Receiving funds on an unverified PayPal account.

If you plan to receive funds in an unverified PayPal account, there are several important things you need to know. First and foremost, you should be aware of the limitations of unverified accounts. You can only receive up to $10,000 per year, and these funds cannot be withdrawn to your bank account. Additionally, you will not be able to send or receive payments in any currency other than the currency of the country in which you reside.

Additionally, you may also experience delays in receiving funds on unverified PayPal accounts. The funds you receive may be held for 21 days or more while PayPal reviews your transaction. This may cause inconvenience and delays in accessing your money.

To avoid these limitations and delays, it is highly recommended to verify your PayPal account as soon as possible. The verification process generally requires providing your personal information, such as name, address, and date of birth. You may also be asked to provide a copy of your government-issued photo identification. Once your account is verified, you will be able to receive funds without restrictions and access your money faster.

If you have any doubts about the verification process, you can contact PayPal customer service for help. They can walk you through the steps and answer any questions you may have. Remember that verifying your PayPal account is an important step to protect your funds and ensure a smooth user experience. By following these steps, you can enjoy the full benefits of using PayPal with peace of mind.

Restrictions on transactions with an unverified PayPal account.

Receiving funds on an unverified PayPal account is possible, but there are several limitations that must be considered. Unverified accounts have stricter transaction limits compared to verified accounts.

First, there is a limit on the amount of funds that can be received. Unverified accounts usually have daily and monthly funds receipt limits. If the amount of funds received exceeds this limit, the transaction will be held or limited.

Second, limitations on funding sources. Funds received from sources considered risky, such as gambling transactions or illegal activities, may not be accepted on unverified accounts. PayPal has a risk assessment system to identify and block potentially suspicious transactions.

Third, limits on withdrawals. Unverified accounts may experience limitations in withdrawing funds. Withdrawn funds may be held for several days or subject to additional fees.

Additionally, unverified accounts may also incur additional fees. These fees vary depending on the type of transaction and the amount of funds transacted. Verified accounts are generally not subject to these additional fees.

To avoid these limitations and fees, we recommend that users verify their PayPal account. The verification process usually involves providing personal information, such as name, address, and telephone number. Once an account is verified, transaction limits will increase and users can enjoy a wider range of PayPal features and services.

Although unverified accounts have limitations, they can still be used to receive funds in small amounts and from trusted sources. However, if users plan to receive large amounts of funds or from potentially risky sources, it is recommended to verify their PayPal account first.

How to complete verification to lift account limits.

Withdrawing Funds in an Unverified PayPal Account

If you have created a PayPal account but have not verified your identity, you may face restrictions in receiving funds. Verification is an important step to ensure the security of your account and allows you to access PayPal’s full features.

Why is Verification Required?

Identity verification helps PayPal detect fraudulent activity and protects you from identity theft. Additionally, it ensures that the person using your account is the real you.

How to Complete Verification

The verification process varies depending on your country. In general, you will need to provide valid identity documents, such as a driver’s license, ID card, or passport. You may also be asked to provide proof of address, such as a utility bill or bank statement.

To verify your account, follow these steps:

1. Log in to your PayPal account.

2. Click “Resolution Center” at the top of the page.

3. Under “Review Your Account Status,” click “Complete Verification.”

4. Follow the on-screen instructions to upload the required documents.

What Happens After You Are Verified?

Once your account is verified, you will be able to receive funds without restrictions. Additionally, you will have access to other features, such as sending funds, making online payments, and withdrawing funds to your bank account.

The Importance of Verification

Keeping your PayPal account verified is very important for the following reasons:

Security: Verification helps protect your account from fraudulent activity.

Access to Full Features: Verify allows you to access all PayPal features.

Limits Lifted: You can receive funds without restrictions once your account is verified.

If you have any questions or difficulty verifying your account, please do not hesitate to contact PayPal customer service. By verifying your account, you can ensure security and convenience when using PayPal.

Can I receive money on my PayPal, with a PayPal that’s isn’t linked to any card or bank and isn’t verified?

Receiving Money on PayPal Without a Card or Bank Account: Is It Possible?

