Verification requirements for PayPal in India

Verification Requirements for PayPal in India

To enjoy the full range of services offered by PayPal in India, you need to verify your account. This verification process ensures that you are who you claim to be and helps protect your account from unauthorized use.

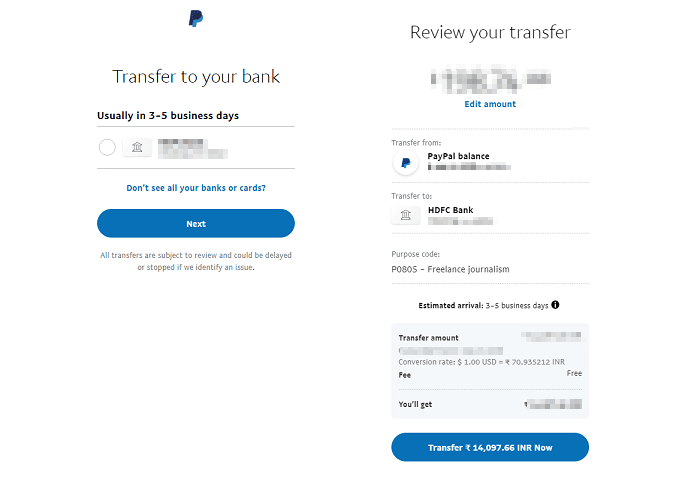

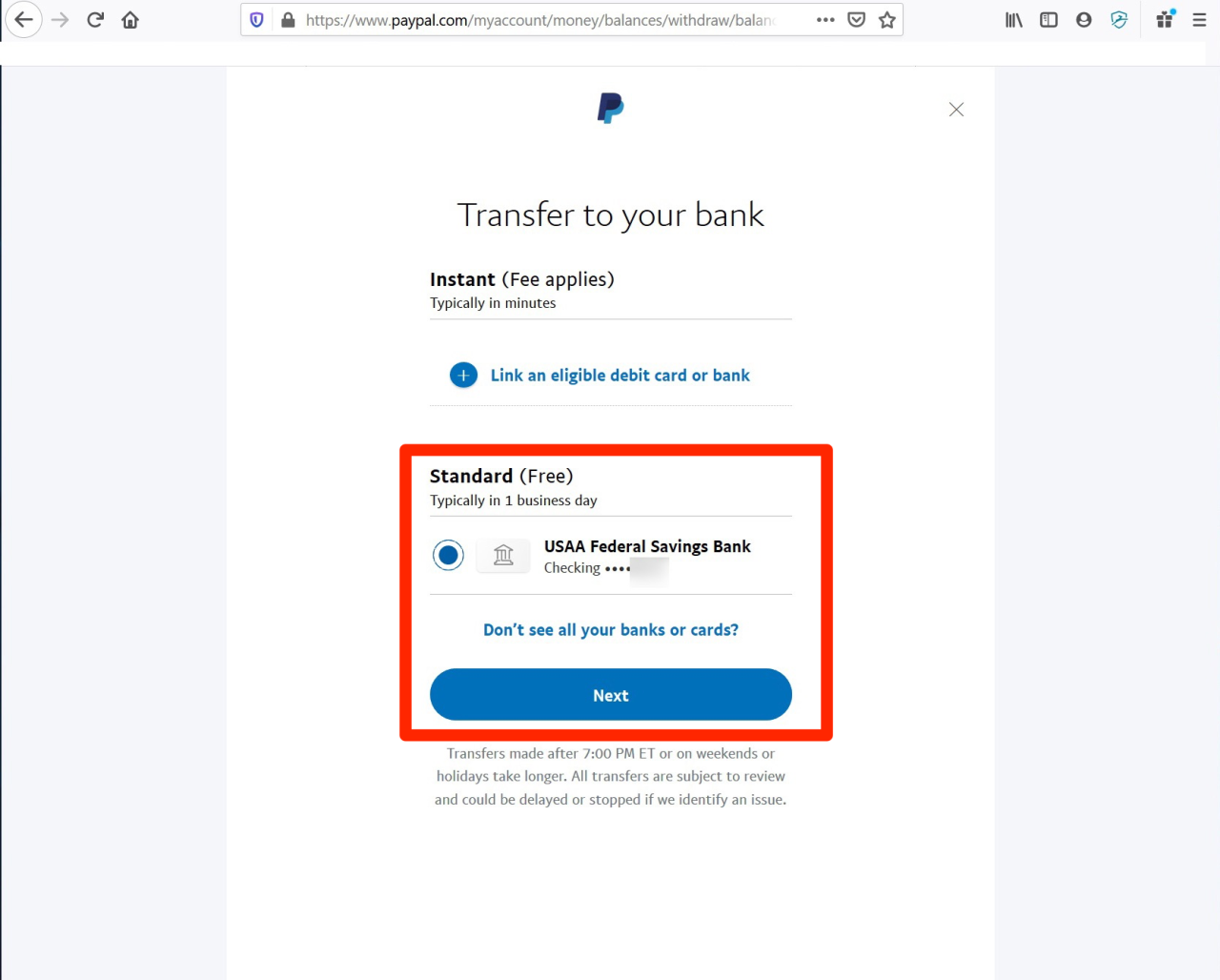

The first step in the verification process is to connect your bank account to PayPal. This can be done by adding your bank account number and IFSC code. Once your bank account is linked, PayPal will make a small deposit and ask you to confirm the amount. By confirming the amount, you will prove that you have access to the bank account.

If you want to withdraw funds from PayPal to your bank account, you must also verify your phone number. PayPal will send a verification code to your phone, which you must enter to complete the process.

After you complete these steps, PayPal will assess your account and determine whether additional verification is necessary. Depending on account usage and other risk factors, PayPal may require you to provide additional documentation, such as government-issued identification or proof of address.

The verification process generally takes between several hours to several days. However, if you have provided all the necessary information, there should be no significant delays.

It’s important to note that PayPal does not charge any fees to verify your account. If you are asked to pay a fee, it may be fraudulent, and you should report it to PayPal.

Verifying your PayPal account is an important step to ensure the security of your account and funds. By following these simple steps, you can protect your account and enjoy all the benefits PayPal has to offer.

Steps to transfer between PayPal accounts

Hello our loyal readers,

In this article, we will discuss simple steps to transfer money between PayPal accounts in India. Before we get into those steps, it’s important to make sure that your PayPal account is verified. This is an important step that helps PayPal protect the security of your funds and your account.

