Freelancing sites that pay via PayPal

In this fast-paced digital era, freelancers are increasingly relying on online platforms to find flexible and profitable work. One of the most common and convenient payment methods for freelancers is PayPal. If you are a freelancer looking for a site where you can work and get paid via PayPal, here are some of the best options:

Upwork

Upwork is one of the most popular freelancing sites, with millions of clients and freelancers worldwide. The platform offers a variety of projects, from design to web development, content writing and more. Freelancers on Upwork can create portfolios, bid on projects, and receive payments via PayPal securely.

Fiverr

Fiverr is a unique site that allows freelancers to offer their services starting from $5. This site is perfect for small, quick tasks, such as logo design, short article writing, and translation. Freelancers on Fiverr can receive payments instantly via PayPal after completing a project.

Freelancer.com

Freelancer.com is another well-respected freelancing platform, with millions of projects posted every day. The site offers a variety of categories, including software development, digital marketing, and consulting. Freelancers on Freelancer.com can accept payments via PayPal or other supported methods.

99designs

99designs is a specialized platform that connects designers with clients looking for logo, website and marketing material designs. Designers at 99designs can compete in contests or work directly with clients. Payment is made via PayPal, ensuring safe and convenient transactions.

Teacher

Guru is an online learning platform that allows tutors and students to connect. Tutors at Guru can offer classes in a variety of subjects, including math, languages, and programming. Payment is made via PayPal, providing convenience and flexibility for tutors.

When choosing a freelancing site that pays via PayPal, consider the platform’s reputation, project reach, and ease of use. The sites listed above offer a safe and reliable environment for freelancers to find work and receive payments conveniently. With PayPal as the preferred payment method, freelancers can access global job opportunities and enjoy greater financial freedom.

Receiving payments without a linked bank account

Whether you are a freelancer just starting out or a seasoned professional, finding a reliable freelancing site with flexible payment options is essential. PayPal has become the preferred payment method for many freelancers due to its ease of use, security, and global acceptance. If you want to accept payments via PayPal without linking a bank account, here are some highly recommended freelance sites:

Upwork

One of the largest freelancing platforms, Upwork offers a variety of projects suitable for a variety of skills and experience levels. You can create a free profile and start applying for jobs. Upwork supports payments via PayPal, so you can receive your earnings directly to your PayPal account.

Fiverr

Fiverr is a service-based freelance marketplace that allows you to offer your services from as little as $5. You can create gigs for various services, such as graphic design, content writing, and social media. Fiverr also allows payments via PayPal, making it a great option for freelancers who are just starting out and want to set a base level for their services.

Freelancer.com

Another leading freelancing site, Freelancer.com provides access to a large number of projects from all over the world. You can create a portfolio and apply for jobs that match your skills. Freelancer.com also supports payments via PayPal, making it easier for you to access your earnings.

Toptal

An elite platform for top freelancers, Toptal connects businesses with highly skilled developers, designers, and project managers. If you have exceptional skills and proven experience, Toptal could be a great choice for finding high-paying projects. Toptal also allows payments via PayPal, giving you security and convenience.

Teacher

Guru is a special platform for online tutors. If you have expertise in a particular area, you can register as a tutor and offer your services. Guru allows payment via PayPal, so you can receive payment for your tutoring services easily.

Apart from these freelancing sites, there are several other platforms that also support payment via PayPal, such as FlexJobs, Indeed, and SimplyHired. When choosing a freelancing site, it is important to consider factors such as reputation, listing fees, and customer support. By doing your research and choosing a site that suits your needs, you can take advantage of the flexibility and convenience of PayPal payments as a freelancer.

