How to send money to non-PayPal users.

Sending money to people who don’t have a PayPal account can be a hassle, but there are some relatively easy ways to do it. Let’s discuss some of the options available to you:

Bank Transfer: This option allows you to send money directly to the recipient’s bank account. You’ll need the recipient’s complete banking information, including name, account number, and SWIFT code (if international transfer). Although safe and reliable, bank transfers usually take several days to complete.

Third Party Transfer Platforms: There are several third party transfer platforms that allow you to send money to non-PayPal users. The platform functions as an intermediary, making transfers from your bank account to the recipient’s account easy. Some popular options include Wise (formerly TransferWise), Western Union, and MoneyGram.

Mobile Payment Apps: If your recipient has a mobile payment app like Venmo or Cash App, you can send them money using those apps. Transfers via these apps are usually instant and cost-free, making them a convenient and fast option. However, availability and features may vary depending on the platform you use.

Prepaid Card: You can purchase a prepaid card and fund it with the amount you want to transfer. You can then give the prepaid card to the recipient, who can use it to withdraw money at an ATM or spend it anywhere they are accepted. This is a simple and safe option, but it can incur costs.

Cash transfers: Although somewhat outdated, cash transfers remain a convenient way to send money to non-PayPal users. You can meet the recipient in person and hand over the cash to them. However, make sure to take proper precautions and conduct transactions in safe and public places.

When choosing the right method, consider factors such as cost, speed, security, and ease of use. Always check which platforms or services are available in your and your recipient’s country. Doing a little research can help you find the best option for your needs.

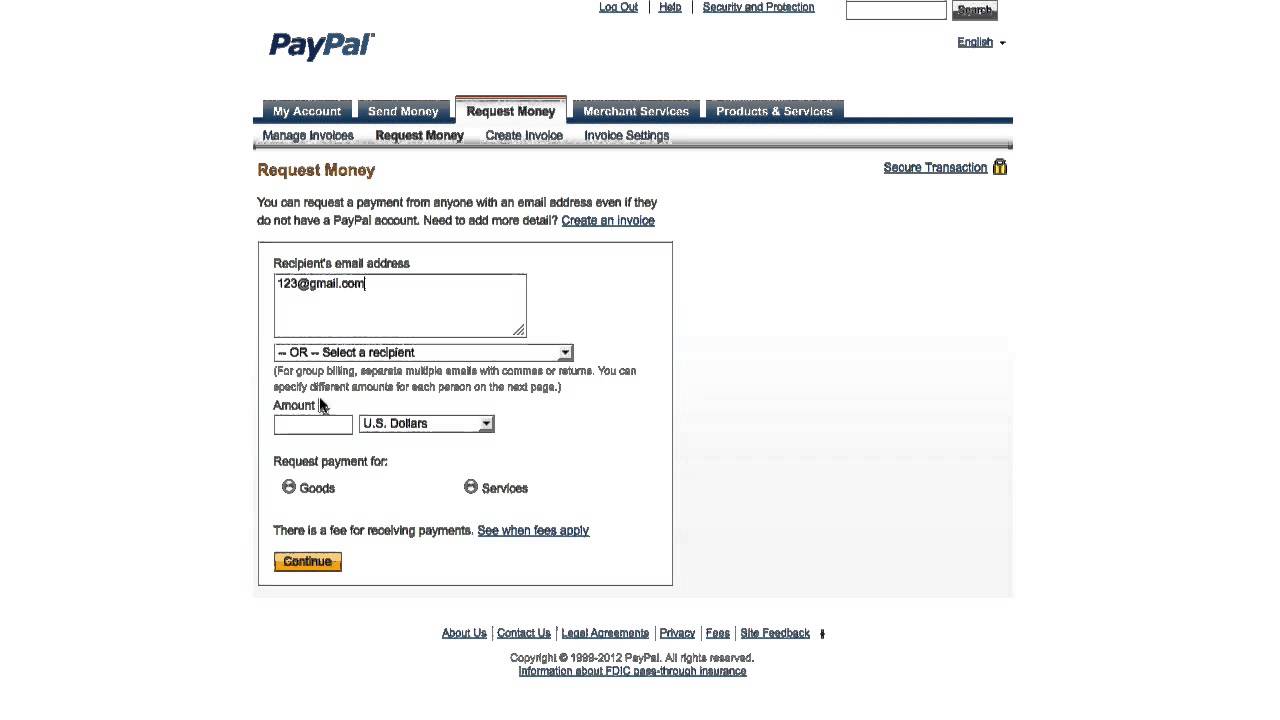

Options for receiving funds without a PayPal account.