To verify your PayPal account, you need to link an Indian bank account to your PayPal account. The process is easy and only takes a few minutes. Once you link your bank account, PayPal will make two small transactions to your account. The amount of this transaction will appear on your bank statement.

The next step is to confirm this amount in your PayPal account. You will be asked to enter the amount you see in the transaction. Once you enter it correctly, your account is verified. This verification is very important because it increases your transfer limit and allows you to enjoy various PayPal features.

Now, let’s discuss the steps to transfer money between PayPal accounts in India:

1. Sign in to your PayPal account: Sign in to your PayPal account with your email address and password.

2. Select “Send & Request”: Click on the “Send & Request” tab on the top menu bar.

3. Enter the recipient’s email address: On the Send Money page, enter the recipient’s email address.

4. Enter amount and select currency: Determine the amount you want to send and select the desired currency.

5. Add optional notes: You can add optional notes to transactions if required.

6. Review and send: Review your transfer details carefully, then click the “Send” button.

Once you click “Send”, the money will be transferred directly to the recipient’s PayPal account. It is important to note that PayPal may charge a small transaction fee for these transfers. These fees vary depending on the amount transferred and the currency selected.

The transfer process is fast and convenient. You can transfer money anytime, anywhere, as long as you have internet access. So, next time you need to send money to family or friends in India, remember these easy steps to transfer money between PayPal accounts.

Restrictions on unverified accounts in India

Restrictions for Unverified PayPal Accounts in India

PayPal, India’s leading online payments platform, implements verification measures to ensure security and compliance. Without verification, a PayPal account has certain limitations that may limit your functionality and experience.