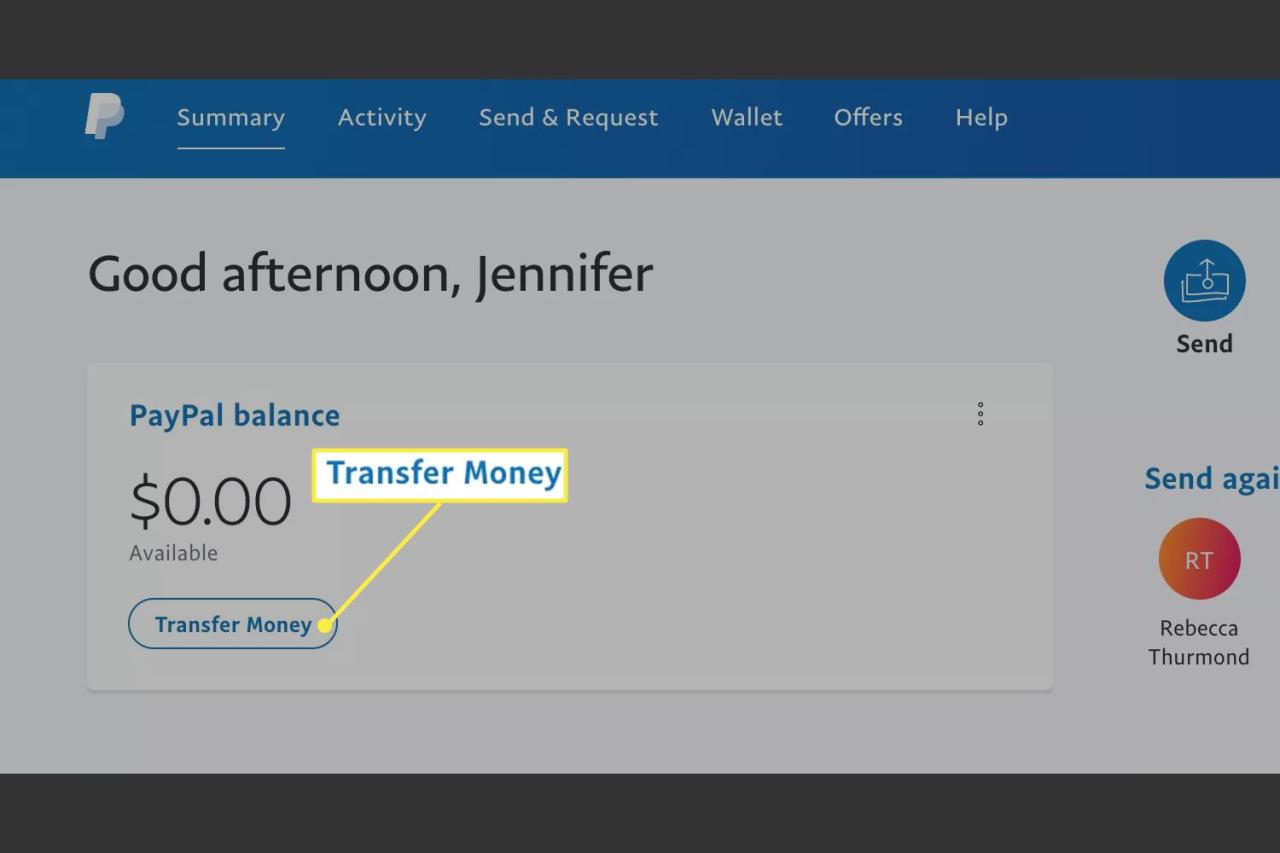

How to withdraw PayPal funds without a bank link

Discover the convenience of withdrawing PayPal funds without needing to link your bank account with this leading freelancing site.

Tired of expensive bank transfer fees and long waiting times? No need to worry anymore! Famous freelancing sites provide a convenient and efficient option to withdraw your earnings directly to your PayPal account.

Upwork:

As one of the largest freelancing platforms, Upwork offers fast and easy withdrawals via PayPal. Just add your PayPal account to your payments profile, and you can withdraw funds at any time after receiving payment from a client.

Fiverr:

Fiverr, a task-based freelancing website, also allows withdrawals via PayPal. Once you’ve accumulated enough funds to meet the minimum withdrawal threshold, you can transfer the money directly to your PayPal balance.

