Understanding PayPal Credit

Hi there! Want to know about PayPal Credit? Let’s discuss it together.

PayPal Credit is basically a line of credit that allows you to make purchases online or offline. It’s like a credit card, but tied to your PayPal account.

How does it work? Just apply and get approved for PayPal Credit. Once approved, you can use it to pay for purchases at any online store that accepts PayPal or at a brick-and-mortar store that has PayPal Here.

The main advantage of PayPal Credit is its flexibility. You can choose to pay for your purchase in full each month or pay over time at a low interest rate during the promotional term. This gives you more control over your expenses and can help you manage cash flow.

Additionally, PayPal Credit often offers promotions and rewards, such as 0% interest for a certain period or cash back. This can be a great way to save money and earn rewards on your purchases.

While PayPal Credit has many benefits, it’s important to remember that it is a form of credit and should be used responsibly. If you fail to make payments, you may be charged late fees and higher interest rates.

Therefore, before using PayPal Credit, make sure you understand the terms and conditions carefully. Consider your budget and only spend what you can afford.

Overall, PayPal Credit can be a useful financial tool if used wisely. It offers flexibility, potential savings, and convenience of shopping online and offline. So, if you’re looking for a way to manage your spending, PayPal Credit is worth considering.

How to send money using PayPal Credit

When you want to send money using PayPal Credit, it’s important to understand how it works. PayPal Credit is a line of credit that allows you to borrow funds to make purchases using your PayPal account. Similar to a credit card, it has an approved credit limit and you must make monthly payments on your outstanding balance.

To use PayPal Credit, you must first register and be approved for this service. Once approved, you can use it to send money to other people or make purchases on websites that accept PayPal. However, please note that PayPal Credit cannot be used to withdraw cash or send payments to yourself.

When using PayPal Credit, remember that this is a debt. It’s important to only borrow what you can afford and make payments on time every month to avoid late fees or damaging your credit score.

PayPal Credit offers a number of benefits, including the ability to make large purchases without having to pay up front and an interest-free grace period on qualifying purchases. However, there are also some downsides to consider, such as the fact that it can affect your credit score and you could be charged fees if you don’t pay off your balance on time.

If you’re considering using PayPal Credit, take the time to understand how it works and whether it’s right for you. Weigh the pros and cons carefully, and always remember to borrow responsibly.

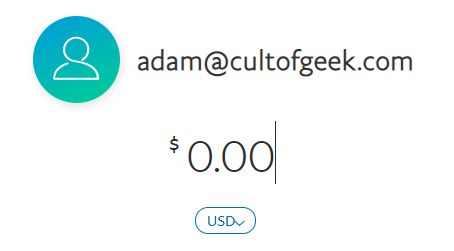

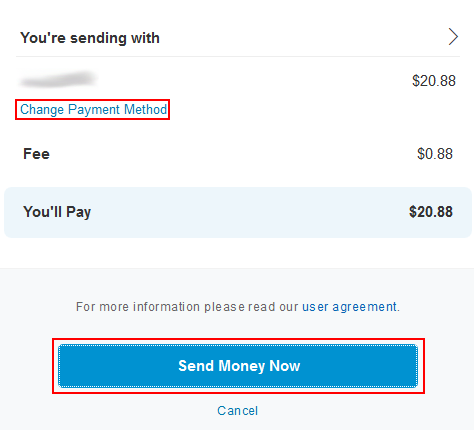

To send money using PayPal Credit, simply select the “Send Money” option in your PayPal account and select PayPal Credit as your payment method. You can then enter the amount you want to send and the recipient’s name and email address. Once you confirm the transaction, the money will be sent to the recipient’s account within minutes.

Overall, PayPal Credit can be a convenient tool for sending money or making purchases. However, it is important to use them responsibly and understand the potential costs.

Limitations and fees associated with PayPal Credit for personal payments

When using PayPal Credit for personal purchases, it is important to be aware of the limitations and associated fees.

PayPal Credit has a set credit limit, which varies depending on your creditworthiness. This limit limits the amount you can borrow using PayPal Credit. Additionally, PayPal Credit charges interest on unpaid balances. These interest rates also vary depending on your credit worthiness.

If you do not pay your PayPal Credit balance in full each month, you will be charged a late fee. Late fees are usually fixed, regardless of the amount of the unpaid balance. Additionally, PayPal Credit may charge transaction fees for some purchases, such as international purchases or purchases from certain sellers.

It’s important to compare the costs of PayPal Credit to other financing options before using it for personal purchases. If you’re not sure whether PayPal Credit is the best option for you, it’s a good idea to consult a financial advisor.

The limitations and fees associated with PayPal Credit can have a significant impact on the overall cost of your purchase. By understanding these limitations and fees, you can make an informed decision about whether or not to use PayPal Credit for personal payments.

