How cryptocurrency balance works on PayPal

Imagine entering the fast-paced world of finance, where digital currencies have become a part of everyday life. One of the leading platforms that has adopted this realm is PayPal. Let’s explore how cryptocurrency balancing works on PayPal.

PayPal serves as a bridge between traditional currencies and cryptocurrencies. When you buy cryptocurrency through PayPal, you are not actually buying the coins themselves. Instead, PayPal holds the cryptocurrency on your behalf in what’s called a “crypto wallet.” This way, you can easily transact with cryptocurrencies without the hassle of managing private keys or digital wallets.

Your cryptocurrency balance in PayPal is reflected in your “Crypto Wallet”. This is a separate account from your regular PayPal balance. Crypto Wallet allows you to buy, sell, and hold PayPal-supported cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

The process of buying cryptocurrency via PayPal is very easy. Just select the currency you want, specify the amount, and complete the transaction. PayPal will automatically add cryptocurrency to your Crypto Wallet.

However, keep in mind that PayPal charges fees for cryptocurrency transactions. These fees vary depending on the currency and transaction amount. Additionally, the value of cryptocurrencies can fluctuate significantly, so it is important to understand the risks before investing.

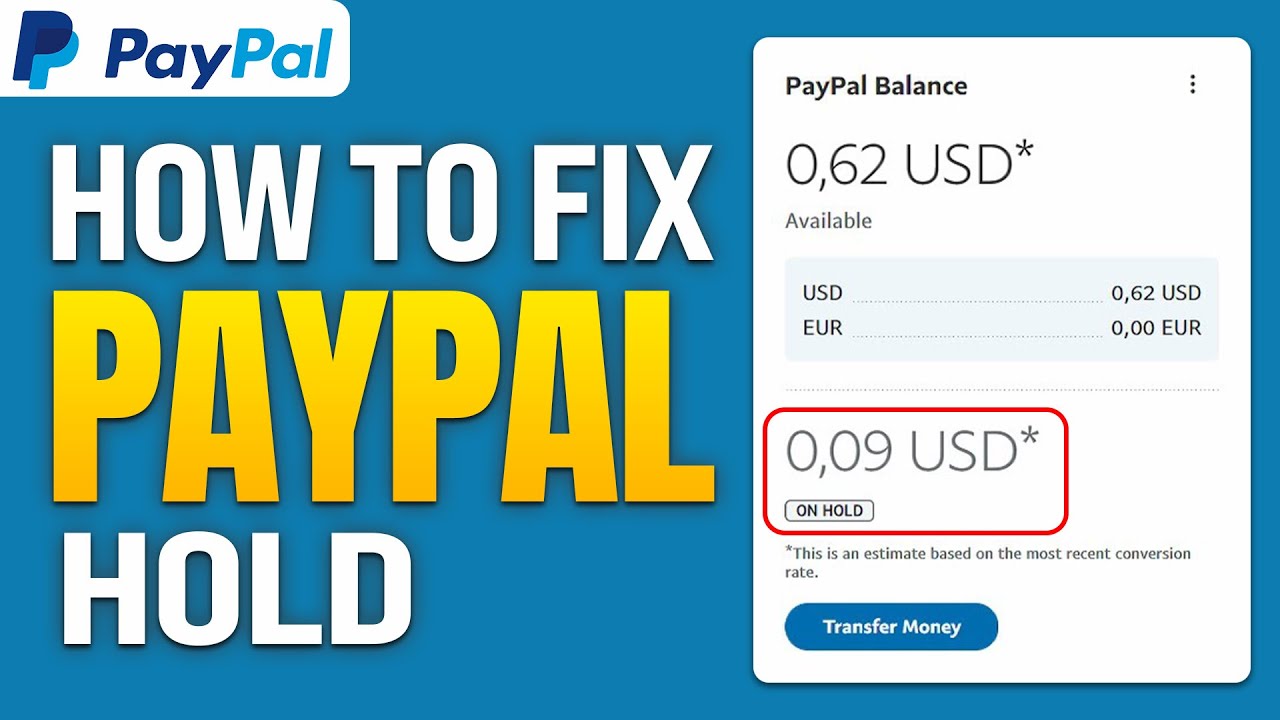

PayPal does not allow direct cryptocurrency withdrawals to external wallets. If you want to withdraw your cryptocurrency, you must first sell it on PayPal and withdraw funds in the form of traditional currency. This process also incurs a fee.

Despite these limitations, PayPal offers a convenient and safe way to interact with cryptocurrency for those unfamiliar with its technical aspects. With Crypto Wallet, you can store, buy, and sell cryptocurrency without needing to manage a digital wallet or private keys.

In conclusion, cryptocurrency balancing on PayPal is a feature that makes it easier for people to participate in the dynamic cryptocurrency environment. Through Crypto Wallet, you can buy, sell, and hold PayPal-supported cryptocurrencies easily and conveniently. However, it is important to understand the costs and value fluctuations associated with cryptocurrencies before you dive into them.