Toptal:

Toptal, a platform that connects businesses with top developer and design talent, offers withdrawals via PayPal as one of its payment options. You can withdraw funds at any time, provided your earnings have been confirmed and reviewed by the Toptal team.

Freelancers:

Freelancer, known for its various freelancing services, allows you to withdraw funds via PayPal. Just set up your PayPal account first, then set PayPal as your preferred payment method for receiving earnings.

PeoplePerHour:

PeoplePerHour, a freelancing website for various industries, provides withdrawals via PayPal. You can set PayPal as your preferred payment method and withdraw funds at any time as long as funds are available in your balance.

Withdrawing Funds to a Non-Bank Account:

Once you withdraw funds to your PayPal account, you can easily withdraw the money to a non-bank account, such as a prepaid card or debit card. Here are some options:

PayPal Cash Card: Withdraw funds from PayPal directly to a prepaid card linked to your PayPal account.

Venmo: Transfer funds from PayPal to your Venmo account and use your Venmo debit card to withdraw money.

Cash App: Withdraw funds from PayPal to your Cash App account and use your Cash App card to withdraw money.

By using freelancing sites that pay via PayPal, you can enjoy the flexibility and convenience of withdrawing your earnings quickly and easily, even if you don’t have a bank account. Good luck!

Can I use my PayPal account to receive money from freelancing websites without linking it (PayPal) to a bank account?

Using PayPal Without a Bank Account: Is It Possible?

As a freelancer, having a PayPal account to receive payments from clients is very important. However, did you know that you can use PayPal to receive money without having to link it to a bank account? In this article, we will discuss this possibility and how to do it.

PayPal Without a Bank Account: How Does It Work?

PayPal allows you to receive money without having to link it to a bank account. You can use PayPal services to receive payments from clients, but the money will not be automatically charged to your bank account. Instead, the money will be stored in your PayPal account.

How to Receive Money on PayPal Without a Bank Account

Here are the steps to receive money on PayPal without a bank account:

- Create a PayPal Account : If you don’t have a PayPal account, create a new account by visiting the PayPal website.

