Using PayPal for stock market investments

Invest in the Stock Market Easily Using PayPal

Stock investments can be a profitable gateway to financial security. However, for beginners, the process can seem intimidating. This is where PayPal comes in providing convenience and simplicity.

PayPal, a leading online payment service, recently expanded its services to include stock investments. This means you can now invest in your favorite companies just by using your PayPal account.

The process is easy and comfortable. Just link your bank account to your PayPal account, and you’re ready to start investing. You can choose from a diverse list of stocks, including large and growing companies.

One of the main advantages of using PayPal for stock investments is its low fees. PayPal doesn’t charge commissions for trades, so you can keep more money in your investments. Additionally, the easy-to-use platform makes navigating the investment process easy, even for beginners.

Not only is it convenient and cost-effective, investing in shares with PayPal is also safe. PayPal has strong security measures to protect your funds. The platform uses advanced encryption and fraud detection systems to ensure your investments are protected.

If you are considering investing in the stock market, PayPal is an option worth considering. The easy process, low fees, and strong security measures make it an attractive way to start your investment journey.

So, why delay? Take advantage of the convenience of PayPal and start investing today. With PayPal, you can grow your wealth and achieve your financial goals easily and conveniently.

Supported stock brokers for PayPal funding

PayPal has become a popular choice for stockbroker funding for investors. Its ease of use, safety, and wide reach make it an attractive option. When it comes to choosing a stockbroker that supports PayPal funding, there are several options available.

One of the top options is Robinhood. This commission-free trading platform allows funding via PayPal, making it an affordable option for novice investors. Plus, its user-friendly interface and wide selection of stocks and ETFs make it a great choice for those just starting out.

Another option is Webull. This stock broker also supports PayPal funding and offers low commissions on stock and ETF trades. Webull is known for its advanced mobile trading platform, which provides a convenient and modern trading experience.

For those looking for a stockbroker with a wider range of offerings, Charles Schwab is an excellent choice. This well-established stockbroker supports PayPal funding and provides a variety of services, including stock, mutual fund and bond trading. Schwab also offers comprehensive financial advisory and research tools.

If you prefer a stockbroker that focuses on options trading, Tastyworks is a great choice. This stockbroker allows PayPal funding and specializes in options trading. Tastyworks has a custom trading interface and extensive educational platform, making it a great choice for options investors.

Lastly, for investors looking for an advanced trading platform, TD Ameritrade is an option worth considering. This stockbroker supports PayPal funding and provides a wide range of trading tools, including advanced charts, price alerts, and news feeds. TD Ameritrade also offers financial advisors and educational webinars.

When choosing a stockbroker that supports PayPal funding, it is important to consider factors such as fees, product offerings, trading platforms, and customer support. By considering your needs and preferences, you can choose a suitable stock broker with PayPal to start your investment journey.

Limitations and fees involved in stock investments via PayPal

PayPal has become a convenient gateway for individuals looking to dive into the world of stock investing. The platform offers easy access and an intuitive interface. However, before you start your stock investing adventure through PayPal, it is important to understand the limitations and fees associated with this service.

One of the main limitations is limited stock availability. PayPal only offers a relatively small selection of stocks compared to traditional stock brokers. This can limit your investment options and cause you to miss out on potential opportunities.

Fees also play a role in stock investing through PayPal. PayPal charges fees for every transaction you make, including buying and selling shares. These fees vary depending on the type of stock and the amount traded. Additionally, some shares may incur additional commission charges.

It is important to note that PayPal does not offer financial advisory services. When you invest through PayPal, you make your own investment decisions. You must have a solid understanding of the stock market and the risks involved before starting.

Additionally, PayPal may not be suitable for active investors. These platforms have limited trading frequency, and may not be able to meet the needs of investors who wish to trade regularly.

Despite these limitations, PayPal can still be a viable option for novice investors looking to gain exposure to the stock market. These platforms provide an easy and affordable way to start your investments, although it is important to be aware of their limitations and invest wisely.

Before you invest through PayPal, do your research and compare fees with other stock brokers. Make sure you understand the investment terms and are comfortable with the risks involved. With careful planning, you can leverage PayPal to expand your investment portfolio.

Can I use my PayPal account to invest in stock market?

Using PayPal to Invest in the Stock Market: Is it Possible?

In the last few decades, technology has developed rapidly and changed the way we carry out various financial transactions. One of the clearest examples is the emergence of online payment services such as PayPal. PayPal has become one of the most popular online payment methods in the world, due to its convenience and security.

However, many people wonder if they can use PayPal to invest in the stock market. The answer is not entirely simple, as there are several things to consider. In this article, we will discuss the possibility of using PayPal to invest in the stock market and some things to keep in mind.

What is PayPal?

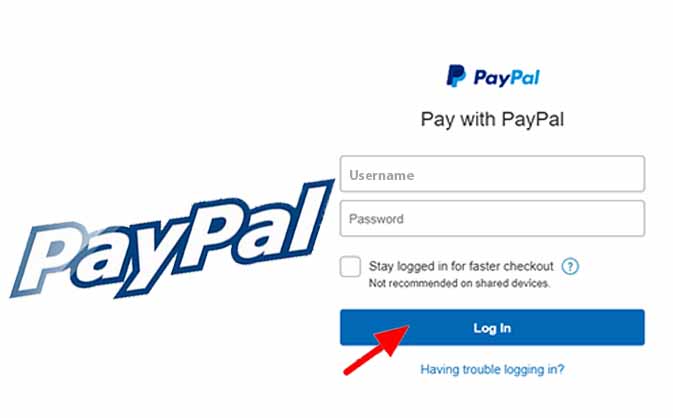

Before we talk about the possibility of using PayPal to invest in the stock market, let’s understand what PayPal is first. PayPal is an online payment service that allows users to carry out financial transactions online easily. With PayPal, you can make payments, send money, and receive money from others using your PayPal account.