If you want to send money to someone who doesn’t have a PayPal account, don’t worry, there are several options you can consider. Let’s discuss each of them in more depth:

Bank Transfer

Transferring money directly to the recipient’s bank account is a safe and reliable way. Simply collect the recipient’s account number and SWIFT code (or BIC). However, bank transfers usually take several business days and may incur fees, especially if sent overseas.

Payment Processing Services

Besides PayPal, there are other payment processing services that allow you to send money to non-users. Platforms like Wise, Venmo, and Google Pay offer easy ways to transfer funds, often with lower fees than bank transfers.

Money Orders

Money orders are a classic way to send money. You can purchase a money order at a post office or bank, and the recipient can cash it at a designated location. However, money orders can be expensive and not as convenient as other options.

Gift Card

If the recipient wants the flexibility to spend funds as they wish, you can send a gift card from their preferred retailer. Simply purchase a gift card online or in store and send it physically or electronically.

Social Platforms

Several social media platforms, such as Facebook and WhatsApp, have launched money transfer features. This can be a convenient option if you and the recipient are connected on the platform. However, keep in mind that this feature may have certain limitations and is only available in certain countries and currencies.

Cash Payment

If you and the recipient are in the same location, you can choose to pay in cash. However, this method is only recommended for small amounts due to security concerns and lack of transaction proof.

Additional Tips

Make sure to confirm recipient details before sending funds.

Compare the fees and exchange rates offered by different service providers.

Tell recipients about the shipping method you use and when they can expect funds.

Save proof of transaction for your records.

Limitations on sending money to non-users.

Although PayPal is known for its ease in sending and receiving money, there are certain limitations when sending money to non-PayPal users. However, don’t worry, here are some ways to overcome this limitation and ensure your transactions remain smooth:

Ask Them to Create a PayPal Account

The most direct way is to ask the recipient to create a PayPal account. It’s free and only takes a few minutes. Once they create an account, you can easily send them money using their email address or phone number.

Use a Credit or Debit Card

If the recipient doesn’t want to create a PayPal account, you can use a credit or debit card to send money through the PayPal website. Just enter your card information and recipient details. However, keep in mind that this option may incur transaction fees.

Send a Gift Card

PayPal offers Digital Gift Cards that you can send to non-PayPal users. Recipients can use this gift card to shop at various online merchants and physical stores.

Third Party Services

In addition to PayPal, there are third-party services that allow you to send money to non-PayPal users. These services often have higher transaction fees, but can be a solution if other methods are not possible.

Bank Message

If the amount you want to send is large enough, you may consider using a bank message. This involves sending money via wire transfer through your bank. Although it may take a few days for the money to arrive, this is a safe and reliable option.

However, it’s important to remember that these limitations are intended to protect PayPal users from fraud. Therefore, always be careful when sending money to non-PayPal users and only use the official methods mentioned above.

Can I send money to someone who doesn’t have a PayPal account?

Sending Money to Someone Who Doesn’t Have a PayPal Account

PayPal is one of the most popular online payment services in the world. However, there are times when we want to send money to someone who doesn’t have a PayPal account. The question is, is it possible to send money to someone who doesn’t have a PayPal account? The answer is yes, but there are several options you should consider.

In this article, we’ll discuss how to send money to someone who doesn’t have a PayPal account, as well as some options you can use.