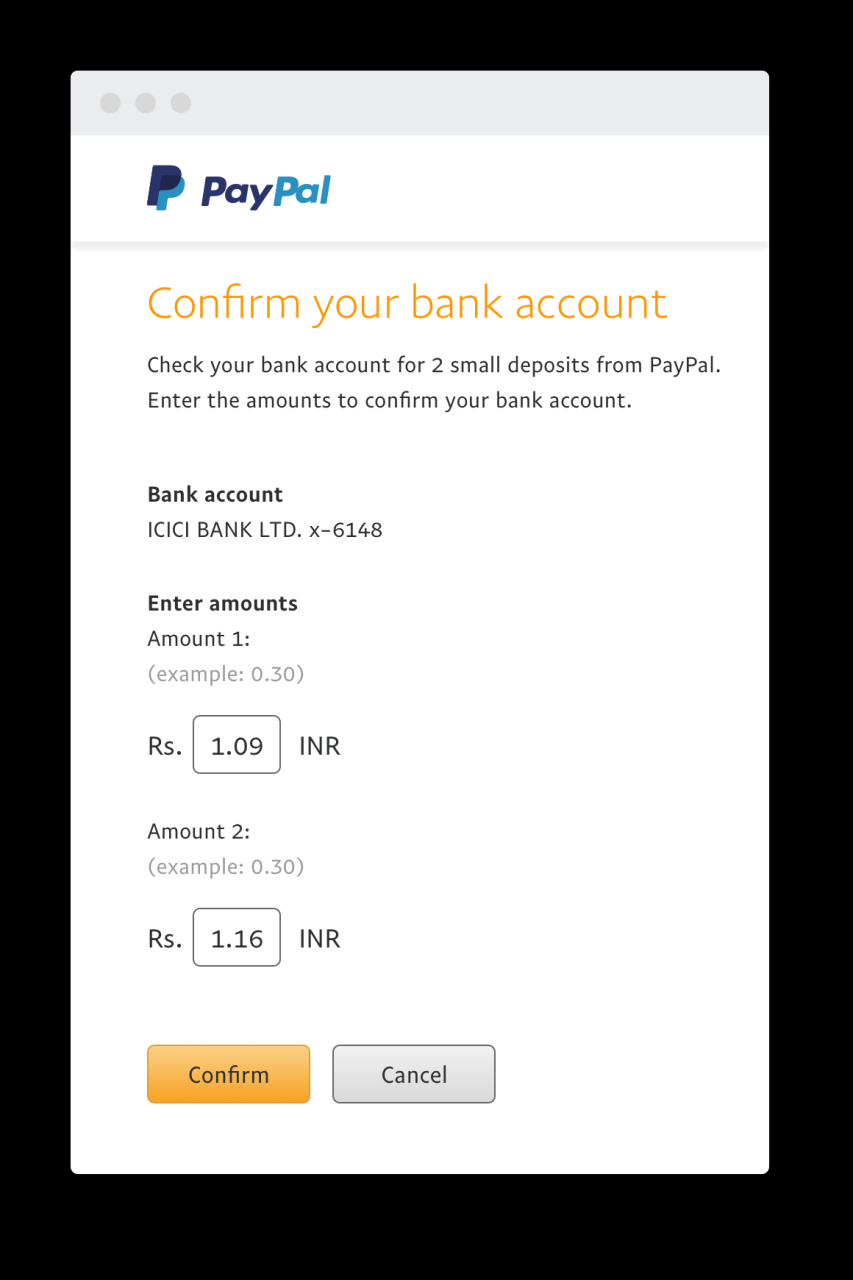

- Account Verification : Verify your PayPal account by following the instructions provided by PayPal.

- Specify an Email Address : Make sure the email address you use for your PayPal account has been verified.

- Receive Payment : If you receive a payment from a client, the money will go to your PayPal account.

Advantages of Receiving Money on PayPal Without a Bank Account

Here are some of the advantages of receiving money on PayPal without a bank account:

- Convenience : You don’t need to connect a bank account with PayPal, so the process is easier and faster.

- Security : The money you receive will be stored in your PayPal account, making it safer from fraud or theft.

- Flexibility : You can use the money in your PayPal account to make online purchases or pay bills.

Disadvantages of Receiving Money on PayPal Without a Bank Account

Here are some disadvantages of receiving money on PayPal without a bank account:

- Limit Money Withdrawals : If you don’t have a bank account connected to PayPal, you may not be able to withdraw money from your PayPal account directly.

- Withdrawal Fees : If you want to withdraw money from your PayPal account to another bank account, you may be charged a withdrawal fee.

- Limitations on Withdrawals : PayPal may have restrictions on withdrawing money for accounts that are not connected to a bank account.

How to Withdraw Money from PayPal Account Without a Bank Account

If you want to withdraw money from your PayPal account without a bank account, you can use the following methods:

- PayPal Card : You can use PayPal Card to withdraw money from your PayPal account at an ATM or make offline purchases.

- Transfer to Another Bank : You can transfer money from your PayPal account to another bank account, but keep in mind that there is a transfer fee that must be paid.

- PayPal Balance : You can use your PayPal balance to make online purchases or pay bills.

Conclusion

Receiving money on PayPal without a bank account is a possibility. However, keep in mind that there are several advantages and disadvantages to consider. If you want to use PayPal to accept payments from clients, make sure you understand how PayPal works and policies.

Tips and Suggestions

- Make sure you understand PayPal’s policies : Before using PayPal, make sure you understand the applicable policies and conditions.

- Verify your PayPal account : Verify your PayPal account for increased security and flexibility.

- Use PayPal Card : If you want to withdraw money from your PayPal account, use PayPal Card to withdraw money at an ATM or make offline purchases.

- Pay attention to withdrawal fees : If you want to withdraw money from your PayPal account, pay attention to the withdrawal fees that must be paid.

By understanding how PayPal works and policies, you can use PayPal to receive payments from clients more safely and flexibly.