How PayPal functions as a payment system

PayPal, the pioneer of online payments, has revolutionized the way we conduct financial transactions. Its innovative system connects buyers, sellers and financial institutions, creating a safe and secure digital trading ecosystem.

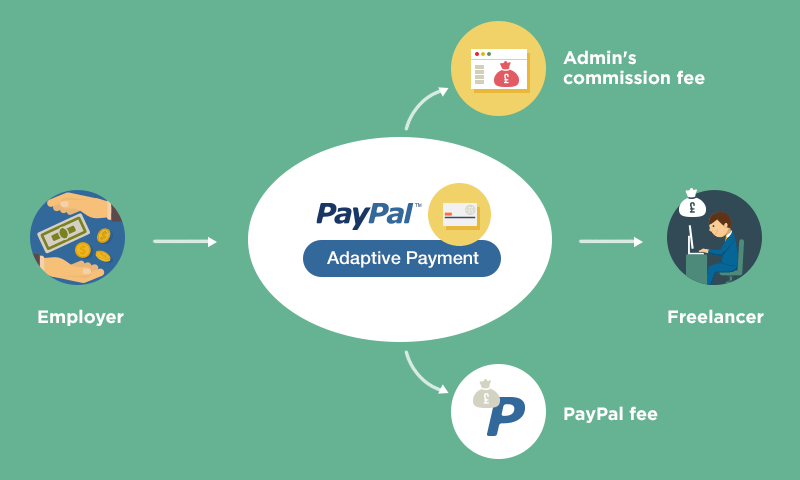

When you make a purchase using PayPal, you select it as your payment method at the online checkout. PayPal then bridges the gap between your account and the seller’s account, facilitating instant funds transfer. These transactions are securely encrypted, protecting your financial information from unauthorized third parties.

Once the payment is processed, PayPal holds the funds in your account until the seller delivers the goods or services. It acts as a reliable mediator, ensuring that both parties fulfill their obligations. Once the order is received, you can release funds to the seller, completing the transaction.

For sellers, PayPal offers an easy-to-use platform for accepting payments. They can create custom payment buttons, send invoices, and manage transactions through a convenient dashboard. PayPal also provides seller protection tools, reducing the risk of fraud and disputes.

Apart from online payments, PayPal has expanded its reach into other areas. You can use PayPal to transfer money to friends and family, deposit checks, and even manage your investments. Its integration with various platforms and applications makes it a comprehensive and versatile payment solution.

PayPal’s efficient and secure system has made it the preferred choice of millions of users worldwide. Whether you’re buying goods at a small online store or sending money around the world, PayPal offers an easy, reliable and secure transaction experience. By continuously innovating and evolving, PayPal continues to lead the way in digital payments, making the world of finance even more accessible and connected.

Limitations of using PayPal for escrow

PayPal has gained great popularity as a reliable and convenient payment platform. However, like any other payment system, PayPal also has its limitations, one of which is its limited functionality as an escrow service.

Escrow is an arrangement in which a neutral third party holds funds during a transaction until certain conditions are met. It serves to protect both parties to the transaction, ensuring that the buyer gets the goods or services they paid for and the seller receives the payment they have been promised.

Unfortunately, PayPal does not offer native escrow functionality. This means that users cannot utilize escrow services for their transactions directly through the PayPal platform. This raises several limitations that need to be considered:

Safety: PayPal’s lack of escrow functionality can pose a risk to both buyers and sellers. Buyers have no guarantee that they will receive goods or services after making payment, while sellers have no guarantee that they will receive payment after providing goods or services.

Complexity: To overcome this limitation, users sometimes try to create their own escrow arrangements outside of PayPal. This can be complicated and time consuming, as users must find a trusted third party to act as guarantor.

Availability: Many stand-alone escrow service providers do not integrate with PayPal. This can cause delays and inconvenience, as users have to manually transfer funds between different platforms.

Despite these limitations, PayPal remains a popular choice for online payments. The platform offers strong security features, convenience, and widespread acceptance worldwide. However, if users require escrow functionality, they will need to consider a dedicated escrow service provider that integrates with PayPal or an alternative payment platform that offers integrated escrow functionality.

By understanding PayPal’s limitations when it comes to escrow, users can make informed decisions about whether the platform meets their needs. By exploring available alternatives, users can ensure that their transactions are safe and secure.

Alternatives for using a proper escrow service with PayPal

PayPal, the online payments giant, offers an attractive alternative to traditional escrow services. As a neutral third-party platform, PayPal serves as a safe and convenient intermediary for transactions between buyers and sellers.

When using PayPal as an appropriate escrow service replacement, both parties experience a number of benefits. One of the main benefits is added security. PayPal has strong security measures to protect user data and their transactions. This provides peace of mind for buyers and sellers, knowing that their funds and personal information are safe.

