the amount sent.

- Handling Fees : PayPal will also charge a handling fee of 1.5% to 2% of the amount sent.

Advantages and Disadvantages of Using PayPal to Transfer Money Abroad

Here are some advantages and disadvantages of using PayPal to transfer money overseas:

Excess:

- Easy and Fast : The process of transferring money abroad with PayPal is relatively easy and fast.

- Safe : PayPal ensures that your transactions are safe and secure.

- Wide Receiver : PayPal can be used to send money to over 200 countries and territories worldwide.

Lack:

- Cost : Fees for transferring money overseas with PayPal can vary and can be quite expensive.

- Limitation : PayPal has a limit on the amount of money that can be sent per day.

- Verification : The verification process may take several days.

Conclusion

Using PayPal to transfer money overseas can be easy and fast. However, keep in mind that fees for transferring money overseas with PayPal can vary and be quite expensive. Therefore, it is necessary to consider other options before transferring money abroad.

By using PayPal, you can transfer money abroad easily and quickly. However, keep in mind that fees for transferring money overseas with PayPal can vary and be quite expensive. Therefore, it is necessary to consider other options before transferring money abroad.

Tips and Suggestions

Here are some tips and suggestions for using PayPal for overseas money transfers:

- Check Fees : Check overseas money transfer fees with PayPal before making a transaction.

- Information Verification : Make sure you verify your information before making a transaction.

- Use the Right Payment Method : Use the correct payment method to avoid additional fees.

- Check Limitations : Check the limits on the amount of money that can be sent per day.

By following the tips and suggestions above, you can use PayPal to transfer money abroad easily and quickly.