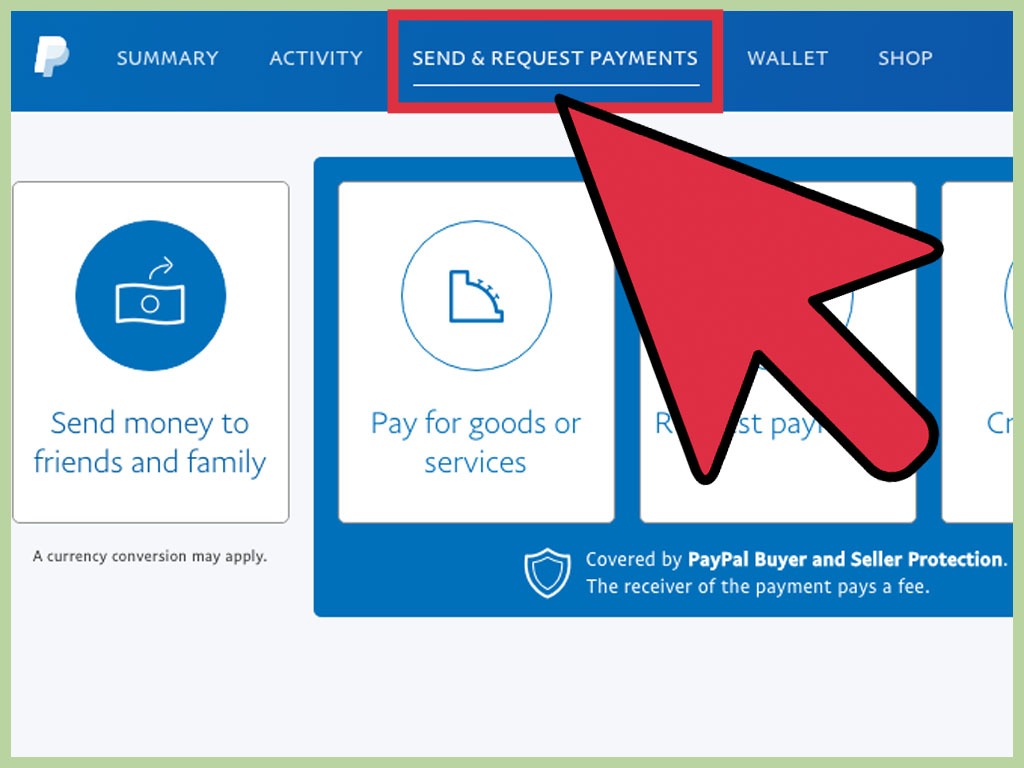

PayPal is one of the most popular and widely used online payment methods worldwide. With the ability to send and receive money quickly and securely, it’s no wonder that many people choose PayPal as their payment option. However, there are some frequently asked questions by PayPal users who don’t yet have a card or bank account associated with their account. One such question is: “Can I receive money on PayPal without a card or bank account?”

In this article, we will discuss the ability to receive money on PayPal without a card or bank account. We will also discuss the PayPal verification process and how to receive money on PayPal without a card or bank account.

Ability to Receive Money on PayPal Without a Card or Bank Account

PayPal allows users to receive money without a card or bank account. However, there are several limitations and conditions that must be met. Here are some things you need to know:

- PayPal does not require a card or bank account to receive money : PayPal allows users to receive money without a card or bank account. However, you must have a valid and complete PayPal account.

- Withdrawal limits : If you don’t have a card or bank account associated with your PayPal account, then you can only receive money up to a certain limit. This limit is usually around $100-$500, depending on your country and PayPal account type.

- PayPal Verification : To be able to receive money on PayPal without a card or bank account, you must verify your PayPal account. This verification process involves sending identity documents and addresses to PayPal.