In addition to credit limits and interest fees, PayPal Credit also has a 21-day grace period, which gives you time to pay your balance in full without incurring interest. However, it is important to note that the grace period only applies to purchases made within the country. For international purchases, the grace period may be shorter or not available at all.

Overall, PayPal Credit can be a convenient and flexible financing option for personal purchases. However, it is important to know the limitations and costs involved to ensure that this is the best option for you.

Can I use a PayPal credit payment method to send money to friends?

Using PayPal Credit as a Payment Method to Send Money to Friends

PayPal is one of the most popular online payment services in the world. With more than 400 million active users worldwide, PayPal has become the first choice for many people to make online transactions safely and easily. One of the interesting features of PayPal is the ability to use PayPal Credit as a payment method. However, can you use PayPal Credit to send money to friends? Let’s discuss more about this.

What is PayPal Credit?

PayPal Credit is a payment service from PayPal that allows users to make online purchases using credit. PayPal Credit works with several banks and other financial institutions to provide credit to PayPal users. By using PayPal Credit, you can make purchases online without having to pay in full right away. Instead, you can make payments in installments or in full on the specified due date.

How to Use PayPal Credit?

Using PayPal Credit is relatively easy. Here are the steps you need to take to use it:

- Create a PayPal Account : If you don’t have a PayPal account, create one first. You can do this by visiting the PayPal website and following the registration process.

- Information Verification : After you create an account, verify your personal information, such as email address, date of birth, and home address.

- Activate PayPal Credit : Once you have verified your personal information, activate PayPal Credit by clicking the “Activate” button on your PayPal account page.

- Agree to the Terms and Conditions : Before you can use PayPal Credit, you must agree to the terms and conditions specified by PayPal.

Can I Use PayPal Credit to Send Money to Friends?

Unfortunately, PayPal Credit cannot be used to send money to friends directly. PayPal Credit can only be used to make online purchases from merchants who have partnered with PayPal. However, there are several alternative ways you can send money to friends using PayPal Credit:

- Buying Items and Sending Them to Friends : You can use PayPal Credit to buy goods from merchants who have partnered with PayPal, then send them to your friends. However, keep in mind that you will have to pay shipping costs and other fees associated with the transaction.

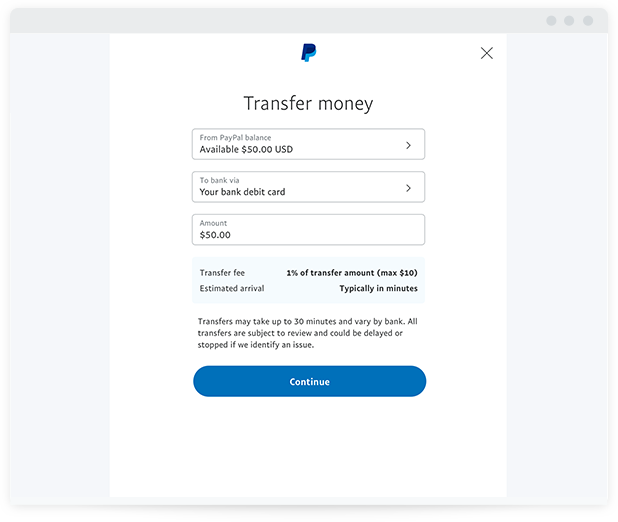

- Make a Payment to a Friend’s Bank Account : You can use PayPal Credit to make payments to your friends’ bank accounts. However, keep in mind that you will need to have your friend’s bank account information and bank transfer fees may apply.

Benefits of Using PayPal Credit

Using PayPal Credit has several benefits, such as:

- Payment Flexibility : PayPal Credit allows you to make purchases online without having to pay in full on the spot.

- Competitive Credit : PayPal Credit offers competitive credit with low interest rates.

- Safe and Easy : PayPal Credit is safe and easy to use, with strict security protection to protect your personal information.

Risks of Using PayPal Credit

Using PayPal Credit also has some risks, such as:

- High Interest : If you do not pay the credit in full on the due date, you will be charged high interest.

- Applicable Fees : PayPal Credit has applicable fees, such as bank transfer fees and other fees associated with transactions.

- Using More Than You Need : PayPal Credit can let you use more than you need, because you can make purchases online without having to pay in full on the spot.

Conclusion

Using PayPal Credit as a payment method to send money to friends cannot be done directly. However, there are several alternative ways you can send money to friends using PayPal Credit. Keep in mind that using PayPal Credit has several benefits, such as payment flexibility and competitive credit. However, it also has some risks, such as high interest and applicable fees. Therefore, make sure you read the terms and conditions set by PayPal before using PayPal Credit.