PayPal’s global reach

PayPal has become a global payments giant, spanning over 200 countries and territories. This incredible development has opened the door for businesses and individuals around the world to make, receive and manage money across borders with ease and convenience.

An increasingly connected world is driving global commerce, and PayPal plays an important role in facilitating this exchange. From small businesses in rural China to multinational corporations in the United States, PayPal offers a safe and reliable platform for cross-border transactions.

PayPal’s offerings are not limited to sending and receiving money. The platform also allows currency conversion, helping businesses overcome foreign exchange barriers that can hinder growth. With this feature, companies can carry out transactions in various countries without having to deal with large conversion fees.

In addition to its wide geographic reach, PayPal is also widely accepted by both online and offline merchants. This allows customers to shop with confidence, knowing they can pay in a secure and globally recognized way. PayPal’s huge presence increases trust and convenience in international transactions.

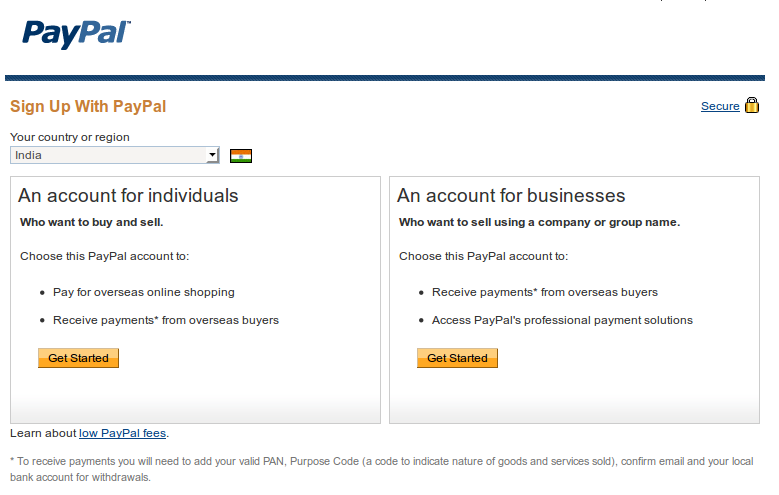

The company also invests in local initiatives around the world. In India, for example, PayPal is working with the government to promote financial inclusion among rural residents. In Africa, PayPal seeks to bridge the gap in access to financial services by providing affordable and easy-to-use mobile payment solutions.

PayPal’s global reach reflects its commitment to connecting the world and empowering commerce. The platform has become a catalyst for growth for businesses and individuals around the world, breaking down barriers and opening up new opportunities for collaboration and innovation.

With its growing reach and expanded service offerings, PayPal is further strengthening its position as a leader in global payments. The platform will continue to play an important role in facilitating international trade and creating economic opportunities for everyone, wherever they are.

Steps to transfer money internationally

In today’s increasingly connected world, sending and receiving money internationally is more important than ever. PayPal has emerged as the leading solution to this need, offering a global reach that makes it easy for individuals and businesses to facilitate cross-border transactions.

For those looking to transfer money internationally, PayPal simplifies the process with easy-to-follow steps. First, create a PayPal account and link it to your bank account or debit card. Once your account is verified, you can log in to the PayPal website or app.

When you want to send money abroad, select the destination country from the list of PayPal supported countries. Next, enter the amount you want to transfer and the desired currency. PayPal will automatically calculate the applicable exchange rate and indicate the fees associated with the transaction.

Before completing the transfer, review the details carefully to make sure everything is correct, including the recipient’s name, amount, and currency. PayPal will give you a unique reference number to track your transaction. Once you press the “Send” button, the funds will be debited from your account and begin transferring to the recipient’s account.

The time required for a transfer to complete varies depending on several factors, such as the destination country and the payment method used. However, PayPal generally processes transactions quickly and efficiently. You can track the status of your transaction through your PayPal account or by contacting customer service.

In addition to convenience and reliability, PayPal also offers a variety of features that make international money transfers even more convenient. You can set up recurring transfers for regular payments, schedule transfers in advance, and even send money using the recipient’s phone number or email address.

With its global reach and simplified transfer process, PayPal empowers users to make international transactions with confidence and security. The platform provides a comprehensive solution that meets the needs of businesses and individuals looking for an efficient way to send and receive money worldwide.

Exchange rates and fees for cross-border transactions

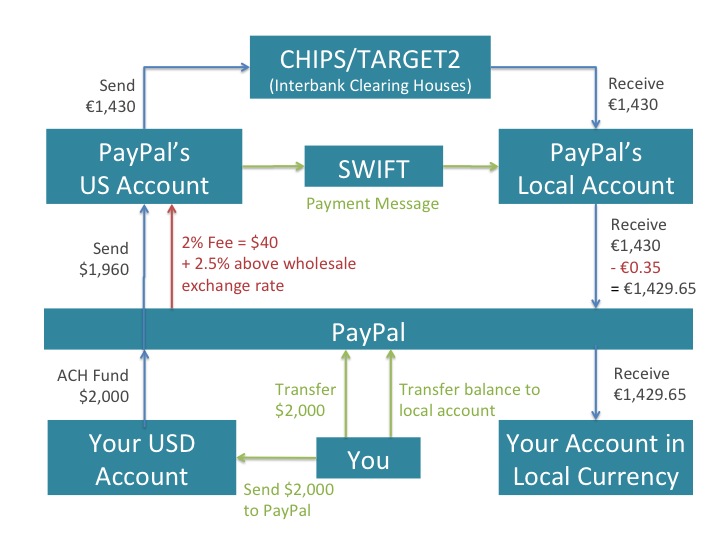

When you transact cross-border using PayPal, it is important to understand the exchange rates and fees that will be charged. The exchange rate is the price of one currency against another currency. PayPal uses real-time exchange rates, which means the exchange rate you see when making a transaction is the rate that will be applied.