PayPal was founded in 1998 and has become one of the most popular online payment methods in the world. With more than 400 million active users, PayPal has become one of the most popular online financial services in the world.

Using PayPal to Invest in the Stock Market

Now, let’s talk about the possibility of using PayPal to invest in the stock market. Basically, there are two ways to invest in the stock market: through a traditional stock broker or through an online platform.

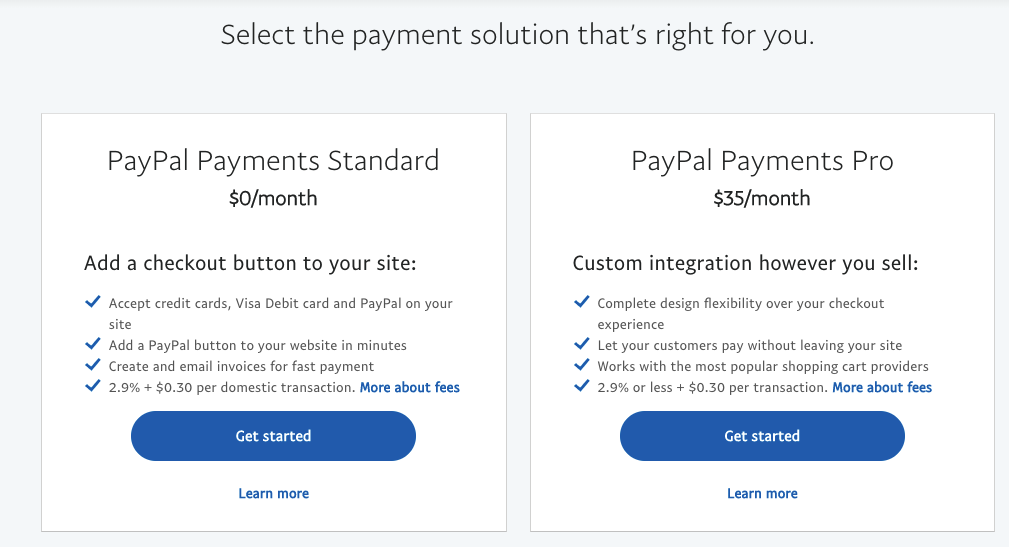

Traditional stock brokers usually require you to open a stock account directly with them. After that, you can make stock transactions using the funds in your account. However, traditional stock brokers usually have stricter requirements and higher fees than online platforms.

Online platforms, on the other hand, allow you to invest in the stock market online easily. You can choose an online platform that suits your needs and carry out stock transactions using the funds in your account. However, keep in mind that not all online platforms accept PayPal as a payment method.

Online Platforms That Accept PayPal

There are several online platforms that accept PayPal as a payment method for investing in the stock market. Here are some examples:

- eToro : eToro is one of the most popular online platforms for investing in the stock market. They accept PayPal as a payment method and offer a wide variety of financial instruments, including stocks, ETFs, and options.

- Robinhood : Robinhood is a popular online platform in the United States. They accept PayPal as a payment method and offer a wide variety of financial instruments, including stocks and ETFs.

- Ally Invest (formerly known as TradeKing): Ally Invest is an online platform that accepts PayPal as a payment method. They offer a wide variety of financial instruments, including stocks, ETFs, and options.

However, keep in mind that not all online platforms accept PayPal as a payment method. Therefore, you should check the terms and conditions of the online platform before making a transaction.

Advantages and Disadvantages of Using PayPal to Invest in the Stock Market

Using PayPal to invest in the stock market has several advantages and disadvantages. Here are some examples:

Excess:

- Convenience : Using PayPal to invest in the stock market is very easy. You only need to have a PayPal account and make stock transactions using the funds in your account.

- Security : PayPal is known to have a good reputation for security. They have a sophisticated security system to protect your transactions.

- Lower costs : Using PayPal to invest in the stock market can help you save on costs. Some online platforms that accept PayPal do not have additional fees for stock transactions.

Lack:

- Limitation : Some online platforms that accept PayPal have limitations for stock transactions. For example, eToro has a limit of $50,000 per transaction.

- Cost requirements : Some online platforms that accept PayPal have higher requirement fees than other payment methods.

- Not all online platforms accept PayPal : As mentioned earlier, not all online platforms accept PayPal as a payment method. Therefore, you should check the terms and conditions of the online platform before making a transaction.

Conclusion

Using PayPal to invest in the stock market is possible, but there are a few things to consider. You should check the terms and conditions of the online platform before making a transaction, and understand the advantages and disadvantages of using PayPal to invest in the stock market.

By choosing an online platform that suits your needs and understanding how to use PayPal to invest in the stock market, you can increase your potential profits and reduce the risk of loss. Therefore, make sure you do enough research and understand how to use PayPal to invest in the stock market wisely.