PayPal Verification Process

PayPal’s verification process is an important step to improve security and user experience. Here are some steps you should take to verify your PayPal account:

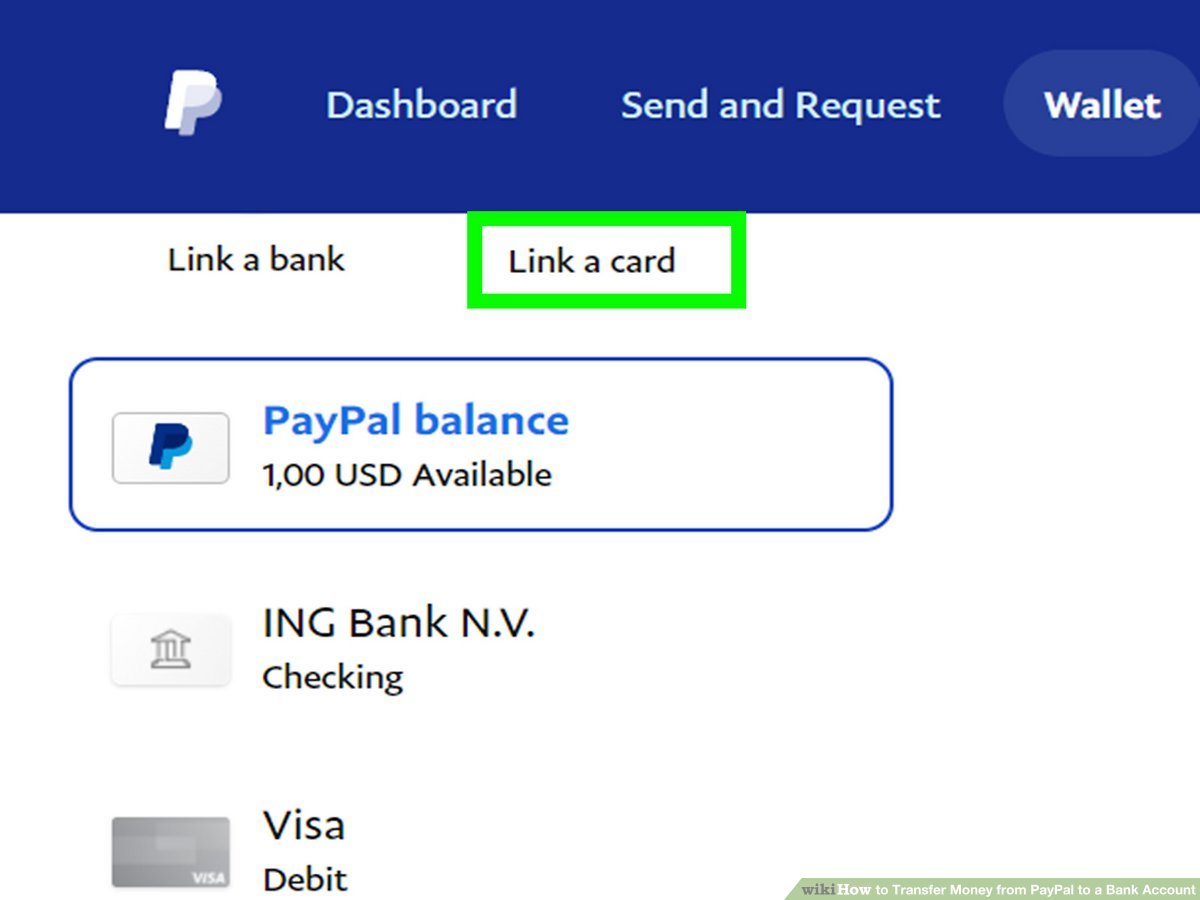

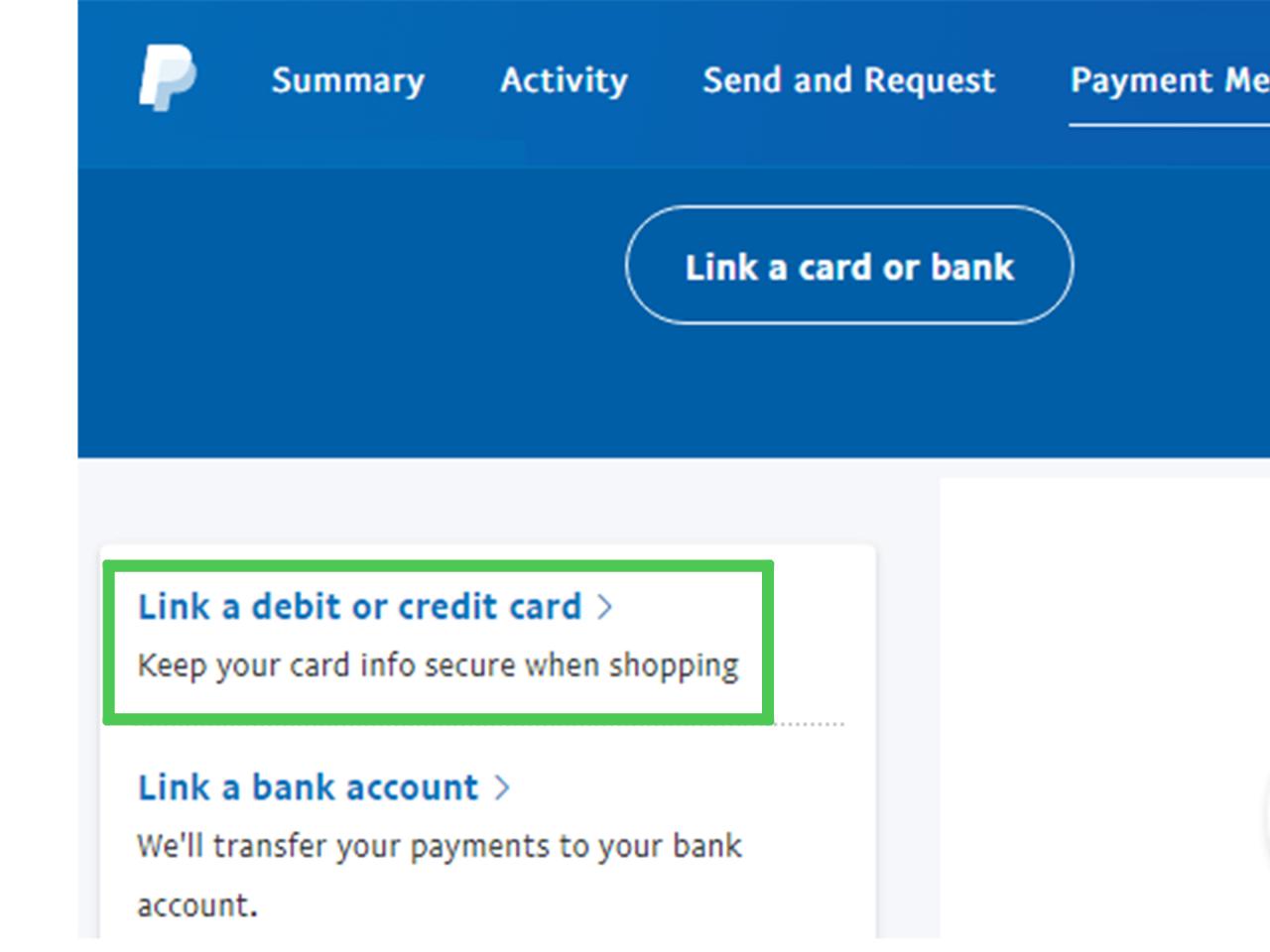

- Log in to your PayPal account : First, log in to your PayPal account using your email address and password.

- Click the “Verify” button : At the top of your PayPal account page, you will see a “Verify” button. Click this button to start the verification process.

- Upload identity documents : You must upload a valid identity document, such as KTP, driving license, or passport. This document must be clear and readable.

- Upload address document : You must also upload address documents, such as a bill or rental contract. This document must show your name and address.

- Wait for the verification process : After you upload your identity documents and address, wait for the verification process. This process usually takes several days to several weeks.

How to Receive Money on PayPal Without a Card or Bank Account

If you have verified your PayPal account and do not have a card or bank account, you can receive money on PayPal in the following ways:

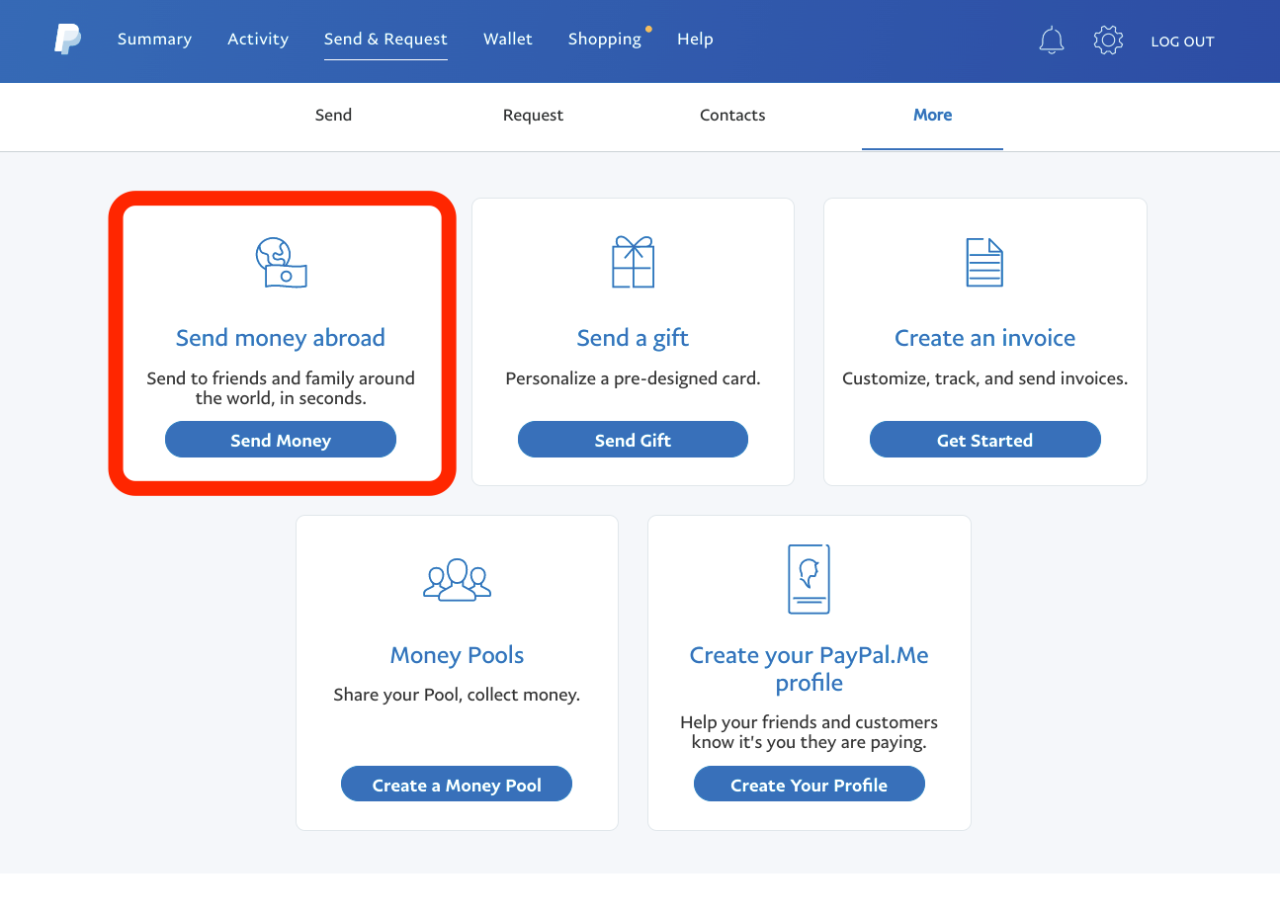

- Get transaction code : If you want to receive money from someone, ask them to send you a PayPal transaction code.

- Enter the transaction code : Enter the PayPal transaction code you received into your PayPal account.

- Receive money : After you enter the transaction code, the money will be transferred to your PayPal account.

Advantages and Disadvantages of Receiving Money on PayPal Without a Card or Bank Account

Receiving money on PayPal without a card or bank account has several advantages and disadvantages. Here are some of them:

Excess:

- Easy and fast : Receiving money on PayPal without a card or bank account is very easy and fast.

- Safe : PayPal uses advanced security technology to protect your transactions.

Lack:

- Withdrawal limits : If you don’t have a card or bank account, then you can only receive money up to a certain limit.

- Verification process : The PayPal verification process can take several days to several weeks.

Conclusion

Receiving money on PayPal without a card or bank account is possible. However, there are several limitations and conditions that must be met. PayPal’s verification process is an important step to improve security and user experience. By verifying your PayPal account and understanding how to receive money on PayPal without a card or bank account, you can make online transactions more easily and safely.