Steps to use cryptocurrency as a payment method

PayPal has revolutionized the way people manage money, and the addition of cryptocurrencies further expands its services. If you want to harness the power of cryptocurrency, here’s how cryptocurrency balances work on PayPal:

Once you have enabled cryptocurrency on your PayPal account, you will see a “Crypto” tab on your account homepage. This tab displays your balance for Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

Adding cryptocurrency to your balance is very easy. Just click the “Buy” button in the “Crypto” tab and follow the instructions. You can buy cryptocurrency using your bank account or credit card. Once your purchase is processed, cryptocurrency will be added to your balance.

Using cryptocurrency as a payment method is just as easy. When you pay for a purchase via PayPal, you will see the option to “Pay with Crypto.” Select this option and select the cryptocurrency you want to use. PayPal will convert your cryptocurrency to the merchant’s local currency automatically.

It is important to note that the value of cryptocurrencies can fluctuate, so always check the exchange rate before making a transaction. You should also be aware that PayPal charges fees when buying or selling cryptocurrency.

If you want to withdraw cryptocurrency from your PayPal balance, click the “Withdraw” button in the “Crypto” tab and follow the instructions. You must provide your crypto wallet address to complete the withdrawal.

PayPal cryptocurrency balance offers many conveniences. You can buy, hold and sell cryptocurrency easily and safely. You can also use cryptocurrency to make purchases online. However, it is important to know the potential risks associated with cryptocurrencies before using them.

Limitations and supported cryptocurrencies on PayPal

When it comes to cryptocurrencies on PayPal, there are some limitations and supported cryptocurrencies to be aware of. First of all, it is important to understand that PayPal limits the use of cryptocurrency for the purchase and sale of goods or services. You cannot withdraw cryptocurrency funds from PayPal to an external crypto wallet, nor can you fund them directly from a crypto wallet.

Next, let’s discuss the cryptocurrencies supported by PayPal. Currently, PayPal only supports four major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). This cryptocurrency was chosen due to its high popularity and significant liquidity in the market.

In addition to these limitations, it is important to consider the tax implications regarding cryptocurrency on PayPal. When you sell or spend cryptocurrency on PayPal, you may be subject to capital gains tax, depending on the tax laws in your region. Therefore, it is important to consult a tax advisor to understand the tax obligations that may arise from cryptocurrency activities on PayPal.

Overall, although there are some limitations and requirements associated with cryptocurrencies on PayPal, the platform offers a convenient way for users to buy, sell, and store popular cryptocurrencies. With a clear understanding of these limitations and the support available for certain cryptocurrencies, users can utilize PayPal’s cryptocurrency services with confidence.

Can I use a cryptocurrency hold on PayPal to pay or send money with PayPal?

Using Cryptocurrency on PayPal: Is It Possible?

PayPal is one of the largest online payment platforms in the world. In recent years, PayPal has expanded its functionality by adding the ability to buy, sell, and store cryptocurrency. However, have you ever wondered whether you can use cryptocurrency stored in PayPal to make payments or send money through PayPal?

In this article, we will discuss PayPal’s ability to use cryptocurrency to carry out transactions, as well as some restrictions and policies that you need to know before making transactions with cryptocurrency on PayPal.

Cryptocurrencies on PayPal

In 2020, PayPal launched a new feature that allows users to buy, sell, and store cryptocurrency directly on the PayPal platform. This feature is enabled through collaboration with other companies, such as Paxos Trust Company, which provides tax licenses and additional security for cryptocurrency transactions.

PayPal users can buy and sell four main types of cryptocurrency, namely Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Litecoin (LTC). However, keep in mind that cryptocurrency stored on PayPal cannot be moved to another wallet or used as a sending address.

Using Cryptocurrency to Pay or Send Money via PayPal

Unfortunately, cryptocurrency stored in PayPal cannot be used directly to make payments or send money through PayPal. However, there are several ways to use your cryptocurrency on PayPal to make transactions:

- Convert Cryptocurrency to Local Currency : You can convert your cryptocurrency into local currency on PayPal, such as US Dollars (USD) or Euros (EUR). After conversion, you can use the local currency to make payments or send money via PayPal.

- Using PayPal Card : If you have a PayPal Card, you can use your cryptocurrency to top up the card’s balance. After that, you can use the card to make payments online or offline.

- Using Payment Acceptance in E-commerce : Some e-commerce have added a feature to accept payments using cryptocurrency via PayPal. However, this feature is still limited and only available in certain e-commerce sites.

Limitations and Policies

Before making transactions with cryptocurrency on PayPal, you need to know the following restrictions and policies:

- Location : The cryptocurrency feature on PayPal is only available in certain countries, such as the United States, Canada, and the European Union.

- Transaction Limitations : There is a transaction limit for cryptocurrency on PayPal, which is around IDR 10 million per day.

- Cost : There is a transaction fee charged for making cryptocurrency transactions on PayPal, which is around 2.3% to 3.1% of the transaction value.

- Security : Cryptocurrency stored on PayPal cannot be moved to another wallet or used as a sending address.

Conclusion

In recent years, PayPal has expanded its functionality by adding the ability to buy, sell, and store cryptocurrency. However, you need to know that cryptocurrency stored in PayPal cannot be used directly to make payments or send money via PayPal. You will need to convert your cryptocurrency into local currency or use PayPal Card to make transactions. Make sure you also understand the applicable restrictions and policies before making transactions with cryptocurrency on PayPal.