Apart from security, PayPal also offers convenience and efficiency. This platform allows users to make and receive payments easily and quickly. Payments are processed instantly, eliminating delays associated with traditional escrow services. PayPal also integrates with many websites and services, making it easily accessible to users.

However, it is important to note that PayPal is not a perfect replacement for escrow services. While PayPal does provide some protection, it does not provide the same level of protection as a dedicated escrow service. Proper escrow services often require third-party review and verification, which PayPal does not provide.

Additionally, PayPal charges fees for its services, which can be burdensome for both buyers and sellers. These fees may vary depending on the number and type of transactions. It is important to consider these costs when deciding whether to use PayPal as an appropriate escrow service replacement.

Overall, PayPal offers a viable alternative to traditional escrow services in certain situations. Its security, convenience, and ease of use make it an attractive choice for buyers and sellers looking for a reliable and easy-to-use payment platform. However, it’s important to understand PayPal’s limitations and consider whether it’s the right choice for your specific needs.

Can Paypal be used as an escrow system?

Can PayPal be Used as an Escrow System?

In recent years, PayPal has become one of the most popular online payment methods in the world. With more than 400 million active users, PayPal has become the top choice for many people looking to make online transactions. However, can PayPal be used as an escrow system? In this article, we will discuss PayPal’s capabilities as an escrow system and whether it can be a viable choice for online transactions.

What is an Escrow System?

The escrow system is a payment method used to protect both parties in online transactions. In an escrow system, payment money is held by an independent third party until the transaction is complete and both parties have agreed to the outcome. Escrow systems are typically used in online transactions involving goods or services of high value, such as real estate, cars, or professional services.

How Does PayPal Work as an Escrow System?

PayPal can be used as an escrow system in several ways. Here are some examples:

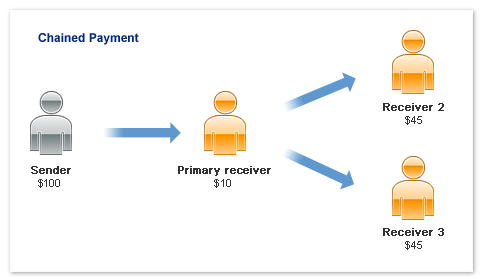

- Withheld Payments : PayPal can hold payment until the seller delivers the goods or services that have been ordered. If the seller fails to deliver goods or services, then payment can be returned to the buyer.

- Buyer Protection : PayPal offers buyer protection which can help protect buyers from unsuccessful transactions. If buyers do not receive the goods or services they have ordered, they can submit a claim to PayPal for a refund.

- Seller Verification : PayPal can verify a seller’s identity and help ensure that they are a legitimate and trustworthy seller.

Advantages of using PayPal as an Escrow System

Here are some advantages of using PayPal as an escrow system:

- Convenience : PayPal is very easy to use as an escrow system. Buyers only need to open a PayPal account and make payment to the seller.

- Security : PayPal offers very high security for online transactions. They use advanced encryption technology to protect payment data.

- Protection : PayPal offers buyer protection which can help protect buyers from unsuccessful transactions.

- Low Cost : The costs of using PayPal as an escrow system are relatively low compared to other escrow systems.

Disadvantages of using PayPal as an Escrow System

Here are some disadvantages of using PayPal as an escrow system:

- Limitation : PayPal has limits on the number of payments that can be made at one time.

- Cost : Although the costs of using PayPal as an escrow system are relatively low, there are still fees that must be paid by sellers and buyers.

- Dependence : PayPal may withhold payment if there is a problem with a transaction, which may result in dependency on third parties.

- Control Limitations : Sellers and buyers have limited control over the transaction process when using PayPal as an escrow system.

Conclusion

PayPal can be used as an escrow system in a number of ways, but there are several advantages and disadvantages to consider. PayPal offers great security, protection, and convenience, but it also has limitations, fees, and dependencies on third parties. Therefore, before using PayPal as an escrow system, it is important to understand its advantages and disadvantages and ensure that it is the right choice for online transactions.

Recommendation

If you want to use PayPal as an escrow system, here are some recommendations:

- Make sure you understand PayPal policies : Make sure you understand PayPal’s policies regarding escrow systems and how they can help protect online transactions.

- Use security features : Use security features offered by PayPal, such as two-factor authentication, to protect your account and transactions.

- Choose a legitimate seller : Choose a legitimate and trustworthy seller to avoid problems with transactions.

- Read reviews and ratings : Read reviews and ratings from other sellers and buyers to ensure they are legitimate and trustworthy sellers.

By understanding the advantages and disadvantages of PayPal as an escrow system and following the recommendations above, you can use PayPal as an escrow system with more confidence and security.