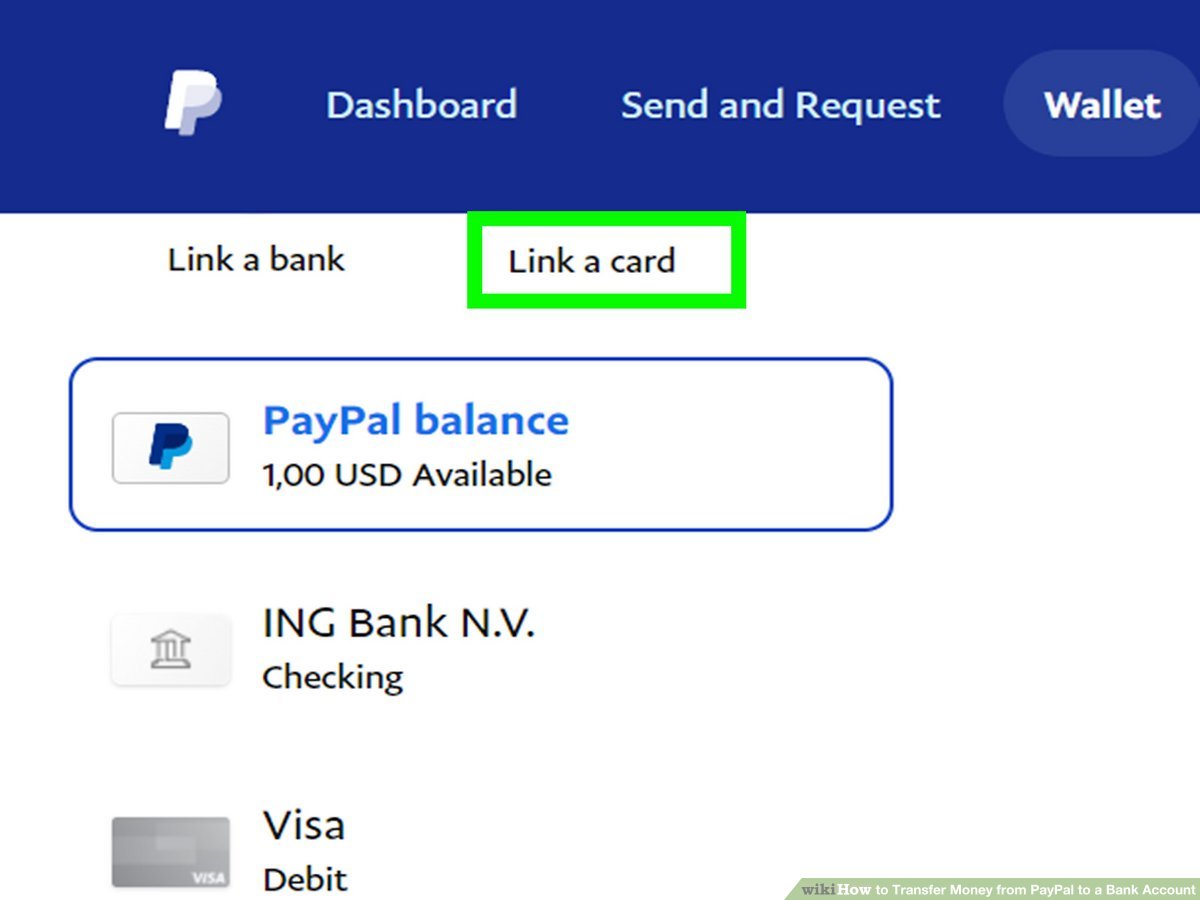

Verifying your PayPal account will help you gain access to the full range of features PayPal has to offer. Benefits include:

Higher transaction limits: Verified accounts have higher transaction limits than unverified accounts. This allows you to make larger transactions with ease.

Ability to accept payments: Once verified, you can accept payments from buyers all over the world.

Enhanced protection: Verification provides an additional layer of protection against fraud and abuse.

However, unverified PayPal accounts have some limitations, such as:

Low transaction limits: Unverified accounts have relatively low transaction limits, which can limit your financial activity.

Unable to receive payments: You will not be able to receive any payments to an unverified PayPal account.

Suspension risk: Unverified accounts are more at risk of suspension for security reasons.

The PayPal verification process is quite easy and can be completed online or via the PayPal application. You must provide the required documents, such as a government-issued identification card or bank statement.

Once the verification process is complete, your PayPal account will be verified and you can enjoy all the features and benefits provided. Verification is critical to ensuring your security and optimal PayPal experience.

Therefore, we strongly recommend that you immediately verify your PayPal account to unlock its full potential and avoid potential limitations associated with unverified accounts.

Can I transfer PayPal to PayPal in India without being verified?

PayPal to PayPal Transfer in India without Verification: Is It Possible?

PayPal is one of the most popular online payment services in the world. With complete features and high security, PayPal has become the choice of many people for making online transactions. However, there are some frequently asked questions by PayPal users, especially in India: is it possible to make a PayPal to PayPal transfer in India without having to verify the account?

In this article, we’ll cover what you need to know about PayPal to PayPal transfers in India, including whether it’s possible to make a transfer without verification. We’ll also provide some useful tips and information to help you use PayPal more effectively.