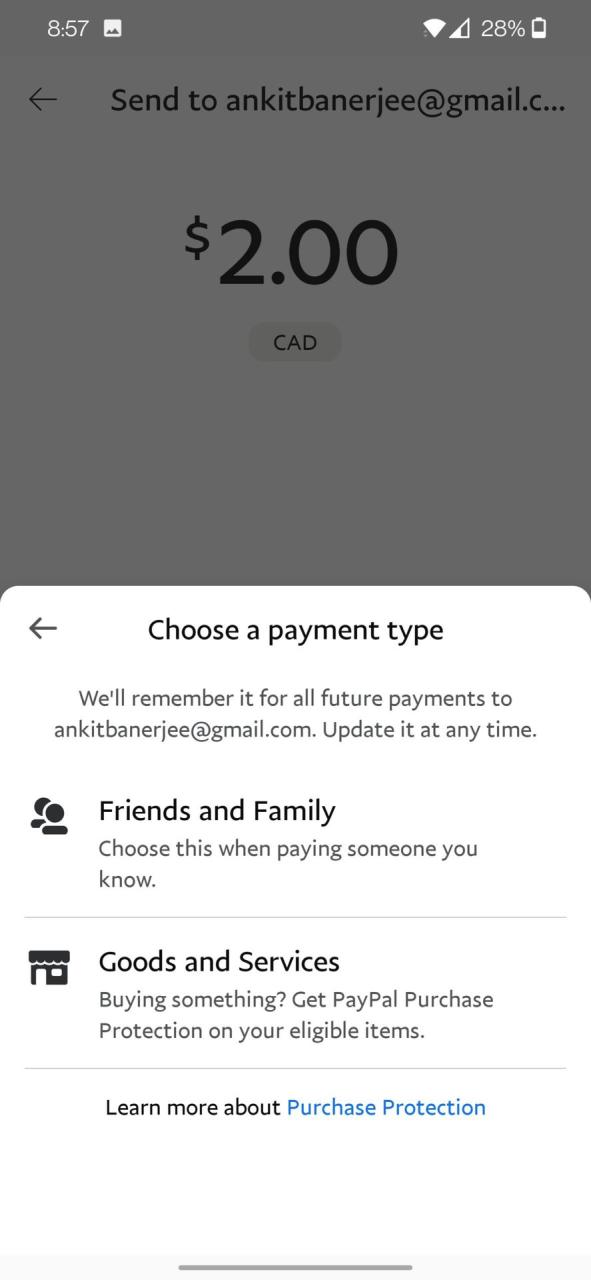

Using PayPal

PayPal allows you to send money to someone who doesn’t have a PayPal account. You can use the “Send Money” feature in your PayPal account and enter the email address or phone number associated with the recipient’s PayPal account. If the recipient does not have a PayPal account, they will receive an email or SMS notification informing them that they have received the money transfer.

The recipient can then create a PayPal account to receive the money. However, if the recipient doesn’t have a PayPal account and doesn’t want to create one, they can use a debit or credit card to claim the money.

However, keep in mind that there are some fees associated with sending money to someone who doesn’t have a PayPal account. These fees can include transaction fees, currency conversion fees, and other fees.

Using Bank Transfer

If you want to send money to someone who doesn’t have a PayPal account, you can use a bank transfer. Bank transfers are a safe and reliable way to send money to someone who doesn’t have a PayPal account.

You can use a bank transfer service like Western Union, MoneyGram, or Xoom to send money to someone who doesn’t have a PayPal account. These services allow you to send money to the recipient’s local bank or to other specified locations.

However, keep in mind that there are some fees associated with bank transfers. These fees can include transaction fees, currency conversion fees, and other fees.

Using Electronic Money Transfer

Electronic money transfers are a fast and secure way to send money to someone who doesn’t have a PayPal account. Services like Venmo, Square Cash, or Google Wallet allow you to send money to someone who doesn’t have a PayPal account.

You can use the mobile app or website to send money to someone who doesn’t have a PayPal account. However, keep in mind that there are some fees associated with electronic money transfers. These fees can include transaction fees, currency conversion fees, and other fees.

Using Gift Cards

Gift cards are a unique way to send money to someone who doesn’t have a PayPal account. You can buy gift cards from retail stores or online and send them to someone who doesn’t have a PayPal account.

Gift cards allow recipients to use them to purchase goods and services from stores that accept gift cards. However, keep in mind that there are some fees associated with gift cards. These fees can include activation fees, monthly fees, and other fees.

Conclusion

Sending money to someone who doesn’t have a PayPal account can be done in several ways. You can use the “Send Money” feature on your PayPal account, bank transfer, electronic money transfer, or gift card.

However, keep in mind that there are some fees associated with sending money to someone who doesn’t have a PayPal account. These fees can include transaction fees, currency conversion fees, and other fees.

Before you send money, make sure you understand the costs involved and choose the method that best suits your needs.

Tips and Suggestions

- Make sure you have a valid and active PayPal account before sending money to someone who doesn’t have a PayPal account.

- Check the fees associated with sending money to someone who doesn’t have a PayPal account before sending.

- Make sure you have sufficient information about the recipient, such as an email address or phone number.

- Use the money transfer method that best suits your needs.

- Check that the recipient has a PayPal account before sending money.

By understanding how to send money to someone who doesn’t have a PayPal account and considering the associated costs, you can send money safely and reliably.