In addition to exchange rates, PayPal also charges fees for cross-border transactions. These fees vary depending on the currency you send and receive, as well as the transaction amount. You can see the specific fees for your transactions by using the PayPal fee calculator.

In addition to exchange rates and fees, it is also important to be aware of potential additional fees that your own bank may charge. Some banks charge fees for international transactions, so it’s important to check with your bank before making a transaction.

Although there are some fees associated with cross-border transactions, PayPal remains a convenient and secure way to send and receive money globally. PayPal’s real-time exchange rates and fee transparency help you make informed decisions when making cross-border transactions.

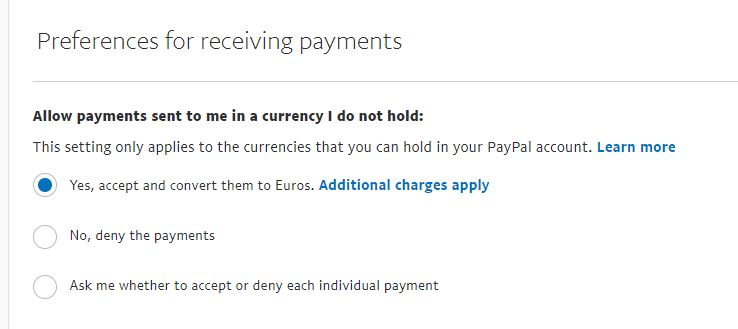

Additionally, PayPal offers a feature called “Automatic Currency Conversion”. This feature allows you to convert currencies automatically when making transactions. This can be a convenient way to save money because you don’t have to worry about fluctuating exchange rates.

In conclusion, understanding the exchange rates and fees associated with PayPal cross-border transactions is very important. By considering these factors, you can ensure that you get the best value from your transaction.

Can I use PayPal for international transactions?

Using PayPal for International Transactions: Conveniences and Limitations

PayPal is one of the most popular online payment methods in the world. With more than 400 million active users, PayPal allows us to make online transactions easily and safely. However, can PayPal be used for international transactions? In this article, we will discuss the conveniences and limitations of using PayPal for international transactions.

What is PayPal?

PayPal is an online payment company that allows us to send and receive money online. Founded in 1998, PayPal was originally called Confinity and was later sold to eBay in 2002. Today, PayPal is an independent company operating in more than 200 countries around the world.

Using PayPal for International Transactions

Yes, PayPal can be used for international transactions. With PayPal, we can make online transactions with sellers or buyers from other countries. Here are some ways to use PayPal for international transactions:

- International payments : PayPal allows us to make international payments easily. We only need to enter the seller’s or buyer’s email address and the payment amount.

- Acceptance of international payments : PayPal also allows us to accept international payments. Sellers only need to enter the buyer’s email address and payment amount.

- International money transfer : PayPal allows us to make international money transfers easily. We only need to enter the recipient’s email address and the transfer amount.

Ease of Using PayPal for International Transactions

Using PayPal for international transactions has several conveniences, including:

- Easy to use : PayPal has an easy to use interface, so we don’t need to have high technical knowledge to use PayPal.

- Safe : PayPal has a high security system to protect our online transactions.

- Fast : PayPal allows us to make online transactions quickly, so we don’t have to wait long to receive or send money.

- Cheap : PayPal has low transaction fees, so we don’t have to pay high fees to make international transactions.

Limitations of Using PayPal for International Transactions

Even though PayPal has several conveniences, there are several limitations that we need to pay attention to, including:

- Transaction fees : Even though PayPal transaction fees are low, we still need to pay transaction fees which can range between 2.9% + $0.30 per transaction.

- Transaction limits : PayPal has different transaction limits depending on the country and type of transaction.

- Processing time : PayPal takes a few days to process international transactions.

- Tax : We need to consider the taxes associated with international transactions.

Tips for Using PayPal for International Transactions

Here are some tips we can follow to use PayPal safely and effectively:

- Check email address : Make sure we enter the correct email address to receive or send money.

- Check the transaction amount : Make sure we enter the correct transaction amount to avoid errors.

- Use a strong password : Make sure we use a strong password to protect our PayPal account.

- Check security : Make sure we check the security of our online transactions by checking the “https” logo and the padlock icon in our browser.

Conclusion

Using PayPal for international transactions has some conveniences and limitations. With PayPal, we can make online transactions easily and safely. However, we need to consider transaction fees, transaction limits, processing times, and taxes associated with international transactions. By following the tips we have conveyed, we can use PayPal safely and effectively.