How to Transfer PayPal to PayPal in India?

To make a PayPal to PayPal transfer in India, you need to have an active PayPal account and sufficient balance. Here are the steps you need to do:

- Login to your PayPal account : Open the PayPal website and log in to your account using the correct email and password.

- Select the “Send” option : Once you have logged in, select the “Send” option on the main menu.

- Enter your email address or PayPal number : Enter the email address or PayPal number of the user you want to transfer to.

- Enter the transfer amount : Enter the transfer amount you want to make.

- Select a payment method : Select the payment method you want to use, such as credit or debit card.

- Confirm transfer : Make sure all the information you entered is correct, then click the “Send” button to make the transfer.

Is It Possible to Transfer PayPal to PayPal in India without Verification?

This question is frequently asked by PayPal users in India. The answer is: not completely. To make a PayPal to PayPal transfer in India, you need to verify your account first.

PayPal account verification is required to ensure that your account is a legitimate account and is not being used for illegal activities. The PayPal account verification process includes several steps, such as:

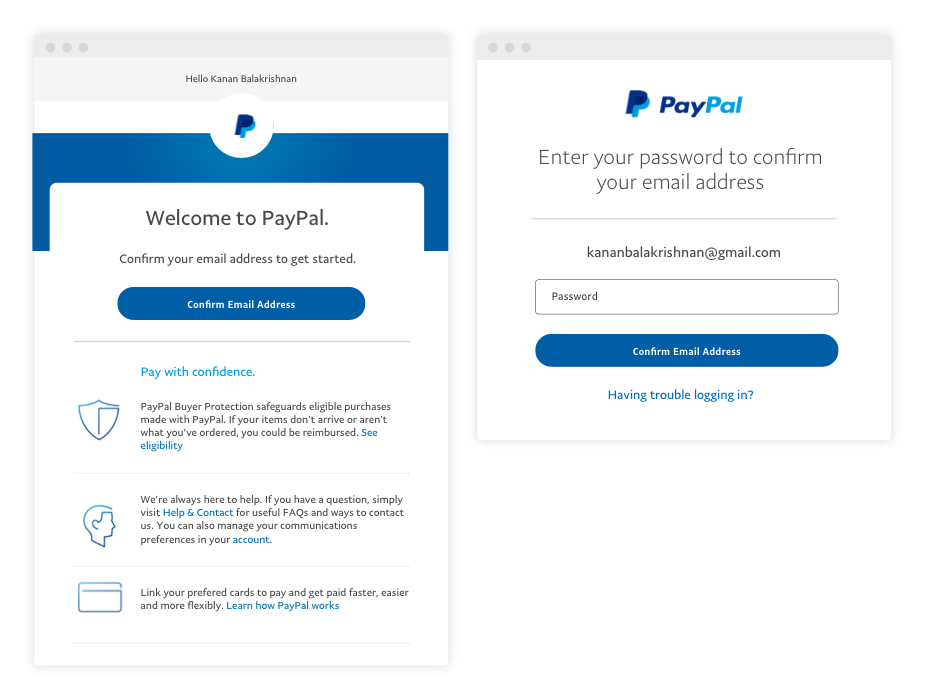

- Email verification : You need to verify your email address by clicking on the link sent by PayPal to your email.

- Verify phone number : You need to verify your phone number by receiving a verification code sent by PayPal to your phone number.

- Verify credit or debit card : You need to verify your credit or debit card by entering the correct card information.

Once you verify your account, you can make PayPal to PayPal transfers in India more easily and safely. However, if you do not verify your account, you may experience some limitations, such as:

- Transfer restrictions : You may not be able to make large transfers.

- Additional cost : You may be charged additional fees for making a transfer.

Useful Tips and Information

Here are some useful tips and information that can help you use PayPal more effectively:

- Make sure you verify your account : Verify your account to ensure that your account is a legitimate account and is not being used for illegal activities.

- Use a secure payment method : Use a secure payment method, such as a credit or debit card, to make the transfer.

- Check your balance : Make sure you have sufficient balance before making a transfer.

- Check transfer fees : Make sure you understand the transfer fees charged by PayPal before making a transfer.

Conclusion

PayPal to PayPal transfers in India without verification are not completely possible. To make transfers more easily and safely, you need to verify your account first. By verifying your account, you can make large transfers and will not incur additional fees. Don’t hesitate to use PayPal as a safe and effective online payment service.